Archive for December, 2006

-

Slowing Growth or Inflation?

Eddy Elfenbein, December 13th, 2006 at 8:23 pmFor this week’s Blogger’s Take, Barry Ritholtz posits: “Given the concerns raised by the Fed, what is really the bigger threat to the economy: Slowing Growth or Inflation?”

Here’s my answer:Slowing growth is more important, by far. Through its history, the Fed has basically perfected the art of killing off growth. Stopping inflation? Eh…not so much. In fact, I would say that slowing growth is itself an inflation threat. Personally, I’d like to see the Federal Reserve much less federal, and far more reserved. Monetary policy is always and everywhere a human phenomenon.

As a general rule, $13 trillion economies don’t start or stop on a dime. Since 1990, when one quarter of GDP growth is above trend (3%), there’s a 60% chance that the following quarter will also be above trend. Conversely, when growth falls below trend, there’s a 64% chance that the following quarter will also be below trend.

In other words, once you’re stuck in slow growth, it’s hard to break out. During the last recession, we had 11 straight below-trend quarters. We finally broke out, but now the outlook is looking shaky. The last two quarters, and three of the last four, have been below trend.

Inflation, on the other hand, is—and has been—well contained. The 12-month core CPI has bounced between 1% and 3% for ten straight years. Not once has it left that range. And it’s been over 15 years since it hit 4%, which was during a period of below-trend growth. That’s not a coincidence.Other bloggers weighing in include Rob May of Businesspundit.com, Abnormal Returns, Mike Shedlock of Mish’s Global Economic Trend Analysis and Russ Winter of Winter (Economic & Market) Watch.

-

Lindsay & the Pacemakers

Eddy Elfenbein, December 13th, 2006 at 9:09 amToday, WallStrip looks at Medtronic (MDT).

Medtronic is simply an amazing company. The medical device maker has increased its dividend every year for the past 28 straight years! In the last 40 years, Medtronic’s stock has split 2-for-1 ten times. That turned every one share into 1,024 shares.

Ah, but what have you done for me lately? Well, for starters, three weeks ago the company gave us another great earnings report. For the October quarter, MDT made 59 cents a share, three cents more than Wall Street was expecting.

More importantly (in my mind), Medtronic stood by its earnings forecast for FY2007 and FY2008 (its fiscal year ends in April). For 2007, MDT expects earnings-per-share to range from $2.30 to $2.38. And in 2008, it expects EPS of $2.65 to $2.75. Trust me, not many companies make public forecasts like that.

This was actually a reiteration of an earlier projection. I always like to see companies stand by their forecasts. This is especially important in Medtronic’s case because the stock’s relative valuation has dropped sharply this year.

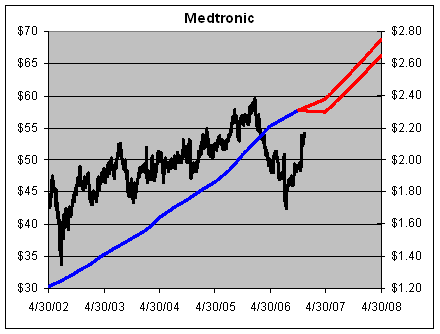

Shares of Medtronic routinely traded above 25 times earnings. But this summer, the stock plunged to a four-year low, even as its earnings and dividends continued to grow. Check out this graph:

The black line (left scale) is the share price, and the blue line is the earnings (right scale). The red is the company’s projection. The two sides of the chart are set at 25-to-1. If anything, the lower end of the forecast appears to be very conservative.

You can see that the stock really got smacked around. The good news is that its been recovering, but even a $60 share price today would still been on the modest side by historical standards.

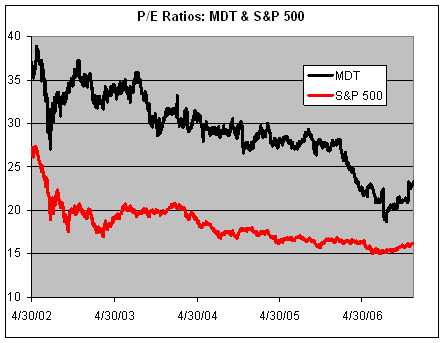

While the P/E ratios have narrowed in general for the overall market, the effect has been even greater on Medtronic. Here’s a chart showing MDT’s P/E compared with the S&P 500.

Here’s Medtronic’s relative P/E ratio, which is probably one of the purest measures of values. The relative P/E ratio is simply the company’s P/E divided by the market’s P/E. Medtronic would often carry an earnings multiple 50% to 70% greater than the market’s. Today, that’s down to 44%, but it’s higher than where it was.

Here are Medtronic’s numbers for the past several quarters:

Quarter………..EPS………….Sales

Jul-01…………$0.28………..$1,455.70

Oct-01………..$0.29………..$1,571.00

Jan-02………..$0.30………..$1,592.00

Apr-02………..$0.34………..$1,792.00

Jul-02…………$0.32………..$1,713.90

Oct-02………..$0.34………..$1,891.00

Jan-03………..$0.35………..$1,912.50

Apr-03………..$0.40………..$2,148.00

Jul-03…………$0.37………..$2,064.20

Oct-03………..$0.39………..$2,163.80

Jan-04………..$0.40………..$2,193.80

Apr-04………..$0.48………..$2,665.40

Jul-04…………$0.43………..$2,346.10

Oct-04………..$0.44………..$2,399.80

Jan-05………..$0.46………..$2,530.70

Apr-05………..$0.53………..$2,778.00

Jul-05…………$0.50………..$2,690.40

Oct-05………..$0.54………..$2,765.40

Jan-06………..$0.55………..$2,769.50

Apr-06………..$0.62………..$3,066.70

Jul-06…………$0.55………..$2,897.00

Oct-06………..$0.59………..$3,075.00 -

Happy Birthday, Mr. Chairman

Eddy Elfenbein, December 13th, 2006 at 8:44 amBen Bernanke turns 53.

-

“Substantial”

Eddy Elfenbein, December 12th, 2006 at 2:15 pmFor the fourth straight meeting, the Federal Reserve didn’t change interest rates. Here’s the statement:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Economic growth has slowed over the course of the year, partly reflecting a substantial (NEW!) cooling of the housing market. Although recent indicators have been mixed (also new), the economy seems likely to expand at a moderate pace on balance over coming quarters.

Readings on core inflation have been elevated, and the high level of resource utilization has the potential to sustain inflation pressures. However, inflation pressures seem likely to moderate over time, reflecting reduced impetus from energy prices, contained inflation expectations, and the cumulative effects of monetary policy actions and other factors restraining aggregate demand.

Nonetheless, the Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Susan S. Bies; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; William Poole; Kevin M. Warsh; and Janet L. Yellen. Voting against was Jeffrey M. Lacker, who preferred an increase of 25 basis points in the federal funds rate target at this meeting.The “substantial” is new. That sounds like there was some debate about that one. If I had to guess, I’d say there was some debate at previous meetings. The “although recent indicators have been mixed” used to be just “going foward.” That entire sentence was added last time.

The vote was the same as in October. Jeffrey Lacker wanted higher rates for the fourth straight time. This is Lacker’s last meeting with a vote as the chairs rotate at the end of the year. Hoenig, Minehan and Moskow will get votes at the next meeting in January.

It’s now been over five months since the Fed last raised rates. It’s not unusual for the Fed to cut rates so soon after a series of increases. The Fed cut rates in July 1995, less than five months after an increase. And at the start of 2001, the Fed lowered rates seven months after an increase.

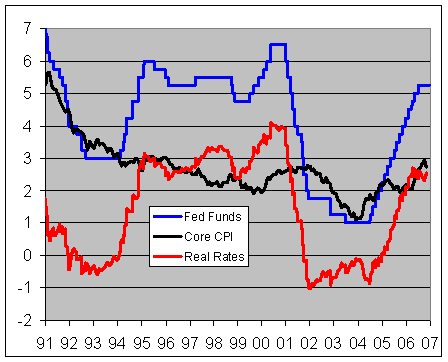

Real rates are still rather modest for an economic expansion.

-

Breaking: Transcript of Today’s Fed Meeting

Eddy Elfenbein, December 12th, 2006 at 1:45 pmI’m afraid I can’t disclose my sources, but I got hold of a transcript of today’s FOMC meeting.

I’ll warn you, it’s a bit rough: -

Goldman’s Profits Up 93%

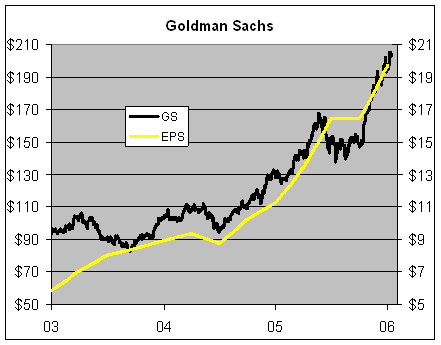

Eddy Elfenbein, December 12th, 2006 at 10:00 amAnother blow-out quarter for Goldman Sachs (GS).

The famous Price/Earnings Ratio comes under frequent attack, but you can see from the chart Goldman’s stock has followed its earnings rather closely. Goldman just capped off the most profitable quarter in Wall Street history. The firm made $3.15 billion in the November quarter, nearly doubling what it made last year. Revenues soared 47% to $9.41 billion. All told, Goldman made $6.59 a share, which beat Wall Street’s consensus by 42 cents. Once again, the profits were driven by trading:Fourth-quarter trading revenue rose 55 percent to $5.24 billion, accounting for more than half of the firm’s income. Revenue from fixed-income, currencies and commodities trading rose 58 percent to $3.1 billion, including the Accordia gain. Equities trading revenue jumped 52 percent to $2.13 billion.

By the way, if you’re interested in working for Goldman, you can take their “where do I fit in” quiz. Good luck!

-

Jim Cramer–Cub Reporter

Eddy Elfenbein, December 11th, 2006 at 4:53 pmWay back when, Jim Cramer used to be president of the Harvard Crimson. The paper has all of his stories archived online.

Here’s JJC’s very first article, from March 16, 1974, about being a vendor at the Vet. Apparently, he’s always had the heart of a trader.As soon as the 1973 campaign began, I rushed down to Veteran’s Stadium to watch not the Phillies, but the professional vendors. I noticed two types of real hawkers: the 40-year veterans who sell year-round, and the college kids from the Mainline area who work from May to September. I realized I couldn’t vie with the aging hustlers. These lower-deck professionals had techniques and aisle space-rights not to be violated by any rookie.

So I decided to go to the lucrative upper-deck trade and challenge the successful students. I went to the upper deck commissary and demanded to sell hotdogs. I hoped to combine the style of Veteran’s Stadium fixture Charlie “Hotdog” Frank and the hustle of the nouveau-riche dog-men. Nevertheless, lacking the seniority to sell the high-profit-margin dogs, I settled back to the 35-cent cokes and prayed for an instant heat wave.This just in, Carter beat Ford.

-

Bambi on What Yahoo Did Wrong

Eddy Elfenbein, December 11th, 2006 at 3:51 pmBambi Francisco does a good take down on how Yahoo (YHOO) missed, and keeps missing, the ball.

-

Craig’s List: Delightfully Communist

Eddy Elfenbein, December 11th, 2006 at 12:58 pmDealBook writes about the appearance of Craig’s List at the UBS global media conference.

When one analyst asked how CL plans to maximize its revenue, the company said, “um yeah, we’re really not interested in that stuff.”

A riot nearly broke out.Following the meeting, Mr. Schachter wrote a research note, flagged by Tech Trader Daily, which suggests that he still doesn’t quite get the concept of serving customers first, and worrying about revenues later, if at all (and nevermind profits). Craigslist, the analyst wrote, “does not fully monetize its traffic or services.”

Mr. Buckmaster said the company is doubling in size every year, as measured by page views and listings.

Larry Dignan, writing on Between the Lines blog at ZDNet, called Mr. Buckmaster “delightfully communist,” and described the audience as “confused capitalists wondering how a company can exist without the urge to maximize profits.”A Web site that doens’t run ads? What-EVER!

-

Smith & Nephew Poised to Bid for Biomet

Eddy Elfenbein, December 11th, 2006 at 10:32 amWhoa, this is big. The Financial Time‘s Alphaville is reporting that Smith & Nephew is in merger talks with Biomet (BMET). Coming after Golden West Financial, this would be our second Buy List merger of the year.

Smith & Nephew is in preliminary merger discussions with Biomet, its US rival best known for its artificial hips and other replacement joints, in a deal that could double the size of the British healthcare group. While sources stressed last night that the talks were at a very early stage, the deal is aimed at creating an orthopaedic specialist worth up to $20bn and capable of competing against the US sector leaders, Zimmer and Stryker.

Morgan Stanley, Biomet’s financial adviser, was drafted in to work on the company’s options in the spring following the sudden resignation of its co-founder and president, Dane Miller. Biomet is believed to have also held discussions with JPMorgan private equity.

S&N is valued at £4.8bn ($9.2bn), while Biomet’s market cap is $8.9bn. S&N would likely demerge Biomet’s dental business, which has been valued at $2bn. Zimmer has been mooted as a possible buyer.Biomet is up big today. My hope is that they accept nothing less than $45 a share.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His