Archive for January, 2007

-

It’s a Small-Cap World

Eddy Elfenbein, January 5th, 2007 at 12:02 pmFrom 1994 to 1999, the Russell 2000 (^RUT) badly lagged the market. But since then, the little guys have left the rest of the market in the dust:

-

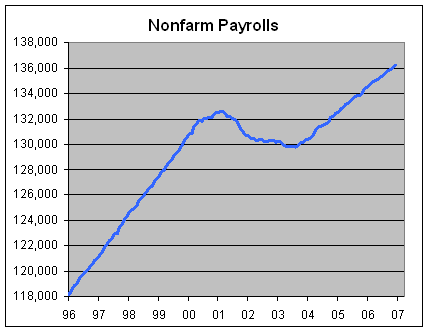

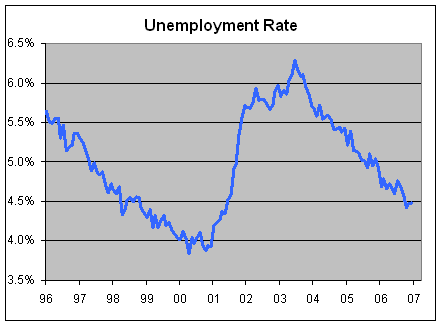

Today’s Employment Report

Eddy Elfenbein, January 5th, 2007 at 9:19 am

The economy created 167,000 jobs last month. This was more than the Street was looking for, but it’s still pretty tepid growth.

The unemployment rate stayed the same at 4.5%. -

Theme for the Year

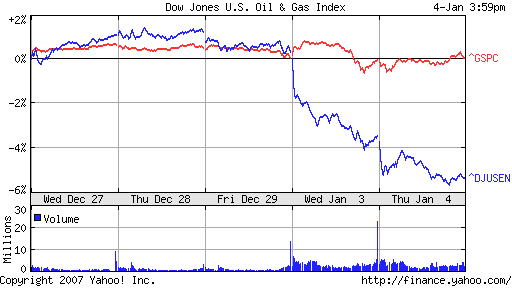

Eddy Elfenbein, January 4th, 2007 at 4:23 pm

Oh Seven is not being kind to energy stocks. In just two days, the Dow Oil & Gas Index (^DJUSEN) has dropped 5.7% while the S&P 500 is flat. Well, it’s really up 0.04 points which is 0.0028%, so let’s just say it’s flat.

Crude oil is down 8.9% in the last two days, and oil is now at its lowest price since June 15, 2005. Since the July 14 high of $78.40, oil is down 29%. Even in euros, oil is down!

I’m pleased to report that our new Buy List had a very good day. Fifteen of the 20 stocks went up. The Buy List rose 0.72% compared with the S&P 500’s 0.12%. The big winner was Amphenol (APH), which rose 3.2%. Joe Banks (JOSB) also had a good day, rising 2.6%. The company reported that same-store sales increased 1.4% in December.

Our insurance stocks were the laggards today. Both AFLAC (AFL) and WR Berkley (BER) dropped 0.5%. Naturally, this is one of the many reasons why I’m crazy. By any reasonable standard, we had a very good day today, yet I’m still upset about the few stocks that didn’t do well. I’m sorry, I need help. The good news is that it doesn’t seem specific to either company. The culprit was probably a story from the WSJ on falling insurance premiums. -

An Inconvenient Truth Means Very Convient Weather

Eddy Elfenbein, January 4th, 2007 at 11:40 amIt’s another balmy day here in our nation’s capital. The Post said it’s going to get up to 63 today. Here’s a cherry blossom from my back yard:

They’re about three months ahead of schedule. Warm weather is bursting out all across the East Coast. Barry Ritholtz said that he rolled top down the other day.

The warm weather is also having a big impact on the financial markets. Oil is down again today. The latest quote shows oil off $2.73 to $55.59 a barrel.

(By the way, whatever happened to the Goldman/Paulson/Oil plot to lower gas prices before the election? I thought that prices were supposed to go right back up.)

Here’s the February contract for light sweet crude:

-

Gretchen Mails It In

Eddy Elfenbein, January 4th, 2007 at 11:02 amGretchen Morgenson on Nardelli:

Even though the board gave him $20 million that was not a part of his employment contract, perhaps smoothing his way out the door, the departure seemed to be a watershed. No longer can executives demand — and directors happily grant — contracts worth hundreds of millions of dollars without at least some shareholders uttering a peep.

How much would you bet that she went back and forth between “watershed” and “wake-up call”?

This is what I wrote over the summer on HD.Oh for the love of carbs, people. This Home Depot (HD) nonsense is getting out of control. I can’t believe what I’m seeing. The stock’s popularity is somewhere between Hamas and Diptheria, and it’s getting worse. In the less than three months, shares of HD have plunged over 20%. And the stock made another 52-week low today.

Now there’s a lynch mob after CEO Bob Nardelli. He’s even getting blamed for things he’s had nothing to do with. To quote Hoover from Animal House: “They confiscated everything, even the stuff we didn’t steal!”

To be honest, I’ve never been terribly impressed with Nardelli. He was one of Jack Welch’s protégés at GE. Nardelli rose through the ranks at GE to lead its Power Systems division. He did a great job there but I think he’s a bit too rough around the edges to be the corporate face of Home Depot, or any other company for that matter. Perhaps that’s why Jack Welch passed him over to be GE’s next top dog. In any event, Home Depot jumped at the chance, and made him their CEO in December 2000.

There’s an important point to remember. Nardelli didn’t start Home Depot. He was the rock star manager brought in to take over from the founder. Just because he thrived in the GE system, doesn’t mean he’ll be effective at a major company in an entirely different industry. In fact, it doesn’t make much sense at all.

Sadly, the loudest protests concerns Nardelli’s pay. This is really a lame issue. Last year, he raked in $32 million, and over $120 million in the last five years. Yes, yes, I know. It would be great to see CEOs get paid the same as teachers. Give me a petition and I’ll sign it, but I’m not going to pretend that CEOs can be found on the cheap.

The fight against CEO pay has probably caused shareholders more problems than the pay itself. In 1993, Congress capped the tax deductibility of salaries at $1 million, so CEOs fought back by issuing stock options. This led to companies slashing dividends payments which, in turn, increased the market’s volatility. Then we had the battle to expense stock options. Now we have the battle on back-dating, which in some cases, is perfectly legal. Chris Cox said that the 1993 law deserves “pride of place in the museum of unintended consequences.” Let’s keep the pay issue is proportion. Nardelli’s compensation last year works about to about 1.6 cents a share. This isn’t exactly soaking a $34 stock.

The anti-Bob furor got even louder when the company said that it would no longer provide same-store sales figures. Again, I’d prefer to see this number. (Except that, Lowe’s (LOW) always creams HD’s same-store sales.) But when I hear these critics yell and scream, I don’t think they understand what Nardelli is trying to do.

Let’s look at HD’s position from management’s point of view. They have a maturing retail business and strong competition from Lowe’s. The difficulty is that they’re running out of prime retail spots. So Nardelli is shifting HD’s strategy. If they decide to go to war with Lowe’s and play the game of “who can open up the most new stores,” Home Depot will lose, and lose badly. Remember what happened to Rite Aid?

Instead, he’s doing something different. He’s focusing the business on commercial customers. This is a huge market segment, and it makes sense for HD to shift the battle to this front. I didn’t quite “get it” until HD made its bid for Hughes Supply. This was Home Depot’s largest acquisition in its history. Now I see how committed HD is. Plus, the company has been quietly snatching up several smaller wholesale suppliers, even one in China. Notice how they’re acting before the problems get worse.

While, I’d prefer to see HD report the same-store sales figures, I understand why they’re not doing it. It’s simply not going to be a key component of its business strategy. Last week, however, Nardelli back-tracked and told Maria Bartiromo that HD may go back to reporting same-store sales.

The really big showdown came at the company’s annual meeting in May. This was a PR disaster. None of the outside director showed up. The meeting was just 30 minutes long, and Nardelli refused to answer any questions about his pay. Shareholder activists were furious and they urged shareholders to withhold their support of HD’s directors.

In the past, the company has given the results of the votes at the annual meeting. Um…not this year. The company eventually said that 10 of the 11 directors saw over 30% of their votes withheld. That ain’t good. Of course, shareholders have another way of voting—they can sell, and that’s what’s been happening.

But Home Depot is not like Dell. The company is still doing very well. In fact, Home Depot has beaten Wall Street’s estimate for the past few quarters. The company has also reiterated its earnings guidance. We’re not seeing those ugly earnings warnings that have hit so many others. In May, Home Depot said that it expects earnings growth of 10% to 14% this year, which translates to per-share earnings of $2.99 to $3.10. This means that HD is going for just 11 times this year’s earnings. That seems pretty darn cheap to me. -

Reversify

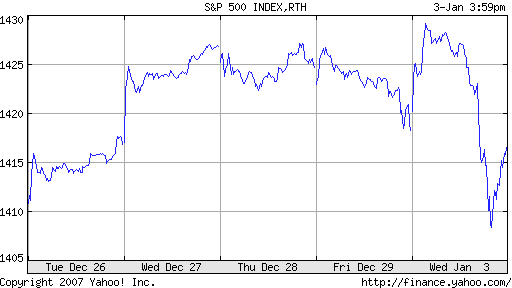

Eddy Elfenbein, January 3rd, 2007 at 4:48 pm

After an early rally, the market reversed course this afternoon to close down 0.12%. The new Buy List lost 0.19%. Ironically, I just threw Home Depot (HD) overboard and it was up over 2.2% today thanks to Bob Nardelli’s resignation. Oh well, I told you I’m not much of a market timer.

The good news is that two of my new buys, Amphenol (APH) and Jos. A Bank (JOSB), had good days. APH was up 2.7 and JOSB was up 2.9%. Sysco (SYY), which is one of the most stable stocks on the Buy List, was hurt by a downgrade from JP Morgan. The stock dropped 1.3%. Also, Fiserv (FISV) was downgraded by AG Edwards. FISV lost 1.6%.

The most surprising activity came from the energy sector. The Dow Energy Index (^DJUSEN) closed down 3.8%. For the record, I’ve been expecting energy stocks to crack for over a year. Yesterday, oil had its biggest fall in 20 months. -

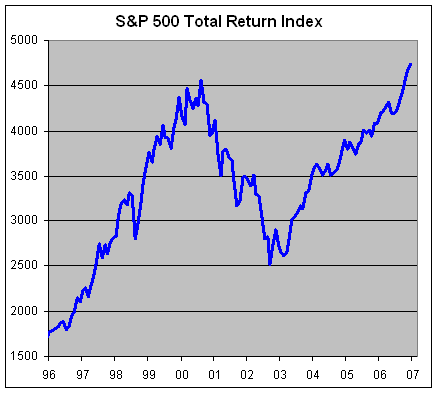

The S&P 500 Total Return Index

Eddy Elfenbein, January 3rd, 2007 at 1:43 pmThe market is starting 2007 just how it finished 2006. For the year, the S&P 500 was up 15.80% including dividends. How’s how the Total Return Index has done since 1996:

Here’s the sector breakdown for 2006:

Telecom………………………………32.13%

Energy………………………………..22.22%

Consumer Discretionary………..17.23%

Utilities……………………………….16.87%

Financials……………………………16.16%

Materials…………………………….15.73%

Consumer Staples………………..11.76%

Industrials…………………………..11.02%

Technology……………………………7.70%

Health Care……………………………5.78% -

Mark Cuban: The Stock Market Is for Suckers

Eddy Elfenbein, January 3rd, 2007 at 10:31 amExactly one year ago, Mark Cuban wrote on his blog that the stock market is for suckers:

The concept that you own “your share” of the company is a joke. You are completely at the whim of the CEO and board who will dilute you on a daily basis with stock options, then try to buy back stock to cover it up and push up the price, rewarding the shareholders who get out, rather than those that continue to hold the shares. Meaning you.

Cuban’s post was a response to a comment from Thomas Hawk. Yesterday, Hawk followed up:

So here we are a year later (much too short a time horizon to matter by the way) — where would you be if you took $100,000 and followed Mark Cuban’s advice vs. mine?

For comparison purposes, I’m going to assume that two investors both had $100,000 to invest on January 3, 2006. Had you followed Cuban’s advice (and I’m using the Vanguard Prime Money Market Fund) you would have today approximately $104,882.60.

Had you taken that same $100,000 and put it into the Vanguard Total Stock Market Index (a low cost basket of stocks that tries to roughly equate to the U.S. Market) today you would have approximately $113,890.00. -

Nardelli Quits Home Depot

Eddy Elfenbein, January 3rd, 2007 at 10:03 amAnd he’s taking his money with him.

Vice Chairman Frank Blake, 57, will replace Nardelli, effective immediately, Home Depot said in a statement today. Nardelli, 58, will receive $210 million in severance payments, the company said.

Home Depot has lost market share to Lowe’s Cos. during Nardelli’s six-year tenure, its shares have declined 7.9 percent and the company is headed for its smallest annual gain in profit in at least nine years.

“Ultimately the board felt the negativity associated with Nardelli was an impediment to his and the company’s success,” said Daniel Popowics, an analyst with Fifth Third Asset Management. “This is a surprise. I thought Nardelli carved out some time for himself to turn things around.” The Cincinnati firm manages $21 billion, including Home Depot stock.

Nardelli, who joined Home Depot from General Electric, became a lightning rod for critics of excessive executive pay. Nardelli was the only board member to appear at the company’s annual meeting last year, where the size of his pay package was questioned.In the press release, the company stated exactly what Nardelli is going to get.

Nardelli and the Company have agreed in principle to the terms of a

separation agreement which would provide for payment of the amounts he is

entitled to receive under his pre-existing employment contract entered into

in 2000. Under this agreement, Nardelli will receive consideration

currently valued at approximately $210 million (including amounts which

have previously been earned or vested). This consideration will include a

cash severance payment of $20 million, the acceleration of unvested

deferred stock awards currently valued at approximately $77 million and

unvested options with an intrinsic value of approximately $7 million, the

payment of earned bonuses and long-term incentive awards of approximately

$9 million, the payment of account balances under the Company’s 401(k) plan

and other benefit programs currently valued at approximately $2 million,

the payment of previously earned and vested deferred shares with an

approximate value of $44 million, the payment of the present value of

retirement benefits currently valued at approximately $32 million and the

payment of $18 million for other entitlements under his contract which will

be paid over a four year period and will be forfeited if he does not honor

his contractual obligations. -

World War II Ends

Eddy Elfenbein, January 2nd, 2007 at 3:32 pmThe Brits pay off their war debt to us.

Under the arrangement, the US handed a financial lifeline to Britain, allowing it to secure oil, food, arms and other military equipment on credit to help the war effort. Though other countries also benefited under the programme — a $48 billion project — Britain received the largest chunk of aid.

When the war finished, the economist Maynard Keynes — by then the government adviser Lord Keynes — led a delegation to the U.S to agree repayment for those materials for which it had been charged and to secure a loan of $4 billion. He warned that Britain had been left facing a “financial Dunkirk”.Still, I was kinda hoping we could send over a couple repo guys. Nothing big. Maybe a few castles.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His