Archive for February, 2007

-

Best Hockey Fight Ever

Eddy Elfenbein, February 3rd, 2007 at 7:58 am

Last month was the 20th anniversary of the “Punch-up in Piestany,” of one of the greatest moments in hockey, and Canadian, history.

In 1987, Canada was playing the (then) Soviet Union in the World Junior Championships in Piestany, Czechoslovakia. Mid-way through the game, all hell broke loose. I can’t believe YouTube has the video.

Canada had a decent shot to win the gold, while the Soviets were out of medal contention. Canada was winning 4-2 when the frustrated Soviets started ganging up on the Canadian players. The commies got really nasty. Soon the boys from the Great White North had seen enough. They jumped over the boards, and, knowing they would forfeit any medal, fought back (note the 4:20 mark in the video).

The place went frickin berserk. A dust-up turned into an all-out 20-on-20 brawl. And not your typical NHL-style “pushing” fight. These guys were punching for real. Sticks, helmets and gloves were everywhere. Did I mention these were kids? Even the two goalies squared off against each other–the two back-up goalies.

The refs completely lost control. After awhile, they just skated off the ice. But the players kept fighting. They even shut off the lights in the arena. It didn’t work. The players KEPT ON FIGHTING. Both teams were disqualified, and according to the record books, the game doesn’t exist.

The aftermath was a huge deal in Canada. Unfortunately, Canada bases much of its national identity on not being like certain other North American countries. You know, violent neocon cowboys and all that. So began the mandatory national period of self-reflection: “What are we teaching our children? This is not how we do things in Canada.” And so on.

The Canadian kids did exactly what they should have. Here’s a clip from the time of the legendary hockey coach Don Cherry debating a clueless sportswriter. There’s even a book about the game. -

A Possible Triple All-Time High

Eddy Elfenbein, February 2nd, 2007 at 2:40 pmYesterday, the Dow Transportation Average (^DJT) closed at 4998.75, just 0.2 points below its all-time high reached last May. In between that time, the index plunged all the way to 4,140 (remember how well EXPD did on last year’s Buy List, before it got weak).

With the Dow Industrials (^DJI) also hitting a new all-time high, and the Dow Utilities (^DJU) just behind, we might be near the first triple all-time high in nine years. The last time all three indexes made new highs was on March 17, 1998. Since 1929, this has happened on only 16 occasions.

For a breif period in 1962, the DJU was slightly greater than the DJT. Today, the Transports are more than 10 times the Utilities. -

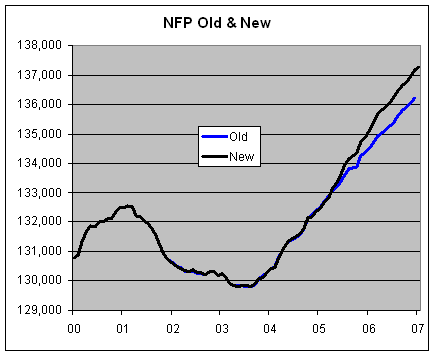

The Revision to Nonfarm Payrolls

Eddy Elfenbein, February 2nd, 2007 at 10:02 amThis morning we learned that nonfarm payrolls increased by 111,000 last month. That’s a so-so number, but I’ve learned not to take the Labor Department reports too seriously. Or most anything from any government.

Cynical? Consider this: The Labor Department also gave us their big annual revision to the nonfarm payroll report. It turns out that they had been undercounting employment in the U.S. by, oh, nearly a million. I’ll turn it over to their press release:The total nonfarm employment level for March 2006 was revised upward

by 752,000 (754,000 on a seasonally adjusted basis). The previously published

level for December 2006 was revised upward by 981,000 (933,000 on a seasonally

adjusted basis).Oh dear lord. That’s like missing an entire state. Here’s what I said in October about employment on Barry Ritholtz’s Blogger Take.

Darn it! The hand-wringing choir has begun, and I’m already behind. Oh, you know the tune: Corporate America is raking in the moolah while Johnny Cubedweller is getting the shaft. I’m sure you’ve heard this before. Paul Krugman even said that we shouldn’t be happy that the Dow has hit a new high.

Sorry professor, but I am happy. (Note: The Dow is up 800 points since then. – Eddy)

What’s the problem this time? It turns out the Labor Department said that the economy created only 51,000 new jobs last month (Note: Now they say it was really 198,000. – Eddy). Now before you join in on the singing, bear in mind that this number will be revised next month. And again in the month after that. And if that’s not enough, sometime in 2017, the later revision of the earlier revision will be revised all over again. It might even lead someone, maybe a taxpayer, to wonder why we have a Labor Department in the first place.

Did I mention that the Labor Department somehow missed 810,000 new jobs created last year? (Note: That was the initial estimate of the revision, which has since been revised. – Eddy) Perhaps they were counting the Household survey. Or was that the Establishment survey? It gets a little confusing here. You see, not only do our labor surveys get revised umpteen times, but there are a few you can choose from.

This is why I don’t pay any of them too much attention. I’m going to take a wild guess and say that September’s number is going to be revised higher. In fact, all of the revisions will tell us the perfectly obvious: The economy is much stronger than the hand-wringers think.

So when those 810,000 workers are finally retired and living on Jupiter, the Labor Department will get around to its last revision of its last survey, and it will tell us exactly what the Dow said all those years ago.The Dow is up again today. Here’s a look at NFP Old & New (subject to revision):

-

Wallstrip Makes the NYT

Eddy Elfenbein, February 2nd, 2007 at 9:45 amWallstrip is profiled in today’s NYT.

It’s ‘Squawk Box’ Meets ‘Saturday Night Live’

A few years ago, a video on the stock performance of Jack in the Box might have involved a sit-down interview with the fast-food restaurant’s chief executive, dryly discussing its fundamentals.

Today, it is just as likely to be a music video with a leggy brunette licking a French fry and a hedge fund manager wearing a massive gold chain necklace, both singing an homage to a recent “Saturday Night Live” sketch.

Welcome to Wallstrip, a three-month-old Web site that mixes stock news and pop culture. Featuring an actress, Lindsay Campbell, as a host, the site offers a short daily video featuring a stock at a 52-week high, as well as financial bloggers who discuss the companies at the heart of each episode.

“We saw a huge space between Jim Cramer and the bottom of the market,” said Howard Lindzon, the manager of a small hedge fund who helped create the show and is now its executive producer.

The popularity of Wallstrip — it claims to have an average of 10,000 views a day — is only the latest sign of the growing use of video on financial Web sites. Sites like CNBC.com and TheStreet.com have increased their video offerings, for example. -

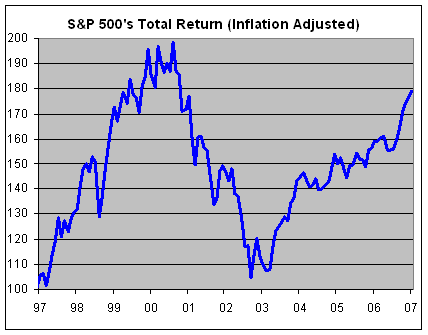

Total Return of the S&P 500

Eddy Elfenbein, February 2nd, 2007 at 6:51 amThe S&P 500 closed at a six-year high yesterday. Here’s how the index has done over the past 10 years, adjusted for dividends and inflation:

-

Turner Puts Other ‘Edgy’ Marketing Plans on Hold

Eddy Elfenbein, February 1st, 2007 at 8:28 pmA day after a Turner Broadcasting guerrilla marketing campaign for an adult cartoon put Boston on full terror alert, the company said it would reconsider other “edgy” marketing plans it was about to launch.

Turner had placed dozens of battery-operated light boards displaying an obscene gesture throughout each of the 10 major U.S. cities. A series of Boston bomb scares sparked by the devices forced authorities to shut down roads, bridges and a section of the Charles River yesterday.

An unnamed spokesman for Turner said the company would now review plans for the following guerrilla marketing campaigns designed to “generate buzz” about the cartoon. -

2006 Personal Savings Fall to 74-Yr. Low

Eddy Elfenbein, February 1st, 2007 at 4:06 pmFrom the AP:

People once again spent everything they made and then some last year, pushing the personal savings rate to the lowest level since the Great Depression more than seven decades ago.

The Commerce Department reported Thursday that the savings rate for all of 2006 was a negative 1 percent, meaning that not only did people spend all the money they earned but they also dipped into savings or increased borrowing to finance purchases. The 2006 figure was lower than a negative 0.4 percent in 2005 and was the poorest showing since a negative 1.5 percent savings rate in 1933 during the Depression.On the bright side, 1933 was a great time to buy.

-

Chicken Vs. Pork

Eddy Elfenbein, February 1st, 2007 at 12:21 pmOver the last 30 years, Tyson Foods (TSN) is up 24,000% while Smithfield Foods (SFD) is up by 33,000%.

The two stocks have done so well that the S&P 500 (the gold line) looks flat, even though it’s up more than 1,300%. -

Exxon Mobil’s Earnings

Eddy Elfenbein, February 1st, 2007 at 11:21 amFor 2006, Exxon Mobil (XOM) earned $39.5 billion. That’s an astounding number.

To put that in perspective, the GDP of the United States for last year was $13.25 trillion. About 27% of XOM’s profits, or $10.8 billion, came from the U.S. So that means that one company makes up nearly 0.1% of the national economy. -

American Standard to Split Itself Into Three

Eddy Elfenbein, February 1st, 2007 at 10:31 amOne of the companies I like to follow is American Standard (ASD). Most people assume that this is a toilet stock. By that, I don’t mean the shares are in the toilet, but that the company literally makes toilets. Actually, both assumptions are incorrect. The company’s main business is Trane air conditioning, and the stock has done very well.

The company has a rather interesting history. American Standard first went public in 1929, which was a good time to be selling shares. In 1968, the company bought WEBCO, which was the Westinghouse Air Brake Company. George Westinghouse’s air brake revolutionized rail travel. When Westinghouse died in 1914, the New York Times wrote that his invention saved more lives than all wars combined.

By 1988, American Standard was threatened with a hostile takeover, so the management decided to take the company private through an LBO. In 1995, American Standard returned to the markets when it IPO’d at $20 a share. The stock reached an all-time high yesterday of $49.47, and that includes a 3-for-1 split. So ASD’s shares are up about 650% in 12 years.

Now for the good news. Today the company announced fourth-quarter earnings of 51 cents a share, and it guided higher for 2007. Now for the really good news—the company will split itself up into three parts. Please take note. Whenever a successful company splits itself up, you can often find outstanding buys. Check out Moody’s stock since it was spun off from Dun & Bradstreet. Or Corporate Executive Board since it was spun off from the Advisory Board Company.

American Standard will sell off its struggling kitchen and bath unit (the toilets), which accounts for about 21% of sales. The WEBCO unit (about 18% of sales), which is now vehicle control, will be spun off to shareholder. ASD shareholders will get one share of WEBCO for every three shares of ASD they own. Lastly, the core air-conditioning business (61% of sales) will change its name to Trane.

The stock is up to $53 this morning.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His