Archive for February, 2007

-

15 Get a Mac Ads

Eddy Elfenbein, February 23rd, 2007 at 10:03 pm

John Hodgman is brilliant. -

Buy List So Far

Eddy Elfenbein, February 23rd, 2007 at 6:46 pmThanks to Donaldson, our Buy List eeked out a slight gain despite the overall market’s sell-off. For the year, the Buy List is up 3.36% compared with 2.32% for the S&P 500 (not including dividends).

Here’s how our stocks have done year-to-date:

Bed Bath & Beyond (BBBY) 11.73%

Respironics (RESP) 11.10%

FactSet Research Systems (FDS) 10.75%

Jos. A Bank Clothiers (JOSB) 10.43%

Amphenol (APH) 9.26%

Donaldson (DCI) 8.47%

SEI Investments (SEIC) 6.70%

Graco (GGG) 6.69%

AFLAC (AFL) 5.63%

Fiserv (FISV) 4.33%

Biomet (BMET) 2.71%

Danaher (DHR) 2.25%

Varian Medical Systems (VAR) 2.17%

Fair Isaac (FIC) -1.25%

UnitedHealth Group (UNH) -1.30%

WR Berkley (BER) -1.68%

Harley-Davidson (HOG) -2.07%

Medtronic (MDT) -4.04%

Nicholas Financial (NICK) -6.44%

Sysco (SYY) -8.19% -

Gold Vs. the Fed

Eddy Elfenbein, February 23rd, 2007 at 1:11 pmIn this corner, weighing 195 pounds, standing 5 foot 10, hailing from Washington D.C. via Harvard, MIT and Princeton, New Jersey, wearing the M1 green trunks, the Charlemagne of Currency, the prince of paper, the bearded bard of the Fed, monarch of monetary policy, Benjamin GOLDILOCKS Bernanke!

And in the opposing corner, weighing 2046 metric tonnes — one ounce at a time — the shiny, precious, storehouse of value, the standard for monetary exchange, the most malleable and ductile of the known metals, that master of disaster, hailing from most of the world, that dense, soft, shiny, yellow metal, GOLD. -

Values Hidden in Plain Sight

Eddy Elfenbein, February 23rd, 2007 at 10:51 amMany investors think that to be successful at investing requires lots of time and very advanced research on companies. But I’m surprised how often great values are perfectly obvious to anyone who is simply paying attention. Malcolm Gladwell recently wrote in the New Yorker that Enron’s financial mess was visible to people who looked for it.

Consider the case of Pfizer (PFE). Obviously, the company has problems. It just announced that it’s cutting 10,000 jobs. But now the stock is below $26 a share. After its latest earnings report, Pfizer said it was projecting adjusted EPS of $2.18 to $2.25 for 2007, and $2.31 to $2.45 for 2008. If the company’s forecast is accurate, this means that the stock is going for about 10 or 11 times next year’s earnings. That’s pretty cheap. On top of that, the dividend yield is 4.4%, which isn’t far behind a Treasury bill.

I’m not necessarily saying that Pfizer is a great buy here, or that a forward P/E is the end of any analysis. But the key information here isn’t any state secret we’re talking about. We’re using information right from the company. They’re telling is what to expect, and the shares are still falling.

Another example is Amgen (AMGN). Historically, this has been a rapidly growing company. Today, the stock is going for about $66 a share. The company recently said that it expects 2007 EPS to be in the range of $4.30 to $4.50 (not including 10 to 12 cents for stock options). That’s means the stock’s “earnings yield” (the inverse of the P/E ratio) is over 6%. That’s certainly worth looking into.

I don’t know what either stock will do over the next 12 months. But if they do well, I’m sure some investors will kick themselves and say, “if they had only known.” -

Greenwich Family Values

Eddy Elfenbein, February 23rd, 2007 at 10:10 amFrom the AP:

A Greenwich mortgage broker who admitted she helped her college-age son recruit investors in a multimillion-dollar hedge fund scam pleaded for a reduced sentence Thursday, downplaying her role and blaming her son and others.

Ayferafet Yalincak, who pleaded guilty last year to conspiracy to commit wire fraud, is scheduled to be sentenced March 2. Her 22-year-old son, Hakan, faces up to 50 years in prison for managing the scheme when he is sentenced March 27.

Prosecutors say Hakan Yalincak charmed his way into the exclusive world of Greenwich high finance by posing as an heir to a wealthy Turkish family, shuttled counterfeit checks across the world and brokered deals with a Kuwaiti financier. Prosecutors said investors lost more than $7 million in the fake fund, an amount he contests.

Ayferafet Yalincak, who faces up to 5 years in prison under guidelines, asked for a short sentence in court papers filed Thursday. She rejected a presentence report that concluded Hakan’s fraud stemmed from the negative role model she provided.She’s got a point. If he blamed it on his kids, then she would be a role model.

-

Donaldson Beats the Street

Eddy Elfenbein, February 22nd, 2007 at 5:30 pmAfter the close, Donaldson (DCI) reported earnings of 38 cents a share, one penny better than estimates.

Donaldson Company, Inc. announced record second quarter diluted earnings per share of $.38, up from $.32 last year. Net income was $31.3 million, versus $26.9 million last year. Sales were a record $463.7 million, up from $392.9 million in fiscal 2006.

For the six month period, EPS was another record at $.81, up from $.69 last year. Net income increased 14 percent to $67.3 million compared to $59.1 million last year. Sales were a record $910.2 million, up 14 percent from $796.3 million in fiscal 2006.

“Sales growth was very strong during the quarter, supporting our outlook for another record year,” said Bill Cook, Chairman, President and CEO. “Our sales were especially good in Europe and Asia, where solid economic conditions and our well-developed market presence combined to deliver growth in excess of 25 percent in both regions. Our year-to-date operating margin of 10.6 percent compares favorably to 10.2 percent a year ago. Global economic conditions remain healthy for most of our businesses, giving us confidence in delivering our 18th consecutive year of record earnings.”Here’s a look at the streak:

Year………….Sales……………..EPS

1990…………$422.9……………$0.19

1991…………$457.7……………$0.21

1992…………$482.1……………$0.23

1993…………$533.3……………$0.26

1994…………$593.5……………$0.30

1995…………$704.0……………$0.37

1996…………$758.6……………$0.42

1997…………$833.3……………$0.50

1998…………$940.4……………$0.57

1999…………$944.1……………$0.66

2000…………$1,092.3…………$0.76

2001…………$1,137.0…………$0.83

2002…………$1,126.0…………$0.95

2003…………$1,218.3…………$1.05

2004…………$1,415.0…………$1.18

2005…………$1,595.7…………$1.27

2006…………$1,694.3…………$1.55

2007…………$1,820.0…………$1.76 (est)

2008…………$1,940.0…………$1.95 (est)

The company expects this year’s earnings to be betweem $1.72 and $1.82 a share. For the first half of this fiscal year (ending in July), DCI’s EPS is up 17.3%. If that trend continues in the back half, Donaldson will net $1.82 a share. -

Defending the Bull. Again.

Eddy Elfenbein, February 22nd, 2007 at 1:39 pm

I defended the bull market four months ago, and I’ll try to do it again today. This time, however, I want to take a look at some of the bearish arguments making the rounds. David Gaffen at Marketbeat outlines a few.

For example:The VIX, commonly known as the “fear index,” is hovering around 10, a low point, suggesting a lot of carefree folks out there these days. This level is often a turning point, a calm before the storm, so to speak.

No! No! A thousand times No! A low VIX does not mean that investors are complacent. It means the exact opposite—investors are being cautious. Notice how all the other risk spreads are also low.

The current rally is now the third longest since 1900 without a 10% correction.

That’s true, but what’s so special about 10%? The S&P 500 had a 7.7% correction last spring, and it kept going. This bull hasn’t exactly been a roaring bull. In almost ten months, we’re up almost 10%. That’s less than both earnings growth and dividend growth. Look at some sentiment indicators. Value stocks are still leading growth. The Nasdaq is still less than one-fifth of the Dow. These aren’t the signs of an overheating market.

Margin debt has hit an all-time high, surpassing the heady days of the technology stock boom, as more people borrow money to buy stocks than ever before.

But what about equity growth? The proper way to look at margin debt is its relation to equity. Why isn’t margin growth a good thing, reflecting investor optimism? (Update: Bill Rempel makes several good points on this misleading stat.)

The Dow industrials, transports and utilities all closed at new highs on the same day last week — something that became a routine occurrence in just two years, 1929 and 1986, both preludes to big market falloffs.

The last two triple highs came in March 1998, and the Nasdaq promptly tripled. The time before that came in April 1993, and the market rallied for another nine months. Nearly anything can prelude a big market falloff.

Another bearish talking point is that the market hasn’t had a 2% down day in nearly four years. Once again, I don’t see what’s so bad about that. The market is in a period of low volatility. There’s nothing unusual or dangerous about it. Today’s volatility is roughly equal to other periods of low volatility. Was their anything dangerous about the market of the mid-1990s? There were just three 2% down days from November 1991 to July 1996, and we survived. Some of us even made money. Remember this was the market that led to Irrational Exuberance.

Also, what’s so special about 2%? Since the last 2% day, we’ve had over 60 1% falls, including a few 1.8%-ers and one 1.9%-er. Change the parameters slightly, and the talking point goes away. We’ve gone almost nine months since a 1% correction, and that’s far from the longest streak ever. -

Chicks on the Street

Eddy Elfenbein, February 22nd, 2007 at 11:47 am

From an actual academic study:We study the relation between gender and job performance among brokerage firm equity analysts. Women’s representation in analyst positions drops from 16% in 1995 to 13% in 2005. We find women cover roughly 9 stocks on average compared to 10 for men. Women’s earnings estimates tend to be less accurate. After controlling for forecast characteristics, the difference in accuracy is roughly equivalent to four years of experience. Despite reduced coverage and lower forecast accuracy, we find women are significantly more likely to be designated as All-Stars, which suggests they outperform at other aspects of the job such as client service.

(Pictured is Hetty Green.)

-

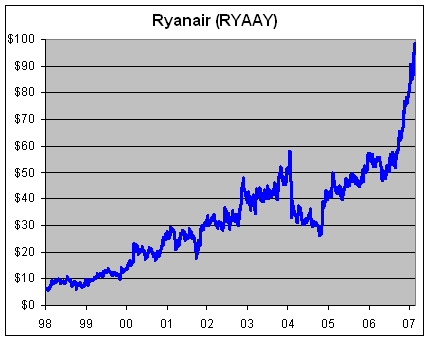

The Best Airline You’ve Never Heard Of

Eddy Elfenbein, February 22nd, 2007 at 9:48 amDublin-based Ryanair (RYAAY) is revolutionizing air travel in Europe. They’ve borrowed their business model from Southwest Airlines (LUV), and they’re having the same kind of success.

What’s their base rate for a round-trip flight from London to Pisa? One euro cent. Of course, there are some setbacks.Not everyone is happy with Europeans’ unchecked mobility. People in countries newly served by budget airlines complain that British bachelor and bachelorette parties are taking over Eastern European cities such as Riga.

European Weekends, a Nottingham-based events coordinator, offers one package that features a “Soviet nurse banquet,” with prices starting at 55 pounds ($108) per person.

The cost covers five shots of vodka, five female entertainers, a “lesbian nurse show” and a meal.

“I know about guys who go to Prague for a weekend of cheap beer, prostitutes and fighting,” Vertovec says. “People there really complain about it — and that’s due to low-cost airlines.”In the last nine years, the stock is up more than 15-fold.

-

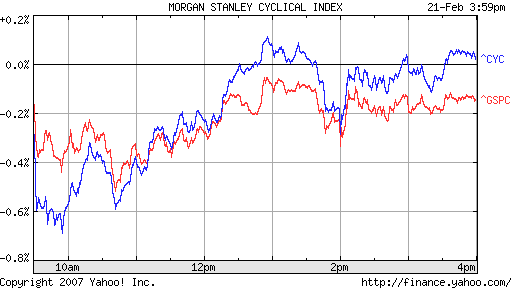

Cyclicals Do It Again

Eddy Elfenbein, February 21st, 2007 at 4:02 pm

That’s eight straight days of beating the S&P 500.

This morning, it looked like the streak was done for, but the cyclicals did it again.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His