Archive for February, 2007

-

Damn It Feels Good to Be a Banker

Eddy Elfenbein, February 21st, 2007 at 1:55 pmGoldman Sachs breaks down Blankfein’s pay:

TALLY SHEET

Components of 2006 Compensation, Benefits and Perquisites

Lloyd C. Blankfein

Cash Compensation

Base Salary $600,000

Cash Bonus (Includes $24,000 Qualified Money Purchase Pension Plan Contribution) $27,267,500

Equity-Based Compensation

Restricted Stock Units (RSUs) $ 15,679,500

RSUs — 77,776

Vested — 31,110

Unvested — 46,666

Stock Options $ 10,453,000

Shares Underlying Options — 209,228

Vested — 83,691

Unvested — 125,537

Exercise Price — $199.84

Total Compensation $ 54,000,000

Retirement and Welfare Benefits

Life Insurance Premiums $12,211

Firm Qualified Profit Sharing Plan Contribution $5,000

Medical/Dental Benefit Premiums $40,571

Long-Term Disability Insurance Premium $1,094

Other Benefits and Perquisites

Financial Planning Services $63,518

Car and Driver $198,388

Total Benefits and Perquisites $320,782

Dividend Equivalents on All Prior Years’ Restricted Stock Units $402,582

Total $54,723,364

Do you think “Car and Driver” means the magazine? Me neither. -

Worthwhile Canadian Initiative

Eddy Elfenbein, February 21st, 2007 at 11:43 amTelus to offer wireless adult content

We begin counting, now. One, two, thr…

Telus halts porn downloads -

The AFLAC Duck Is Not Dead

Eddy Elfenbein, February 21st, 2007 at 11:02 amDespite what Regis and Kelly said, and the New York Post, the AFLAC (AFL) duck is not going away.

“The company’s chief marketing officer tells adage.com he wants to focus less on the mascot and more on what Aflac does — supplemental insurance,” the CNN report stated. “He says many people recognize the duck’s squawk, but have no idea what product he’s selling.”

From there, the story was picked up by radio stations as far away as Los Angeles.

As the story spread, Herbert said he went from “from being annoyed to being concerned.”

About 2 p.m., the company issued the news release stating the duck was still alive. -

Investing Factoid of the Day

Eddy Elfenbein, February 21st, 2007 at 10:25 amThe Dow falls an average of 18.7% from one year’s high to the following year’s low.

This is from Mark Hulbert’s article which takes a skeptical look at the idea that years ending in “seven” are bad for the market. -

Cyclicals Are Soaring

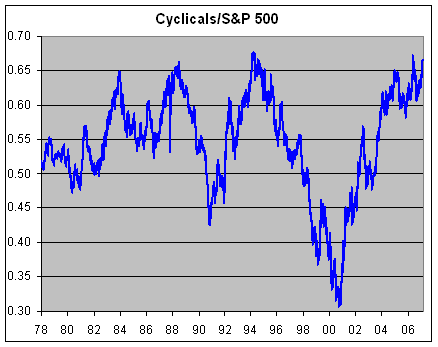

Eddy Elfenbein, February 21st, 2007 at 8:52 amCyclical stocks have been red-hot lately. The Morgan Stanley Cyclical Index (^CYC) has beaten the S&P 500 for the last seven straight days, and 25 of the last 30. This may be a sign that the economy isn’t ready to throw in the towel just yet.

The cyclical rally is notable because the sell-off last May and June fell disproportionately on cyclicals. Still, cyclicals have been the uncrowned kings of this bull market. In less than four years, the CYC is up over 150%, which is nearly twice as much as the S&P 500.

I like to track the CYC/S&P ratio, which often gives us a better reading on the economy’s health than any government report. The ratio increases when cyclicals outperform, and decreases when cyclicals underperform. On May 10, the ratio got to 0.672, its highest point in 12 years. The correction brought it back below to 0.610, but now it’s closing in on the May high again. Yesterday, the ratio got to 0.665.

The ratio’s high mark of 0.677 came on March 23, 1994 (my records date back to 1978), so we’re in striking distance of a new high. During previous economic recoveries, the ratio has usually petered out around 0.65. Currently, the ratio is in the top 1% of all readings. In other words, we’re near outlier territory.

While cyclicals are surging now, history suggests that the end of the party may soon be near.

-

That Was Fast

Eddy Elfenbein, February 21st, 2007 at 7:18 amWhen the Altria Group announced in the fall that it was planning to spin off its Kraft Foods division, Wall Street cheered.

New York Times, February 21Kraft Chief Outlines Turnaround Strategy

New York Times, February 21 -

Medtronic Earns 61 Cents a Share

Eddy Elfenbein, February 20th, 2007 at 4:09 pmMedtronic (MDT) just reported earnings of 61 cents a share, three cents more than exectations. Here are MDT’s results for the past few quarters:

Quarter………..EPS………….Sales

Jul-01…………$0.28………..$1,455.70

Oct-01………..$0.29………..$1,571.00

Jan-02………..$0.30………..$1,592.00

Apr-02………..$0.34………..$1,792.00

Jul-02…………$0.32………..$1,713.90

Oct-02………..$0.34………..$1,891.00

Jan-03………..$0.35………..$1,912.50

Apr-03………..$0.40………..$2,148.00

Jul-03…………$0.37………..$2,064.20

Oct-03………..$0.39………..$2,163.80

Jan-04………..$0.40………..$2,193.80

Apr-04………..$0.48………..$2,665.40

Jul-04…………$0.43………..$2,346.10

Oct-04………..$0.44………..$2,399.80

Jan-05………..$0.46………..$2,530.70

Apr-05………..$0.53………..$2,778.00

Jul-05…………$0.50………..$2,690.40

Oct-05………..$0.54………..$2,765.40

Jan-06………..$0.55………..$2,769.50

Apr-06………..$0.62………..$3,066.70

Jul-06…………$0.55………..$2,897.00

Oct-06………..$0.59………..$3,075.00

Jan-07………..$0.61………..$3,048.00 -

Wal-Mart: $1 Billion a Day

Eddy Elfenbein, February 20th, 2007 at 11:21 amIn 1955, General Motors (GM) became the first American company to make over $1 billion in a single year. Today Wal-Mart (WMT) reported its fourth-quarter earnings. The earnings aren’t that interesting (95 cents a share), but check out the sales number–$98.09 billion! That’s an average of $1.06 billion a day.

For the record, ExxonMobil (XOM) already hit the $100 billion quarterly revenue mark in 2005, but that was due to soaring oil prices. -

10 Things You Might Not Know About the Sirius-XM Merger

Eddy Elfenbein, February 20th, 2007 at 11:05 amFrom the Wired Blog:

1. It’s being touted as a “merger of equals,” but in fact, Sirius is buying XM for nearly $4.6 billion in stock. (Source:Bloomberg)

2. Sirius and XM’s receivers are incompatible: it won’t be elementary to combine the two services, and to get both, you’ll probably have to buy a new receiver. The companies have promised to merge channel lineups, however, letting customers pick and choose on an “a la carte” basis.

3. Sirius offered one-time payments for a lifetime subscription, but tied it to a receiver. These users could be offered deals to add XM or upgrade their receiver, or could be told that one-time payment forever applies only to Sirius-branded content on the original box. What deal will the merged giant offer?

4. The merger effectively creates a local monopoly in digital radio (excepting that provided through cable television services.) Under scrutiny from the Justice Department and FCC, Sirius and XM may claim to be competing not with each other, but with iTunes and other music download services. If they do, might it have consequences for XM’s claim that they aren’t a download service, in regard to an RIAA lawsuit? However it pans out, the phrase “regulatory hurdles” could haunt the deal for months.

5. Channels will die. There’s a lot of duplicated content across the two networks. It’ll be interesting to see how closely culling is tied to earcount and ego.

6. Though XM has more subscribers (XM has claimed 7.6 million to Sirius’s claimed 6 million) and had more than double Sirius’ revenue in 2005, Sirius recently boasted about its economic performance and climbing subscriber base. Both companies have been losing money hand-over-fist for years, however: Shares for both declined about 50 percent last year. Sirius is worth $5.2 billion, while XM was recently valued at $3.75 billion. (Compare the buyout price!)

7. Sirius was originally called Dog Radio, and was founded in 1990. XM was originally called American Mobile Satellite Corp, and was founded in 1988.

8. The elliptical orbit of Sirius’s satellites causes trouble for customers who receive their Musak-like business music service through stationary antennas. Sirius is launching a geostationary satellite just for them.

9. Sirius’ and XM’s press release contained a boilerplate legal disclaimer about “Forward Looking Statements,” listing the words “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “will,” “should,” “may,” as ones that predicate statements the reader should take with a pinch of salt.

10. Worldstar serves satellite radio to Europe, Africa and the rest of the world. With about a hundredth of the merged giant’s revenues, it doesn’t compete in its home market, instead licensing a few select channels to XM. -

News this Morning

Eddy Elfenbein, February 20th, 2007 at 10:09 amGood morning. I hope everyone had a great three-day weekend. This is an important week for us. Two of our Buy List stocks will report earnings. First, Medtronic (MDT) reports after the close today. Wall Street is looking for 58 cents a share. Also, Donaldson (DCI) reports on Thursday. The Street is looking for 37 cents a share. I don’t expect any surprises here.

The best news is that Harley-Davidson (HOG) has reached a tentative deal with its union. Hallelujah! The stock is up early this morning.

Another big event will come tomorrow morning when the Consumer Price Index for January comes out. I’m expecting more good news on the inflation front.

Finally, a word on JetBlue (JBLU). The stock is getting slammed this morning, and deservedly so. What I don’t get about JBLU is that in the five years since its IPO, the stock has split 3-for-2, three times. Yet the stock hasn’t gone anywhere. Splits are for high prices! On its first day of trading, JBLU soared from $27 to $45. Three 3-for-2 splits works out to one 3.375-to-1, so $45 is equal to $13.33 today. The shares are around $12.67 this morning.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His