Archive for February, 2007

-

W. R. Berkley Rulz

Eddy Elfenbein, February 8th, 2007 at 9:23 pmAfter the bell, W. R. Berkley (BER) reported operating earnings of 96 cents a share on revenue of $1.36 billion. (With insurance companies, the key number to watch is operating earnings.) This was a very good report. The Street was expecting earnings of 89 cents a share, and revenue of $1.4 billion.

-

The Subprime Fallout

Eddy Elfenbein, February 8th, 2007 at 4:21 pmThe subprime market took a beating today. Here’s how some stocks in, and near, the industry fared:

HSBC (HBC) -2.65%

New Century Financial (NEW) -36.21%

Novastar Financial (NFI) -11.12%

Fremont General (FMT) -11.04%

American Home Mortgage Investment (AHM) -8.14%

Impac Mortgage Holdings (IMH) -4.68%

Countrywide Financial (CFC) -2.57%

IndyMac Bancorp. (NDE) -2.78%

PMI Group (PMI) -3.92%

Radian Group (RDN) -3.23%

MGIC Investment (MTG) -2.67% -

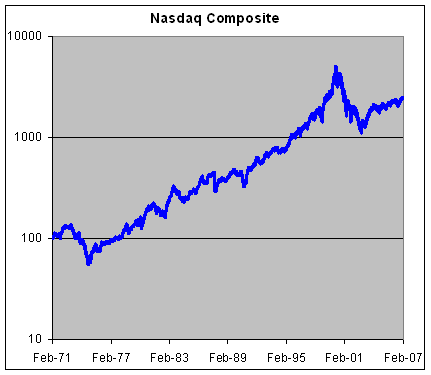

Happy Birthday Nasdaq

Eddy Elfenbein, February 8th, 2007 at 11:39 amThirty-six years ago today, the National Association of Securities Dealers Automated Quotations was born.

On its first day, the index rose 0.84 to close at…100.84! The index reached its low close of 54.87 on October 3, 1974, and its high of 12.3 gazillion on March 10, 2000 (well, 5048.62).

Since 1971, the index has returned 9.34% a year, though not in a straight line.

-

The Blue Meanies Strike Back

Eddy Elfenbein, February 8th, 2007 at 11:32 amIf you ever find yourself literally Crossing Wall Street, please — no iPods.

-

The Irrational Quest for Charismatic CEOs

Eddy Elfenbein, February 8th, 2007 at 11:25 amHere’s part of an interview with Harvard professor, Rakesh Khurana, on his book Searching for a Corporate Savior: The Irrational Quest for Charismatic CEOs:

Lagace: CEOs are suddenly very much in the spotlight, but you have been studying the dynamics of CEO successions for a number of years. What drove you to examine this topic in such depth? What surprised you most in your research?

Khurana: I guess one could have accused me of being opportunistic in writing this book, but the fact is the book was finished last year and is only now getting published. I actually wrote my dissertation in 1998 on this topic.

The common thread that got me started on studying CEOs is evident in my body of work in exploring the forces that govern the process of CEO change. I have conducted research in four interrelated areas: factors that lead to vacancies in the CEO position; factors that affect the choice of successors; the role of market intermediaries such as executive search firms in the CEO search; and the consequences of CEO succession and selection decisions for subsequent firm performance and strategic choices.

What surprised me most was that the CEO labor market is not a market in any traditional sense of the term. Rather, it resembled more of a closed ecosystem in which selection decisions were based on highly stylized criteria that often had little to do with the problems a firm was confronting.

Although I did not at first believe the results, the evidence was overwhelming and not pretty. The rise in the power of institutional investors has led to the creation of an “external” market for CEOs that is wracked with irrational decision making. Increasingly, the emphasis was more on bringing in a ruthless outsider to boost the performance of an under-performing company than on grooming leadership within the company. A famous CEO was preferred over a low-profile CEO, as the former was seen as a boost to public and investor confidence—and share prices—fast. -

Liz Claman is now CNBC’s anti-Maria Bartiromo

Eddy Elfenbein, February 8th, 2007 at 11:05 amFrom Jon Friedman at MarketWatch:

You could call Liz Claman CNBC’s anti-Maria Bartiromo, a counterpoint to controversy.

In recent weeks, CNBC has received a flood of negative publicity. Bartiromo, CNBC’s biggest star, was accused of getting too close to one of her sources. Bartiromo got so much coverage that it seemed as if CNBC consisted of one superstar anchor.

By contrast, the unpretentious Claman, who joined CNBC in 1998 and now anchors “Morning Call,” almost seems out of place in TV news. After all, this is a business which cranks out divas with the precision of a Detroit assembly line rolling out new cars.

“You can’t start believing your own press clippings,” Claman told me. “Your vision gets clouded.” -

Why is Yahoo Going for $30

Eddy Elfenbein, February 8th, 2007 at 10:21 amCan anyone tell my why Yahoo (YHOO) is going for $30 a share?

Seriously, I just don’t get it. I’m always looking at stocks and asking myself if the price “makes sense.” Usually they do, sometimes they don’t. But Yahoo? Sheesh…it’s not even in the ballpark.

Here’s a quick look as some valuations:Stock Price 08 Estimate Multiple Yahoo $29.89 $0.73 40.9 Cognizant $94.88 $2.76 34.4 Google $470.01 $18.42 25.5 Apple $86.15 $3.78 22.8 eBay $33.37 $1.51 22.1 EMC $13.60 $0.78 17.4 SanDisk $41.66 $2.54 16.4 Intel $21.51 $1.34 16.1 GE $36.10 $2.49 14.5 Amgen $70.00 $4.95 14.1 A look at the P/E ratio based on next year’s earnings is far from a perfect valuation measure, but it gives you an idea of just how pricey Yahoo is. I don’t see how Yahoo can be that much higher than Google and Apple.

Make no mistake: Yahoo had a very good earnings report last quarter. The company topped expectations by six cents a share (19 to 13). But still, Yahoo’s revenues grew by 13%. Is that enough to justify this valuation? -

Varian Joins the S&P 500

Eddy Elfenbein, February 8th, 2007 at 9:44 amCongratulations to Varian Medical Systems (VAR) for its inclusion in the S&P 500. This is Wall Street’s equivalent of being a “made man.” The opening was made thanks to Blackstone’s acquistion of Equity Office.

Also, Joe Bank (JOSB) just raised its forecast for this year to $2.25 a share from its earlier estimate of $2.15.

Finally, Harley (HOG) said it will miss Q1 shipment targets due to the strike. -

The Disposition Effect

Eddy Elfenbein, February 8th, 2007 at 7:02 amFrom Wikipedia.

The Disposition Effect is an anomaly discovered in Behavioral Finance. It relates to the tendency of investors to sell shares whose price is increasing, while keeping assets that have dropped in value.

Don’t let this happen to you.

-

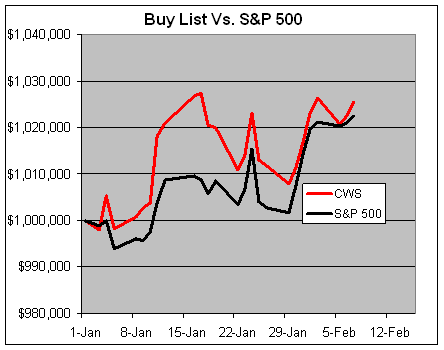

The Buy List So Far

Eddy Elfenbein, February 7th, 2007 at 5:07 pmThrough today, the Buy List is up 2.54% (the red line) versus 2.24% for the S&P 500 (the black line).

WR Berkley (BER), one of our weaker stocks this year, reports tomorrow after the close.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His