Archive for March, 2007

-

Slower Earnings Growth

Eddy Elfenbein, March 31st, 2007 at 11:49 pmI think I’ve been too optimistic regarding earnings growth for this year. I thought there was a chance that profit growth could come in lower-than-expected, but now we’re seeing the proof.

Jacqueline Doherty notes in Barron’s that on January 1, first-quarter earnings growth for the S&P 500 was estimated to be 8.7%. Today, it’s down to 3.8%. Since analysts tend to low-ball their forecasts, the results will probably be a bit better, perhaps around 7% or 8%.

After that, however, things get hazy. For the second quarter, analysts see earnings growing by 4%, then 6.8% for the third quarter and 12.5% for the fourth quarter. I expect that the forecasts for third and fourth quarters will soon be pared back.

The reason for the slower earnings growth can be blamed largely on just two sectors—the homebuilders and the autos:James Paulsen, chief investment strategist at Wells Capital Management, notes that 91% of real gross domestic product is growing by 4.3%. Only 9% of the economic is contracting by 10%–the part that is attracting all the attention.

The good news is that even with lower earnings growth, the S&P 500 is still going for just 15.2 times 2007’s earnings.

-

Biomet’s CFO Resigns

Eddy Elfenbein, March 31st, 2007 at 8:29 pmBiomet Inc. said Friday its chief financial officer and another executive resigned after an internal inquiry found accounting errors related to stock option grants over the past 11 years.

The company said it will have to restate its most recent annual report to reflect the disparity in the recorded expenses for stock option grants and the actual expenses for the grants, which totals about $50 million over 11 years, according to preliminary findings. -

Asset Managers

Eddy Elfenbein, March 30th, 2007 at 3:37 pmThe old saying is true, it’s better to buy the stocks of asset managers than their funds.

-

University May IPO

Eddy Elfenbein, March 30th, 2007 at 1:45 pmNo, really. In India:

When finance minister P Chidambaram said he wanted to make Mumbai Asia’s financial hub, he certainly wouldn’t have imagined the folks at Mumbai University latching on to every word of his.

But quite obviously, they did. Why else would a proposal come up to convert the university into a company and get itself listed on the stock exchange? -

Highlights from Yesterday’s Demonstration

Eddy Elfenbein, March 30th, 2007 at 12:11 pmIn case you missed it, there was a demonstration on Wall Street yesterday. Don’t worry, PinkNews was on the scene:

The crowd swelled at the New York Stock Exchange, as call-and-response chants condemned health care profiteering by insurance and health care companies.

The protest concluded at the “Wall Street Bull” statue, as the fervent group observed those engaging in civil disobedience.

The bull was left with a pair of condoms adorning its horns.I think that’s supposed to be a metaphor.

-

The Great Corn Boom

Eddy Elfenbein, March 30th, 2007 at 11:33 amFortune looks at the dramatic rise in the price of corn:

Four-dollar corn. The price probably doesn’t mean much to many Fortune readers, certainly not the city slickers who wouldn’t know a combine from a planter. But in farm country, $4 corn is more than a big deal. It’s a phenomenon. “It’s the center of conversation in the center of the country,” says Elizabeth Hund, head of agricultural lending for U.S. Bancorp.

In the span of just eight months, the price of the U.S.’s most important crop – our biggest agricultural export as well as the staple feed for our livestock – has doubled from $2, about where it had been stuck since the late 1990s, to $4 a bushel. The cause is soaring demand from ethanol plants, which bought 2.2 billion bushels last year, 34% more than in 2005. Previous price spikes were short-lived and usually caused by drought, but the futures market thinks this rally has legs.

May 2008 corn recently traded at $4.20 a bushel, while December 2010 futures were at $3.74. This means farmers can lock in terrific prices not just for the 2007 crop but for the three after that as well.

Problem is, what’s good for farmers – and even better for the companies selling them tractors, seeds, and fertilizer – has started to roil other parts of the economy. The feed costs of cattlemen and hog farmers have skyrocketed. Ethanol producers have seen their profits slashed. Food companies are being squeezed and are starting to pass along higher costs to consumers. (This isn’t just a U.S. problem: Mexico is in an uproar over soaring tortilla costs.)The market is responding. The Department of Agriculture reports that corn plantings will reach the highest level since 1944.

-

Take-Two Shareholders Win

Eddy Elfenbein, March 30th, 2007 at 10:26 amA group of Take-Two Interactive Software Inc. shareholders owning 46.1% of the videogame maker’s stock succeeded in removing the board and replacing it with six new directors.

The newly elected board already nominated as chairman Strauss Zelnick, founder of media management and investment firm ZelnickMedia. The board also named Benjamin Feder as acting chief executive, succeeding former CEO Paul Eibeler, and increased the number of board seats to seven from six in order to reappoint the just-ousted Grover Brown as the seventh director.

The board coup is the handiwork of four institutional shareholders, a class of investors not known for activist investing, or agitating for change at companies to boost the stock price. The group consists of mutual-fund firm OppenheimerFunds Inc., D.E. Shaw Valence Portfolios LLC, Tudor Investment Corp. and hedge fund S.A.C. Capital.

The upheaval comes as the maker of “Grand Theft Auto” videogames struggles to rebound from a stock-options scandal and return its operations to profitability. Earlier this year, former Chairman and Chief Executive Ryan Brant pleaded guilty to charges in connection with an options-backdating scheme.Despite the victory, Take-Two (TTWO) is still an unimpressive stock. But I’m happy to see shareholders beat management. Ideally, this should happen much more often than it does. Shareholders are owners, and should be treated as such. It’s unfortunate that it took such a dismal performance to bring this about.

-

Solengo Capital Takes on Internets

Eddy Elfenbein, March 29th, 2007 at 12:27 pmYesterday, DealBreaker and Naked Shorts posted the marketing brochure for Solengo Capital, the new hedge fund started by Brian Hunter, who happens to have the same name as the energy trader who ruined Amaranth. Turns out, it’s the same guy.

One would think that a marketing brochure’s purpose is to market the company. One is, apparently, wrong. Solengo asked both blogs to take down the brochure. I guess they don’t want the word to get out. Anyway, Naked Shorts complied, but DB is holding its ground.

Reuters reports:“We think it is valuable information to our readers and they haven’t given us persuasive arguments for taking it down,” said Beth Levin, associated editor of the site, which focuses on Wall Street matters.

(Note to Reuters: That’s Bess Levin.)

I can’t believe that Solengo really thinks it can come out this looking good. I find it ironic that energy traders are wasting their energy on this. -

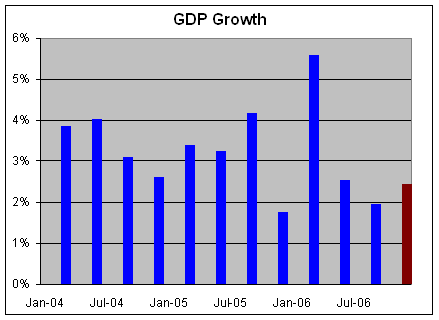

Q4 GDP Revised to 2.5%

Eddy Elfenbein, March 29th, 2007 at 8:52 amThe economy grew by 2.5% for the fourth quarter (technically, it was 2.452%).

Three percent is the Magic Line in GDP growth. Once the economy starts growing less than 3%, it will tend (though not always) to keep doing that for several quarters. The fourth quarter was the third straight quarter of below-trend growth.

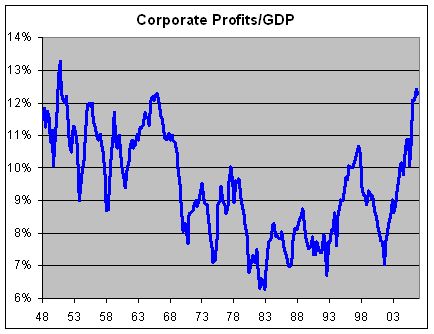

Corporate profits had been growing faster than the economy, but that has probably come to an end. For the third quarter of 2006, corporate profits comprised 12.41% of the overall economy, which was the largest share in over 50 years. In the fourth quarter, it dropped to 12.25%.

-

Wall Street and the Subprime Market

Eddy Elfenbein, March 29th, 2007 at 8:34 amIn today’s Wall Street Journal, Gregory Zuckerman has a great article on the decline and fall of New Century Financial:

In February, New Century mortgages that had been worth $8 billion fell by more than $300 million within days, someone familiar with the matter says. The result: More lenders demanded additional collateral, also called margin, from New Century, including Goldman and Credit Suisse, people familiar with the matter say. Banks also invoked terms allowing them to demand that the company buy back loans if borrowers failed to make payments.

The company’s cash was dwindling quickly. Adding to the company’s woes were revelations about accounting problems, plans to restate 2006 earnings and post a fourth-quarter loss, and a Securities and Exchange Commission inquiry.

New Century was running out of options. It was unable to get new financing and in violation of its existing lending agreements, in part because it was low on cash. So the company convened the March 6 conference call with its 11 lenders. Mr. Morrice, the CEO, was joined on the call by New Century board member David Einhorn, who runs Greenlight Capital, a New York hedge fund that owned 6% of the company’s stock, which by then had fallen 70% in two weeks.

Mr. Morrice informed the bankers that New Century’s available cash had dropped to $40 million, down from the $100 million he had reported to some of the bankers a day earlier and from $350 million at year end, a participant on the call said.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His