Archive for April, 2007

-

Even CEO Can’t Figure Out How RadioShack Still In Business

Eddy Elfenbein, April 26th, 2007 at 12:47 pmFrom The Onion:

The retail outlet boasts more than 6,000 locations in the United States, and is known best for its wall-sized displays of obscure-looking analog electronics components and its notoriously desperate, high-pressure sales staff. Nevertheless, it ranks as a Fortune 500 company, with gross revenues of over $4.5 billion and fiscal quarter earnings averaging tens of millions of dollars.

“Have you even been inside of a RadioShack recently?” Day asked. “Just walking into the place makes you feel vaguely depressed and alienated. Maybe our customers are at the mall anyway and don’t feel like driving to Best Buy? I suppose that’s possible, but still, it’s just…weird.” -

Earnings: The Good, the Bad and the Very Ugly

Eddy Elfenbein, April 26th, 2007 at 11:03 amThis has been a very busy week for earnings. Let’s run down some of the recent reports from the stocks on our Buy List.

Graco (GGG) reported yucky earnings after the bell on Tuesday. The company made 50 cents a share, which was seven cents below Wall Street’s estimate and a penny less than last year. Not good! Revenue rose just 3% to $197.5 million. The stock dropped 5% yesterday to $40 a share.

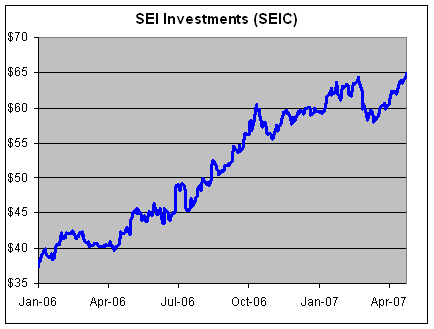

Right after I mentioned that SEI Investments (SEIC) was at a new high, the company reported blah earnings. For the first quarter, SEIC earned 62 cents a share, one penny shy of expectations. Of course, that’s still good growth over last year’s 54 cents a share, but Wall Street wanted better. Me too. The stock fell 3.6% yesterday.

At least, AFLAC’s (AFL) earnings were a bright spot. The company reported operating earnings of 82 cents a share, three cents more than estimates. Revenue rose 5% to $3.75 billion. The stock rose 4.5% yesterday. That helped ease some of the pain.

Fair Isaac (FIC) already announced that it would have bad earnings. Well, they were right. Analysts had been looking for 59 cents a share, but the company said it would be 35 cents to 37 cents a share. The results came in at 37 cents a share. The stock dropped last week when the earnings shortfall was announced, so the shares didn’t do much yesterday. I’m not encouraged by this.

Fiserv (FISV) had a bit of a mixed picture:Actually, they’re both right. Net income fell, but earnings-per-share rose from 64 cents to 66 cents. Analysts, on average, were expecting 67 cents. I’m not worried about FISV. This is a solid company.

Varian Medical (VAR) is today’s problem child. The company made 46 cents a share for the first quarter, which was in line with expectations. But VAR’s EPS outlook for next quarter is for 35 to 36 cents, which is well below the Street’s forecast of 45 cents. VAR sees full-year EPS of $1.79 to $1.81 compared with the Street’s forecast of $1.85. The stock is down about 7% this morning.

Finally, Respironics (RESP) had good news this morning. The company reported earnings of 46 cents a share, one penny better than expectations. RESP also said this quarter’s earnings will be 50 cents to 52 cents a share compared with the Street’s forecast of 48 cents a share. Full year EPS is expected to be $1.74 to $1.76 compared with the Street’s outlook for $1.63.

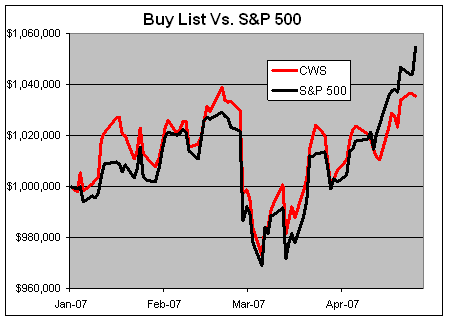

Unfortunately, the Buy List hasn’t benefited as much as I hoped from this recent up move in the market. For the year, the Buy List (red line) now trails the S&P 500 (black line), 5.44% to 3.55%. It all turned recently. Since April 5, the S&P 500 is up 3.58% while the Buy List is up just 1.15%.

-

Lindsay San Looks at Stryker (SYK)

Eddy Elfenbein, April 26th, 2007 at 8:39 am

Next week, the stock celebrates 28 years since its IPO. Since then, the shares are up 800 fold, or 27% a year, which is even better than Berkshire Hathaway. -

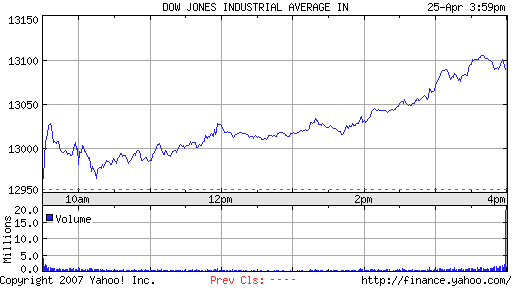

Dow 13000

Eddy Elfenbein, April 25th, 2007 at 4:01 pm

Wow, what a day!

The Dow (^DJI) shot up 135.95 points to break 13000. This comes just 127 trading days after breaking 12000. The index closed today’s trading at 13089.89.

The bull keeps on charging. I’m too modest to mention that I defended the bull six months ago and again two months ago, so I’ll just play it cool.

The Dow isn’t the only one partying. The S&P 500 is at 1495.42, only inches away from 1,500 — a number it hasn’t seen in over six years. The Nasdaq is at 2547.89 and is closing in on 2,584 which is a Fibonacci number. I have know idea what it means, but you can use this as a conversation starter.

What pushed us over the top today is what’s been driving us all along, energy. The S&P Energy Index (^DJUSEN) was up 2.07%. The Morgan Stanley Cyclical Index (^CYC) shot up 1.28% to close at 1,010.56, its first ever close over 1,000.

Here’s my estimate of how many Dow points each stock has added since October 19 when the Dow broke 12000:

Honeywell………………………100.85

Boeing…………………………….99.80

Altria……………………………….99.06

IBM…………………………………94.27

Exxon……………………………..82.81

Alcoa………………………………66.88

Merck……………………………..64.20

McDonalds……………………….63.88

Coke……………………………….55.51

JP Morgan Chase………………48.35

AT&T……………………………….43.80

DuPont……………………………40.39

Amex………………………………35.35

Caterpillar………………………..34.21

Citi………………………………….31.94

Disney……………………………..30.31

Home Depot……………………..29.17

AIG………………………………….27.39

United Tech………………………24.71

HP…………………………………..18.77

Intel………………………………….9.98

Procter & Gamble………………..8.37

Microsoft……………………………5.69

3M……………………………………4.63

Verizon……………………………..3.58

Wal-Mart……………………………2.60

GE…………………………………….1.06

Pfizer………………………………-11.05

GM………………………………….-16.01

J&J………………………………….-27.31 -

Royal Bank-Led Group Bids $98.5 Billion for ABN Amro

Eddy Elfenbein, April 25th, 2007 at 3:32 pmI told you this wasn’t over. Now a group led by RBS is making a counter offer of $98.5 billion for ABN Amro. Barclay’s bid is for about $90 billion.

Royal Bank of Scotland Group Plc, Santander Central Hispano SA and Fortis offered 72.2 billion euros ($98.5 billion) to buy ABN Amro Holding NV, sparking the biggest takeover battle in the financial-services industry.

The Royal Bank-led group offered 39 euros a share, with 70 percent in cash and 30 percent in stock, the companies said in a statement today. The group said its approach is 13 percent higher than the all-stock bid ABN Amro accepted from Barclays Plc two days ago. Barclays’s bid was worth 67 billion euros at the time.

The fight for control of Amsterdam-based ABN Amro, which has branches in 53 countries, centers on its LaSalle unit in Chicago. ABN Amro and Barclays elbowed Royal Bank Chief Executive Officer Fred Goodwin aside by agreeing to sell LaSalle to Bank of America Corp. for $21 billion. Goodwin said today that LaSalle will be a “major piece” of any bid.The numbers here are staggering. Let’s see if Barclays makes a move.

-

Respironics On Wall Strip

Eddy Elfenbein, April 25th, 2007 at 9:32 am -

The First Global Bubble?

Eddy Elfenbein, April 24th, 2007 at 9:25 pmI don’t necessarily agree with Jeremy Grantham, but here’s an interesting take on the markets.

For the last 5 years to this March, in dollar terms, the S&P 500 was up 35 per cent compared with 192 per cent for non-US small cap and 221 per cent for emerging markets. After these moves most diversifying and exotic assets are badly overpriced and the risk premium is the lowest it has ever been.

In fact, the new global money flows have probably created the first truly global bubble, almost everywhere in almost everything. Particularly noteworthy and the beneficiary of our twin forces are small caps everywhere which on our data are more overpriced, driven by private equity deals, than an overpriced market. -

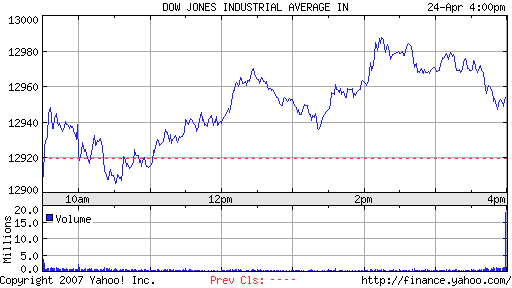

Dow Flirts With 13000, Gets Number, Never Calls

Eddy Elfenbein, April 24th, 2007 at 4:32 pm

Close. Oh so close. -

SEI Investments Hits New High

Eddy Elfenbein, April 24th, 2007 at 3:24 pm

Can’t keep a good stock down. Last year, SEI Investments (SEIC) was the top-performing stock on the Buy List (up 61%).

I decided to keep it on this year’s Buy List. The stock got slammed last month, but has regained all the lost ground and is now at an all-time high. Earnings come out tomorrow. -

W.R. Berkley’s Earnings

Eddy Elfenbein, April 24th, 2007 at 11:12 amWR Berkley (BER) had a decent earnings. For insurance companies, the key stat you want to see is operating earnings. For BER, operating income came in at 91 cents per share, two cents more than expectations.

The stock hasn’t done very well over the past year, but the earnings have been good. At one point, BER was over $40 a share (post-split). It’s down again today. The P/E ratio is now under 10.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His