Archive for May, 2007

-

RM + WSJ: Let’s Do The Math

Eddy Elfenbein, May 14th, 2007 at 10:03 amHoward Kurtz in today’s Washington Post makes some interesting points about Rupert Murdoch’s bid for Dow Jones:

The newspaper business is battered these days, with rich folks buying up properties at fire-sale prices and proceeding to slash costs. Avista Capital Partners just cut 50 newsroom jobs at the Minneapolis Star Tribune. Philadelphia public relations executive Brian Tierney laid off 71 at the Philadelphia Inquirer. Chicago real-estate mogul Sam Zell hasn’t taken a wrecking ball to the Tribune papers yet, but the chain’s jewel, the Los Angeles Times, announced plans to eliminate another 150 editorial jobs. And none of these new owners had a previous day of newspaper experience.

Along comes Murdoch with a generous offer to buy Dow Jones, and he’s not talking about slashing costs. In fact, he told the New York Times he wants to expand the Journal’s Washington coverage.The Financial Times reports that some Bancrofts are ready to meet with Murdoch.

-

One-In-Three Chance Greenspan Is Making Sense

Eddy Elfenbein, May 11th, 2007 at 10:36 amAlan Greenspan is in the news again. The former Fed chair now thinks there’s a 1-in-3 chance of a recession. Or more specifically, he said:

At the moment, I still say as I said before, by algebraic implications, the odds are 2 to 1 we won’t have a recession.

Oh dear lord. He can’t even deliver a simple declarative sentence. I think half the battle of making everyone think you’re a genius is simply being convoluted. Also, start dropping phrases like “algebraic implications.”

So, let’s take a closer look at what Greenspan is really saying.

I looked at the data from the last 20 years. Of the last 80 quarters, real GDP declined for five quarters and growth came in below 2% for 22 quarters. This means that economy is close to recession levels for one-quarter of the time. (I’m being pretty liberal in my definition, but you get the point.)

Despite his algebraic implications, Greenspan is hardly making a bold prediction. This is almost like saying that there’s a 1-in-5 chance that any given day is Saturday.

Why is this news? -

Whole Foods Bombs

Eddy Elfenbein, May 10th, 2007 at 2:54 pmI’ve been a bear on Whole Foods Market (WFMI) for some time so today’s earnings dud doesn’t come as a surprise.

I first warned about the stock in December 2005 when it was at $76 a share. Thanks to today’s sell-off, the shares are down to $41.

But! It could be a good buy soon. I’d consider paying $35 for WFMI. -

JoS. A. Bank Clothiers Sales Rise

Eddy Elfenbein, May 10th, 2007 at 11:13 amJoe Bank (JOSB) is up 6% today. Here’s the story from AP:

Men’s clothing retailer JoS. A. Bank Clothiers Inc. said Thursday its same-store sales climbed 7.3 percent in April, easily topping Wall Street’s expectations for a 0.7 percent increase.

Same-store sales, or sales at stores open at least a year, are a key measure of retailer performance, because they measure growth at existing stores rather than from newly opened ones.

Total sales for the fiscal month ended May 5 surged 18.5 percent to $45.5 million from $38.4 million in the prior-year period.

Direct marketing sales grew 30 percent in April. -

The Fed Stays on Hold

Eddy Elfenbein, May 9th, 2007 at 2:15 pmFor the seventh straight meeting, the Federal Resserve has left interest rates alone:

Here’s the statement:The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Economic growth slowed in the first part of this year and the adjustment in the housing sector is ongoing. Nevertheless, the economy seems likely to expand at a moderate pace over coming quarters.

Core inflation remains somewhat elevated. Although inflation pressures seem likely to moderate over time, the high level of resource utilization has the potential to sustain those pressures.

In these circumstances, the Committee’s predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Voting for the FOMC monetary policy action were: Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Cathy E. Minehan; Frederic S. Mishkin; Michael H. Moskow; William Poole; and Kevin M. Warsh.This is almost an exact replica of the March statement.

-

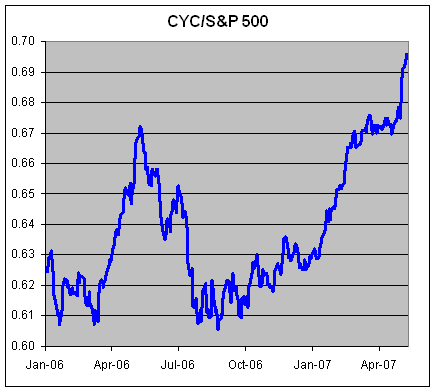

Are Cyclicals Leaving Orbit?

Eddy Elfenbein, May 9th, 2007 at 11:06 am

I’ve written about the surge in cyclical stocks before, but now the trend is starting to leave orbit.

The Morgan Stanley Cyclical Index (^CYC) is up for 15 of the last 19 trading sessions. Not only that, it’s beaten the S&P 500 for the last six sessions, and 13 of the last 14.

As I write this, the index is up again today while the S&P 500 is down. The ratio of the CYC against the S&P 500 is at its highest in 30 years of data.

As a general rule, cyclical stocks outperform the market when long-term interest rates rise. But lately, that hasn’t been the case. The yield on the 30-year T-bond (^TYX) is down a bit over the past few weeks, and it’s been locked between 4.5% and 5% for nearly nine months. -

The Blair Market

Eddy Elfenbein, May 8th, 2007 at 10:01 amLater this week, Tony Blair will pack his bags and leave 10 Downing Street after 10 years in office.

It’s worth reflecting on how much Blair has changed Britain. He had the Labor Party drop its controversial Clause IV, which called for the “common ownership of the means of production.” I don’t think you could get elected dogcatcher in America if you believed that.

So how has the British Dow, the FTSE 100 (^FTSE), done under Blair?

May 2, 1997: 4,455.60

May 4, 2007: 6,603.70 (the British market was closed yesterday)

That’s 48% in 10 years, although the FTSE gained 37% in his first ten months in office. Since April 6, 1998, the British market is up just 8.2%.

In that same time, the British pound has increased from $1.62 to $1.99. -

Hewlett Packard Hikes 2Q Outlook

Eddy Elfenbein, May 8th, 2007 at 9:43 amI didn’t see this coming.

The company now expects second-quarter net income of 64 cents to 65 cents per share — or 69 cents to 70 cents excluding amortization costs.

HP projects sales for the second quarter will range from $25.5 billion to $25.55 billion.

Analysts expect earnings, on average, of 65 cents per share on $24.58 billion in revenue, according to a Thomson Financial survey.

The company projected in February second-quarter earnings of 57 cents to 58 cents on roughly $24.5 billion in revenue. Excluding one-time costs, the company had forecast profit of between 63 cents and 64 cents per share for the quarter.That’s great news, but why are they announcing it now?

HP said it decided to update its guidance after an internal e-mail with financial details of the quarter was accidentally sent to someone outside the company.

Oh.

-

Investing in Intellectual Property

Eddy Elfenbein, May 7th, 2007 at 2:57 pmThe Washington Post has an interesting article on the Ocean Tomo 300 patent index, which tracks the leading stocks of the “knowledge economy.” There’s even an ETF.

-

eBay from its High

Eddy Elfenbein, May 7th, 2007 at 2:51 pmI’m always curious what exactly constitutes an investment bubble. Even though shares of eBay (EBAY) got a super-atomic wedgie following its March 2000 high, the stock has still slightly outperformed the S&P 500.

True, it wasn’t a smooth path getting there, but it did do it.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His