Archive for May, 2007

-

Economist of the Empire

Eddy Elfenbein, May 6th, 2007 at 5:12 pmAngus Burgin reviews Prophet of Innovation, Thomas McCraw’s biography of Joseph Schumpeter:

As with many such stories, Schumpeter’s begins with a rapid ascent. Born into a bourgeois family that had resided in the Moravian hamlet of Triesch for four centuries, he gained entrance — via his mother’s remarriage to a much older three-star general — into Viennese society and the most prestigious schools in the empire. His precocious academic abilities led him through the two great centers of economic thought in continental Europe: the University of Vienna, home to the great second generation of the Austrian School; and Berlin, the academic center of the Austrians’ bitter rivals, Gustav von Schmoller and the German historical economists. Through a combination of work and fortune, he became the youngest tenured professor of political economy in the empire at age 28, secretary of state for finance in Austria’s First Republic at 36, and a prosperous bank chairman four years later.

Schumpeter remained a mess of contradictions, however, and his personal triumphs were quickly matched by stunning reversals. Soon after receiving tenure, his harsh classroom discipline inspired a crushing, and largely unprecedented, student boycott of his lectures. He lost his fortune in the Viennese stock market crash of 1924, and spent the next decade laboring to repay the ensuing debt. And in a forever devastating setback, he lost his beloved second wife and son in childbirth just two years later. Following his financial and familial ruin, Schumpeter structured his remaining life around two competing sentiments: a retrospective pessimism that gradually permeated his worldview and a relentless desire to produce academic works worthy of his youthful ambitions. The Schumpeter who arrived at Harvard in 1927, where he would serve as a central influence for a generation of graduate students, was at once intensely passionate and socially removed. His subsequent works, from the seminal popular work “Capitalism, Socialism and Democracy” (1942) to his encyclopedic and still unparalleled “History of Economic Analysis” (1954), remain suspended between cool objectivity and moments of fiery, often cynical, judgment. -

Friday Night Jazz: Artie Shaw

Eddy Elfenbein, May 4th, 2007 at 9:25 pm

This week, Barry Ritholtz let me sit in with him at TBP’s Friday Night Jazz. Thanks Barry! Here’s my take on the great Artie Shaw.Artie Shaw was cool. Not Elvis cool or Sinatra cool, but a darker, more subdued cool.

What Shaw did was make things look easy. Check out this clip and notice how, even after six decades, his music hasn’t aged a bit. It’s still fresh and smooth. It’s just…cool. (You gotta love Shaw’s reply to the compliments: “Yeah, yeah. Glass of water.” Pure cool.)

Artie Shaw was the very last of the big bandleaders. He died a year ago at age 94 and fifty years after his last performance. He wound up outliving all the greats—Goodman, Herman, Miller. Those names may loom larger today, but back then, Shaw’s star was the brightest. He was making $60,000 a week—not bad for the Depression. With America poised to enter World War II, Time magazine reported that Germans’ vision of America was “skyscrapers, Clark Gable and Artie Shaw.”

Fascists, apparently, have issues with tall buildings.

When Shaw hired Billie Holiday, he became the first white bandleader to hire a full-time black singer. But Shaw detested the limelight. In fact, Shaw hated the words “jazz” and “swing.” No, he considered himself a musician. He hated the audience. He hated the singers. He hated the dancers. He hated other bandleaders (“Benny Goodman played clarinet. I played music.“)

By 1951, Shaw walked away from music altogether and became—what else?—a dairy farmer. Crazy, maybe, but cool in its own way. Duke Ellington told him, “Man, you got more guts than any of us.”So what did Shaw like? Women. Lots and lots of them. He was married eight times. He nabbed Betty Grable which would have pleased most men. Not Shaw. While they were engaged, he ran off with Lana Turner. (Whoa, Duke was right!) Shaw had an affair with Rita Hayworth. He dumped Judy Garland. He married Ava Gardner before Sinatra. How in earth did he have time enough time for music?

Ah, the music. Brilliant. Here’s an example: In 1938, Shaw took an obscure and forgotten Cole Porter song and made it a jazz classic. Have a listen to “Begin the Beguine.”

If you’re keeping score, that’s a Jewish bandleader playing Negro music written by a homosexual.

Exceedingly trivial trivia: “Begin the Beguine” has been performed a gazillion times since. In the movie, The Rocketeer, it’s performed by Melora Hardin, who’s better known as Jan in The Office. (Told you it was trivial.)

If you’ve never heard of Shaw and want to get your feet wet, I’d recommend: The Very Best of Artie Shaw.

That pretty much has it all. Personally, I love “Star Dust” and “Deep Purple.” Wonderful stuff.

Two others you might enjoy are: The Complete Gramercy Five Sessions (all the big band guys made smaller bands after the war); and Last Recordings: Rare and Unreleased.Barry adds: “There is a terrific recording of Shaw at NPR: Performance by Shaw of Shaw’s 1940 Concerto for Clarinet.”

This post can also be found at Barry’s blog, “The Big Picture.”

-

Nicholas Financial’s Earnings

Eddy Elfenbein, May 4th, 2007 at 1:28 pmNicholas Financial (NICK) just reported earnings of 29 cents a share versus 28 cents a year ago. Revenue dropped 1% to $12,044,000. The March quarter is the company’s fiscal fourth quarter, so NICK just wrapped up its 18th straight record year for sales and earnings.

Overall, I think this was a decent earnings report. Not terrific, but decent. -

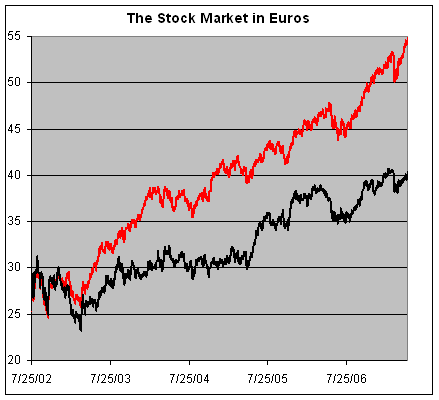

The Stock Market in Euros

Eddy Elfenbein, May 4th, 2007 at 12:46 pmIn July 2002, the dollar and the euro reached parity. But today, the euro is 35% higher.

Here’s what the Wilshire 5000 Total Return Index (^DWCT) looks like in dollars (red line) and adjusted for euros (black line).

-

Microsoft to Buy Yahoo?

Eddy Elfenbein, May 4th, 2007 at 8:10 amStung by the loss of Internet advertising firm DoubleClick to Google last month, Microsoft has intensified its pursuit of a deal with Yahoo!, asking the company to re-enter formal negotiations, The Post has learned.

While Microsoft and Yahoo! have held informal deal talks over the years, sources say the latest approach signals an urgency on Microsoft’s part that has up until now been lacking.

The new approach follows an offer Microsoft made to acquire Yahoo! a few months ago, sources said. But Yahoo! spurned the advances of the Redmond, Wash.-based software giant. Wall Street sources put a roughly $50 billion price tag on Yahoo!.Fifty billion??

No. No way. Never.

By my math, that’s $36 a share, eight bucks above yesterday’s close. It’s eight times next year’s sales and 52 times earnings.

If Google went for that much, it would be a $1,000 stock. -

The Magazine Cover Indicator

Eddy Elfenbein, May 3rd, 2007 at 10:33 amIn August 1979, BusinessWeek ran its famous “Death of Equities” cover. The bull market began three years later (to the day).

Now three finance professors have looked at the impact of magazine covers on stock prices. As you might guess, it’s a contrary indicator:A recent article in The Financial Analysts Journal by Thomas Arnold, John H. Earl Jr. and David S. North, all finance professors at the University of Richmond, called “Are Cover Stories Effective Contrarian Indicators?” offers an intriguing finding.

The professors look at how a company’s stock responds to a cover story in BusinessWeek, Fortune and Forbes. They find that positive stories follow periods of positive performance and negative stories follow periods of negative performance, which admittedly is not too surprising. More interesting, they also find that the appearance of a cover story tends to signal the end of the abnormal performance. Hence, individuals who trade on such “news” are not likely to do well.

This is not to say that articles in the financial press are not worth reading. Quite the contrary. They often provide insightful reporting and in-depth analysis. But by the time the articles have been researched, written and published, they are no longer news — the market price of the stock already reflects the company’s future prospects.

Taken together, this research offers yet more support for the time-tested investment strategy of buy and hold. Anything that you think is news is old hat to the professionals. Trying to outguess the market is a sucker’s game. -

Productivity Growth Slows

Eddy Elfenbein, May 3rd, 2007 at 9:51 amThe Labor Department reported that productivity growth slowed to 1.7% in the first quarter. That’s not a very good number, and productivity has been a bit sluggish in the past three years.

Still, today’s report marks an important milestone. The “American Productivity Miracle” began exactly ten years ago. This reversed a 24-year slide in productivity.

Despite weaker numbers in recent years, productivity has grown by an annual rate of 2.77% for the last ten years. To put that in perspective, in the ten years prior to that, productivity grew by just 1.56% a year. And in the ten years before that, it grew by just 1.23% a year.

It’s hard to overstate the importance of improved productivity. It allows workers to do more with less. Inflation is also kept down due to higher productivity, and by extension, interest rates are lowered. -

The Subprime Fallout hits GM

Eddy Elfenbein, May 3rd, 2007 at 9:14 amHow’s this for subprime fallout? Profits at GM (GM) dropped 90% from last year due to bad loans at its GMAC unit.

This is sad because GM was improving so nicely. Last year, the company only lost $2 billion compared with the $10 billion it lost in 2005.

But now the subprime mess has caught up with GM. Last year, GMAC’s Residential Capital earned $201 million. This year, it lost $905 million. GM had recently sold 49% of its stake in GMAC to Cerberus Capital Management.

Bloomberg noted that the yield on GM bonds due in 2033 fell to 9.2%. -

Dual-Class Share Structure

Eddy Elfenbein, May 2nd, 2007 at 1:09 pmJust a quick note on Murdoch’s bid for Dow Jones (DJ). I can’t think of a better argument against dual-class shares than the Bancroft family’s public rift over the offer.

The family’s super shares have ten times the voting power of the Class A shares (by the way, the same thing exists at many other companies like Google). There are at least 35 family members with super shares.

A Bancroft family representative said that “slightly more than 50%” of DJ’s voting power is against the deal. Breaking out the math, that means that about 80% of the family’s 64% is voting “No.” But still, we now know that some in family are for it, and “some” is all we need to make a point. The idea of super shares is so families can maintain control, but families don’t act as a single unit.

The idea of family control is turning back on itself. Couldn’t it be said that the family members in favor of the deal are speaking in the family’s interest? I certainly think so. Dear lord, it’s a 67% premium for a stock that hasn’t moved in eons. Before the offer, the stock was lower than where it was 24 years before while the Dow is up more than 10-fold. How much more evidence do we need that something needs to be done.

The family can’t hold back change forever. The company will have to be revamped, and hopefully it will happen before the Dow Jones Murdoch Industrial Average goes up another 10-fold. -

“They were able to manage through that fantastically.”

Eddy Elfenbein, May 1st, 2007 at 8:44 pmIt’s hard to avoid: If a firm’s costs go up, its profits go down.

Amphenol (APH) has impressed investors by bucking this logic.

The firm makes connectors, the thousands of different products that link electronic gizmos. Its connectors end up in cars, planes and almost any device that uses electric or fiber optic signals. It also makes cables.

To manufacture all this, it needs raw materials. They include gold, aluminum, copper and oil-based resin. Prices of those commodities have skyrocketed.

Yet with material costs rising, the firm managed to boost profits.

Raw materials were a “big head wind,” Shawn Harrison of Longbow Research said. “They were able to manage through that fantastically.”

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His