Archive for June, 2007

-

Bed Bath & Beyond Warns on Q1

Eddy Elfenbein, June 5th, 2007 at 9:44 amAfter the bell yesterday, Bed Bath & Beyond (BBBY) said its first-quarter earnings will be between 36 cents a share and 38 cents a share. Wall Street was looking for 39 cents a share. Frankly, this is upsetting, but it’s not that bad.

As usual, housing is to blame. Steven Temares, the CEO, said “the overall retailing environment, especially sales of merchandise related to the home, has been challenging.”

Last year, BBBY reported earnings of 35 cents a share. The company is due to report on June 27. The stock opened trading today at $37.93. -

Executive Fascinated By Electrician’s Lunch

Eddy Elfenbein, June 4th, 2007 at 1:59 pmThe Onion reports on Chuck Prince:

While waiting for an elevator en route to a lunch meeting at Central Park’s Tavern on the Green restaurant Monday, Citibank CEO Chuck Prince said he became “spellbound” by the meal being consumed by an electrician working in the area.

“First, he opened some sort of tiny, metal, barn-looking object, and then he took out and ate one of those sandwich things, you know, the kind with bologna and two slices of mushy white bread,” said Prince, who was equally amazed that the electrician’s snack-cake dessert wasn’t set ablaze before consumption. “I had heard of this sort of meal before, but never actually seen it. My goodness, his thermos contained soup!”

Prince added that he was even more stunned when he realized that the electrician must have prepared his meal at home. -

Biomet Trades Over $44

Eddy Elfenbein, June 4th, 2007 at 10:42 amFor a company that makes spinal implants, you’d think Biomet‘s (BMET) board would have a backbone. Apparently not.

The good news is that shares of BMET are now trading above private equity’s $44 offer price. I hope this means the market expects a higher bid. Shareholders will vote on the offer this Friday. -

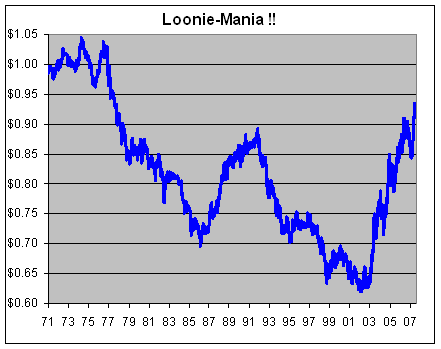

Canadian Dollar Close to Parity of U.S.

Eddy Elfenbein, June 4th, 2007 at 10:41 amThis is embarrassing. The U.S. dollar is in such bad shape, it just hit a 30-year low against the Canadian dollar. Who knew Canada even had its own currency? Apparently, it does and if this keeps up, it’ll soon reach parity. That means you could exchange one Canadian dollar for one real dollar.

Sheesh, sometimes I think our monetary policy is being run by a bunch of 13th graders….

-

Sign of a Top?

Eddy Elfenbein, June 4th, 2007 at 8:32 amThere’s a shortage of butlers.

Egad! I’ll have to pour my own sherry. No! -

News from Last Week

Eddy Elfenbein, June 4th, 2007 at 8:07 amI forgot to mention this last week, but one of our Buy List stocks, Fiserv (FISV), rose nearly 10% in last week’s trading.

The company agreed to sell its Fiserv Investment Support Services business in two separate transactions. The stock was also upgraded by Cowen & Co. Shares of FISV are up 12.32% this year.

Also, Donaldson (DCI) got hit despite a good earnings report. I’m still trying to figure this one out. At one point on Wednesday, DCI was down 9%.

Earnings came in at 49 cents a share, four cents ahead of estimates. Sales came in at $484 million which also Wall Street’s estimate of $462 million. The company sees full-year EPS of $1.73 to $1.80. -

Job Openings at the Federal Reserve

Eddy Elfenbein, June 4th, 2007 at 7:35 amIf you’re in the job market, here are the openings at the Federal Reserve Board. They’re looking for everything from economists to IT folks and lawyers, even law enforcement.

Also, here’s the Web site of Renaissance Technologies. Kinda plain. I guess the best sign of being big and powerful is not caring what your Web site looks like. -

“One of the most interesting and unnoticed developments of recent decades has been the tendency of big enterprise to socialize itself”

Eddy Elfenbein, June 3rd, 2007 at 1:27 amNick Schulz writes on “The Greening of Capitalism.” He finds this quote from John Maynard Keynes:

A point arrives in the growth of a big institution…at which the owners of the capital, i.e. the shareholders, are almost entirely dissociated from the management, with the result that the direct personal interest of the latter in the making of great profit becomes quite secondary. When this stage is reached, the general stability and reputation of the institution are more considered by the management than the maximum of profit for the shareholders. The shareholders must be satisfied by conventionally adequate dividends; but once this is secured, the direct interest of the management often consists in avoiding criticism from the public and from the customers of the concern….They are, as time goes on, socializing themselves.

-

The Earl of Baltimore

Eddy Elfenbein, June 1st, 2007 at 5:30 pmNow that the week is over, I thought you might enjoy this — the great Earl Weaver in top form. I have to warn you, the language is…Earl Weaver-esque.

Here’s the funny part. On the scoreboard, you can see that there’s one out in the top of the first. Yep, the game had just started.

By the way, Weaver was right. He’s now in the Hall of Fame. -

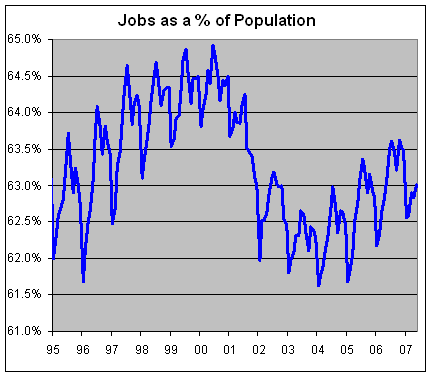

Today’s Jobs Report

Eddy Elfenbein, June 1st, 2007 at 2:09 pmThe government reported that 157,000 jobs were created last month. That’s good, not great, but good. The unemployment rate stayed at 4.5%.

The problem I have is that many Americans have left the job market. The number of employed people as a percent of the civilian population is still not very high.

Allow me to chartify:

Warning: The line is bumpy because it’s not seasonally-adjusted. You can see that we’re better than where we were, but far from our best.

If the same percent of the population were employed today as we had seven years ago, that would mean 3.2 million more jobs.

-

-

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His