Archive for July, 2007

-

Fox Business Network To Launch October 15

Eddy Elfenbein, July 12th, 2007 at 9:33 amFrom Variety via DealBreaker:

Fox News Channel’s long-planned business net spinoff has an official name and a launch date.

New web will be called Fox Business Network, or FBN, and launch Oct. 15, announced Neil Cavuto, managing editor of business news.

News Corp. is proceeding with plans for the business network, an extension of its successful and profitable Fox News franchise, without regard to the status of chairman Rupert Murdoch’s bid for Dow Jones. Sale appears close but could drag out for a few more weeks.

The use of the Wall Street Journal brand in conjunction with the nascent business channel is one of the major synergies touted in News Corp.’s $5 billion bid for Dow Jones.

News Corp. sources indicated that if Murdoch’s bid for Dow Jones is successful, the Fox Business Network branding could change. -

China’s Foreign Reserves hit $1.33 trillion

Eddy Elfenbein, July 11th, 2007 at 12:17 pmFrom Reuters:

China’s foreign exchange reserves, the world’s largest, swelled to $1.33 trillion by the end of the first half on the back of massive trade flows that contributed to an acceleration in money supply growth in June.

The central bank said on Wednesday that reserves had grown by $266.3 billion to $1.3326 trillion between January and June, in excess of the $247.3 billion reserves accumulation for the whole of 2006.Wow!

I mean it. Wow! -

The iPhone Surrender

Eddy Elfenbein, July 11th, 2007 at 12:11 pmMichelle Leder of Footnoted.org gives up on the iPhone:

Now I’ve been an Apple customer since 1998 when I bought my first Imac and I’ve been generally pretty happy with all of their products. But when a device that’s supposed to make your life easier (or at the very least cooler) starts to take up large chunks of your time, that’s when it’s time to raise the white flag. Which is what I did last night when I returned it. The woman at the Apple store looked as if I had insulted her personally when I said I had had enough with the Iphone and just wanted a full refund (read: no $59.99 restocking fee).

-

WallStrip on Focus Media

Eddy Elfenbein, July 11th, 2007 at 12:07 pm -

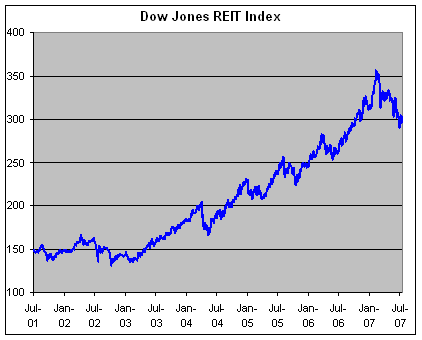

The Fall of REITs

Eddy Elfenbein, July 11th, 2007 at 9:37 am

I’m not a technical analyst, but that chart isn’t not looking good. The Dow REIT Index (^DJR) is down 17% in the last five months. I don’t think it’s over yet. -

“They Don’t Have Enough Skill to Make up for Two and Twenty”

Eddy Elfenbein, July 10th, 2007 at 3:14 pmThis is from last week’s New Yorker. John Cassidy looks at research done by Harry Kat on the returns of hedge funds. It turns out—shocker—they don’t look so good.

With the help of a graduate student, Helder Palaro, Kat also undertook a larger study, in which he examined more than nineteen hundred funds. The results, which Kat and Palaro posted online as a working paper last year, showed that only eighteen per cent of the funds outperformed their benchmarks, and returns even at the most successful funds tended to decline over time. “Our research has shown that in at least eighty per cent of cases the after-fee alpha for hedge funds is negative,” Kat told me. “They are charging more than they are adding. I’m not saying they don’t have skill; I’m just saying they don’t have enough skill to make up for two and twenty.”

Other economists had been scrutinizing hedge funds closely. In a widely discussed 2005 paper, Burton Malkiel, a Princeton professor, and Atanu Saha, a New York investment analyst, argued that many published estimates of hedge-fund returns are misleading. Malkiel and Saha discovered that funds tend to exaggerate how well they performed in the past, and that those which perform badly often close and disappear from databases, leaving a biased sample. After examining results of now defunct firms, Malkiel and Saha found that between 1996 and 2003 hedge funds made an average return of 9.32 per cent, significantly less than the 13.74-per-cent average return of funds included in the published databases. -

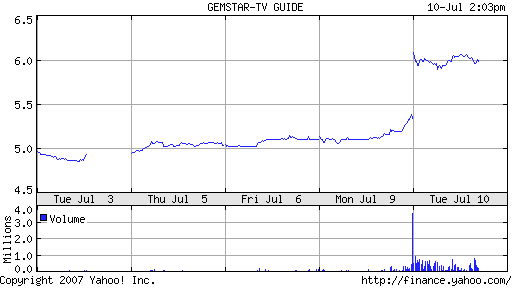

Maybe I’m Being Cynical

Eddy Elfenbein, July 10th, 2007 at 2:19 pmAfter the bell yesterday, Gemstar-TV Guide (GMST) announced that it hired UBS to help it explore strategic alternatives. In other words, the bidding starts now. Rupert Murdoch owns a big stake in Gemstar and I guess he got tired of it going nowhere.

But check this out. Even though the announcement came after yesterday’s, doesn’t this chart suggest that somebody knew something?

-

Dollar-Cost Averaging Is Complete Bullshit

Eddy Elfenbein, July 10th, 2007 at 1:42 pmThis is from an investing article that appeared a few days ago:

A widely recognized investment strategy known as dollar cost averaging offers a systematic approach to investing. By following this plan, you invest a specific dollar amount at set times, regardless of where the market may be at the time. One of the advantages of this strategy is that it can be applied to a wide variety of investment vehicles.

As you know, the market price of an investment fluctuates. By using dollar cost averaging, you can buy more shares when the price is low, but you buy fewer shares when the price is high. While that seems fairly elementary, the interesting thing is that by spreading out your investment dollars this way, the average cost you pay per share can actually end up being lower than the average price per share over an extended period.No. Wrong. Incorrect.

I don’t mean to pick on this writer in particular. You can find dozens of such articles every month. The problem is that dollar-cost averaging is complete bullshit.

Don’t get me wrong: The idea of investing fixed sums each month isn’t a bad. That’s how many people invest because that’s how they’re paid.

But there is absolutely no inherent advantage in dollar-cost averaging over lump-sum investing. ZERO. Spreading out your investments over an extended period doesn’t decrease your risk one bit. The idea has been thoroughly refuted yet the myth won’t die.

The advantage of dollar-cost averaging was blown to smithereens nearly 30 years ago in this article by George Constantinides. Here’s another article on the subject by John R. Knight and (my old finance professor) Lewis Mandell.

Lump sum investing is the best. Don’t diversify by time, diversify by assets. -

How Did I Miss This One?

Eddy Elfenbein, July 10th, 2007 at 12:56 pmI often tell investors not to beat themselves up over the “ones that got away.” Naturally, I don’t always take this advice myself.

The black line is Oracle‘s (ORCL) share price and the yellow is the EPS line (right scale). The two lines are scaled at 20 to 1. This stock was an obvious buy in early 2006 and I (ugh!)…let it go.

Update: Here’s me in a Q&A from October 2005 saying to stay away from ORCL. Double Ugh!! -

1,000% in Ten Month

Eddy Elfenbein, July 10th, 2007 at 12:22 pmDavid Phillips looks under the hood at Transcend Services (TRCR) and likes what he sees.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His