Archive for July, 2007

-

Morgan Stanley Hit By “Sex Pencil” Suit

Eddy Elfenbein, July 10th, 2007 at 10:18 amCan’t write…too…many…puns….

From the NY Post:A Long Island woman says her boss at Morgan Stanley gave a creepy new meaning to the term “pencil pusher.”

In papers filed in Manhattan Supreme Court, Lisa LaMacchia claims Richard Dorfman groped her and then tried to “sexually assault her” with a pencil.

When she complained to his bosses at the financial giant’s Melville office, she got no help, says the suit, which seeks unspecified money damages from Dorfman and Morgan Stanley.

A rep for Morgan Stanley said the company had not seen the suit and had no comment. Dorfman could not be reached, and LaMacchia, 31, declined comment.

She went to work for Morgan Stanley in 2004, the year the company settled a federal sexual-discrimination suit filed on behalf of more than 300 female employees for $54 million.

Her duties included filing papers and answering phones for Dorfman, a “hostile and aggressive” boss who once stole a pair of underwear from her gym bag, she claims.

In July 2005, the suit says, Dorfman called her “a f- – -ing bitch” and threw a file at her.

Human relations told her to “suck it up,” the suit says.

A few months later, when she complained about not getting a raise, Dorfman allegedly “put his right hand up” her skirt and groped her.

She confronted him an hour later, and he “smiled and replied for her to receive what was due, ‘f- – -ing him wouldn’t be a bad idea,’ ” the papers say.

When she turned to leave, he put his hand up her skirt again, this time with a pencil in his hand in an attempt to sexually assault her with the object,” the suit says.

She eventually went on leave because of “emotional distress,” according to the suit.

“Before her leave expired, Ms. LaMacchia was terminated” in April 2006, the papers say. -

Sears Warns

Eddy Elfenbein, July 10th, 2007 at 9:35 amFor the quarter ending Aug. 4, executives at the nation’s third-largest retailer said Sears Holdings Corp. expects to post earnings between $160 million and $200 million, or between $1.06 and $1.32 per share. That includes an 8-cent per share gain from bankruptcy-related settlements and investing activities.

Analysts polled by Thomson Financial had expected second-quarter earnings of $2.12 per share for the Hoffman Estates-based company.

“We are disappointed with our recent performance,” Chief Executive Aylwin Lewis said in a statement. “Although we believe our business has suffered from many of the same factors that have led other retailers to announce disappointing results and lowered expectations, our recent performance underscores our ongoing need to become more relevant to consumers while improving our discipline around expense management.”They didn’t just miss earnings, they weren’t in the ballpark.

-

The Bard CEO

Eddy Elfenbein, July 10th, 2007 at 7:54 amHere’s an interesting article on Shakespeare on Leadership from Wharton@Work, a newsletter from the Wharton School of the University of Pennsylvania.

Shakespeare on Leadership

At the battle of Agincourt on October 25, 1415, the young English King Henry V faced extraordinary odds. To make his claim as ruler of France, Henry had crossed the channel to Calais with 10,000 men. In his first battle at Harfleur, he lost 4,000 men. The French army pursued him, with 30,000 to 60,000 men (or more), well armored, well fed, and well rested, with a strong cavalry. Henry chose to stand his ground with his 6,000 men at Agincourt and prevailed against the odds — primarily through his clever strategy and force of leadership.

During a recent session of Wharton’s The Leadership Journey: Creating and Developing Your Leadership program, executives considered the lessons from William Shakespeare’s play Henry V. Why study Shakespeare? While some managers may be put off by the language of Shakespeare’s plays (“It’s Greek to me,” as the Bard would say), there are three reasons to use Shakespeare to study leadership. First, he offers a window into human nature. Second, he tells the best stories, and stories are critical to leadership. Third, he is a master of language, and leaders need to be effective communicators.

“To be a great leader, you have to understand people,” said Carol Adelman, who led the session with her husband Ken, founders of Movers & Shakespeares. After distinguished careers in government service, they have conducted sessions on Shakespeare and leadership in diverse business, educational, and government organizations.

Building Coalitions

The opening scene of the Wharton session could have been a modern business meeting. A bureaucrat drones on about an obscure legal principle while participants in the meeting stare blankly. In a meeting with the king and English noblemen, the archbishop of Canterbury presents the argument for Henry’s right to govern France. With little discussion, Henry makes his decision to go into battle.

But before this meeting, Henry astutely had aligned the interests of all the major players. For the nobles, the conquest of France offered access to rich resources and plunder. The clergy, by offering a religious justification for the invasion, gained the king’s support to kill a pending bill in Parliament that would have taken half of church lands and imposed heavy fines. The king himself saw the French campaign as a chance to demonstrate his leadership, secure his hold on the English throne, and make his indelible mark on history. None of these issues is discussed during the meeting, but the work in building coalitions was done beforehand. The meeting is a formality that ensures that everyone has bought into the plan. “It can be a very costly mistake if you don’t do this kind of consensus building,” said Ken Adelman.

Rising to the Challenge of Leadership

Taking up the mantle of leadership changes the leader and all his relationships. Prince Hal was known for his drinking with friends Falstaff and Bardolph. But when he took the crown as King Henry V, he needed to rise to this new role. At his coronation, he brushed aside Falstaff (“Get thee gone, old man.”) During his campaign in France, Henry faced a more severe test. Because he hoped to rule France peacefully after the war, Henry had told his soldiers that the penalty for rape and pillaging during the campaign would be death. When his old friend Bardolph was brought to him after taking a pewter goblet from a church, Henry had to choose between his past friendship and his new authority. Henry gave the nod to hang him.

“What we saw here is holding people to certain standards, holding them accountable,” said Ken Adelman. “How much should organizations hold people accountable to zero tolerance?”

Attaining a position of senior leadership often changes the leader. US administration leaders expected little change when Anwar Sadat came to power in Egypt. Similarly, Mikhail Gorbachev, a career communist leader in the Soviet Union, and F.W. de Klerk, a proponent of Apartheid in South Africa, were expected to make few changes before they came to power. The world was surprised.

“All three leaders were in their organizations, but when they got to a position of leadership, they changed. They were no longer cogs in the wheel. They were the wheel now,” said Carol Adelman. “Henry had to learn to be the boss and handle a supervisory role.”

Strategy and Motivation

The triumph at Agincourt was a testament to Henry’s strategy and his ability to motivate his followers. Henry’s military strategy turned the strengths of his opponents into weaknesses. The size of the French army meant nothing on the narrow battlefield Henry chose at Agincourt, fringed by thick forests on both sides. Only a small portion of the French could face the British at a given time. The superior French horses and armor were a liability on the muddy battlefield, and Henry erected a set of sharpened stakes to drive the horses back. Henry also lengthened his lances and shifted most of his forces to the longbow. These archers, with a range of three football stadiums, could fire tens of thousands of arrows every minute into the advancing French, killing them before they reached the English lines. By the end of the battle, there were 6,000 French dead and only about 475 English casualties. “Henry shaped the battlefield himself,” said Ken Adelman.

Even so, before the battle began, Henry’s men were overwhelmed by the odds against them. They knew their young king had lost 40 percent of his army at Harfleur. As the king, in disguise, walked through the camp the night before the battle, he heard the grumbling. The next day, on the eve of the battle, Henry made his famous St. Crispin’s Day speech. He told the men that they did not want more men here to share the glory of their victory. He said they would all be remembered as heroes on this day. He appealed to their camaraderie, as a “band of brothers.” At the end, Henry asked one of the primary doubters if he still wished to have more reinforcements. The nobleman replied, “You and I alone can win this.” Henry connected them to a higher mission but also appealed to their own egos and desire for glory.

“He expresses passion, emotion, and total confidence,” said Carol Adelman. “He recognizes the people he works with by name and paints a picture of the future, how they will be showing their scars from this battle years later. And he puts himself right there with them as a band of brothers.”

Henry V offers many other lessons, including how to win over a new partner after a hostile takeover (as he does with the French princess, Katherine). While the stories and plays are hundreds of years old, the leadership challenges are the same ones that are faced by leaders in every age.

“Shakespeare speaks the language of leadership,” said Carol Adelman. “When you have a crisis, you can’t just stand behind the podium. You need to think about language to inspire people.” -

Jim Mora Really Ought to Be on Wall Street

Eddy Elfenbein, July 9th, 2007 at 8:17 pm -

Looking at J&J

Eddy Elfenbein, July 9th, 2007 at 2:01 pmJohnson & Johnson‘s (JNJ) stock hasn’t done anything in the last five years. What would get me interested in it?

Well, this for starters. -

An Inconvenient Heatwave

Eddy Elfenbein, July 9th, 2007 at 1:40 pmI hope you’re keeping cool wherever you are. It’s 97 here in Washington.

-

Pop!: Why Bubbles Are Great For The Economy

Eddy Elfenbein, July 9th, 2007 at 1:28 pmThis is long overdue but I wanted to recommend Daniel Gross’ excellent book, Pop!: Why Bubbles Are Great For The Economy.

Ever since Charles MacKay’s Extraordinary Popular Delusions and the Madness of Crowds, investment bubbles have gotten a bad rap. Gross comes to their defense and convincingly argues that investment bubbles should be recognized as very positive for the economy. They allocate capital quickly, if not accurately. Plus, when the bubble eventually bursts, prices plunge and there’s tons of excess capacity for the second wave of businesses to make the new technology work. This happened with telegraphs, railroads and now with Web 2.0.

Gross also includes a fascinating observation. Through the years, government has not been an innocent bystander. In fact, its hand has been quite visible. Government has often been a willing participant in the development of new technologies. In 1843, Congress approved $30,000 for telegraph testing and in the 1850s, taxpayers provided one-fourth of all railroad financing.

It’s easy to dismiss bubbles as some kind of mass hysteria, but in reality, they do a lot of good. -

The Quarterly Earnings Myth

Eddy Elfenbein, July 9th, 2007 at 11:44 amToday, Moody’s came out with a report that questions the idea that taking a firm private helps the company because it frees it from quarterly earnings reports.

CNBC just had a segment on the report and they featured the standard debate of a labor guy against a free market think tank guy, but I think this misses the point of the report. Moody’s wasn’t questioning the efficiency of buyouts, but the idea that quarterly earnings reports stifle companies.

I haven’t seen the report, but I’m not surprised by the findings. The myth of the quarterly earnings ogre is vastly overrated. This is one of those make-believe issues that sweep over Wall Street every few years. Some folks even want to ditch them. My feeling is that if companies find themselves held hostage to quarterly forecasts, then at some level, it’s their fault.

It’s very easy for management to downplay the importance of earnings reports. The trouble comes when they consistently play them up, then suddenly face a bad quarter. Here’s a Business Week article describing how several years ago, employees at Cisco loaded up boxes on trucks before midnight to boost their earnings. They failed and the stock missed by a penny a share. The stock fell 13%. So who’s at fault? Unlike many investment writers, I have no problem blaming the investing public. But I’ll also fault management for relying so heavily on earnings reports before.

The idea that a buyout liberates management is just silly. Also, management still has to answer to their new owners. Does anyone believe that the private equity folks are more patient than the investing public? -

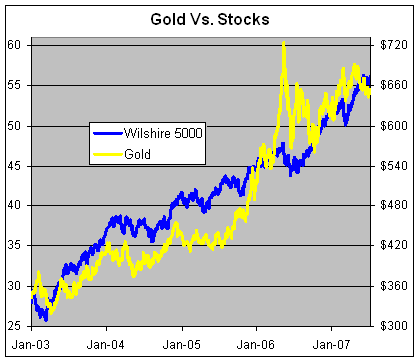

Gold Versus Stocks

Eddy Elfenbein, July 9th, 2007 at 10:59 amGold bugs like to point out that gold has risen against the major stock indicies. A better comparison, however, is to look at gold versus the Wilshire 5000 Total Return Index (^DWCT), which includes almost all stocks and their dividends.

Here’ a look at gold (the gold line, right scale) against the Wilshire 5000 (the blue line, left scale). I made it so both scales match at 12 to 1.

Gold has indeed done well, but stocks have certainly held their own. Plus, you can see how much less volatile stocks are. Gold is down about 10% from its peak of last year. The peak almost perfectly coincided with this New York Times article. I should have known. -

Biomet’s Earnings Fall

Eddy Elfenbein, July 9th, 2007 at 9:13 amSince the company is headed to go private, this doesn’t matter very much, but Biomet’s earnings took a tumble last quarter:

Medical device maker Biomet Inc. (BMET) reported a fall in quarterly earnings, hurt by lower sales in spinal and fixation products segments and a charge related to re-negotiation of some distribution agreements.

The company, which is being taken private by a group of equity firms for $11.4 billion, posted fourth-quarter earnings of $41.5 million, or 17 cents a share, compared with $100.4 million, or 41 cents in the year-ago quarter.

Excluding certain items, the company earned 39 cents a share compared with 46 cents in the year-ago quarter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His