Archive for July, 2007

-

The Original Gilligan’s Island Theme Music

Eddy Elfenbein, July 7th, 2007 at 3:18 pm -

Today’s Jobs Report

Eddy Elfenbein, July 6th, 2007 at 11:22 amToday’s employment report was another disappointment. The economy created 132,000 jobs last month, which is just about the pace of population growth, perhaps a bit slower.

The unemployment officially stayed the same at 4.5%, but to be very precise, it climbed from 4.46% to 4.53%. -

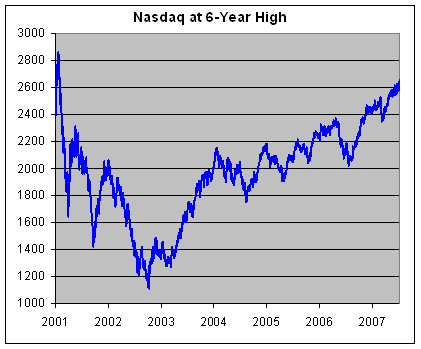

Nasdaq At 6-Year High

Eddy Elfenbein, July 5th, 2007 at 10:46 am

Even though the S&P 500 is off its highs, the Nasdaq keeps moving along. -

Blackstone & Hilton

Eddy Elfenbein, July 5th, 2007 at 9:46 amSteve Schwarzman is reading my blog! Consider the evidence. Just a few days after I highlighted Hilton’s (HLT) performance over the past few years, Blackstone (BX) announces a $20 billion buyout of the hotel chain.

Coincidence? Not likely.

Here are some details:Blackstone will pay $47.50 for each share, Hilton said in a statement. That’s 32 percent more than its closing price yesterday. Barron Hilton, the son of founder Conrad Hilton and co-chairman of the Beverly Hills, California-based company, will get $990 million for his 20.8 million shares.

The purchase is a record for the hotel industry. Blackstone, the owner of the La Quinta lodging chain, joins Apollo Management LP and Texas Pacific Group in targeting hotel companies for their cash flow and real estate. Worldwide, hotel acquisitions more than doubled in the first half of this year, to $81.4 billion.

“It’s a classic Blackstone play: the size, the asset class, the management and the brand,” said Michael Pralle, who ran General Electric Co.’s GE Real Estate unit, with $59 billion in assets, before resigning in June to pursue other interests.

Including the assumption of debt, the transaction totals $26 billion. Hilton, second in the U.S. to Marriott International Inc., has more than 2,800 locations.What I find interesting is that going forward, the main mover of BX’s stock will probably be merger announcements, not earnings reports. I would also guess that the market will react negatively initially to most merger announcements from BX, not matter how favorable they are. That’s an unusual drive of a share price, but we may need to learn to expect it.

-

Early Close

Eddy Elfenbein, July 3rd, 2007 at 10:46 amNot much to blog about this week. Volume is very light. Everyone, it seems, is at the beach.

The market closes at 1 p.m. today. You’ll have to pardon me, I’m having trouble typing while holding my Mimosa.

Ta! -

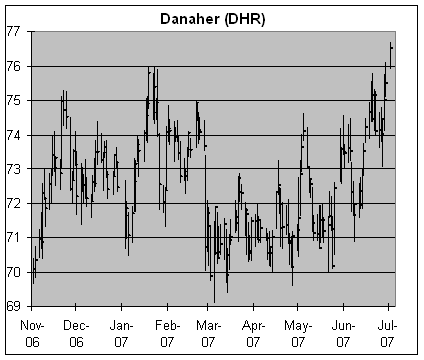

Danaher Hits New High

Eddy Elfenbein, July 2nd, 2007 at 11:37 am

They don’t come much steadier than Danaher (DHR). I’ll leave the technical stuff for the charting folks, but stock broke out to a new high above $76 this morning. -

The Case for Harley

Eddy Elfenbein, July 1st, 2007 at 12:23 amFrom the WSJ:

But it isn’t hard to see why the company attracts attention. It throws off heaps of cash and has a clean balance sheet. Last year Harley posted $1.8 billion in earnings before interest, taxes, depreciation and amortization on $5.8 billion of sales.

Numbers like that should make potential buyers salivate. But squeezing much additional profit from a company that posts net margins of nearly 18% would be hard for either a strategic acquirer or buyout shop.

Still, there are other reasons to own Harley’s stock. Its earnings this year have been hit by a strike in February at its York, Pa., factory. Yet analysts expect profit growth of nearly 12% next year. And international sales, which account for about a fifth of its business, are booming in Europe and Japan. The company has barely scratched the surface in emerging markets such as China.

Moreover, Harley has doubled its dividend in the past two years. With a current valuation roughly in line with the market, solid earnings growth and a healthy balance sheet, Harley could support a share price of $80 — a third higher than now. There’s clearly room for this hog to run.As I mentioned before, HOG has been the worst-performing stock on the Buy List this year. It was our third-best stock last year. The next earnings report, which is due on July 19, will be very interesting to see. The market currently expects $1.13 a share, which seems low.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His