Archive for 2007

-

The Market Five Years On

Eddy Elfenbein, October 9th, 2007 at 11:02 amToday is the fifth anniversary of the market’s low close. On October 9, 2002, the Dow closed at 7,286.27. The S&P 500 closed at 776.76, which is eerily similar to the Dow’s low from 20 years before.

Over the last five years, the Wilshire 5000 is up 132.1% (including dividends) which slightly beats gold’s gain of 129.8%. Also, the dollar has lost about 30% of its value against the euro. -

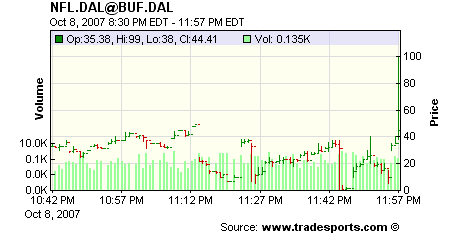

Monday Night Football at Tradesports

Eddy Elfenbein, October 9th, 2007 at 10:09 amHere’s the futures contract for the Cowboys to win last night’s game:

If you missed the game, I’m not sure how to describe it. Dallas was counted out not once, but a few times and still managed to win. Look at how often the contract was basically worthless. -

Write-Offs Are a Buy?

Eddy Elfenbein, October 9th, 2007 at 9:24 amDavid Weidner looks at the recent round of broker write-offs:

The bet is that the bigger the write-down now, the less these institutions will have to write down in the future. This is like a baseball team that celebrates after losing by nine runs, because the odds seem somehow greater that it will lose the next game by a big margin. This logic has Richard Bove, an analyst at Punk Ziegal & Co., flabbergasted.

“These companies are not going to see their markets jump back immediately,” he wrote in a note to clients. “Their earnings power has been lowered. This is a reason to sell not buy. The theory that if the company writes off $2 billion it should see its stock price up $1 and if it writes off $6 billion the stock should jump $3 is not one I can embrace.”Doesn’t make much sense to me either.

-

Option Traders Fear a Crash

Eddy Elfenbein, October 8th, 2007 at 12:14 pmIn the stock pits, traders are bullish but not so in the options arena:

Investors are paying the most ever to protect against a drop in the Standard & Poor’s 500 Index, data compiled by Morgan Stanley show. The gap between the price of so-called put options on the benchmark for U.S. equity and the cost to wager on further gains has averaged about 8 percentage points since August. That’s more than the previous high in July 2001, before the index dropped 34 percent and fell to the lowest this decade.

-

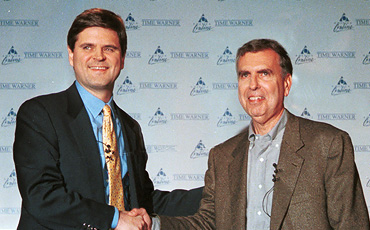

Business Deals Gone Bad

Eddy Elfenbein, October 4th, 2007 at 11:11 am

Business Week has an interesting article on bad business deals. This problem is far more common than most people realize. My particular concern is the mega-merger. Time and time again, these deals never seem to work out. They’re always greeted with great fanfare. You see the new CEOs smiling and shaking hands. Everyone is talking about synergy this and new markets that.

My hunch is that mega-mergers flatter the vanities of the executives who make the deal. Shareholder value, on the other, is probably more do to innovation and execution where executive decisions play a much smaller role.

So how come the mergers rarely seem to work out? I think the problem is that there are a million steps that can go wrong. You have to merge two different cultures. Your clients need to realize that. There are ego and turf wars. Shareholders must be pleased. Lawyers need to be pleased. Plus, there’s always the issue of anti-trust battles.The wreckage of deals gone bad litters the business landscape these days. On Oct. 4, shareholders of German automaker DaimlerChrysler (DAI) are expected to approve renaming the company Daimler, jettisoning the last vestiges of the disastrous 1998 acquisition of Chrysler, for which it paid some $40 billion. While retaining a 19.9% stake in the Michigan company, Daimler’s shareholders will be more than happy to forget the whole episode, which saw litigation over the deal, a dearth of hit models, cultural and operational snags between U.S. and German managers, and heavy financial losses. In May, Daimler agreed to sell the bulk of the company to private equity firm Cerberus Capital Management for a mere $6 billion.

On Oct. 1, online auction house eBay (EBAY) conceded that it had overpaid in its $2.6 billion acquisition of Internet telephone service Skype Technologies in 2005. EBay took a writedown of $1.4 billion, and Skype founders Niklas Zennström and Janus Friis departed from their former suitor.Here’s Business Week‘s list of the Worst Deals of All-Time.

-

The Buy List Today

Eddy Elfenbein, October 3rd, 2007 at 5:00 pmI shouldn’t toot my own horn, but the Buy List has been doing pretty well lately. Since September 21, we’re up 2.91% a full two points ahead of the S&P 500. For the year, however, we’re still trailing the S&P 500, 8.55% to 3.74%.

Today we were up 0.19% while the S&P was down -0.46%. That’s a nice spread for one day. Today’s big winners were Harley-Davidson (HOG) and Fiserv (FISV). Harley’s been a disaster this year, but to be honest, I still like the stock. For the year, HOG is down over 30% but the company recently raised its dividend.

Respironics (RESP) is still kicking ass and it’s another 52-week high today. FactSet Research Systems (FDS) is also doing well and it nearly made a new high yesterday. -

Date Of Apple Backlash Set For March 21, 2008

Eddy Elfenbein, October 3rd, 2007 at 3:09 pmIn the face of Apple, Inc.’s 3-billionth iTunes sale and soaring stock price, some Wall Street forecasters are predicting that consumers will finally get fed up with the computer manufacturer’s high retail prices and various product bugs sometime between March 20 and 22 of next year.

“At the current rate, we believe that at this time a sea change will occur in which people will look down at their glossy white or black devices and feel a sense of embarrassment and gullibility,” Goldman Sachs analyst Steven Shore said. “They will realize that, despite all the sleek design, they got caught up in a wave of hype that made them shell out additional hundreds of dollars for options and features they didn’t need. Until then, I would like to point out that my iPhone is awesome.”

Apple has responded to the backlash rumors by announcing the late-October release of a mint green iPod in time for the holiday shopping season, a strategy that appears to have silenced naysayers at least temporarily. -

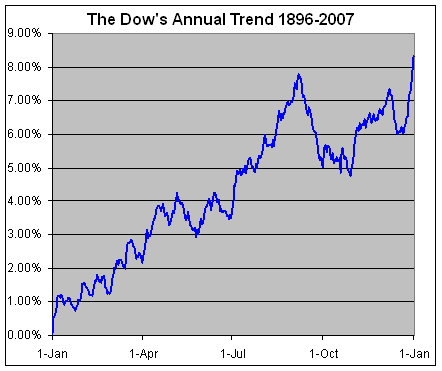

The Dow’s Annual Trend

Eddy Elfenbein, October 3rd, 2007 at 11:59 am

Here’s a look at how the Dow has performed, on average, throughout the year. I used all the daily closings since 1896.

Looking at the annual trend, there are two basic surges. The biggie is from October 29 to May 6, when the Dow rises 7.79%, which is about 93% of the annual gain. The rest of the time, the Dow gains just 0.49%. The other big surge is from May 25 to September 6 when the Dow rises an average of 4.72%.

The average sell-off from May 6 to May 25 is -1.25%, and the one from September 6 to October 29 is -2.82%.

The most impressive short-term gain is from December 21 to January 7 when the Dow averages a gain of 3.39%. -

Right on Walgreen

Eddy Elfenbein, October 2nd, 2007 at 11:40 amLast year, I wrote that Walgreen was too expensive at $44 a share. Let’s just say that it wasn’t one of my more popular posts. One commenter at Seeking Alpha was abusive that the editors there had to rewrite his comment.

Today, the company announced a 4% profit decline. The shares are now down to $39. It doesn’t look like things will get better soon:Net income was $396.5 million, or 40 cents a share, compared with $412.3 million, or 41 cents, in the quarter a year earlier.

It was the first decline in quarterly profit since early in the 1998 fiscal year, and executives warned that trouble could persist.

Revenue in the period, which ended Aug. 31, rose more than 10 percent, to $13.4 billion from $12.2 billion.

Analysts expected earnings of 47 cents a share and revenue of $13.5 billion.

“Many of the challenges we faced in this quarter will continue, including comparisons to last year’s blockbuster generics,” said Rick Hans, the company’s director of finance. -

GorillaTrades Unmasked

Eddy Elfenbein, October 2nd, 2007 at 11:14 amBusiness Week looks at GorillaTrades:

But does the gorilla deliver for investors? A BusinessWeek analysis of the service’s picks found they performed far worse than the stock market as a whole.

The company has attracted attention thanks to its quirky approach and heavy advertising. It has refused to divulge the identity of the firm’s founder and chief spokesman, who calls himself “the gorilla.” Nor does it give out results on the overall performance of his picks. However, BusinessWeek has learned that the gorilla is a former stockbroker named Ken Berman, in Jupiter, Fla., who has confirmed that fact in an interview.

- Tweets by @EddyElfenbein

-

-

Archives

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His