Archive for February, 2008

-

Astrologers offer Year of the Rat stock tips

Eddy Elfenbein, February 7th, 2008 at 9:47 amFrom Reuters:

Forget about graphs, charts and economic forecasts. Wary investors in Asia are turning to feng shui masters to tell them which way the markets will head in the Chinese Year of the Rat.

Perhaps not surprisingly for investors already burnt by recent stock market slides, feng shui experts are predicting a gloomy year for shares, not good news for those hoping for a rebound in global markets hit by worries over the U.S. economy.

“The rat will become aggressive at the tail end of the year and its underlying water element will cool the stock market,” said Vincent Koh, a feng shui master at Singapore Feng Shui Centre.

Feng shui is popular across East Asia, where it is traditionally practiced by ethnic Chinese. It relies on movements of the cosmos as well as placement of furniture and arranging space to generate a “flow of wealth”.

Believers say it can be used to improve wealth, health and personal relationships.

In Hong Kong and Singapore, it’s taken so seriously that corporations consult feng shui experts about everything from business strategy to interior design. Disneyland changed the angle of the main entrance of its Hong Kong theme park after consulting a feng shui expert.

So great is the interest in feng shui, that CLSA, a regional brokerage house, issued a feng shui client note which predicted the stock market would rise from May to August and the U.S. dollar would remain weak.

“Be mindful of your speculations, especially in the third quarter,” said the note, which CLSA described as “topical” rather than a formal investment advisory.

Raymond Lo, a feng shui master in Hong Kong who does readings for corporations, expects industries linked to earth and metal signs to flourish during the Year of the Rat.

“The rat is a symbol of money to the earth industry … Strong water element in the year indicates productivity and strong activity in the metal industries,” said Lo, who suggested investors put their money into property, mining and gold.

He predicts stock markets will be soft this year as the elements of earth and water, which he says are strong in the Year of the Rat, weaken the fire element that influences shares.

“The water element affects the fire of the markets. I can foresee a lot of correction in the stock market,” said Koh.

With stocks markets from Japan to New York cooling since the start of the year on concerns of a global economic slowdown, sceptics may argue that you don’t need to be a feng shui master to make such predictions.

Yet Malaysian feng shui master Yap Boh Chu is optimistic with predictions that Southeast Asian markets will be stable after a tumultuous start.

“The whole concept we have for the year is the image of a seed sprouting from the ground — the beginning is hard,” he said.The rat is the symbol of money? Not to me. They’re just rats.

-

We’re Holding Up Well

Eddy Elfenbein, February 6th, 2008 at 4:39 pmOur Buy List is down 8.68% for the year, but we’re holding up much better than the rest of the market. Since January 14, the S&P 500 is down 6.34%. We’re only off 2.54%.

-

Independent Research and Blogs: A Quite Modest Proposal

Eddy Elfenbein, February 6th, 2008 at 2:50 pmFive years ago, Wall Street and the SEC reached the famous Global Settlement. This came as a result of the conflict of interest between equity research and investment underwriting. The settlement required funding of “independent research.”

The result has been a disaster and few people will admit it. Basically, nobody wants this research. At one point, Goldman’s website got a grand total of 408 unique visitors in one month. That’s just pathetic. The money allocated for state government “education programs” has done even worse. In Georgia, $4.3 million was spent on commercials that were little more than political ads for the incumbent.

While this has been happening, an impressive stock blog culture has blossomed and become a real part of Wall Street. And most of these blogs, like mine, are completely free. If investors want independent research, they now know where to find it.

Here’s my proposal: Instead of wasting money on political ads or over-paid consultants that nobody reads, let’s fund something that’s already working. Each year, the trustees of the of independent research funds should award prizes of, say, $10,000 each, to the best finance bloggers. A committee could decide the awards.

The Global Settlement was for $1.4 billion so I think they could scrape together a little cash to fund some worthy blogs. It would be a small slice of what’s already being spent and it would certainly have a much greater impact on research that is truly independent. -

Department of Irony

Eddy Elfenbein, February 6th, 2008 at 2:10 pmAt the same time, Google is complaining about the Microsoft/Yahoo merger, Time Warner announces plans to split up AOL.

To add some context, check out this concern from eight years ago:Others say the deal could also raise flags over the combined AOL Time Warner’s ability to limit access to Internet content. “From the consumer point of view, there may be questions about whether you’ll have to be an AOL subscriber to get Time magazine,” says Charlene Li, an analyst with Forrester Research (FORR) . “That combination of media with the access is one through which you may be able to block access to your competitors’ subscribers.”

-

The Black Swan

Eddy Elfenbein, February 6th, 2008 at 12:55 pmI finally got around to reading The Black Swan: The Impact of the Highly Improbable by Nassim Nicholas Taleb. It’s fascinating, albeit, infuriating book.

In it, Taleb critics the idea that financial markets follow the classic bell curve. As a result, much of understanding about markets—everything from risk control to options values—is completely wrong. While this is an intriguing idea, and I believe he’s correct, The Black Swan is largely unreadable.

Taleb’s writing isn’t merely bad, it’s downright offensive. The entire book is written in a smug and obnoxious style filled with pointless asides. He’s argument is barely coherent and nearly every page includes parentheticals or scare quotes that simply aren’t needed. Taleb, like all writers, ought to adhere to Mark Twain’s dictum: eschew surplusage

Taleb could have written the book in 50 pages, tops. He also could have spared us his opinion on everything I don’t care about. Taleb constantly reminds us that he’s an aesthete, which you would think would lead him to be a better writer.

He’s one of the people, and I’m sure you’ve met someone like this, who needs to call everything by its less-well-known variant. Do you remember the guy in college who did one semester abroad and came back suddenly using “lift” and “petrol”? That’s Taleb. Now imagine 300 pages of it. Muslims are “Moslems”; he’s “Levantine” not Lebanese. First and second become “primo” and “secondo” (I had to Google it).Strangely, even Daniel Kahneman is routinely called “Danny.”

Leaving the writing aside, the subject is very important. The question that I think it most interesting is, how do we quantify the risk of outliers—meaning, very rare events. Or, due to their nature, is that impossible? Interestingly, we’re been watching a Black Swan event unfold (fly out?) before us in real time. The subprime crisis has exposed many financial firms to far more risk than they believed.

All the major investment banks report their “value at risk,” or if you’re a cool kid, their VAR. They all use different equations to reach their VAR but basically, it designed to measure how much money is at risk with a 95% confidence level. But this is where some problems are coming. For example, Merrill Lynch’s VAR indicated that it couldn’t be expected to lose more than $5.8 billion in a single quarter. Well, they lost $8.4 billion.

I don’t have any answers to the issues Taleb raises, but it’s not an academic point. The worst part of the subprime debacle is that we don’t know what we don’t know. The odd thing about Black Swans is that even if we suspect their existence, then they no longer exist. -

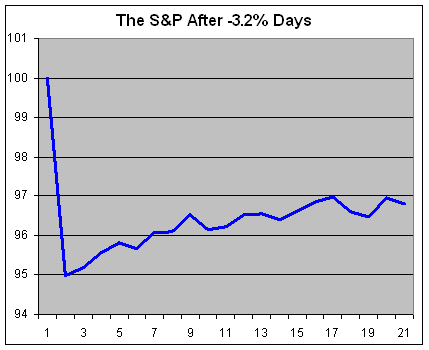

How the Market Behaves After Big Down Days

Eddy Elfenbein, February 6th, 2008 at 10:56 amI once remember hearing that the market tends to retrace one-third of its previous days trend after a large move. I decided to put that theory to the test.

Yesterday, the S&P 500 lost 3.2%. This was the 38th time the index has done that since 1950. Here’s an average of how those 37 previous sell-offs played out.

The average loss for the sell-off is 5.01%. After that, nearly every day is an up day. By the ninth day, the S&P 500 is down 3.48%, which is indeed, a retracement of about one-third.

The market still trends higher to the 17th day where it’s down just 3.01%, or about a 40% retracement. At that point, the linger effects of the sell-off seem to dissolve. -

Strange Market Fact of the Day

Eddy Elfenbein, February 5th, 2008 at 1:49 pmNever underestimate the power of momentum on Wall Street. Since 1950, every penny of gains in the S&P 500 has come on days following 0.64% up moves. That happens roughly once every five market days.

In other words, if you invested only on days following 0.64% up days, and sat in cash the other 81% of the time, you would have easily beaten the market.

Warning: I’m not advocating such a strategy. That’s your classic sinkhole of back-testing. I merely want to show you how trend sensitive Wall Street can be. -

Nicholas Financial Reports Earnings

Eddy Elfenbein, February 5th, 2008 at 11:34 amNicholas Financial (NICK) reported earnings today. For the December quarter, the company’s third, NICK earned 22 cents a share which is a big drop from the 27 cents a share it made in last year’s third quarter. The big difference was the 106% rise in “provision for credit losses.” That’s about an increase of 12 cents a share.

If these results are as bad as it gets for NICK, consider that the stock is going for 32 times this past quarter’s earnings. -

The Myths of Innovation

Eddy Elfenbein, February 5th, 2008 at 10:07 amHere’s an interesting article from the Sunday New York Times. It questions the idea that innovation comes from a sudden burst—a Eureka moment—but instead is the result of gradually building smaller insights.

“The most useful way to think of epiphany is as an occasional bonus of working on tough problems,” explains Scott Berkun in his 2007 book, “The Myths of Innovation.” “Most innovations come without epiphanies, and when powerful moments do happen, little knowledge is granted for how to find the next one. To focus on the magic moments is to miss the point. The goal isn’t the magic moment: it’s the end result of a useful innovation.”

Everything results from accretion, Mr. Berkun says: “I didn’t invent the English language. I have to use a language that someone else created in order to talk to you. So the process by which something is created is always incremental. It always involves using stuff that other people have made.” -

Politics and the Markets

Eddy Elfenbein, February 5th, 2008 at 9:49 amRichard Nixon was once asked what he would do if he weren’t president. He said that he’d probably be on Wall Street buying stocks. One old-time Wall Streeter was asked what he thought of that. He said that if Nixon weren’t president, he too would be buying stocks.

Today is Super Duper Tuesday. There are about a million primaries going on in several different states. I don’t have much to say about politics, but I would strongly caution anyone from drawing investing conclusions from today’s results.

People love to talk politics, and people love to talk stocks, but the two really don’t have that much to do with each other. Policy, of course, can have a major impact on stocks but when it does, it’s the kind of policy that’s barely a part of the permanent Republican-Democrat debate. Sarbanes-Oxley, for example, passed the Senate 99-0, and the House 423-3 (Ron Paul being one of the three).

Stocks have done well under Democratic and Republican presidents. Stocks have also crashed under Democratic and Republican presidents. The closest thing to a constant I can find is that the stock market really doesn’t like Quaker presidents (Nixon and Hoover), but the sample size is kinda small.

My advice is to ignore any chatter you may hear that so-and-so is good or bad for the market. The assumption is that politicians are like players on a football field, and the stock market is the score. I think it’s exactly the opposite. What’s really interesting isn’t how the market responds to politicians, it’s how politicians respond to the markets.

The stock market is running unopposed this year.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His