Archive for February, 2008

-

Today’s Jobs Report

Eddy Elfenbein, February 1st, 2008 at 9:40 amThe government just reported that the economy lost 17,000 jobs last month. This was the first decline in employment since 2003. The unemployment rate ticked down to 4.9% from 5.0%, but looking at the raw numbers, it really only dropped from 4.75% to 4.25%.

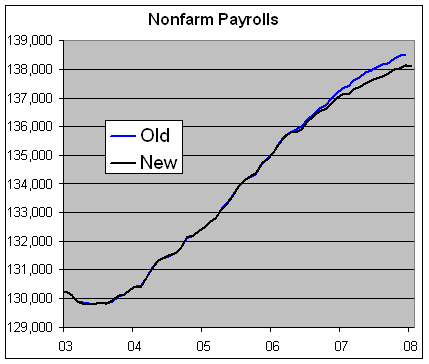

It also looks like the BLS undated all the non-farm payroll numbers going back to 1990. I get a little annoyed seeing the government completely revised numbers from nearly 20 years ago. This revision could have happen earlier but it’s the first I’ve seen of it. Not surprisingly, payrolls weren’t as strong as previously believed. Here’s a look at the old and new numbers:

On the chart, the gaps looks small, but don’t let that fool you. There are about 400,000 jobs less than previously thought.

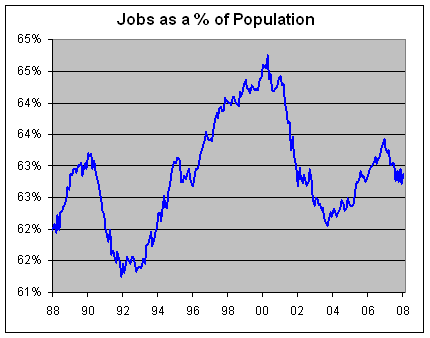

Here’s a look at the number of jobs as a percent of the population. The regular unemployment rate only counts people in the labor force.

-

The Risk Cycle

Eddy Elfenbein, February 1st, 2008 at 9:05 amAEI recently published an interesting report on the economy. It’s a bit long, but here’s a sample:

The temptation during the last half of 2007 was to view the problems tied to falling house prices as contained and manageable. At first, it was just a subprime crisis, but by the end of 2007, it had become clear that the subprime crisis was expanding into a real-estate sector crisis that, in turn, had been magnified by the securitization of claims on real estate whose value was falling. Every financial statement by a bank or investment bank that failed to specify underlying assumptions about the path of real-estate prices was and is subject to constant revision. Fourth-quarter reports by U.S. commercial and investment banks all reflect the sharply elevated losses attributed to worsening conditions in the real-estate market that, in turn, reduced the value of derivative securities on the balance sheets of U.S. financial institutions.

The negative interaction between the real economy and the financial sector has been exaggerated in this cycle. House prices stopped rising in 2006 because they had exceeded affordability levels for most potential buyers. As house prices leveled off, the initial wave of problems emerged in the subprime sector late in 2006 and early in 2007. The hope of containment of the subprime problem evaporated in the summer of 2007 as leveraged investment funds like the Bear Stearns Asset-Backed Securities Fund collapsed. Unfortunately, in terms of providing a timely response to the rapidly deteriorating financial conditions tied to falling real-estate prices, the real economy grew strongly in the third quarter with substantial help–since reversed–from inventory accumulation and strong net exports. The real economy slowed during the fourth quarter, and the economy probably entered recession at year’s end. Substantial damage to the balance sheets of U.S. banks and investment houses had occurred that added to the negative pressure on the real economy. -

The Surge in Tobacco Stocks

Eddy Elfenbein, February 1st, 2008 at 9:01 amThis November will mark the 10th anniversary of the Master Tobacco Settlement. The settlement was an outrageous agreement between the four largest tobacco companies on several state governments. The tobacco companies have to make huge payments to state governments. As a result, their business has to be protected. The government’s revenues are too dependent on them. Now cigarette prices are kept artificially high and the industry is well-protected.

As you can see, the major tobacco stocks have done very well since the settlement was signed.

-

Microsoft Bids for Yahoo

Eddy Elfenbein, February 1st, 2008 at 8:38 amI’ve made of this story for months and now it’s coming true. Microsoft (MSFT) is offering $44 billion for Yahoo (YHOO). This comes out to $31 a share. I honestly don’t see how this makes sense at all.

Before taking a detailed look at the businesses, just look at the numbers. For the last three years, Yahoo’s earnings-per-share have dropped from 58 cents to 52 cents to 47 cents. This year, the consensus is for 45 cents. I just don’t get how that equals $31.

Years from now, business students will study how Yahoo was in perfect position to dominate the Internet, but they lost. Google didn’t have to win. The future was in Yahoo’s lap, but they went for Hollywood instead.

Two earnings reports to pass along. AFLAC (AFL) earned 78 cents a share, two cents below estimates. Still, that’s a nice jump over the 66 cents they made last year. The company said that it’s looking to grow EPS by 13% to 15% this year, which works out to EPS of $3.70 to $3.76.

Yesterday, SEI Investments (SEIC) reported earnings of 35 cents a share. That was inline with forecasts. The stock responded by dropping 80 cents a share.

Also, Leucadia (LUK) is buying a large stake in AmeriCredit (ACF) which is an auto finance firm. Leucadia is a shrewd investor and I note this because ACF is in the same industry as our own Nicholas Financial (NICK). NICK will release its earnings on Tuesday.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His