Archive for March, 2008

-

Anatomy of a hedge fund collapse

Eddy Elfenbein, March 10th, 2008 at 10:46 amFortune has an interesting article on the collapse of the Tequesta Mortgage fund. What’s interesting is that the fund steered clear of the risky investments that others were taking. The reason is fell was due to the credit markets drying up.

In one case, Citigroup seized collateral from Tequesta and put it up for sale in a bid-list auction. According to a trader at another firm, however, Citigroup’s mortgage trading desk offered to sell Tequesta’s bonds to regional brokerage firms at prices even lower than listed prices. In another instance, Tequesta’s portfolio managers were told by Citigroup rivals that its seized bonds had been offered to other hedge funds for more than $25 below where they had been trading in the previous days.

Under that kind of pressure, Tequesta decided by early March that they’d have to shut the mortgage fund down. Tequesta, according to a firm executive, still has several portfolios open. Ross declined comment to Fortune.com on his future plans. But as long as the credit markets remain in their current miserable state, there are going to be more stories like Tequesta’s.There’s a saying that if you can’t sell what you want, sell what you can.

-

An Emergency Rate Cut?

Eddy Elfenbein, March 10th, 2008 at 10:00 amIs an emergency Fed rate cut on the way? Goldman says we can’t rule it out:

An emergency interest rate cut from the Federal Reserve is possible ahead of its March 18th policy meeting, according to a Goldman Sachs research note on Monday.

Goldman said its view on Fed policy changed on Friday.

The government reported on Friday that a second straight month of job losses and the Fed announced new steps to inject liquidity into the financial system as credit availability remains tight.

Goldman said the Fed would drop the benchmark federal funds target rate to 2 percent by late April, most likely in two 50 basis-point steps at the next two meetings.

“We cannot rule out an intermeeting rate cut today,” the Monday note said. -

Highlights of the Congressional Hearings

Eddy Elfenbein, March 10th, 2008 at 7:08 amThere seems to be a disturbing trend:

“Punishing individual corporate executives with public floggings like this may be a politically satisfying ritual — like an island tribe sacrificing a virgin to a grumbling volcano,” Rep. Tom Davis of Virginia said.

And later:

An investor advocate who also testified, Nell Minow of Corporate Library, appeared amused by Davis’ comparison of the hearing to a tribal sacrifice.

“These are not scapegoats and they are certainly not virgins,” she said.Ouch.

-

When It Rains, It Pours

Eddy Elfenbein, March 10th, 2008 at 7:00 amThe FBI is investigating Countrywide.

-

The Unknown Billionaire

Eddy Elfenbein, March 10th, 2008 at 6:52 amNever heard of Chuck Feeney? Well, that’s the way he wants it.

He once owned six luxurious homes from the French Riviera to Mayfair to Park Avenue. These days, he owns none, instead hunkering down in a cramped one-bedroom rental in San Francisco with his second wife, Helga, his former secretary.

He raked in billions selling duty-free cognac, perfume and designer labels. But you won’t catch Feeney in a Hermes tie or Gucci loafers. He once met the prime minister of Ireland with his drugstore glasses held together by a paper clip.

Feeney doesn’t own a car and prefers buses to taxis. Until he turned 75, he flew coach. Now, making excuses for wobbly knees, he upgrades with frequent flier miles.

Fine dining? “There are restaurants you can go in and pay $100 a person for a meal,” he muses. “I get as much satisfaction out of paying $25. I happen to enjoy grilled cheese and tomato sandwiches.”

Niall O’Dowd, a friend of Feeney and editor of Irish-America magazine, reflects: “The way he copes with his wealth is to never remove himself from his working-class persona. He keeps grounded by acting like it hasn’t happened to him — like basically he is still the same guy. -

After Hours: Some Chick

Eddy Elfenbein, March 7th, 2008 at 7:48 pmI have no idea who this young woman is, but she has a beautiful voice. Enjoy.

“You Are My Sunshine” was written by a country singer named Jimmie Davis. It was such a big hit that it propelled him into the Louisiana governor’s mansion.

The song is often considered a children’s song which I don’t think it is. The young woman above does an excellent job capturing its melancholy.

Davis died in 2000 at the age of 101. -

Trade of the Year

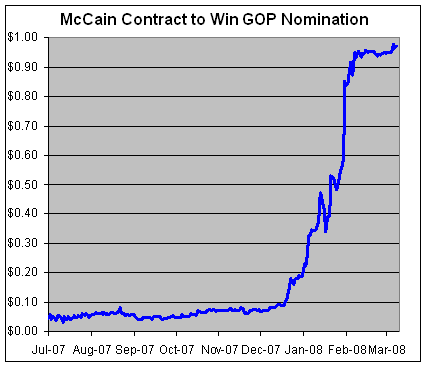

Eddy Elfenbein, March 7th, 2008 at 4:20 pmHere’s an observation on political markets. This is a clip of Larry Kudlow, Robert Reich and Steve Moore discussing what a great job John McCain did at the CNBC/MSNBC/WSJ debate in October.

After hearing that, you could have run out and bought a McCain-to-win contract for just 5.2 cents. Today, you’d be sitting on a profit of…oh, about 1,700%.

See, it pays to listen to Larry. And that’s just at 97 cents; your McCain contract still has a very good chance of hitting $1 by Labor Day.

But there’s something else. That day, October 9, was the exact high of the stock market (if you watch the clip again, you can see the “record high” alerts). This was also the debate where McCain said, “I’m glad whenever they cut interest rates, I wish interest rates were zero.”

There is a serious economic argument in favor of 0% interest rates. This is known as the “Friedman Rule.” To be fair to the late professor, I don’t think that’s what McCain was thinking about.

Was that debate the turning point of McCain’s campaign (going up) and the stock market (going down), and are they related?

Personally, I think it’s just a coincidence. B-Riz has more. -

Blankfein Earns $100 Million

Eddy Elfenbein, March 7th, 2008 at 4:14 pmLloyd Blankfein, the CEO of Goldman Sachs, made $100 million last year. His salary was just $600,000. The rest comes from stock and bonuses. Here’s the SEC filing.

-

Three-Month T-Bill Hits 1.1%

Eddy Elfenbein, March 7th, 2008 at 2:10 pmWow! This morning, the yield on three-month T-bills (^IRX) dropped to 1.1%. That’s just stunning. The Fed is miles behind the rest of the market. The T-bill rate has since ticked up to 1.4%.

The five-year yield dropped below 2.4%. Think about that. There are people who are so scared that they’re willing to lock-in a 2.4% return for the next five years. -

Futures Say 98% Chance of 0.75% Rate Cut

Eddy Elfenbein, March 7th, 2008 at 12:17 pmFrom Bloomberg:

The U.S. dollar has declined against 14 of the world’s 16 most-actively traded currencies this year on bets the Federal Reserve will continue to cut interest rates to avert a recession. Futures show traders see a 98 percent chance the Fed will lower its target rate 0.75 percentage point to 2.25 percent on March 18. The balance of bets is on a half-point cut.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His