Archive for April, 2008

-

Volcker at the Fed

Eddy Elfenbein, April 29th, 2008 at 12:47 pmMegan McArdle has a smart post on her choice for the most underrated and overrated presidents of the 20th century. She says that Jimmy Carter’s economic policies are underrated and she cites his appointment of Paul Volcker to head the Federal Reserve as an example.

I agree that Volcker was a good choice and Carter deserves credit for it, however I’m not willing to give him much credit. According to William Grieder’s wonderful book, Secrets of the Temple, Jimmy Carter was almost comically illiterate on monetary policy. Plus, the Volcker selection hardly signaled any policy shift from the Carter administration, and if Carter had realized what he was doing, he probably would have had second thoughts.

Carter’s selection of Bill Miller for Fed Chairman was disastrous, and it made Volcker’s job that much harder. When it came to replace Miller, Volcker was actually Carter’s second choice. His first choice was Tom Clausen, who was the president of Bank of America (he later became head of the World Bank). Also, Volcker was already an important voice on the Fed. He was president of the Federal Reserve Bank of New York, which in the Federal Reserve system, is first among equals. The president of the New York Fed also has a permanent seat on the interest-rate-setting Federal Open Market Committee. The other bank presidents have to rotate. In fact, at the time of his appointment, Volcker was serving as vice-chair of the FOMC.

So Carter’s choice was a natural elevation more than taking a major gamble, or boldly separating himself from a previous path. Still, he did make the right choice and that’s worthy of praise. The point that I find interesting is how often we give credit to people for doing something that really had no intention of doing. Instead, circumstances came to them, and they made the best of it. Perhaps, that’s a good definition of leadership. -

Investors Are Basically Crazy

Eddy Elfenbein, April 29th, 2008 at 11:06 amI’m a bit skeptical of this, but I’ll pass this along from the Genetic Engineering & Biotechnology News website (I know, like you don’t have it under your favs):

‘Emotional inflation’ leads to stock market meltdown

Investors get carried away with excitement and wishful phantasies as the stock market soars, suppressing negative emotions which would otherwise warn them of the high risk of what they are doing, according to a new study led by UCL (University College London). Economic models fail to factor in the emotions and unconscious mental life that drive human behaviour in conditions where the future is uncertain says the study, which argues that banks and financial institutions should be as wary of emotional inflation as they are fiscal inflation.

The paper, published in this months issue of the International Journal of Psychoanalysis, explores how unconscious mental life should be integrated into economic decision-making models, where emotions and phantasies unconscious desires, drives and motives are among the driving forces behind market bubbles and bursts.

Visiting Professor David Tuckett, UCL Psychoanalysis Unit, says: Feelings and unconscious phantasies are important; it is not simply a question of being rational when trading. The market is dominated by rational and intelligent professionals, but the most attractive investments involve guesses about an uncertain future and uncertainty creates feelings. When there are exciting new investments whose outcome is unsure, the most professional investors can get caught up in the everybody else is doing it, so should I wave which leads first to underestimating, and then after panic and the burst of a bubble, to overestimating the risks of an investment.

Market investors relationships to their assets and shares are akin to love-hate relationships with our partners. Just as in a relationship where the future is unexpected, as the market fluctuates you have to be prepared to suffer uncertainty and anxiety and go through good times and bad times with your shares. You can adopt one of two frames of mind. In one, the depressive, individuals can be aware of their love and hate and gradually learn to trust and bear anxiety. In the other, the paranoid schizoid, the anxiety is not tolerated and has to be detached, so the object of love is idealised while its potential for disappointment is split off and made unconscious.

What happens in a bubble is that investors detach themselves from anxiety and lose touch with being cautious. More or less rationalised wishful thinking then allows them to take on much more risk than they actually realise, something about which they feel ashamed and persecuted, but rarely genuinely guilty, when a bubble bursts. Again, like falling in idealised love, at first you notice only the best qualities of your beloved, but when everything becomes real you become deflated and it is the flaws and problems that persecute you and which you blame.

Lack of understanding of the vital role of emotion in decision-making, and the typical practices of financial institutions, make it difficult to contain emotional inflation and excessive risk-taking, particularly if it is innovative. Those who join a new and growing venture are rewarded and those who stay out are punished. Institutions and individuals dont want to miss out and regulators are wary of stifling innovation. If other investors are doing it, clients might say why arent you doing it too, because theyre making more money than we are.You can find the full paper here.

-

Markets In Everything

Eddy Elfenbein, April 29th, 2008 at 8:57 amFrom Bloomberg:

A pair of dinosaur turds, about 140 million years old, will go on the block tomorrow at Bonhams in New York. The rusty-brown mounds, known in scientific circles as “coprolite,” are estimated to fetch more than $350.

Coprolite comes cheaper than other dinosaur fossils.

“Most people think of dino dung and think, ‘Why would I want to have that on my shelf?'” said Thomas Lindgren, the Bonhams specialist in charge of the natural history sale. On the plus side, Lindgren said, the dung “no longer smells.”

The seller is a Utah private collector who found the 5- and 7-inch, 2-pound specimens in the Morrison Formation, a layer of sedimentary rock dating back 150 million years, spanning several Western states and known for dinosaur fossils. To the untrained eye, coprolite resembles an ordinary rock.

“The appeal is that it’s from a dinosaur,” Lindgren said. “This is one of those items that strikes a curious nerve. It’s just a great conversation piece.”I’m not sure if that’s a good investment. It took 140 million years just to get to $350. Of course, that’s starting from a low base.

-

Making Millions in Milliseconds

Eddy Elfenbein, April 29th, 2008 at 12:22 amThis seems pretty cool, which probably means that I’m not all that cool. At UVA, Professor Stefano Grazioli has an investing tournament at the end of “Financial Systems Engineering” class.

A team wins the tournament by minimizing their ‘tracking error’ – the difference, measured weekly (i.e. every seven minutes of tournament time), between the value of their portfolio and a portfolio value target that would reflect an ‘ideal’ rate of return (2.5 percent).

Many of the 15 teams spent 40 hours or more preparing for the event, said Grazioli. “Virtually everybody that I ask tells me that this is the most complex problem that they have solved in their entire academic career. Not necessarily the hardest, but certainly the most complex — the most data, most moving parts, fastest moving, and so on.”If you run a hedge fund and you return 12% a year, you’ll be a millionaire. But if you can return 1% a month, every month with very little deviation, then you’ll be a billionaire. Many times over.

Read the whole article. Best line: “About 10 percent of them in the anonymous class comments tell me this is the best class they have taken.” -

Intrade on the Electoral College

Eddy Elfenbein, April 28th, 2008 at 10:47 pmI went to Intrade to see the latest results on outcome for each state’s vote in the electoral college. The table below shows each state, the latest price for Democratic and GOP candidate to win the state, the number electoral votes and the projected number for the GOP candidate (sorry Dems, it just seemed easier that way).

The projected number is the GOP contract times the number of electoral votes. The total comes to 251.65, which indicates a Democratic victory. Let me add the usual caveats that this is far from scientific, and the trading volume is very light.

State…DEM…….GOP…….EV……Proj. GOP

AL……..7.5……….92.5……..9……..8.33

AK……..10.0……..90.0……..3……..2.70

AZ……..6.2……….93.8…….10…….9.38

AR……..26.0……..74.0……..6……..4.44

CA……..91.5……..8.5………55…….4.68

CO……..60.5……..39.5…….9………3.56

CT……..93.0……..7.0………7………0.49

DE……..90.0……..10.0……..3……..0.30

DC……..96.3……..3.7……..3……….0.11

FL………20.0……..80.0……27……..21.60

GA……..12.0……..88.0……15……..13.20

HI……..93.0……..7.0……….4……..0.28

ID……..5.0……….95.0……..4……..3.80

IL……..92.2……..7.8……..21……..1.64

IN……..24.0……..76.0……..11……..8.36

IA……..66.0……..34.0……..7………2.38

KN……..12.0……..88.0……..6……..5.28

KY……..8.7……….91.3……..8……..7.30

LA……..13.2……..86.8……..9……..7.81

ME……..80.0……..20.0……..4……..0.80

MD……..92.3 ……..7.7……..10……..0.77

MA……..92.0……..8.0……..12……..0.96

MI……..78.0……..22.0……..17……..3.74

MN……..79.0……..21.0……..10…….2.10

MS……..10.5……..89.5……..6………5.37

MO……..42.5……..57.5…….11…….6.33

MT……..10.2……..89.8……..3……..2.69

NE……..15.0……..85.0……..5……..4.25

NV……..50.0……..45.0……..5……..2.25

NH……..53.5……..43.0……..4……..1.72

NJ……..81.0……..19.0……..15……..2.85

NM……..64.0……..36.0……..5……..1.80

NY……..92.5……..7.5……..31……..2.33

NC……..24.0……..76.0……..15……11.40

ND……..15.0……..90.0……..3……..2.70

OH……..61.9……..38.1……..20……7.62

OK……..10.0……..90.0……..7……..6.30

OR……..85.0……..20.0……..7……..1.40

PA……..70.0…….. 33.5……..21……7.04

RI……..94.0……..6.0……….4………0.24

SC……..19.5……..85.0……..8……..6.80

SD……..15.0……..85.0……..3……..2.55

TN……..10.0……..90.0……..11…….9.90

TX……..14.0……..86.0……..34…….29.24

UT……..7.5……..92.5……..5……….4.63

VT……..89.5……..10.5……..3……..0.32

VA……..44.5……..55.5……..13……..7.22

WA……..90.0……..10.0……..11…….1.10

WV……..18.0…….. 82.0……..5……..4.10

WI……..72.5……..27.5……..10………2.75

WY……..7.5……..92.5……..3………..2.78

A few observations. Once again, Ohio is the Middle C State. The states that are more in the GOP column than Ohio added up to 258 electoral votes, the states that are more Democratic add up to 260. You need 270 to win, so as goes Ohio, so goes the nation. At least, according to Intrade.

Currently, five Bush states are in the Democratic column; Nevada, Colorado, Ohio, New Mexico and Iowa.

It seems like there are just few battleground states: Nevade, New Hampshire, Colorado, New Mexico, and most importantly, Ohio. So if you don’t live in one of those states, you really don’t need to vote. -

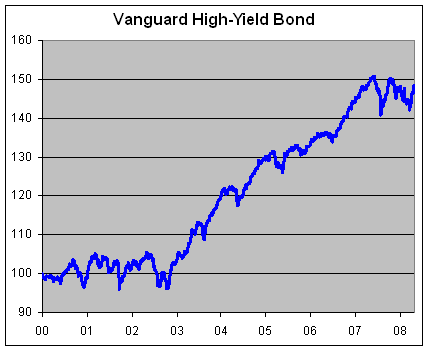

Looking at High-Yield Bonds

Eddy Elfenbein, April 28th, 2008 at 3:30 pmThanks to the credit crunch, the market for high-yield bonds is in the toilet. For example, I called Vanguard to see what the yield is on its Vanguard High-Yield Corporate (VWEHX) fund is. The fund is currently yielding 8.3%, and it has rallied a good ways off its mid-March low.

Please note that I’m not recommending this fund, I’m just using it to show you the state of the high-yield market. -

Golman Sachs’ Top 10 Stocks to Benefit from Rebate Checks

Eddy Elfenbein, April 28th, 2008 at 12:50 pmCheesecake Factory

Best Buy

Darden Restaurants

Home Depot

JC Penney

Kroger

Kohls

Royal Caribbean

Safeway

Wal-MartEh, call me unconvinced. I think it’s a mistake to over conceptualize investing ideas. (By the way, investing in something due to demographics is another good example.) There really aren’t many better ideas than to find great companies going for decent prices.

-

The Crash Of Zoe Cruz

Eddy Elfenbein, April 28th, 2008 at 12:06 pmNY Mag has a long article on the career of Morgan Stanley’s Zoe Cruz. At one point, it looked as if she would be Wall Street’s first female CEO. But she was fired in November. Here’s a sample:

If that meeting in Mack’s office had been the meeting she was hoping for, Cruz would have made history: No woman has ever been CEO of a Wall Street firm. Now it looks like that won’t change for a very long time—there are no other high-ranking women in serious contention for a top job. If women across Wall Street viewed Cruz’s firing as a blow, there were men at Morgan Stanley who seemed almost gleeful about it. The woman they had nicknamed the “Czarina,” the “Wicked Witch,” and, most famously, “Cruz Missile” was out of the picture. They joked that it was worth the $9 billion loss to have her gone. In her rise through the company, Cruz had become not just one of the most powerful women on Wall Street but also the most loathed. It’s a matter of opinion whether those two things are inextricably linked, but for Cruz the same qualities that propelled her almost to the top also prevented her from reaching it.

-

Introduction to Mamajuana Energy

Eddy Elfenbein, April 28th, 2008 at 11:24 amI really don’t know what to say about this, but here’s Mr. Meredith Whitney’s herbal supplement.

(Via: Timothy Sykes) -

Yahoo Finance Malfunction

Eddy Elfenbein, April 28th, 2008 at 11:03 amIf you use Yahoo Finance to track your portfolio, except for a small number of tickers, it doesn’t seem to be listing current articles this morning.

Update: It looks like it’s back up.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His