Archive for June, 2008

-

Junk Default Recoveries Maybe Lower Than Usual

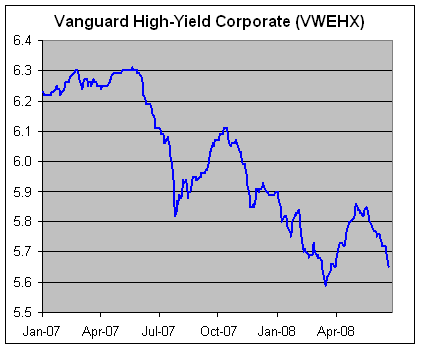

Eddy Elfenbein, June 24th, 2008 at 10:31 amI’ve been surprised by the wide yield spread between low-risk bonds and high-risk bonds. Just look at the downward drift of Vanguard’s High-Yield Corporate Bond Fund (VWEHX).

I called Vanguard and the fund pays a dividend yield of 8.61%. Wow, that creams just about anything else you can find today.

Of course, they’re called junk for a reason. High-yield bonds have a greater risk of defaulting than investment grade debt. In today’s Wall Street Journal, Liz Rappaport says that if defaults do happen, the amount recovered could be less than it has been in the past.A report to be published Tuesday by Moody’s Investors Service argues that the explosion of loans issued by junk-rated companies in the past few years means that if they default, the recoveries on these loans might be less than in the past.

The highest-priority loans, called first-lien senior secured bank loans, will likely recover on average 68 cents on the dollar upon default in this downturn, compared with a historical average of 87 cents, Moody’s said.Here’s the money quote:

Now, Moody’s expects loan investors to fare almost as badly as investors in riskier junk bonds have done in previous busts. “It doesn’t matter what you call something,” says Kenneth Emery, author of the report. “What matters is where you sit in the liability structure.”

Historically, it’s fairly rare for a bond, even a junk bond, to default. The long-term rate for junk is about 2.6%, but for investment grade bonds, the default rate is just 0.1%. However, defaults can often spike dramatically higher. There have been times when the junk default rate has hit 15%, while it’s never gone above 1.6% for the highest-grade bonds.

Reuters reports today:The U.S. default rate on junk bonds, high-yield debt that is below investment grade, rose to 1.89 percent in May, a 26-month high, from 1.64 percent in April. The rate is expected to rise to 4.7 percent within a year and there is a 20 percent chance it could go as high as 8.5 percent, S&P said.

-

Goldman Admits It Goofed

Eddy Elfenbein, June 24th, 2008 at 9:34 amYou don’t find the word “goofed” in many financial headlines, especially ones dealing with Goldman Sachs, but Reuters has the goods:

Goldman cuts financials, admits goofed on upgrade

Goldman Sachs & Co strategists urged stock investors on Monday to “underweight” U.S. financial and consumer shares, admitting it was wrong when it upgraded both sectors just seven weeks ago.

The downgrades sparked selling in the two sectors as investors feared that weakening consumer demand and deterioration in the credit markets will weigh on profitability.

“We boosted our consumer discretionary and financials weights in May on the belief the sectors would benefit from bank recapitalizations and fiscal stimulus,” Goldman strategists led by David Kostin wrote. “Our thesis was clearly wrong in hindsight.”Good for them for reversing their call. One of the biggest mistakes investors make is refusing to admit defeat on an investment. People will hang on to the worst sorts of stocks just so because they don’t “want to take a loss.” Stocks don’t have egos. Sometimes it’s best just to let it go.

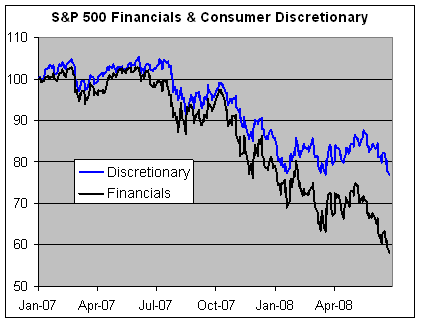

Here’s a look at how the S&P 500 Financials and Consumer Discretionary Indexes have done since the beginning of last year.

This chart reminds me of another big mistake investors make: “It’s already down so much, it can’t possibly go any lower?” -

UNH Under $27

Eddy Elfenbein, June 23rd, 2008 at 3:07 pmUnitedhealth Group (UNH) got down to $26.35 today. That’s the lowest price in over four years. The company said that it expects earnings this year of $3.55 to $3.60 per share.

I’m going go out on a limb here and say, I don’t think the market believes that. -

Aussie Power Crisis Leads to Flat Beer

Eddy Elfenbein, June 23rd, 2008 at 2:40 pmTalk about globalization. Thanks to demand from China, a town in Australia is booming. That is, until an explosion cut off natural gas supplies.

Hotels are turning off heaters, dirty laundry is piling up and restaurants and bars expect shortages of beef and draught beer. The crisis may shave a quarter point off Australia’s gross domestic product as mines and processing plants cut production, slowing the state’s commodities-driven boom, estimates Brian Redican, a senior economist at Macquarie Group Ltd. in Sydney.

It’s a nightmare deciding what stays on and what stays off. My favorite quote:

”When it gets to the stage where you can’t pour a beer in a pub, you know this crisis has the potential to affect every aspect of business,” says Bradley Woods, CEO of the Australian Hotels Association’s West Australian branch.

-

Buy! Buy! Buy! Wait, I Never Said Buy.

Eddy Elfenbein, June 23rd, 2008 at 2:11 pmOh Jim.

(Via Felix via the tireless Don Harrold) -

Market Failure Versus Government Failure

Eddy Elfenbein, June 23rd, 2008 at 1:57 pmHere’s an interesting article from the Washington Post looking at the government’s ability to handle market failures.

“How well does government do in helping the market to improve what it does?” asked Clifford Winston, an economist at the Brookings Institution and the author of the 2006 book “Market Failure Versus Government Failure.” “The research consistently finds that, in fact, government efforts to correct market failures have little effect, or actually make things worse.”

“There is a tendency for people to say, ‘If things are safer, then I will take more risk,’ ” he added. “It does not have to involve government interventions: Drugs are developed to reduce blood pressure, so people say, ‘Okay, I can eat more, and it does not matter if I gain weight, because I can take this pill.'”I think people are inherently poor judges of risk.

Previous research has shown that people drive faster in vehicles that feel safer, attempt to bike on more dangerous terrain when they wear helmets and pay less attention to infants being bathed when the children are in seats that are said to reduce the risk of drowning.

Winston does not believe in one-size-fits-all solutions — whether interventionist approaches that liberals favor, or the hands-off strategies that conservatives prefer. Rather, he argues that solutions need to be tailored to produce measurably successful outcomes.

He once studied the effect of installing air bags in cars at a time when automakers were offering customers the option of buying cars with and without the safety devices. Winston found that people who bought cars with air bags tended to be the safest drivers to begin with. And now, lulled into a sense of security, they tended to drive faster, effectively canceling out the safety benefits.

The wrong lesson to draw from this is that air bags are useless. The right lesson is that air bags can improve safety when they are targeted at the riskiest drivers. As the safety devices become standard issue, for example, risky drivers are automatically protected. And as the safest drivers stop feeling they are extra safe, they may take their foot off the gas. -

RIP: George Carlin

Eddy Elfenbein, June 23rd, 2008 at 1:38 am -

Nasdaq Composite and Long-Term Support

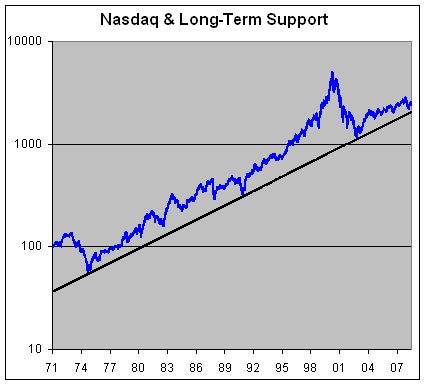

Eddy Elfenbein, June 20th, 2008 at 11:03 amI’m not much of a market technician, but I’m passing along this chart because the time period is so long.

In March, the Nasdaq came within 10% of hitting the long-term support line. Even though it looks close, the black line is around 2050 today, which is far below where the Nasdaq (^IXIC). -

Doomsdays Past and Present

Eddy Elfenbein, June 19th, 2008 at 4:33 pmRBS issues global stock and credit crash alert

The Royal Bank of Scotland has advised clients to brace for a full-fledged crash in global stock and credit markets over the next three months as inflation paralyses the major central banks.

“A very nasty period is soon to be upon us – be prepared,” said Bob Janjuah, the bank’s credit strategist.

A report by the bank’s research team warns that the S&P 500 index of Wall Street equities is likely to fall by more than 300 points to around 1050 by September as “all the chickens come home to roost” from the excesses of the global boom, with contagion spreading across Europe and emerging markets.

Such a slide on world bourses would amount to one of the worst bear markets over the last century.I love British understatement (“very nasty period”), but I think their metaphors are a bit mixed up. Chickens can’t come home to roost while the contagion spreads. Perhaps Chickenpox could spread, but certainly not roosting chickens. If the chickens were paralyzed, well…that just seems rather cruel.

Of course, predicting crashes is a great way to get attention. It’s also not so new. Nearly 151 years ago, on June 27, 1857, the New York Herald predicted a market panic (which indeed began in August).

The founder and publisher of the Herald, James Gordon Bennett, editorialized: “What can be the end of all this but another general collapse like that of 1837, only upon a much grander scale?”

What did he mean by “all this”?Government spoilation, public defaulters, paper bubbles of all descriptions, a general scramble for Western lands and town and city sites, millions of dollars, made or borrowed, expended in fine houses and gaudy furniture; hundreds of thousands in silly rivalries of fashionable parvenus, in silks, laces, diamonds and every variety of costly frippery are only a few among the many crying evils of the day.

Yes, we’ve always had purple prose Doomsday writers. It sells better than balanced reporting.

By the way, 1857 is a…Fibonacci Number…dun..dun…DUNNH. -

Krugman Misled America!!

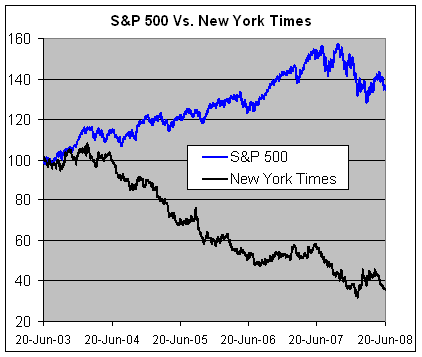

Eddy Elfenbein, June 19th, 2008 at 2:48 pmFive years ago, Paul Krugman wrote:

The big rise in the stock market is definitely telling us something. Bulls think it says the economy is about to take off. But I think it’s a sign that America is still blowing bubbles — that a three-year bear market and the biggest corporate scandals in history haven’t cured investors of irrational exuberance yet.

And.

In short, the current surge in stocks looks like another bubble, one that will eventually burst.

Well, there was one stock that was in a bubble.

Krugman lied. Profits died.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His