Archive for June, 2008

-

“The US economy is Out of the Woods”

Eddy Elfenbein, June 16th, 2008 at 10:33 amAnatole Kaletsky at the Times argues that the U.S. economy is not in a recession:

American consumers, far from cutting back to bare essentials as was expected by bearish commentators after the credit crunch, are actually increasing their spending. The evidence of this, contained in the strong retail sales figures for May published last Thursday, was by far the most important economic news of the past few weeks. Yet these figures received almost no media coverage and little market attention.

Yet May’s retail sales figures revealed a picture completely at odds with conventional wisdom about the US economy. Despite the jump in energy prices and the related collapse in measures of consumer confidence, retail sales rose by 1.1 per cent on the month, the strongest gain since last November. Sales adjusted for inflation and excluding food and energy also showed gains much stronger than expected. Also April’s sales, initially thought to have fallen, were revised upwards to show a significant gain – and the two-month average of these volatile figures suggested that growth in the US consumer economy is now similar to the rate a year ago, before the sub-prime crisis and credit crunch.

This conclusion is not based on one set of good retail sales statistics, but includes stronger-than-expected recent figures on industry sales, stocks, imports, exports, purchasing managers’ surveys and even home sales. But in saying this, am I not forgetting about the dreadful employment figures published last Friday, which triggered the collapse of the dollar I mentioned at the start? Not at all. Despite the shock-horror headlines about a terrifying leap in unemployment from 5 to 5.5 per cent, employment figures for May were quite strong and fully consistent with the message of economic acceleration. Rates of unemployment are irrelevant in timing the economic cycle, since they are a lagging indicator, turning some six to nine months after the economy as a whole. Meanwhile, the job creation figures, which do reflect current economic conditions, showed a modest decline of 49,000 in payroll employment, exactly in line with expectations and consistent with the economy growing at about 1.5 per cent, just slightly below the 2 per cent trend rate of productivity growth.

Of course May’s strong retail sales were due in part to the tax rebates of $600 to $2,000 per household from the US Treasury from last month. Many analysts, therefore, dismissed the gains as misleading. But this was the wrong response. The role of tax cuts in boosting consumer spending is a reason for optimism, not scepticism, about the economic outlook. The tax rebates were designed to boost consumer spending and that is why we have always expected (in line with the Fed and the US Treasury) to see economic recovery from this summer. Retail sales figures have now shown that the US tax cuts are working as planned. They will temporarily boost consumption – and by the time that this temporary tax boost runs out around Christmas, the US economy will be starting to enjoy the benefits of lower interest rates, operating with a lag of 12 to 18 months. -

Lehman’s Earning, Or Lack Thereof

Eddy Elfenbein, June 16th, 2008 at 9:26 amLehman Brothers (LEH) told us to expect the worst and they were right. The company lost an astonishing $2.8 billion last quarter. Revenues came in at negative $688 million. It’s hard to make a profit when your revenue is in the red. The company got rid of $147 billion in assets last quarter.

Lehman’s leverage ratio — how many times assets exceed a firm’s equity — fell to 24.3 from 31.7 at the end of the first quarter and 28.7 last year. A week ago, Lehman predicted the ratio would slide to 25. The higher the number, the more debt the firm has taken on to fund those assets.

Lehman’s capital-markets business posted negative net revenue of $2.4 billion as fixed-income revenue fell to negative $3 billion. Both were in line with projections.

Equities revenue dropped 65% from a year earlier and 57% from the fiscal first quarter to $600 million, amid $300 million in losses on private equity and investments in which the bank was a principal.

The investment-banking business saw net revenue slump 25%. But investment-management revenue was flat at $800 million, worse than the company’s projection last week for a 13% rise to $900 million.

The brokerage said it has a liquidity pool of $45 billion, up 32% from the prior quarter.

Lehman said it reduced its exposure to residential mortgages, commercial mortgages and real estate investments by about 20% in each asset class during the quarter.From the end of 1996 to the end of 2006, shares of LEH climbed from $7.69 (adjusted for two 2-for-1 splits) to $78.12. That’s a 10-fold gain in 10 year, and it doesn’t include the modest amount from Lehman’s dividend.

The company just made a high-profile change in the executive suites but I really don’t think that’s what needed right now. Moody’s, for their part, recently downgraded the company. Naturally, this comes after the stock has plunged 75%. I doubt Lehman will able to continue as a separate entity. -

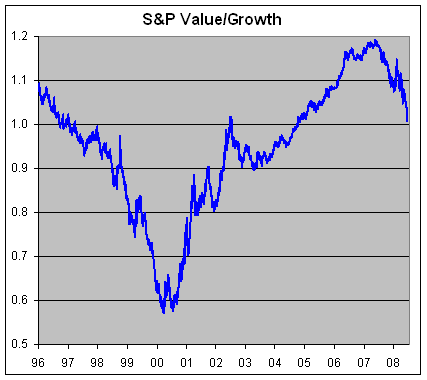

S&P 500 Value Index Divided By the S&P 500 Growth Index

Eddy Elfenbein, June 13th, 2008 at 11:48 am

Growth has recently been outperforming Value which is unusual for a bear market. The difference is that many financial stocks fall into the Value category, and that’s where the most pain has been. -

Portfolio Called It

Eddy Elfenbein, June 12th, 2008 at 2:11 pmFrom the April issue of Portfolio on Erin Callan:

Wall Street’s Most Powerful Woman

And why she might not rise higher than Lehman’s C.F.O. -

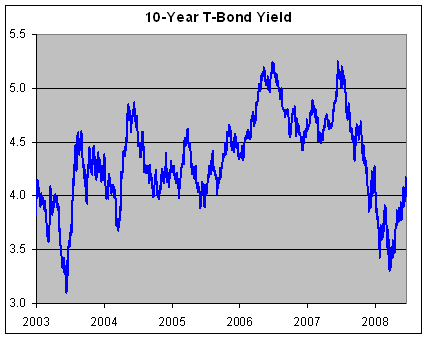

10-Year T-Bond Hits 2008 High

Eddy Elfenbein, June 12th, 2008 at 10:25 amI know we’re supposed to be in the worst economy since the Great Depression, but no one told retail shoppers.

Retail sales climbed 1 percent last month, from a 0.2 percent drop in April, the Commerce Department said. Excluding autos, retail sales increased 1.2 percent in May, after a 0.5 percent rise in April. The median forecast in a Bloomberg News survey was for an increase of 0.5 percent in retail sales and 0.7 percent in sales excluding autos.

Sales at retailers may have been boosted by Americans spending their tax-rebate checks and by higher receipts at service stations, Bloomberg News surveys of economists show. The data helped fuel speculation accelerating inflation will make investors reluctant to bid at today’s auction of 10-year notes.The yield on the 10-year Treasury (^TNX) bumped up to 4.18% this morning which is the highest yield all year. Still, by the standard of the past few years, the yield is quite modest:

In the retail sector, Ross Stores (ROST) has been doing very well. The stock is up over 45% this year and the shares hit another new high today. Last week, the company reported that its same-store sales rose 7% in May. -

Bear’s Lacrosse Team Beats Lehman’s

Eddy Elfenbein, June 11th, 2008 at 3:36 pmFrom Bloomberg:

Bear Stearns Cos.’ lacrosse team beat Lehman Brothers Holdings Inc. 11-4 last night, a rare piece of good news for workers at the now-defunct Wall Street firm.

Peter LeSueur, 25, scored four of Bear Stearns’s goals, leading the team to victory at Baker Field in Manhattan three months after the firm collapsed and was forced to sell itself to JPMorgan Chase & Co.

“It’s been something that we’ve been able to look forward to,” said LeSueur, a former fixed-income analyst at Bear Stearns who played lacrosse at Johns Hopkins University from 2002 to 2005. “There were a lot of question marks surrounding the firm in the last couple of months, and just for fun we were able to keep our focus on this and know that we’d be able to play together and maintain our friendships.” -

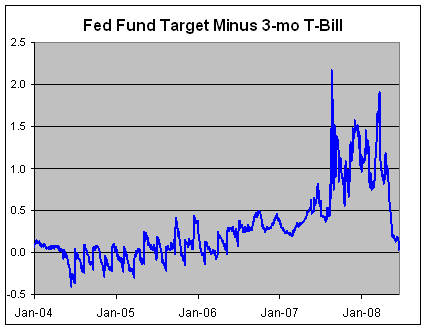

The T-Bill Rate Catches Up to the Fed’s Rate

Eddy Elfenbein, June 11th, 2008 at 12:14 pmAlthough the stock market may be headed back to where it was in March, there’s a major difference between now and three months ago–the short-term credit market isn’t nearly as chaotic as it was. This doesn’t suggest that the stock market shouldn’t be falling, but it could mean that the worst of the credit crunch has passed.

The yield on the three-month T-bill is usually pretty close to the Fed Funds target rate, but that relationship went kabluey last year. Yesterday, for the first time in over two years, the T-bill rate nearly exceeded the Fed Funds target rate.

Last August, the T-bill rate plunged all the way to 2.95% (and an intra-day low of 2.4%) while the Fed was still at 5.25%. That’s a huge gap.

Here’s a look at the difference between the Fed Funds target rate and the yield on the three-month Treasury:

The Fed responded by cutting and cutting, but the T-bill rate continued to head lower. By mid-March, the spread was still close to 200 basis points. On March 20, the intra-day low for the three-month T-bill was just 0.2%. That’s a panic price.

Since the Fed last cut in late April, the T-bill rate has slowly crept higher. Now of course, there’s talk of the Fed raising rates soon. -

Market Orders Vs. Limit Orders

Eddy Elfenbein, June 11th, 2008 at 11:29 amTim Sykes has a good article at TradingMarkets on the advantages of limit orders over market orders. I always enjoy hearing what Tim has to say because his approach to investing is almost the polar opposite of mine. Plus, any article that says, “90% of traders are known losers,” has got to win a place in your heart. (BTW, how many are unknown losers?)

Tim is a frenetic trader whereas I change one-quarter of my Buy List just once a year. There’s no one right way to invest—it often comes down to personality and temperament. Tim says that he hasn’t once used a market order; I can’t remember the last time I didn’t.

Tim’s point is that so much of strategy comes down to simple execution:By using limit orders, I ensure a satisfactory execution. And, if none or only some of my order executes – as often times stocks run too hard and too fast, blowing past my limit price – then it’s probably for the best because experience has taught me not to chase stocks. Obviously buying to cover into a short squeeze is an altogether different animal – on those you need to get out as soon as possible – so I just place my limit far above the current price, still cautious not to wildly overpay or open myself up to getting taken advantage of by many of Wall Street’s nefarious players.

That’s an interesting angle because one of the frustrations I’ve found in limit orders is only getting partially filled. That would drive me nuts because I felt half dressed. With stop-losses, I found myself canceling far more than any there were ever triggered.

Tim concludes:So, demand more from yourself whenever you place a trade. Be disciplined, be cautious, and be wary. Thinking this way will surely cost you a few missed opportunities, but the money saved over time from minimizing poor executions and emotionally charged trades will make it well worth your while.

-

Financials Fall to 3rd Place in S&P 500

Eddy Elfenbein, June 11th, 2008 at 8:49 amRemember when the financials fell to second place in the S&P 500? It seems as if it was only a few days ago, which it, in fact, was. Well, now the financials are in third place.

The market value of IT stocks surpassed financials last month for the first time since the tech bubble imploded at the start of the decade. And now, energy names top financials in the widely followed index for the first time since 1992.

Worries over the health of the financial sector, which has suffered from bad bets on now souring mortgage debt, resulting tightness in the credit markets and a slowdown in corporate dealmaking, have dragged on the stocks of big names on Wall Street like Citigroup Inc. and Lehman Brothers Holdings Inc.

As of Monday’s stock market close, financials had fallen 36.6 percent from their October 2007 highs, according to S&P figures. During the same time, energy stocks have gained 11.79 percent and IT stocks have posted a 9.57 percent decline.Kinda like Big Brown down the stretch in the Belmont.

-

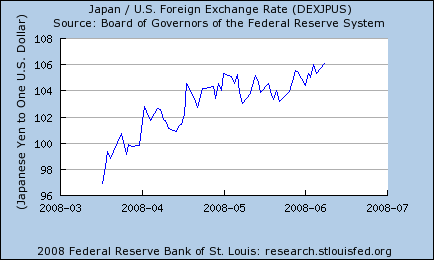

Is the Dollar Coming Back to Life?

Eddy Elfenbein, June 11th, 2008 at 8:11 amCould be. Here it is against the yen.

The greenback still has a long, long way to go.The dollar picked up momentum throughout the global session, rising to a three-month high of 107.43 yen while pushing the euro down to a three-session low of $1.5453. The U.S. currency had rallied for the second straight day after Federal Reserve Chairman Ben Bernanke downplayed recession risks in a speech Monday night. He repeated concerns about inflation that had led to a dollar rally last week when Mr. Bernanke tied those price pressures to the weaker U.S. currency.

Foreign-exchange analysts said Mr. Bernanke’s new comments bolster the market view that the specter of dollar-supportive rate increases has now entered the picture.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His