Archive for November, 2008

-

Glad That’s All Cleared Up

Eddy Elfenbein, November 25th, 2008 at 9:41 am -

Goldman’s Forecast

Eddy Elfenbein, November 24th, 2008 at 4:22 pmCitigroup cut its 2008 target for the index to 850 points from 1,200 points. The 2009 target was cut to 1,000 points from 1,300 points.

Goldman cut its 2008 earnings-per-share estimate on the index to $55 from $65 — its third estimate cut in less than three months. The 2009 estimate was cut to $53 from $68.What’s the point in making forecasts if you can instantly slash next year’s estimate by 22%?

I don’t mind estimates, and I don’t mind people being wrong. But I do mind frivolousness. There’s no value in that forecast whatsoever. -

High Yield Rates Soar

Eddy Elfenbein, November 24th, 2008 at 4:13 pmWith T-Bills yielding less than 1 bip, look at the Vanguard High-Yield Corporate (VWEHX):

-

Google: A Value Stock

Eddy Elfenbein, November 24th, 2008 at 1:01 pmAnyone notice that Google (GOOG) is going for 11.3 times next year’s earnings?

-

Assorted Links

Eddy Elfenbein, November 24th, 2008 at 12:47 pmHere are a few good links I want to pass along.

The New Yorker does 12,000 on the bearded one.

The Wall Street Journal looks at the Morgan Stanley Panic.

The New York Times looks at the decline and fall of Citigroup. Hint: Rubin doesn’t come out looking so good.

Every Stock Mutual Fund Has Lost Money in 2008, Except One

China’s richest man disappears

China’s second-richest person detained

Very cool NYT graphic tracking the bailout money. -

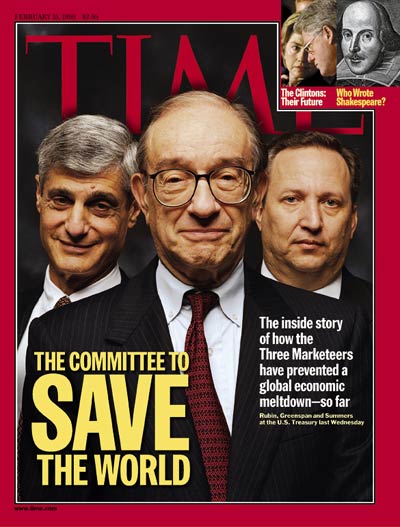

Time Magazine: February 15, 1999

Eddy Elfenbein, November 24th, 2008 at 1:56 amRubin, Greenspan and Summers. Diminished reputations all.

-

Citigroup, Feds Reach Deal

Eddy Elfenbein, November 24th, 2008 at 1:08 amWell, the deal is done. Citigroup reached a deal with the Feds whereby the government will backstop $306 billion of its crappy assets. Note that the assets are not being taken off the balance sheet (TARP is dead). In exchange, the government will get 8% preferred shares (i.e., our crappy assets). The government will also kick in another $20 billion of TARP money (Update: TARP lives!)

For its troubles, Citi will now have to comply with the exec comp restrictions plus it has to go along with the FDIC’s mortgage modification program.

There’s a lot going on here so let’s look at the objectives. For one, the government is aware that other troubled banks are watching this deal. Even if other banks never get it, a bar has been set that will influence future behavior.

There’s also the question of preferred shares versus warrants. That could go either way. If it works and the price is good, the warrants could be a very good deal for taxpayers. Actually, it could be an insanely good deal. That’s a risk, however, I’m not inclined to take. For one, what price? Citi’s dropped something like 60% in the past few days. The warrants in this deal have a price of $10.61 which is the 20-day trailing price. Friday’s close was $3.77. You do the math. I don’t get why the preferreds pay 8% instead of the previous 5%. For taxpayers, I don’t see why we can’t get the same 10% that Buffett got from Goldman.The U.S. government is committed to supporting financial market stability, which is a prerequisite to restoring vigorous economic growth. In support of this commitment, the U.S. government on Sunday entered into an agreement with Citigroup to provide a package of guarantees, liquidity access and capital.

As part of the agreement, Treasury and the Federal Deposit Insurance Corporation will provide protection against the possibility of unusually large losses on an asset pool of approximately $306 billion of loans and securities backed by residential and commercial real estate and other such assets, which will remain on Citigroup’s balance sheet. As a fee for this arrangement, Citigroup will issue preferred shares to the Treasury and FDIC. In addition and if necessary, the Federal Reserve stands ready to backstop residual risk in the asset pool through a non-recourse loan.

In addition, Treasury will invest $20 billion in Citigroup from the Troubled Asset Relief Program in exchange for preferred stock with an 8% dividend to the Treasury. Citigroup will comply with enhanced executive compensation restrictions and implement the FDIC’s mortgage modification program.

With these transactions, the U.S. government is taking the actions necessary to strengthen the financial system and protect U.S. taxpayers and the U.S. economy.

We will continue to use all of our resources to preserve the strength of our banking institutions and promote the process of repair and recovery and to manage risks. The following principles guide our efforts:

* We will work to support a healthy resumption of credit flows to households and businesses.

* We will exercise prudent stewardship of taxpayer resources.

* We will carefully circumscribe the involvement of government in the financial sector.

* We will bolster the efforts of financial institutions to attract private capital.Here’s the Summary of Terms.

-

Somali Pirates in Discussions to Acquire Citigroup

Eddy Elfenbein, November 22nd, 2008 at 12:04 pmNovember 20 (Bloomberg) — The Somali pirates, renegade Somalis known for hijacking ships for ransom in the Gulf of Aden, are negotiating a purchase of Citigroup.

The pirates would buy Citigroup with new debt and their existing cash stockpiles, earned most recently from hijacking numerous ships, including most recently a $200 million Saudi Arabian oil tanker. The Somali pirates are offering up to $0.10 per share for Citigroup, pirate spokesman Sugule Ali said earlier today. The negotiations have entered the final stage, Ali said.

“You may not like our price, but we are not in the business of paying for things. Be happy we are in the mood to offer the shareholders anything,” said Ali.

The pirates will finance part of the purchase by selling new Pirate Ransom Backed Securities. The PRBS’s are backed by the cash flows from future ransom payments from hijackings in the Gulf of Aden. Moody’s and S&P have already issued their top investment grade ratings for the PRBS’s.

Head pirate, Ubu Kalid Shandu, said: “We need a bank so that we have a place to keep all of our ransom money. Thankfully, the dislocations in the capital markets has allowed us to purchase Citigroup at an attractive valuation and to take advantage of TARP capital to grow the business even faster.”

Shandu added, “We don’t call ourselves pirates. We are coastguards and this will just allow us to guard our coasts better.”

*CITI IN TALKS WITH SOMALI PIRATES FOR POSSIBLE CAPITAL INFUSION

*WILL REQUIRE ALL CITI EMPLOYEES TO WEAR PATCH OVER ONE EYE

*SOMALIAN PIRATES APPLY TO BECOME BANK TO ACCESS TARP

*PAULSON: TARP PIRATE EQUITY IS AN `INVESTMENT,’ WILL PAY OFF

*KASHKARI SAYS `SOMALI PIRATES ARE ‘FUNDAMENTALLY SOUND’ ‘

*Moody’s upgrade Somali Pirates to AAA

*HUD SAYS SOMALI DHOW FORECLOSURE PROGRAM HAD `VERY LOW’ PARTICPATION

*SOMALI PIRATES IN DISCUSSION TO ACQUIRE CITIBANK

*FED OFFICIALS: AGGRESSIVE EASING WOULD CUT SOMALI PIRATE RISK

* FED AGREED OCT. 29 TO TAKE `WHATEVER STEPS’ NEEDED FOR SOMALI PIRATES -

That’s Like Rearranging the SIVs off the Balance Sheet

Eddy Elfenbein, November 21st, 2008 at 11:10 amThe New York Times on Citigroup:

Within the bank’s Manhattan offices, television screens have stopped displaying the company’s stock price. Traders have begun making jokes comparing Citigroup to the Titanic.

Also, remember that Goldman Sachs IPO from nine years ago?

Shares of The Goldman Sachs Group Inc. closed below their initial offering price of $53 on Thursday, a first since the company went public in May 1999.

The stock dipped as low as $49 in intraday trading, closing at $52.36.

The New York-based company’s shares reached a high of $247.97 on Oct. 31, 2007, creating a market value of $105 billion. -

It Happened

Eddy Elfenbein, November 21st, 2008 at 10:10 amYesterday’s close:

Dow = 7,552.29

S&P 500 = 752.44

Ratio = 10.037

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His