Archive for February, 2009

-

Happy Fun Day

Eddy Elfenbein, February 23rd, 2009 at 9:24 pmStock-Market Crashes and Depressions by Robert J. Barro and Jose F. Ursua

Long-term data for 25 countries up to 2006 reveal 195 stock-market crashes (multi-year real returns of -25% or less) and 84 depressions (multi-year macroeconomic declines of 10% or more), with 58 of the cases matched by timing. The United States has two of the matched events – the Great Depression 1929-33 and the post-WWI years 1917-21, likely driven by the Great Influenza Epidemic. 45% of the matched cases are associated with war, and the two world wars are prominent. Conditional on a stock-market crash, the probability of a minor depression (macroeconomic decline of at least 10%) is 30% and of a major depression (at least 25%) is 11%. In a non-war environment, these probabilities are lower but still substantial – 20% for a minor depression and 3% for a major depression. Thus, the stock-market crashes of 2008-09 in the United States and other countries provide ample reason for concern about depression. In reverse, the probability of a stock-market crash is 69%, conditional on a depression of 10% or more, and 91% for 25% or more. Thus, the largest depressions are particularly likely to be accompanied by stock-market crashes, and this finding applies equally to non-war and war events. We allow for flexible timing between stock-market crashes and depressions for the 58 matched cases to compute the covariance between stock returns and an asset-pricing factor, which depends on the proportionate decline of consumption during a depression. If we assume a coefficient of relative risk aversion around 3.5, this covariance is large enough to account in a familiar looking asset-pricing formula for the observed average (levered) equity premium of 7% per year. This finding complements previous analyses that were based on the probability and size distribution of macroeconomic disasters but did not consider explicitly the covariance between macroeconomic declines and stock returns.

After reading that, here’s something that might cheer you up.

-

Zero for 9,000

Eddy Elfenbein, February 23rd, 2009 at 5:11 pmMebane Faber reports that out of Morningstar’s database of 9,000 stock mutual funds, not one is up for the year.

Oh, and it’s still February. -

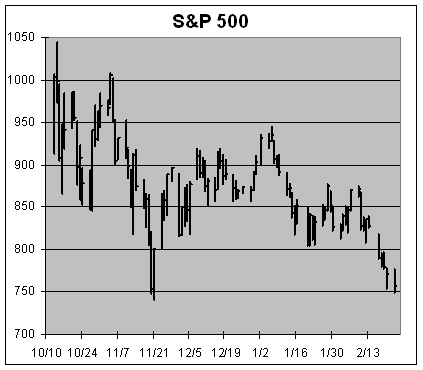

The S&P 500 Just Above Intra-Day Low

Eddy Elfenbein, February 23rd, 2009 at 2:35 pmI noticed that the S&P 500 was hanging at 755, which always make me think of Hank Aaron. The index got as low as 749.69 this morning. The intra-day low from November 21 was 741.02.

-

It Had to Happen Sooner or Later

Eddy Elfenbein, February 23rd, 2009 at 8:16 amFrom the NYT:

Nigerian Accused in Scheme to Swindle Citibank

To carry out the elaborate scheme, prosecutors in New York said on Friday, the man, identified as Paul Gabriel Amos, 37, a Nigerian citizen who lived in Singapore, worked with others to create official-looking documents that instructed Citibank to wire the money in two dozen transactions to accounts that Mr. Amos and the others controlled around the world.

The money came from a Citibank account in New York held by the National Bank of Ethiopia, that country’s central bank. Prosecutors said the conspirators, contacted by Citibank to verify the transactions, posed as Ethiopian bank officials and approved the transfers. -

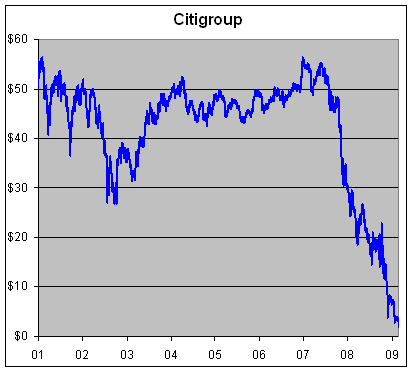

U.S. Eyes Large Stake in Citi

Eddy Elfenbein, February 22nd, 2009 at 8:57 pmFrom the WSJ:

Under the scenario being considered, a substantial chunk of the $45 billion in preferred shares held by the government would convert into common stock, people familiar with the matter said. The government obtained those shares, equivalent to a 7.8% stake, in return for pumping capital into Citigroup.

The move wouldn’t cost taxpayers additional money, but other Citigroup shareholders would see their shares diluted. A larger ownership stake by the federal government could fuel speculation that other troubled banks will line up for similar agreements.

-

Sign of the Times

Eddy Elfenbein, February 20th, 2009 at 10:52 pmRep. Michael Capuano to the bank executives last week:

Basically you come to us today on your bicycles after buying girl scout cookies and helping out Mother Teresa, telling us “We’re sorry, we didn’t mean it, we won’t do it again, trust us”…I don’t really have a question, but I was told that I can use my five minutes.

In other news:

Girl Scout cookie sales crumbling -

Velkomme to Sweden

Eddy Elfenbein, February 20th, 2009 at 1:32 pmI hate saying this, but we have to stop kidding ourselves—it’s time to nationalize our rotten banks. I’m not really pro nationalization but I’m anti stupidity and that’s what we’ve been doing up till now.

My normal fear of nationalizing is that it would lead to a moribund industry incapable of turning a profit. Well, we’re already there.

My only hope is that it’s done quickly. Very quickly. Before anyone notices. -

Blast From the Past

Eddy Elfenbein, February 20th, 2009 at 1:04 pmWith the market at new lows, it’s time to recall some predictions. This is from January 2, 2008:

Christian broadcaster Pat Robertson, who has made predicting the future an annual tradition, predicts a recession and a major stock market upheaval are on their way for the United States.

Aside from a recession this year, Robertson suggested Wednesday that Americans will be paying much more for gas at the pump as the price of a barrel of oil rises by 50 percent in the coming months.

Specifically, he said oil would reach $150 a barrel – the price hit $100 on Wednesday – with the dollar continuing to lose value in 2008.

“I also believe the Lord was saying by 2009, maybe 2010, there’s going to be a major stock market crash,” said Robertson, who is a millionaire businessman as well as an evangelical leader.Not bad. Oil topped out at $147. The stuff about nuclear war? Well, unfortunately, that didn’t pan out.

Still, that’s some pretty good predictioning from Pat. No wonder he came in second in the Iowa caucus. -

Paragraph of the Day

Eddy Elfenbein, February 20th, 2009 at 12:57 pmFrom Arnold Kling:

Starting last September, our country has gone through six months that shook the world. We have abandoned free markets. We have abandoned democracy, in the sense of having policies that reflect the popular will. The United States has become a technocratic dictatorship.

-

How Things Have Changed

Eddy Elfenbein, February 20th, 2009 at 1:18 amJames Surowiecki from January 6:

As I showed yesterday, investors overwhelmingly supported the Paulson plan: it was only when it was killed, that stock prices really started their downward spiral. And it was only after Obama unveiled his economic team and made clear how big his stimulus plans were that the market began its sharp recovery (the S. & P. 500 is now up twenty-five per cent since Nov. 20th).

Surowiecki made what I call, the “Daniel Gross Mistake” which is to read partisan political opinions from stock market returns. January 6 turned out to be the exact near-term high. Since then, the S&P 500 is down 16.7%.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His