Archive for April, 2009

-

RIP: Geocities

Eddy Elfenbein, April 23rd, 2009 at 3:10 pmNot with a bang, but with a whimper. Yahoo! is unceremoniously closing GeoCities, one of the original web-hosting services acquired by Yahoo! in 1999 for $2.87 billion. In a message on Yahoo!’s help site, the company said that it would be shuttering Geocities, a free web-hosting service, later this year and will not be accepting any new customers. Existing customers will still be able to access use GeoCities but Yahoo! is encouraging these customers to upgrade to Yahoo!’s paid Web Hosting service.

GeoCities’ traffic has been falling over the past year. According to ComScore, GeoCities unique visitors in the U.S. fell 24 percent in March to 11.5 million unique visitors from 15.1 million in March of 2008. Back in October, 2006, it had 18.9 million uniques.

There are plenty of other Website creation and hosting services out there, including blog platforms such as WordPress, Blogger, and Typepad, as well as Website creation and hosting services such as Ning, Webs, Jimdo, Snapages, Weebly, and countless more. GeoCities never really kept up with the times, but always remained a decent pageview generator.

One of the pioneers of web-hosting sites, GeoCities gave users personal publishing tools and created “neighborhoods” within its web platform for users to be able to create pages, add a picture, text, a guest book and a website counter. Long before MySpace, Geocities was known as a place where teenagers, college students, and eventually others could impose their own garish taste upon the rest of the world. Here is one Geocities homepage we found from 1996: In honor of GeoCities and all that it has given the Web, whoever can come up with the worst GeoCities homepage design of all time will get a TechCrunch T-shirt.Personally, I think we should have given them several billion dollars in bailout money.

-

Is Oil to Blame?

Eddy Elfenbein, April 23rd, 2009 at 10:27 amJames Hamilton has a great post on the consequences of the oil shock (it’s three weeks old, unfortunately I just noticed recently). He concludes that the rise in oil prices led to the recession.

The implication that almost all of the downturn of 2008 could be attributed to the oil shock is a stronger conclusion than emerged from any of the other models surveyed in my Brookings paper, and is a conclusion that I don’t fully believe myself. Unquestionably there were other very important shocks hitting the economy in 2007-08, first among which would be the problems in the housing sector. But housing had already been subtracting 0.94% from the average annual GDP growth rate over 2006:Q4-2007:Q3, when the economy did not appear to be in a recession. And housing subtracted only 0.89% over 2007:Q4-2008:Q3, when we now say that the economy was in recession. Something in addition to housing began to drag the economy down over the later period, and all the calculations in the paper support the conclusion that oil prices were an important factor in turning that slowdown into a recession.

Of course the problems in the economy were building for a long time, and without an oil shock, they simply would have been put off and not fixed.

-

Best Line of the Day

Eddy Elfenbein, April 23rd, 2009 at 10:22 amFrom a Nobel Prize Winner:

So Citigroup is profitable because investors think it’s failing, while Morgan Stanley is losing money because investors think it will survive. I am not making this up.

-

The Worst Stock of the Decade

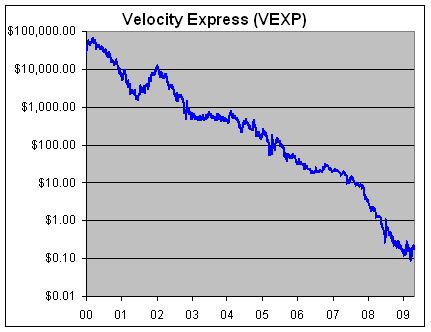

Eddy Elfenbein, April 22nd, 2009 at 12:08 pmCongratulations to Velocity Express (VEXP), the single-worst performing stock of the decade…that’s still trading.

Since the beginning of decade, VEXP has had three reverse stock splits; a 1-for-50, a 1-for-15 and a 1-for-5. That adds up to 1-for-3,750.

VEXP closed last century at $8 a share but adjusting for splits that comes to $30,000. Today, it’s at 21 cents. Ouch! That’s a loss of 99.9993%. Heck, it’s more than Ivory Soap.

Those -99.99…% figures can be a little deceiving so let me add some perspective. Velocity’s loss is the equivalent of dropping in half 17 times. It’s like a 10% loss every month for the decade. If would have turned $1 million into $7.

But it’s still trading

-

Zimbabwe Fed Raided Private Accounts

Eddy Elfenbein, April 22nd, 2009 at 10:52 amI’m no longer surprised by any news story out of Zimbabwe. Still, this is just crazy:

Zimbabwe’s central bank governor admitted today that he took hard currency from the bank accounts of private businesses and foreign aid groups without permission, saying he was trying to keep his country’s cash-strapped ministries running.

In a statement that would be unthinkable coming from most central banks, the governor of the Reserve Bank, Gideon Gono, appeared to be issuing a plea to keep his job in the face of growing criticism.

Gono said it was time “to let bygones be bygones” now that Zimbabwe has a new coalition government dedicated to reversing its economic decline.

The central banker said he gave the money he took from the hard currency accounts as loans to various ministries, and the private accounts would be reimbursed when the ministries repaid the loans. He said the bank’s efforts “sustained the country” in its hour of need. -

Since March 9

Eddy Elfenbein, April 22nd, 2009 at 3:00 amGuess whose Buy List is beating the market by more than 10% since March 9 — 35.88% to 25.65%.

Give up? -

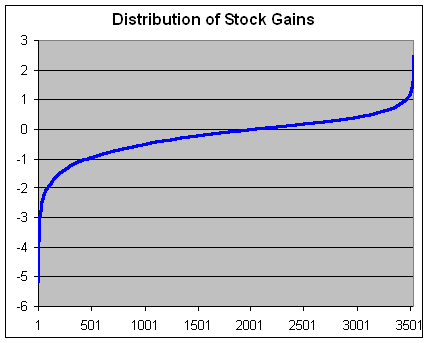

More on the Distribution of Stock Returns

Eddy Elfenbein, April 21st, 2009 at 2:45 pmLast week, I discussed the distribution of stock gains. I speculated that the fat tails is probably very significant. It hints that there may be “great stocks” whose returns make up an unusually large share of the market’s gains.

I looked at the market’s gains this decade. Here’s the distribution of gains for over 3,500 stocks since December 31, 1999 (I used a log scale):

The x-axis shows is the stocks ranked from worst to best (left to right). The y-axis is the log of the gain.

The median stock is a loss of 20%. Over 57% of stocks are down for the decade. Even the stock at the 25th percentile is up about 70% which isn’t that great for a decade’s work.

Just by eyeballing the chart, the appears to be major turn northward at around point 3400 which corresponds with a gain of over 500%.

Here’s the raw data. I’d welcome if anyone could make a histogram based on standard deviation points. I strongly doubt that it’s symmetrical.

Update: Don Fishback was good enough to bring his charting skillz to us. Check out his post. What strikes me is the leftward tilt of the distribution. Lots of underperformers. It’s like Wall Street is a reverse Lake Wobegon.

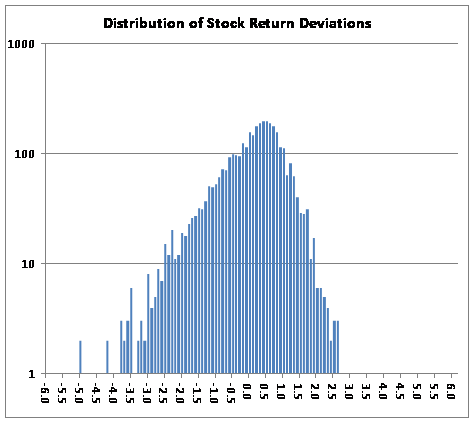

Another Update: A reader provides a graph of returns by standard deviation. Notice how the peaked is to the right of 0.

-

Eaton Vance Takes a Hit

Eddy Elfenbein, April 21st, 2009 at 12:22 amShares of Eaton Vance (EV) got dinged today for over 11%. In this past weekend’s Barron’s, I noticed they ran a research piece from Sandler O’Neill saying that run in asset managers is overdone. That’s not really a big deal except that EV hasn’t been leading the market at all. The stock is up 70% since the market bottom in early March, but the stock was down a lot too.

I can’t be sure if the Barron’s piece caused today’s selloff, but Sandler O’Neill also made it clear that they’re raising their earnings estimates for the quarter and fiscal year. -

Memo to All CWS Employees

Eddy Elfenbein, April 20th, 2009 at 2:26 pmTo: CWS All

From: Eddy

Subject: Cost-Cutting Initiative

Look folks, in case you haven’t noticed, we’re in the worst depression in 70 years. This means that all of us–you, me, my security detail–need to start cutting back on expenses. I’m ordering all department heads to cut their FY 2009 budgets by 0.0028%. I realize this will be painful and I want to thank everyone for their help.

Read here for more details. -

Citi Guys Slams Sysco

Eddy Elfenbein, April 20th, 2009 at 1:12 pmIn NY Mag, a Citigroup exec slams the unwashed masses:

“No offense to Middle America, but if someone went to Columbia or Wharton, [even if] their company is a fumbling, mismanaged bank, why should they all of a sudden be paid the same as the guy down the block who delivers restaurant supplies for Sysco out of a huge, shiny truck?” e-mails an irate Citigroup executive to a colleague.

Two things: First, saying “no offense but” is not an excuse to be offensive.

Secondly, and for the record, you could have bought Sysco (SYY) 35 years ago for $21-1/8. Today, the stock is at $22.30.

Oh, did I mention the splits totaling 144-for-1?

Let’s just say that Citigroup hasn’t been as strong a performer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His