Archive for April, 2009

-

Wall Street Imitates the Simpsons

Eddy Elfenbein, April 16th, 2009 at 11:46 amSelma on the Simpsons in 1994

Hey, relax. I told you, I got money. I bought stock in a mace company just before society crumbled.

The WSJ today:

Fear and Greed Have Sales of Guns and Ammo Shooting Up

-

Baxter and Amphenol

Eddy Elfenbein, April 16th, 2009 at 11:21 amTwo of our Buy List stocks reported earnings this morning, and they were both pretty good.

Amphenol (APH) earned 43 cents a share down from 54 cents a share last year. They had a two-cent benefit, so the 41 cents was a penny better than expectations (though FactSet said consensus was 39 cents. Hmm. No consensus on consensus).

Revenue fell 14.4% to $660 million which was a bit better than the $654.8 million consensus. The company sees Q2 EPS coming in between 41 and 43 cents, and revenues between $660 million and $675 million. The stock seems a bit pricey right now, but terribly overpriced.

The other earnings report came from Baxter International (BAX). First-quarter EPS came in at 83 cents which is a nice improvement from 67 cents a year ago. Sales actually fell 1.8% but if you discount currency moves, they were really up about 6%.

For the year, BAX sees EPS coming in between $3.72 and $3.78. They raised the low end by two cents. For Q2, they see earnings in a range of 93 cents to 95 cents a share.

Both stocks are doing well this morning. -

To All the Goldman H8trs

Eddy Elfenbein, April 16th, 2009 at 11:05 amSeesh, why all hate on Goldman (GS) lately? Face it, Goldman is going to thrive and survive. I’ve never seen an institution that so many people admire yet want to fail at the same time. OK, maybe second to the Yankees.

Their orphan quarter wasn’t some secret conspiracy. It was perfectly public. The Feds forced them to be a bank holding company so they changed their fiscal year, presto four-month reporting.

Just because it’s a large, powerful, filthy rich and highly opaque bank that seems to run the government is no reason to fear them. -

JPMorgan Chase Is Still Ticking

Eddy Elfenbein, April 16th, 2009 at 10:50 amThe other day I said I had no idea what JPMorgan Chase’s (JPM) earnings would be. It turns out, my prediction was correct. The bank earned over $2.1 billion for the first three months of the year, or 40 cents a share.

The news is reporting that the Street’s consensus was for 32 cents a share. That was the average, but analysts were all over the map. I think the Street is just happy to see a profit — any profit. I should remind you that JPM hasn’t posted a single earnings loss during this mess. For last year’s Q1, they made 67 cents a share.

The best news is that banking isn’t dead. The bank said that loan losses will continue growing from credit cards and mortgages. The Bear and WaMu acquisitions are clearly helping out. It’s kinda cool when your trading can make up for all the bad stuff.

Jamie Dimon said JPM wants to pay back its TARP money as soon as they can. He also said that the bank will sit out Timmy’s little public/private plan. If JPM won’t bite, who else will? -

Regulators and Redskins

Eddy Elfenbein, April 15th, 2009 at 8:39 pmWe examine the correlation between federal government activity and the performance of the D.C. area’s National Football League team, the Washington Redskins. We find a significantly positive, non-spurious, and robust correlation between the Redskins’ winning percentage and the amount of federal government bureaucratic activity as measured by the number of pages in the Federal Register. Because the Redskins’ performance is prototypically exogenous, we give this surprising result a causal interpretation. Drawing upon public choice theory and behavioral economics, we provide a plausible explanation for the causal mechanism: bureaucrats must make “logrolling” deals in order to expand their regulatory power, and a winning football team acts as a commonly shared source of joyous optimism to lubricate such negotiations. We do not find the same correlation when examining Congressional activity, which we attribute to legislator loyalty to their home state’s team(s).

(HT: Ribstein.)

-

I’m Sorry But I Just Don’t Get Seasteading

Eddy Elfenbein, April 15th, 2009 at 4:52 pmHere’s another Tax Day post.

As person who enjoys highly theoretical or just plan off-the-wall propositions, it pains me to say that I just don’t get seasteading.

If you’re not familiar with it, this is a radical libertarian venture that aims to build libertarian city-states…are you ready…floating on the high seas. Think of John Galt, but on a raft.

I don’t want to be too dismissive of seasteading. Here’s Patri Friedman making the case.

For myself, count me out. First, I do in fact love my country and feel loyalty to it no matter how batty its laws are. Secondly, I share Arnold Kling’s thought that a lot problems we have on land will follow them at sea.

Still, I think dry land is the way to go. I would try to hunt for some speck in the Pacific Ocean. There are about a billion islands out there just waiting to be made into a libertarian paradise. Come to think of it, I never saw much government on Gilligan’s Island or Lost.

The U.S. has a bunch of possessions out there. So do France and Britain. Why not try to buy one? The Northern Mariana Islands have a couple of uninhabited islands (see Pagan Island).

Even if you don’t want to buy one, just go there and set up your own community. When someone official starts to bother you, do what everyone else does—secede. Sure, that will involve some government, but probably less than running a big boat. -

The Libertarian Way to Fight Pirates

Eddy Elfenbein, April 15th, 2009 at 1:21 pmIn Article I, Section 8 of the Constitution, Congress has the power to issue Letters of Marque. As I understand it, this is an authorization from a government to individuals to let them seize assets from a foreign ship. “Here (scribble), go nuts.”

I always thought this was some curio still left in the Constitution. I even joked with a friend recently that this would be the best way to fight the pirates.

I joked too soon. I give you, Ron Paul:Rep. Ron Paul (R-Texas) has called for the use of congressional letters of marque to allow private security forces to patrol international waters and assume liability for such operations.

“The whole mess over there is a reflection of our foreign policy as well because we’ve been involved in Somalia for a long time,” Paul said on Fox News on Wednesday.I wonder if it would apply to blimps. Shouldn’t they be Emails of Marque? So many questions. Anyway, Happy Tax Day.

-

Taleb Idiocy Watch

Eddy Elfenbein, April 15th, 2009 at 11:05 amI hope to be credited as the person who starts this. Mark my words: More people are going to realize that Mr. Black Swan/Napoleon Dynamite has no idea what he’s talking about.

Private-equity firms and the stock market share characteristics of Ponzi schemes, “Black Swan” author Nassim Nicholas Taleb said.

Leveraged buyouts, the principal tool of private-equity investing, and buying stocks on margin should be restricted for the protection of small investors and the economy, Taleb said in a Bloomberg Television interview.

“We want economic life to be organized to be as distant from that Madoff model as we can,” Taleb said, referring to Bernard Madoff, who pleaded guilty last month to directing the largest Ponzi scheme, bilking investors of about $65 billion.

LBOs are “too close to Madoff” because “you rely on new investors to pay off the other ones,” Taleb said. “The stock market has some mild Ponzi characteristics. We have to make sure that innocent people are not harmed by this Ponzi-attribute.”

The financial system needs to be simple because regulators can’t protect investors from complex financial products, Taleb said.

“Regulators are fundamentally dumb,” he said. “Traders will go around them. I want the system where regulators can be stupid without you and I being harmed by it.” -

Audi Vs. BMW

Eddy Elfenbein, April 15th, 2009 at 9:50 am

-

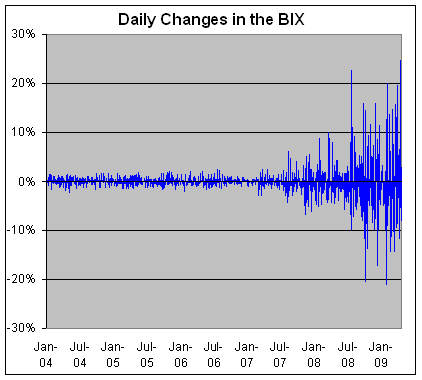

The Last Five Years In One Chart

Eddy Elfenbein, April 14th, 2009 at 10:51 pmHere are the daily changes of the S&P Banking Index:

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His