Archive for May, 2009

-

Goldfinger’s Plan Backfires Again

Eddy Elfenbein, May 11th, 2009 at 12:59 pmCentral Bank Gold Sales Began 10 Years Ago This Week:

Has it Worked?

In the spring of 1959, 50 years ago, the seventh of Ian Fleming’s James Bond novels, Goldfinger, was published. The plot (made into a classic 1964 movie) featured a crazy idea – to blow up all of the U.S. gold at Fort Knox, making it radioactive and worthless. That would make Auric Goldfinger’s gold worth more. However, he didn’t need to stage all that drama to make money. If he had just held on to his gold 20 years, it would be worth 25 times as much. A decade ago, some nations in Europe decided to blow out their gold instead of profiting from buy-and-hold. Their initial plan, from May 1959, has now backfired.

10 years ago, on Friday, May 7, 1999, the Bank of England announced that it would start selling a large share of its gold reserves in favor of assets offering interest rates – namely bonds. That announcement came after a decade of gold going nowhere, causing the impatient anti-gold forces among central bankers to demand a positive return on their investments. On the day of the Bank of England announcement, gold was trading $282.40, but the announcement of the forthcoming sale drove gold prices down to 20-year lows over the next 90 days. In fact, gold traded narrowly between $252 and $262 per ounce all through July & August of 1999, due to the anticipation of the damage done by massive central bank liquidations.

Many central banks followed Britain’s example, including France, Switzerland, Spain, the Netherlands and Portugal. As a result, the proportion of gold in central bank coffers has now slipped from 60% (in 1980) to 10%. European banks eventually sold around 3,800 tons (122 million ounces) of gold, freeing $56 billion to buy their beloved bonds. However, that sold gold would now be worth twice is much: $112 billion! Central banks are finally learning to hold on to their gold. Last year, central banks sold 246 tons, the lowest annual sales in 10 years – equivalent to about 10% of newly-mined annual supplies of gold.

Even accounting for the interest income on the bonds, a study last week showed that central banks lost $40 billion by selling their gold prematurely. The biggest loser was the Swiss National Bank, which sold 1,550 tons over the last 10 years, or more than 40% of all central bank sales. As a result, the Swiss are $19 billion poorer than they would have been by holding on to all their gold. Meanwhile, the U.S., Italy and Germany held all their central gold, so they now represent three of the four top national holdings:

Largest Gold Holdings among Central Banks

United States…………………..8,138.9 (no sales since 1999)

Euro Central Bank…………….6,434.7

Germany…………………………3,412.6 (no sales)

Int’l Monetary Fund…………..3,217.3

France……………………………2,487.1

Italy……………………………….2,451.8 (no sales)

China……………………………..1,054.0 (and rising)

Switzerland……………………..1,040.1 (down 60% since 1999)

Bottom line: A decade ago, the Dow was 11100 and gold was $277, for a 40-to-1 ratio. Today, the Dow is 8450 and gold is $910, for a 9.3-to-1 ratio. Translated into comparative performance over a 10-year period, gold provided 330% greater returns than the Dow since the day central banks began selling gold.

Gold Baffles the Gurus

Experts Yell “May Day” Way Too Soon

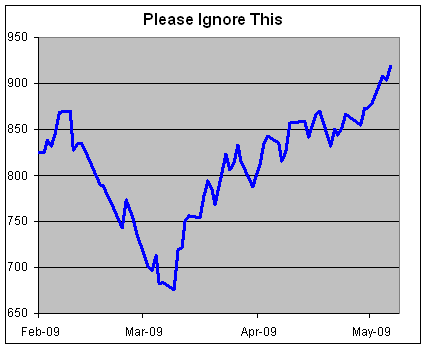

Last Monday, May 4, was a bank holiday in most of Europe. Originally called International Worker’s Day, the first Monday in May has now morphed into a genteel bank holiday. Last Monday, London’s Financial Times surveyed several gold gurus and concluded that most long-term bulls were turning short-term bearish. Dennis Gartman, for instance, was quoted as saying, “I don’t think gold recovers for a long time. You will be surprised by how far down it goes. I can see gold going back to $750 with ease.” The FT’s bottom line advice was to “wait until it gets close to, or past, $800” to buy. The next day, however, gold rose $25 per ounce and stayed cover $900 all week, making all those gurus look a little foolish.

Silver rose even more dramatically, from $12 to $14 in three trading days. The initial impetus for the recovery in the precious metals was a weaker dollar (down 3% to the euro last week, measuring from Monday’s peak to Friday’s trough), plus fear of future inflation, based on record-high levels of money supply creation by the world’s central banks. In addition, oil and natural gas were rising dramatically in price, even though inventories were large and growing. Then, the Euro Central Bank (ECB) cut rates to 1% last week. Lower rates make gold seem more competitive on a total return basis, since gold offers no interest income. After all, the lure of high interest rates initially drove central banks to sell their gold 10 years ago today. Here is the capsule tale of the tape from precious metals last week.

London Daily pm Fix…………….Gold………………Silver………………….Platinum

Year-end 12/31/08………………..865.00……………10.79……………………….899

Friday, May 1……………………….884.50…………….12.15………………………1076

Tuesday, May 5……………………910.00…………….13.11………………………1135

Wednesday, May 6……………….910.00…………….13.44………………………1136

Thursday, May 7…………………..912.25…………….14.01………………………1161

Friday, May 8……………………….907.00…………….13.90……………………….1149

Changes Last Week………….+$22.50 (+2.5%)….+$1.75 (+14.4%)……….-$99 (+6.8%)

Changes so far in 2009………+$42 (+4.9%)……..+$1.36 (+28.8%)………+$177 (+27.8%)

Gold 52 weeks ago (May 9, 2008): $876.00…………….Gold’s low for 2009: $810 on January 15

Gold’s average price during 2009 so far: $904.06…….Gold’s high for 2009: $990 on February 24

Bottom line: Gold gurus, like most other gurus, are adept at extrapolating short-term trends into long-term and non-sustainable straight lines. This refers to downward trends as well as upward surges. (The same Wall Street firm that predicted $200 oil a year ago predicted $40 oil when the tide turned last summer.)

(Posted by CWS contributor Gary Alexander.) -

Strange End-of-Day Phenomenon

Eddy Elfenbein, May 11th, 2009 at 10:57 amThe Financial Times notes that the market is becoming seriously weird late in the day:

“Despite higher liquidity, the equity market has become hard to trade,” stated a December 10 2008 research note from Credit Suisse: “We are seeing volume surge at the end of the day, accompanied by extreme price swings and spreads – yet surprisingly little movement overnight.”

That research team works with Credit Suisse’s advanced execution services algorithmic trading group (AES) in New York, and has tracked the end-of-day phenomenon carefully. In November 2008, it reports, 8 per cent of trades occurred in the last 10 minutes of the day, versus 6 per cent in 2006 and 2007, and end-of-day volatility in November rose to 2.5 per cent from about 0.5 per cent in July 2008. -

Some Quick Hits

Eddy Elfenbein, May 8th, 2009 at 12:53 pmJust a few quick things:

One, did you see NICK at $4.48 today? Yeah, baby!

Also, Alfac is now up to $35. The stock has been up huge off its low, more than tripling in price. Of course, that’s because it had a big spike down. I still like the stock and think it’s a solid bargain, but most of the super easy profits have been erased over the last two months.

Finally, I’m not sure why “bear market rally” is used as an epithet. What’s so bad about them? The gains are real. Even if it is one, we can still enjoy it.

Bear market rally? So was the Renaissance. -

Time to Go on the Record

Eddy Elfenbein, May 8th, 2009 at 12:38 pmBloomberg recently quoted our old friend Nassim Taleb as saying that the global crisis is “vastly worse” than the 1930s. That’s quite a tall order. In the United States, unemployment peaked around 25% while GDP fell by 30%. We’re not even remotely close to those numbers much less can we say that it’s “vastly worse.”

Taleb said, “This is the most difficult period of humanity that we’re going through today because governments have no control.” Joe Weisenthal rightly points out that loss of government control may not be such a bad thing. (Also, are the words “of humanity” really needed?)

What I find frustrating about many prominent bearish forecasters is the refusal to give concrete investment advice. I don’t see the point of telling people how bad things will be if you’re not offering advice on what to do about it. Yes, the world’s going to blow..tell me what to do now. As someone who has his portfolio viewable for free to all-comers 24-hours a day, it’s annoying that these bears refuse to back up their words. There’s no way to hold them accountable.

Is Taleb recommending anything? This is what Bloomberg writes:Gold, copper and other assets “that China will like” are the best investment bets as currencies including the dollar and euro face pressures, Taleb said. The IMF expects the global economy to shrink 1.3 percent this year.

Hmmm…seems a bit vague. Once CNBC tried to get Taleb to give advice. The Maureen Tkacik article I linked to includes this snippet:

In February, Power Lunch, the midday show, booked two of the canniest thinkers to emerge in the crisis, Nassim Nicholas Taleb, the options trader and Black Swan author, and the economist Nouriel Roubini—only to find the two men stubbornly averse to saying anything that might risk making viewers any money. Roubini expounded upon the virtues of the Swedish model of bank nationalization and the dangers of a bubble-driven economy but refused to set a date at which he expected the market to turn around. When reporter Roben Farzad asked “Mr. Black Swan” where he would invest his money for the college fund of a hypothetical child born next month, Taleb began unloading on the extravagant compensation schemes that incentivized investment bankers to take excess risk. “But how is this actionable? How is this actionable? Do I stick my money under a mattress?” Farzad pressed. “I’m not here to give immediate investment advice” Taleb shot back. “Yeah, you’re the prophet of gloom and doom, but I need to know where to put my money now,” Farzad continued, and Mr. Black Swan finally offered that all his money was in various currencies, though he wouldn’t say which. The bullying wasn’t personal.

That’s a very revealing passage. I disagree that the reporter was bullying, he was trying to get a stubborn guest to go on record.

Taleb is happy to say that all these economists and bankers are clowns and fools, but he won’t say what investors should be doing. For many folks, vagueness seems to be fine but it’s not for me. I can’t take a market commentator seriously unless I’m able to hold them accountable. Vague pronouncements don’t cut it.

One of the things I like about Cramer is that he’s not afraid to make himself look bad. For all his antics, what he says here is exactly right.

-

Maureen Tkacik on CNBC

Eddy Elfenbein, May 7th, 2009 at 11:03 pmMaureen Tkacik looks at CNBC which includes a quote from yours truly.

-

Multiply Your Money with Bontrust

Eddy Elfenbein, May 7th, 2009 at 9:49 pm -

Paging All Chinese Lenders to the Yellow Courtesy Phone

Eddy Elfenbein, May 7th, 2009 at 1:56 pmThis does not look good.

Meanwhile, Libor is at a new low. -

“I Assure You It’s Just a Bear Market Rally”

Eddy Elfenbein, May 6th, 2009 at 3:57 pm

Listen folks, it’s just a bear market rally.

Nothing to see here, please keep moving.

I’m telling you — it’s all phony, none of this counts.

Look at the tape. It’s just shorts, nothing more.

Goldman prolly wants to unload some crap.

Trust me. I’ve seen this a hundred times.

Have you seen those phony bank “profits”??

Load up on gold, my friend. $2,000 here we come!

They’re just setting you up for another decline.

Do you have “sucker” written on your forehead?

Roubini said it’s a false rally.

I assure you it’s just a bear market rally.

Vote Ron Paul. -

Market Winning Streaks

Eddy Elfenbein, May 6th, 2009 at 7:37 amThe Nasdaq is now up for the ninth straight week. Jason Goepfert at Sentimental Trader takes an interesting look at historic winning streaks.

-

More on NICK’s Earnings

Eddy Elfenbein, May 6th, 2009 at 7:10 amI’ve looked through Nicholas Financial’s (NICK) earnings and the numbers look solid. Almost all the metrics improved over last quarter. However, there could be some seasonality to their business. Comparisons with a year ago almost seem like comparing them to the 19th century.

The company earned 20 cents a share. Annualized, that’s 80 cents which means the stock could be going for around four times earnings. Book value per share is now $8.21. Also remember that in 2006 and 2007, NICK earned over $1 a share.

The big worry I have each quarter is the line “Provision for credit losses as a percentage of average finance receivables, net of unearned interest.” That’s the unhappy line. The good news is it fell from 8.77% in the December quarter to 6.26% in the March quarter. That’s a difference of $1.3 million which is huge for a company like NICK. It’s still higher than a year ago, 6.26% to 5.20%, but we’re not seeing the huge increases from previous quarters. In the third quarter, for example, loss provisions were up 225% from the year before.

I have little doubt that NICK will survive the only question is when will things turnaround. Delinquencies are down a lot from last quarter, though that may be seasonal. There was a similar drop, though not as large, between the third and fourth quarters of a year ago. Delinquencies are still up from a year ago, but again, they seem to be leveling off.

The bottom line is that this was a very good quarter for NICK. In fact, I wasn’t expecting to see numbers like this until later in the year. At this rate, the loss provisions may soon show year-over-year decline. That will be time to celebrate.

I’ll repeat what I’ve said before about NICK. It won’t be a fun stock to own. It’s small and may drive you crazy. In fact, most investors shouldn’t own it. But if you have a long time horizon and can safely ignore a microcap, then NICK is a great buy.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His