Archive for July, 2009

-

2009 Earnings: A Moving Target

Eddy Elfenbein, July 29th, 2009 at 8:46 amEarlier this week, I mentioned that earnings have been running well ahead of expectations so far this earnings season. Of course, expectations were pretty low.

For all of 2009, Wall Street now sees the S&P 500 earnings $59.80. If we continue to beat expectations, then we have a good shot of exceeding $60.

To put that number in context, here’s a table John Mauldin posted earlier this year of the trend in analyst expectations for 2009.

So expectations are now higher than they were on September 10, 2008. The difference is that the S&P 500 then stood at 1,232.04 compared with yesterday’s close of 979.62. -

Decade Inflection Points

Eddy Elfenbein, July 28th, 2009 at 2:44 pmIf March 9th holds up as the low, this could continue a tradition of major market turning points near the turn of a decade.

The Nasdaq peaked in March 2000 over 5,000. It’s still down over 60%.

The Japanese Nikkei peaked on the last day of trading of 1989 near 39,000. It’s still down around 75%.

Gold peak at $850 just three weeks into the 1980. Gold eventually bottomed out around $253 in 1999, again close to a new decade.

One of the greatest bull markets in history began in June 1949. Thanks to high dividends, the market averaged over 20% a year above inflation for the next seven years.

Finally, in late 1929, stocks ran into a wee bit of trouble. -

95 Years Ago This Week on Wall Street

Eddy Elfenbein, July 28th, 2009 at 1:20 pmOn Tuesday, July 28, Austria-Hungary attacked Serbia, and World War I officially began. Stock markets around the world collapsed (some closed), and the price of gold soared. On Wall Street, trading volume hit 1,020,000 shares, and market officials pondered closing the exchange.

On Wednesday, July 29, politicians were trying to halt the European violence, but Austro-Hungary bombed Belgrade and Russia mobilized troops along Austria’s border. In response, three major European stock exchanges (Vienna, Rome and Berlin) closed their doors.

On Thursday, July 30, the rush to sell stocks and buy gold escalated. Panic selling on the New York exchange reached 1.3 million shares, the highest volume since the Panic of 1907. Many blue chip stocks crashed, falling 20% to 30% that single day. GM fell from $59 to $39 (-34%). Even Bethlehem Steel, which figured to profit from making war armaments, was down 14%. That night, exchange officials met to decide whether or not to close the exchange on Friday.

Early in the morning of Friday, July 31, the London Stock Exchange announced that it would suspend trading until further notice, the first time it had done so in its centuries-long heritage. If the New York Stock Exchange opened for trading on this final day of July, it would have been the only open stock market in the world. Since markets were now connected by undersea cables, all the world’s sellers would converge on Wall Street. In fact, the overnight sell orders “at any price” were lined up for the opening bell, so the NYSE governors decided to close for only the second time in its history. The NYSE was totally closed until the middle of December, 1914, but only a few stocks traded then. The full board only re-opened in April, 1915 – nine months later.

However, U.S. banks stayed open, and the rush to convert cash to gold wiped out many banks. From July 27 to August 7, 1914, $73 million in gold was withdrawn from New York banks alone.

On Monday, August 3, 1914, no stock markets in Europe or America were open. On that day, Germany declared war on France and invaded Belgium; very soon, Britain declared war on Germany, and Turkey signed a military pact with Germany. As the sun set on that dismal day, Sir Edward Grey, British foreign secretary, said, “The lamps are going out all over Europe; we shall not see them lit again in our lifetime.”

(via: Gary Alexander) -

IBM Snatches Up SPSS

Eddy Elfenbein, July 28th, 2009 at 12:22 pmFifteen months, I highlighted SPSS (SPSS), the predictive analysis company, as a good stock to own during tough economic times. When I wrote about SPSS, it was around $42 a share and it promptly dropped in half. So much for my predictive analysis.

Fortunately, IBM (IBM) came to my rescue today (admittedly, that probably wasn’t their top priority). They’re buying SPSS for $50 a share.

The lesson is an old one: Just because a trade goes against you doesn’t mean you’re wrong. Good stocks show their value, but it takes patience. -

Baxter International Announced $2 Billion Share Buyback

Eddy Elfenbein, July 28th, 2009 at 11:40 amAlthough the market is down this morning, our Buy List isn’t down nearly as much. In fact, we just passed the 15% outperformance mark.

The good news today isn’t terribly good news. Baxter International (BAX) just announced a $2 billion share buyback. I’ve grown to hate share repurchases. Just give me the money and don’t worry about the share price.

This is a pretty big repurchase from BAX. The company has 605 million shares, so that’s over $3 a share or about 6% of the share price. -

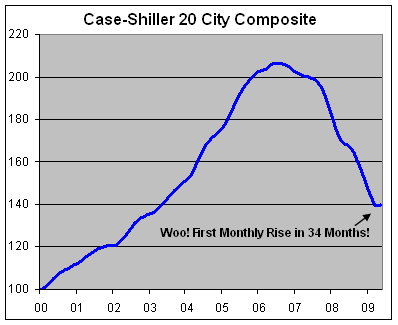

Everybody Celebrate! Home Prices Rise By Tiny Amount!

Eddy Elfenbein, July 28th, 2009 at 10:55 am

We finally had some good news in housing today (ok, modestly good news). The Case-Shiller Index of home prices in 20 leading cities showed a very slight advance in May. Not any second derivative stuff, but an actual real live gain.

The gain was tiny but at least it’s a gain. This ends a run of 34 straight months of declines.The S&P/Case-Shiller home-price index rose 0.5 percent from April, the first monthly gain since July 2006 and biggest since May of that year, the group said today in New York. The measure was down 17.1 percent from May 2008, less than forecast and the smallest year-over-year drop in nine months.

Price declines may keep moderating as demand steadies and distressed properties account for a smaller share of transactions. Even so, rising unemployment, stagnant confidence and the loss of wealth caused in part by the drop in property values mean a rebound may be slow to take hold.

“After three years of this nasty housing recession, I think we’ve got to be pleased with such an improvement in a relatively short period,” said Harm Bandholz, U.S. economist at UniCredit Research in New York.

Economists forecast the index would drop 17.9 percent from a year earlier, according to the median of 32 projections in a Bloomberg News survey. Estimates ranged from declines of 17.5 percent to 18.3 percent.

Compared with a month earlier, 14 cities showed price gains, led by a 4.1 percent jump in Cleveland and a 1.9 percent increase in Dallas.Home prices in Las Vegas and Phoenix are more than half off their peak.

-

Lithuania’s GDP plummets 22.4%

Eddy Elfenbein, July 28th, 2009 at 9:12 amWow. It’s astounding that a country’s economy can fall by nearly one-fourth.

Lithuania’s economy shrank 22.4 percent in the second quarter compared to the same period a year ago, the biggest drop since the Baltic country broke away from the Soviet Union in the early 1990s, officials said Tuesday.

The preliminary figures from Statistics Lithuania were worse than expected, and raised concerns that neighboring Latvia and Estonia may also post steeper-than-expected declines in the second quarter.

The Baltic countries enjoyed strong growth after joining the EU in 2004 but their economies stalled as a property bubble burst and gross domestic product started falling last year amid the global credit crunch.

In the first quarter, EU statistics showed Latvia, Estonia and Lithuania had the worst performing economies in the 27-member bloc, with annual drops in output of 18.6 percent, 15.6 percent and 10.9 percent, respectively.

Danske Bank analyst Lars Christensen said Lithuania’s worse-than-expected figures for the second quarter calls into question whether the EU’s euro3.1 billion bailout package for Latvia was based on “too optimistic” economic forecasts.

The deal relies on an estimate that Latvia’s gross domestic product will drop by 18 percent this year, but Christensen said he expected GDP to fall “no less than 20 percent.”

Unlike Latvia, Lithuania has not requested help from international lenders.

“The GDP fall is just catastrophic, but we were not expecting anything else,” said Gitanas Nauseda, analyst at SEB bank in Vilnius. He said the annual drop is expected to be smaller in the second half of the year. -

Coach’s Earnings Fall

Eddy Elfenbein, July 28th, 2009 at 9:01 amIt’s always interesting to keep on eye on how well high-end retailers are doing. Consumers tend to cut back on luxury items during a recession.

Coach (COH), the handbag maker, just reported bleak earnings.Profit for the quarter ended June 27 fell to $145.8 million, or 45 cents per share, from $213.5 million, or 62 cents per share, a year ago. Excluding one-time items, including tax accounting adjustments and other items, net income totaled 43 cents per share.

Revenue fell less than 1 percent to $777.7 million from $781.5 million last year.

Analysts polled by Thomson Reuters, on average, predicted a profit of 43 cents per share on revenue of $780.4 million. Analyst estimates typically exclude one-time items.When sales are flat and profits fall, that means that profit margins drop. Running the math, the profit margin is close to 19% which is down from 27% a year ago. Still, Coach has pretty high margins for a retailer.

-

Recession Leading to Rise in Public Sex

Eddy Elfenbein, July 27th, 2009 at 10:11 amPolice say there has been a huge increase in the number of folk enjoying outdoor romps since the economic downturn began.

Sex experts reckon with 2.4million out of work and those in jobs putting in fewer hours, people are having to look outside the workplace for their kicks.

Behavioural expert Judi James said: “When people are working long hours they are knackered and also using up a lot of testosterone in the workplace. People may see it as daring and risky, which also perhaps replaces the lack of risk in the current work environment.”

Dogging hotspots have seen record activity. In Ripponden, West Yorks, chiefs have stepped up patrols following a huge number of complaints.

Other areas to have seen big increases include Thetford Forest in Norfolk, Clapham Common in London and Ashgrove picnic site, Bucks. -

Wall Street Analysts Are Finally Raising Dismal Profit Estimates

Eddy Elfenbein, July 27th, 2009 at 9:48 amThe good news is that Wall Street is raising its earnings estimates. The bad news is that the old estimates were for incredibly lousy earnings. Now, they’re just expecting somewhat lousy earnings. Still!

Wall Street firms raised forecasts on Standard & Poor’s 500 Index companies 896 times in June and lowered 886, according to data compiled by JPMorgan Chase & Co. The last time analysts were bullish on a net basis was in April 2007, before more than $1.5 trillion of bank losses tied to subprime loans spurred the first global recession since World War II, the data show.

The failure to anticipate Goldman Sachs Group Inc.’s record second-quarter profits or Freeport-McMoRan Copper & Gold Inc.’s tripling of bullion sales forced analysts to boost 2010 projections. Wall Street firms estimate the S&P 500 will earn $74.55 a share next year, up from $72.54 in May. Stocks now trade at 13.13 times estimated profit, indicating a 26 percent increase in the S&P 500 should the index return to its five-decade average of 16.54 times annual income.Wall Street currently sees the S&P 500 earning $59.80 this year. So far, 75% of earnings reports have beaten expectations this earnings season. That’s on track to be a new record since they started keeping data in 1993.

Let’s look at Black & Decker’s (BDK) earnings because they serve as microcosm for what we’re seeing this earnings season. BDK’s Q2 EPS plunged 60% to 63 cents. However, that came in well above Wall Street’s consensus of 37 cents a share.

What caused the earnings surprise? Cost-cutting. Lots of it. The company cut SGA (sales, general, and administrative costs) from nearly $400 million a year ago to $300 million. That’s pretty impressive. Obviously, one of easiest ways to cut overhead is to reduce your staff and that’s why the unemployment rate has steadily climbed higher.

Some people are quick to dismiss these earnings as somehow phony. They’re not. The earnings are real and the companies who cut costs should be rewarded. But there is room for skepticism because you can’t cut costs indefinitely. At some point, a business needs to expand to survive.

For their part, Black & Decker’s full-year EPS forecast was above the Street, even though the Q3 number was below consensus.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His