Archive for July, 2009

-

It’s Bernanke Day!

Eddy Elfenbein, July 21st, 2009 at 10:08 amToday is Ben Bernanke. For one, he gives the first part of his twice annual report to Congress. Secondly, he led off the day with an editorial in the WSJ.

Here’s his written testimony. Near the end, he addresses the audit issue:The Congress has recently discussed proposals to expand the audit authority of the Government Accountability Office (GAO) over the Federal Reserve. As you know, the Federal Reserve is already subject to frequent reviews by the GAO. The GAO has broad authority to audit our operations and functions. The Congress recently granted the GAO new authority to conduct audits of the credit facilities extended by the Federal Reserve to “single and specific” companies under the authority provided by section 13(3) of the Federal Reserve Act, including the loan facilities provided to, or created for, American International Group and Bear Stearns. The GAO and the Special Inspector General have the right to audit our TALF program, which uses funds from the Troubled Assets Relief Program.

The Congress, however, purposefully–and for good reason–excluded from the scope of potential GAO reviews some highly sensitive areas, notably monetary policy deliberations and operations, including open market and discount window operations. In doing so, the Congress carefully balanced the need for public accountability with the strong public policy benefits that flow from maintaining an appropriate degree of independence for the central bank in the making and execution of monetary policy. Financial markets, in particular, likely would see a grant of review authority in these areas to the GAO as a serious weakening of monetary policy independence. Because GAO reviews may be initiated at the request of members of Congress, reviews or the threat of reviews in these areas could be seen as efforts to try to influence monetary policy decisions. A perceived loss of monetary policy independence could raise fears about future inflation, leading to higher long-term interest rates and reduced economic and financial stability. We will continue to work with the Congress to provide the information it needs to oversee our activities effectively, yet in a way that does not compromise monetary policy independence. -

Can the Nasdaq Make it 10 in a Row?

Eddy Elfenbein, July 21st, 2009 at 10:00 amThe Nasdaq has risen for the last nine straight sessions. So far today, it’s down slightly.

We’re nowhere close to a record. In August 1979, the Naz rose for an amazing 19 straight sessions! -

The Black Turkey

Eddy Elfenbein, July 20th, 2009 at 7:48 pmCheck out Scott Locklin’s brutal takedown of our favorite blowhard, Nassim Taleb. The only part I disagree with it where Locklin calls Taleb a “good writer.” Here’s a sample:

Mountebanks like Taleb sell their wares by making the regular jamoke reading his books and essays feel fiendishly intelligent for understanding the concept of fat tails at the expense of all those pointy headed Ph.D.’s in the back room with their slide rules and white laboratory jackets. I think there would be a lot of social equity in doing this, except, the dudes in the white laboratory jackets are well aware of those fat tails. As such, Taleb is merely setting himself up as some sort of heretical alpha monkey of the quants for stating the obvious, the misleading, and occasionally the gratuitously wrong-headed and untrue.

Very true. The exact same could be said for Matt Taibbi.

-

The Mighty Potato

Eddy Elfenbein, July 20th, 2009 at 11:06 amPaul Kedrosky points to a fascinating academic study:

We have estimated the effect of the introduction of the potato on Old World population growth and urbanization. The nutritional and caloric superiority of the potato, and its diffusion from the New World to the Old, allows us to estimate causal effects using a difference-in-differences estimation strategy. According to our most conservative estimates, the introduction of the potato explains 22% of the observed post-1700 increase in population growth. These results show that food and nutrition matter. By increasing the nutritional carrying capacity of land they can have large effects on population.

To the extent that urbanization serves as a measure of the shift from rural agriculture to urban manufacturing, our estimates also provide historic evidence of the importance of agricultural productivity for economic development. According to our estimates, the introduction of the potato explains 47% of the post-1700 increase in the average urbanization rate. Our estimates suggest that increased agricultural productivity can play a significant part in promoting the rise of urban centers, industry, and economic development. [Emphasis mine] -

Barron’s on Bed, Bath & Beyond

Eddy Elfenbein, July 20th, 2009 at 10:51 amFirst Time took a look at Bed, Bath & Beyond (BBBY), now Barron’s comes out with a very favorable article on BBBY.

Shares of home-furnishings giant Bed Bath & Beyond have climbed 11% in the past year, outpacing those of retailers Target , Wal-Mart and JCPenney , each of which is down at least 10%.

Still, investors would be foolish to bail out of Bed Bath now. The stock, which last week was at 31 and change, could climb nearly 25% in the next year, according to some savvy investors.

That is because even in this lousy economy, Bed Bath (ticker: BBBY) is boosting its store base and earnings. Meanwhile, some competitors have gone belly-up, most notably Linens ‘N Things, which began liquidating its 500-plus stores late last year. A shake-out of the competitive landscape bodes well for Bed Bath longer-term, as it picks up market share.

“This is a high-quality company with lots of financial flexibility,” says David Fording, co-manager of the William Blair Growth Fund (WBGSX), which has held the stock since late last year, when it was around 25. He figures the shares are worth close to 40.The shares are inches away from a new 52-week high.

-

The Market Has Other Ideas

Eddy Elfenbein, July 20th, 2009 at 10:21 amCheck out this headline:

Naturally, shares of Eaton (ETN) are up 8% today.

-

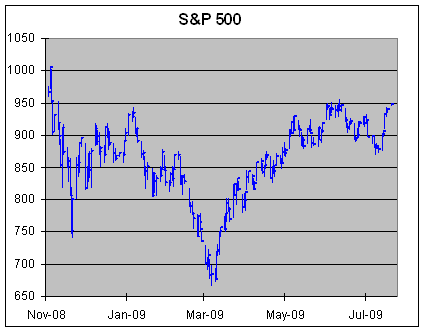

S&P 500 Nears Eight-Month High

Eddy Elfenbein, July 20th, 2009 at 10:13 amThe S&P 500 is currently near its highest level in 8-1/2 months. If the market were to close right now, it would be the highest close since November, although some of the intra-day levels reached back in June were slightly higher.

-

New York Times editorial; July 17, 1969

Eddy Elfenbein, July 19th, 2009 at 9:19 pmA correction 49 years later:

A Correction. On Jan. 13, 1920, “Topics of the Times,” and editorial-page feature of the The New York Times, dismissed the notion that a rocket could function in vacuum and commented on the ideas of Robert H. Goddard, the rocket pioneer, as follows:

“That Professor Goddard, with his ‘chair’ in Clark College and the countenancing of the Smithsonian Institution, does not know the relation of action to reaction, and of the need to have something better than a vacuum against which to react – to say that would be absurd. Of course he only seems to lack the knowledge ladled out daily in high schools.”

Further investigation and experimentation have confirmed the findings of Isaac Newton in the 17th Century and it is now definitely established that a rocket can function in a vacuum as well as in an atmosphere. The Times regrets the error. -

Dow Rallies After Escaped Chimpanzee Rings Opening Bell

Eddy Elfenbein, July 19th, 2009 at 9:15 pm -

Anyone Remember the TED Spread?

Eddy Elfenbein, July 17th, 2009 at 2:10 amOn October 10, the infamous TED Spread peaked at 464 basis points. Now it’s down below 35 basis points.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His