Archive for December, 2009

-

Bernanke Passes Senate Banking Committee

Eddy Elfenbein, December 17th, 2009 at 11:23 amThe vote was 16 to 7.

-

Danaher Guides Higher

Eddy Elfenbein, December 16th, 2009 at 11:30 pmSome good news from Danaher (DHR). The company is raising its Q4 guidance to a range of 99 cents to $1.09 a share. The Street was at 97 cents a share (and had been rising). Still, Danaher has had a rough year. It looks like EPS will be down about 17% or so from last year.

-

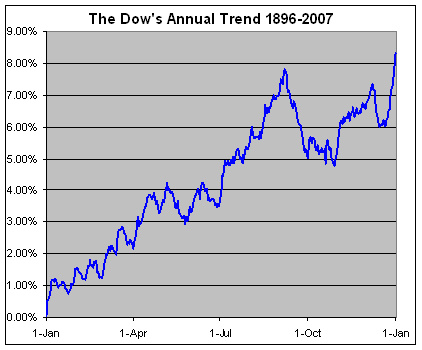

The Best Time of Year for Stocks

Eddy Elfenbein, December 16th, 2009 at 3:39 pmWe’re soon coming up on the famous Santa Claus rally. I crunch all the numbers for the Dow from 1896 through 2007. Historically, the best stretch for the market has come between December 21 and January 7. Of the 15 best days of the year for the market, six are in this period.

Over 111 years, the Dow has gained an average of 3.39% during that 17-day period. To put that in some perspective, the Dow’s annual gain is 8.32%. This means that more than 40% of the Dow’s yearly gain has come during this brief stretch which is less than 1/20 of the entire year.

-

The Dump Bernanke Bandwagon

Eddy Elfenbein, December 16th, 2009 at 3:25 pmThere are now three senators who say they will vote “nay” on Time’s Person of the Year: Jeff Merkley, John McCain and Bernie Sanders. More may be coming.

-

Bernanke Named Time’s Person of the Year

Eddy Elfenbein, December 16th, 2009 at 9:50 amWake up, sheeple.

This will drive the conspiracy folks nuts. Or rather, even nuttier. -

FactSet Drops on Earnings

Eddy Elfenbein, December 15th, 2009 at 10:51 amShares of FactSet (FDS) are down sharply today after posting earnings that were in line with expectations, which makes you wonder what the expectations really were. For their fiscal first quarter, FactSet made 74 cents a share and revenues were down a trivial amount. For the second quarter, which ends in January, the company sees EPS ranging between 73 and 75 cents a share. That’s a narrow range. The Street was at 75 cents a share.

The stock is currently down about 7.6% today. I can’t say I’m complaining since the stock has traveled almost consistently upward all year. -

The Buy List’s Four-Year Gain of 14.31%

Eddy Elfenbein, December 14th, 2009 at 5:16 pmThe Buy List just hit another new high for the year, plus we’re at another new relative strength high. Through today, our Buy List is up 43.61% compared with 23.34% for the S&P 500. That doesn’t include dividends.

Since our Buy List has an overall dividend yield that’s a bit lower than the overall market, the dividend-adjusted return is slightly closer. Through today, the Buy List is up 45.04% compared with 26.26% for the S&P 500.

For our total record of nearly four years, the Buy List has returned 14.31% compared with a loss of -2.83% for the S&P 500. -

“Naked Access” now 38% of U.S. Trading

Eddy Elfenbein, December 14th, 2009 at 2:40 pmFrom Reuters:

A report says that 38 percent of all U.S. stock trading is now done by firms that have “naked sponsored access” to markets, the controversial trading practice said to imperil the marketplace, and which faces a regulatory crackdown.

Naked access gives trading firms, using brokers’ licenses, unfetted access to stock markets. The firms, usually high-frequency traders, are then able to shave microseconds from the time it takes to trade.

Aite Group, a Boston consultancy, found that naked access accounted for just 9 percent in 2005. -

Oooh…Burn

Eddy Elfenbein, December 14th, 2009 at 10:59 amCadbury (CBY) is again not interested in being bought out by Kraft. Still, you have to admire Cadbury for calling Kraft’s (KFT) offer “derisory.” I couldn’t imagine an American company saying that.

“Kraft is trying to buy Cadbury on the cheap to provide much needed growth to their unattractive low-growth conglomerate business model,” Cadbury’s chairman, Roger Carr, said in a statement. “Don’t let Kraft steal your company with its derisory offer.”

-

Women Are Better Money Managers Than Men

Eddy Elfenbein, December 11th, 2009 at 9:32 amFrom DealBook:

It seems that in the hedge fund industry, female fund managers come out on top — at least according to a new study from Bloomberg L.P. and the National Council for Research on Women.

BusinessWeek notes that according to the research, from January 2000 through May 31, 2009, hedge funds run by women delivered nearly double the investment performance of those managed by men.

On average, funds managed by women produced annual returns of 9 percent, compared with a 5.82 percent average annual return by funds run by men.

Furthermore, in 2008, during the height if the financial crisis, funds run by women were down 9.6 percent versus a a 19 percent decline in those run by men.

The study concludes that “on average, women tend to be more consistent investors, holding investments longer and processing a greater level of informational detail, including contradictory data, in making decisions.”

“On the other hand,” the study said, “men tend to manage actively, trading often and basing decisions on overall schema.”

“This research debunks the myth that women are less effective money managers than men,” the report said.So Would Lehman Sisters still be around?

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His