Archive for December, 2009

-

The 90s Are Officially Over

Eddy Elfenbein, December 7th, 2009 at 11:28 amYou’ve Got Freedom: AOL ends ties with Time Warner

AOL is shaking loose from Time Warner Inc. and heading into the next decade the way it began this one, as an independent company. Unlike the 1990s, though, when AOL got rich selling dial-up Internet access, it starts the 2010s as an underdog, trying to beef up its Web sites and grab more advertising revenue.

Despite a few bright spots in its portfolio of sites, such as tech blog Engadget, AOL has a long way to go until Web advertising can replace the revenue it still gets from selling dial-up Internet access. One especially popular property, entertainment site TMZ, is a joint venture with a Time Warner unit that will keep TMZ and its revenue after AOL splits off.

Now investors are getting a chance to place bets on AOL. On Wednesday, Time Warner shareholders as of Nov. 27 will get one share of AOL for every 11 of their Time Warner shares. The next morning, AOL CEO Tim Armstrong is set to ring the opening bell at the New York Stock Exchange, and AOL will begin trading under the ticker symbol of the same name — the one it had when it was known as America Online and used $147 billion worth of its inflated stock to buy Time Warner in 2001. -

Where We Stand with TARP

Eddy Elfenbein, December 7th, 2009 at 11:07 amIt looks like Uncle Sam will only take a $42 billion bath from the TARP program. Only a few months ago, it looked like it would cost a lot more. Overall, that’s a return on equity of about -11%. That’s really not so bad. I have to confess that I’d be almost as worried if the Feds made money on TARP since it might give them confidence to try it again.

Of the money lent to banks, TARP has worked fairly well with a profit of $19 billion on $245 billion lent out. The problem is that nonbank borrowers like General Motors have bled out the rest of the borrowing. Citigroup is the only major bank left that hasn’t paid back all of its TARP money.

This was an ugly government policy but it was the right thing to do. Now all we need is a clear exit strategy. -

The Buy List YTD

Eddy Elfenbein, December 7th, 2009 at 9:08 amWith just a few days left in 2009, the Buy List continues to do well. Through Friday, the Buy List is up 42.36% for the year versus 22.44% for the S&P 500 (that doesn’t include dividends). The Buy List is just a hair below its November 17th high. Since March 9, we’re up 88.37% to 63.48% for the S&P 500. But of course, that’s just a suckers rally.

-

Gold Is Down Again Today

Eddy Elfenbein, December 7th, 2009 at 9:05 amAfter taking a bath on Friday, gold is down again today.

Gold for February delivery slipped $26, or 2.22%, to $1,143.50 a troy ounce early Monday. Gold prices fell sharply Friday after after a much better-than-expected jobs report from the government showed employers trimming a mere 11,000 jobs in November as the unemployment rate ticked down to 10% from 10.2% in the prior month.

“We’ve had a substantial turn in the dollar,” said Mark Hansen, director of trading at CPM Group. “People are taking a second look at their commodity exposure, especially precious metals, which have been investor favorites in the past couple of month.”

Gold prices were pressured by a stronger dollar, as the greenback hit a five-week high against a basket of currencies Monday and also rose against the euro.We’ve become very used to a script lately—dollar down, gold and stocks up. Could that be coming to an end?

Bloomberg notes that since 1980, gold has been an awful investment:Gold’s best year in three decades has yet to match the returns of an interest-bearing checking account for anyone who bought the most malleable of metals coveted for at least 5,000 years during the last peak in January, 1980.

Investors who paid $850 an ounce back then earned 44 percent as gold reached a record $1,226.56 on Dec. 3 in London. The Standard & Poor’s 500 stock index produced a 22-fold return with dividends reinvested, Treasuries rose 11-fold and cash in the average U.S. checking account rose at least 92 percent. On an inflation-adjusted basis, gold investors are still 79 percent away from getting their money back.

“You give up a lot of return for the privilege of sleeping well at night,” said James Paulsen, who oversees about $375 billion as chief investment strategist at Wells Capital Management in Minneapolis. “If the world falls into an abyss, gold could be a store of value. There is some merit in that, but you can end up holding too much gold waiting for the world to end. From my experience, the world has not ended yet.” -

The $1 Million Gold Bet

Eddy Elfenbein, December 4th, 2009 at 2:43 pmI noticed this on Barry Ritholtz’s site more than two years ago (via Prieur du Plessis). Jim Sinclair offered a $1 million bet to anyone that gold will reach $1,650 an ounce by the second week of January 2011. We’re a little over a year away.

At the time of the bet in April 2008, gold was going for about $900 an ounce. It recently jumped over $1,200 an ounce (although it pulled back sharply today to around $1,160). So gold has had a good run. But it still needs a good surge over the next thirteen months to hit Sinclair’s target.

Will it make it? I have no idea. This one may come down to the wire. -

The World Cup Draw

Eddy Elfenbein, December 4th, 2009 at 1:56 pmWe’re in Group C:

Group A

South Africa

Mexico

Uruguay

France

Group B

Argentina

Nigeria

South Korea

Greece

Group C

England

United States

Algeria

Slovenia

Group D

Germany

Australia

Serbia

Ghana

Group E

The Netherlands

Denmark

Japan

Cameroon

Group F

Italy

Paraguay

New Zealand

Slovakia

Group G

Brazil

North Korea

Ivory Coast

Portugal

Group H

Spain

Switzerland

Honduras

Chile

They always talk about one group being the Group of Death. I’m not sure if there is one this time. In 2006, our group was considered by some (though not all) to be the GOD. We were up against Italy, the Czechs and Ghana. We tied Italy and lost the other two.

The U.S. will play England on June 12. We play Slovenia on June 18 and Algeria on June 23. -

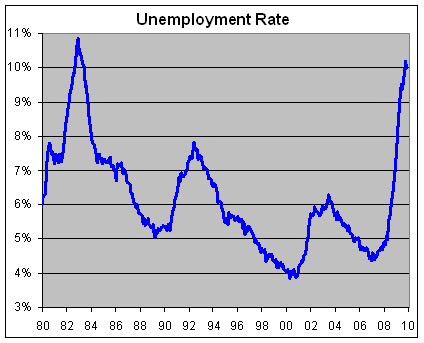

Finally! Not Completely Awful News for Jobs

Eddy Elfenbein, December 4th, 2009 at 10:07 amThe unemployment rate dropped to 10% in November from 10.2% in October. To be very precise, the unemployment rate fell to 9.992%.

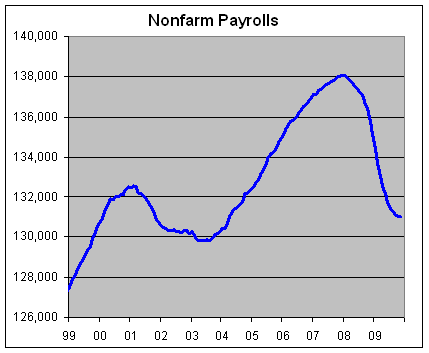

That’s good news but the economy is still losing jobs—only 11,000 jobs were lost last month. That’s a dramatic improvement over the data we’ve seen during the past two years. The Labor Department also revised the data higher for September and October.

Here’s a look at the unemployment rate:

Here’s a look at non-farm payrolls:

In less than two years, seven million jobs have been lost. -

Quote of the Day

Eddy Elfenbein, December 4th, 2009 at 9:48 amFrom Larry Ribstein: “For awhile I carried on an experiment of analyzing closely a mainstream media business commentator to see just how bad it is. The commentator is Gretchen Morgenson, and my findings, as set forth in this archive: very bad.”

-

Tim Sykes Rant

Eddy Elfenbein, December 3rd, 2009 at 2:27 pmI’m glad to see Tim Sykes come out of his shell to tell us what he really thinks.

-

Sign Up Today!

Eddy Elfenbein, December 2nd, 2009 at 3:28 pmSign up for the Wilmott-Taleb “Robust Risk Management” course in London just £1,999 (or £1,499 if you’re early). Sign Up Today!

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His