Archive for April, 2010

-

The Absolute Worst Stock to Buy Right Now

Eddy Elfenbein, April 20th, 2010 at 12:50 pm

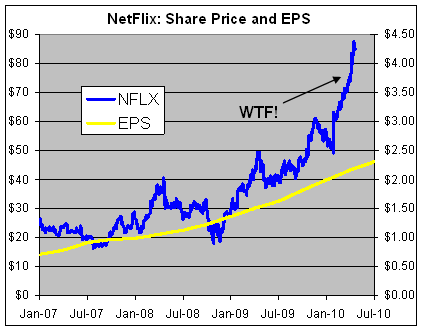

Lots of folks on Wall Street want to know which stock to buy. Today, I want to look at the absolute worst one to buy. My friends, that stock is Netflix (NFLX).

Now before anyone says that I’m being mean to the company, please bear in mind that I’m not offering a judgment on the managers or the employees. There’s a very big difference between a good company and a good stock. Netflix has a business record that anyone should be proud of. The stock, however, is terribly, terribly overpriced.

Let’s look at some numbers. Last year, Netflix made $115.9 million of sales of $1.67 billion. That works out to earnings of $1.98 a share. The stock, however, is currently around $86 or 43 times trailing earnings. The shares were overpriced at the start of the year and they’re up another 55% since then.

When the fourth-quarter earnings came out in January, Netflix said that it expects full-year earnings-per-share for 2010 to range between $2.28 and $2.50. So even going by the top end of forward earnings, NFLX is still trading with a P/E ratio of around 35 which is more than twice the S&P 500. That’s just crazy.

Netflix also said that it expects revenues between $2.05 and $2.11 billion. That’s a growth rate of 23% to 26% which is slightly better than last year’s 22%. The problem with the valuation is that a lot of NFLX’s earnings growth has come from profit-margin expansion. That’s a very good thing to have, but I’m skeptical of how much more that can improve without the company exposing itself to potential rivals like Redbox. On top of that, business could be hurt by higher postal rates and the elimination of Saturday delivery. Also, companies like Walmart (WMT), Amazon (AMZN) and Best Buy (BBY) loom in the background.

Netflix’s net margins improved from 5.6% in 2007 to 6.1% in 2008 to 6.9% last year. Earnings are coming out tomorrow and it could be bad news. I have little doubt that the company will top the Street’s expectations of 54 cents pet share. In January, Netflix said to expect Q1 earnings between 47 and 58 cents per share. With the stock so high, NFLX has zero room for error. The stock is simply far too high to expect a reasonable return.

If you own Netflix, you ought to sell it as soon as possible. The next 12 months won’t be pretty.

The chart above has NFLX’s stock in the blue line which follows the left scale. The right scale has the EPS line which is in yellow. The two lines are scaled at 20-to-1 which means when the lines cross, the P/E Ratio is exactly 20. -

Remembrance of Stocks Past

Eddy Elfenbein, April 20th, 2010 at 12:16 pmAt the end of last year, I decided to remove Amphenol (APH) from our Buy List. The stock had a great run in 2009 as it gained 91%. Even though I still like the company, which makes electronic and fiber optic connectors, I thought the stock needed to rest.

It looks like I was right. Through yesterday’s close Amphenol was down 5% for the year. I’m happy to see that the stock is up nicely today on news of very strong earnings.The company earned $98.4 million, or 56 cents per share, up 32 percent from $74.4 million, or 43 cents per share, in the same period a year earlier.

Excluding a tax-related gain, it earned 55 cents per share in the latest quarter.

Revenue rose 17 percent to $771 million from $660 million. Currency translation boosted sales by about 2 percent, or $15 million.

Analysts, on average, were expecting a profit of 51 cents per share on revenue of $749.2 million, according to a poll by Thomson Reuters.If business continues to improve the stock is reasonably priced, I’d love to welcome APH back to the Buy List.

Another former Buy List stock, Harley Davidson (HOG), is having a good day. The stock was a member of the Buy List in 2006, 2007 and 2008. HOG did well in 2006, but after that, it was an awful pick for us. I let it go last year and, wouldn’t you know, the shares sprung to life so my timing with HOG isn’t so good.

Today’s news is that profits plunged…but beat expectations!!Harley-Davidson Inc. said Tuesday its first-quarter profit fell 72 percent as sales of its high-end bikes remained sluggish.

Harley-Davidson CEO Keith Wandell said the uncertain economy is likely to make business conditions challenging throughout the year.

Still, the Milwaukee company’s results beat analysts’ forecasts, and investors were cheered by a return to profitability at its financial services unit. The stock gained $2.58, or 7.9 percent, to $35.35 in morning trading.

Harley-Davidson reported a profit of $33.3 million, or 14 cents per share, in the three months ended March 28. That’s down from $117.3 million, or 50 cents per share, during the same period last year.

Excluding losses from discontinued operations, the Milwaukee company made 29 cents per share. Revenue during the quarter fell 19 percent to $1.04 billion.

Analysts expected a profit of 22 cents per share on $1.02 billion in revenue. Such estimates typically exclude one-time items.HOG is now up more than four-fold from its March 2009 low. Before I’d add it to the Buy List, I’d like to see its profits growing again.

-

Midday Market Update

Eddy Elfenbein, April 20th, 2010 at 11:40 amVery solid gains this morning. The Buy List is up over 0.5% so far today. We’ve seen new 52-week highs from Sysco (SYY) and Fiserv (FISV). We’re still waiting on earnings reports from Stryker (SYK) and Gilead Sciences (GILD).

The S&P 500 has been as high as 1,205.65 today which isn’t very far from its pre-Fabulous Fabrice Tourre high of 1,213.92. -

Goldman Sachs Earns $3.46 Billion

Eddy Elfenbein, April 20th, 2010 at 10:34 amAnother day on Wall Street, and we’re still talking about Goldman Sachs (GS). To reiterate, I don’t think Goldman is a good buy right now.

Goldman is still doing what it does best—making ridiculous amounts of money. Earnings for the first quarter nearly doubled to $3.46 billion. That comes to $5.59 a share which creamed Wall Street’s estimate of $4.14 a share.

Goldman has always been a bit of a black box so the Street’s earnings estimates can be wildly off the mark. Still, this is a phenomenon ally wealthy firm. The firm’s conference call was dominated by questions about the SEC’s investigation.

I remain unimpressed by the SEC’s case against Goldman Sachs. This seems to be a very well-timed charge especially considering that financial reform has taken center stage in Washington. We also just learned that the SEC dragged its feet on the Allen Stanford case for over 10 years. Furthermore, the SEC vote on the Goldman charge was 3-to-2, so even folks in the government see how thin this case is.

Bloomberg says that the Goldman case may come down to what the meaning of the word “selected” is.The Securities and Exchange Commission must prove that the most profitable company in Wall Street history defrauded investors by failing to disclose that a hedge-fund firm betting against them played a role in creating what they bought. It must also counter Goldman Sachs’s assertion that an independent asset manager, which the SEC said rejected more than half of the securities initially proposed by Paulson & Co. for a collateralized debt obligation, signed off on the selections.

“The question is whether Paulson’s undisclosed role in portfolio selection was material,” said Larry Ribstein, a law professor at the University of Illinois in Champaign who has written about 140 articles and 10 books on topics including securities law and professional ethics. “There’s no clear and well-defined definition of what you have to disclose in this type of transaction.”So the 90s was about the definition of “is” and this decade is about the definition of “selected.” Not sure if we’ve improved.

-

Johnson & Johnson Earns $1.29 a Share

Eddy Elfenbein, April 20th, 2010 at 9:58 amGood news and bad news this morning from Johnson & Johnson (JNJ), one of our Buy List stocks. The good news is that the company reported Q1 earnings of $1.29 per share which beat Wall Street’s estimate by two cents a share. Woo hoo! Revenues rose by 4% to $15.63 billion which was a teeny bit better than expectations.

The bad news is that the company pared back its full-year EPS guidance due to foreign exchange rates. JNJ’s initial full-year guidance was a range of $4.85 to $4.95. They’ve pulled each end down a nickel to a new range of $4.80 to $4.90.

Truthfully, the bad news isn’t very bad. I’m never terribly worried about things outside a company’s control like foreign exchange. If they had experienced an issue related to their operations, that would have been one thing. Foreign exchange is one of those things you simply have to deal with. Sometimes it helps you, sometime it doesn’t. It’s a bit like playing against the wind in football.

The lowered guidance also includes the impact of Obamacare which JNJ pegs at 10 cents per share and a revenues loss of $400 million. Overall, JNJ is still trading at less than 14 times this year’s estimate which is less than the broader market. JNJ remains an excellent buy. -

Roubini Vs. the Market

Eddy Elfenbein, April 19th, 2010 at 3:45 pmEkonomi Turk has a clever post showing the gain in the S&P 500 is aligned with the decline in Google searches for “Dr. Doom” Professor Nouriel Roubini. Click here to see the chart.

When you look at the graph, you will notice the negative correlation especially after Summer of 2007. The graph covers Aug 2006- Apr 2010 period. The last time Roubini’s popularity increased tremendously was March 2009. Since then Roubini’s popularity has been declining and the stock market has been increasing. I also ran a regression test and found that 1 unit increase in Roubini’s popularity is associated with a 114 point decline in S&P 500 index. His popularity was 5.5 in March 2009 and it is 1 now, so this implies that S&P 500 index should increase by about 114*4.5= 513 points since March 2009. Considering that S&P 500 was around 680 when Roubini’s popularity peaked the last time, our regression tells us that S&P 500 index should be around 1200 today.

-

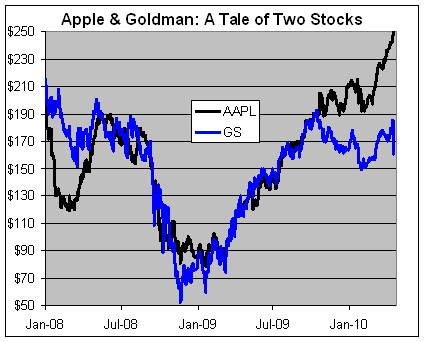

Apple and Goldman — Together No More

Eddy Elfenbein, April 19th, 2010 at 11:16 amFor about 18 months, the share prices of Apple (AAPL) and Goldman Sachs (GS) followed each other pretty closely (though Apple has many more shares outstanding).

As recently as six months ago, both stocks had the same share price. Today, however, Apple’s stock is worth $85 more than Goldman. -

Is Goldman a Good Buy?

Eddy Elfenbein, April 19th, 2010 at 10:34 am

In Tom Wolfe’s The Bonfire of the Vanities, the D.A. was known as Captain Ahab for his tireless search for the Great White Defendant. I can’t help but this of this when looking at the SEC’s case against Goldman Sachs (GS). This is a very convenient target coming at a very convenient time.

If the facts we have are correct, then Goldman should clearly be found guilty before a moral court. However, the actual legal case the SEC has seems shockingly thin. Even after several months, the case will turn on the materiality of John Paulson’s role in forming the Abacus portfolio. Furthermore, Mr. Tourre isn’t merely a small fry—he’s a micro-guppy.

The Wall Street Journal opines:After 18 months of investigation, the best the government can come up with is an allegation that Goldman misled some of the world’s most sophisticated investors about a single 2007 “synthetic” collateralized debt obligation (CDO)? Far from being the smoking gun of the financial crisis, this case looks more like a water pistol.

My guess is that Goldman will end up writing a big check to make all this go away, say, about $200 million which would be around 40 cents a share for a company with a book value of $117. The damage to their reputation won’t be so easy to take care of.

Let’s look at some numbers: Goldman is probably on track to earn about $10 billion this year, give or take, which works out to around $18 a share (in their Annus mirabilis of 2007, they made close to $25 a share). Owning Goldman is almost like owning your own ATM—the cash just flies out anytime you want.

Using some mathematicification we can see that Goldman is going for around nine times earnings, and 1.4 times book value. Is that good buy? The stock is probably cheap but it’s definitely not a good buy. Looks can be deceiving. Sure, the SEC’s case may fall apart and Goldman will zoom back to $200 a share, but there are too many uncertainties to judge if that will happen. One of the most important keys to investing is to avoid any unnecessary risks. I don’t know what the SEC has up its sleeves. The agency is clearly under political pressure and they’ll do whatever they have to validate their existence. Buying Goldman now is a bet I’m not willing to take.

Being a bank is all about trust. Ultimately, that’s the product you offer your clients. The specifics of the SEC’s case are surprisingly sloppy, but the picture is very stark. Goldman was not fully honest with their clients. This will probably lead to a string or more lawsuits. Until the dust clears, there are many better buys elsewhere. -

Lilly Beats the Street

Eddy Elfenbein, April 19th, 2010 at 9:42 amThe earnings parade continues this week. The good news this morning is that one of our Buy List stocks, Eli Lilly (LLY) reported earnings of $1.18 a share which beat the Street by eight cents a share. Revenues rose by 9% to $5.49 billion.

Earlier the company said it was expect full-year EPS of $4.65 to $4.85. I always like it when companies give full-year forecasts. Today, Lilly pared that forecast back to $4.40 o $4.55 due to Medicaid-related rebates.

Here’s the CFO discussing the quarterly result. Interestingly, he notes that the company is increasing its guidance after you discount the charge:

This was another very good quarter by Lilly but I’d like to see more guidance on their pipeline.

We have a few more earnings reports coming out this week. Tomorrow will be an especially big day as Gilead Sciences (GILD), Johnson & Johnson (JNJ) and Stryker (SYK) are due to report. Then on Thursday, Baxter International (BAX) and Reynolds American (RAI) will report. -

Quote of the Day

Eddy Elfenbein, April 18th, 2010 at 11:08 pmThe following is an excerpt from John Keegan’s book The First World War describing the second day of the Battle of Artois:

In early afternoon they moved forward in ten columns ‘each [of] about a thousand men, all advancing as if carrying out a parade-ground drill.’ The German defenders were astounded by the sight of an ‘entire front covered with the [British] infantry.’ They stood up, some even on the parapet of the trench, and fired triumphantly into the mass of men advancing across the open grassland. The machine gunners had opened fire at 1,500 yards range. ‘Never had machine guns had such straightforward work to do … with barrels becoming hot and swimming in oil, they traversed to and fro along the [British] ranks; one machine gun alone fired 12,500 rounds that afternoon. The effect was devastating. The [British] could be seen falling literally in hundreds, but they continued their march in good order and without interruption’ until they reached the unbroken wire of the German’s second position: ‘Confronted by this impenetrable obstacle the survivors turned and began to retire.’

The survivors were a bare majority of those who had come forward. Of the 15,000 infantry of the 21st and 24th Divisions, over 8,000 had been killed or wounded. Their German enemies, nauseated by the spectacle of the ‘corpse field of Loos,’ held their fire as the British turned in retreat, ‘so great was the feeling of compassion and mercy after such a victory.’

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His