Archive for May, 2010

-

Zeroing In on the Bond Market

Eddy Elfenbein, May 25th, 2010 at 2:25 pm

Bloomberg wins the award for cheekiest headline: “Strippers Declare Inflation Dead as Dealers Revive Zero-Coupon Treasuries.” The article is, of course, about stripped zero-coupon bonds (though I’m sure exotic dancers are probably privy to much inside Wall Street info).

Strips are zero-coupon Treasury bonds. So instead of getting semi-annual dividend checks, you get all your money back once the bond matures. The hitch is that zeros can be very volatile—in fact, as volatile as stocks. The longer term the bond, the more volatile it can be.

Of course, if you plan on holding the zeros to maturity, there’s no risk at all. It’s just like a T-bill. One method of investing that zero-buyers use is laddering their purchases. They work their portfolio so bonds come done each year, so there’s a continuous stream of cash.

If you time zeros right, you can make a lot of money (that’s a big if though). The Bloomberg article notes that with inflation so low, investors are crowding into zeros. The 30-year zero is up close to 17% this year. What can I say, that’s pretty darn good. Zeros typically have a higher yield-to-maturity compared to similarly dated coupon bonds. Think of zeros as like regular Treasuries but they have their own automatic dividend reinvestment program. Although they’ve done well this year, I would steer clear of all Treasuries of all maturities, TIP or not, coupon or not.

One more thing…and this is for all you math nerds. If you want to know what should be the difference between the coupon yield of a bond and its zero-coupon equivalent, then you get to be super geeky and whip out Euler’s Number (the mathematical constant e which I’m rounding off 2.718).

For example, a 5% coupon bond is e^.05, then subtract 1, which is about 5.127% for the zero.

This comes from the compound-interest problem that was solved by mathematician Jacob Bernoulli (the guy pictured above). I’ll turn it over to Wikipedia:The compound-interest problem

Jacob Bernoulli discovered this constant by studying a question about compound interest.

One example is an account that starts with $1.00 and pays 100% interest per year. If the interest is credited once, at the end of the year, the value is $2.00; but if the interest is computed and added twice in the year, the $1 is multiplied by 1.5 twice, yielding $1.00×1.5² = $2.25. Compounding quarterly yields $1.00×1.254 = $2.4414…, and compounding monthly yields $1.00×(1.0833…)12 = $2.613035….

Bernoulli noticed that this sequence approaches a limit (the force of interest) for more and smaller compounding intervals. Compounding weekly yields $2.692597…, while compounding daily yields $2.714567…, just two cents more. Using n as the number of compounding intervals, with interest of 100%/n in each interval, the limit for large n is the number that came to be known as e; with continuous compounding, the account value will reach $2.7182818…. More generally, an account that starts at $1, and yields (1+R) dollars at simple interest, will yield eR dollars with continuous compounding. -

Maybe the Worst Is Over…For Today

Eddy Elfenbein, May 25th, 2010 at 10:59 amThe worst of the selling seems to have passed this morning. The S&P 500 reached a low of 1040.78. So far, the Buy List is holding up much better than the rest of the market although that’s not saying much today. We’re basically going through the Flash Crash again but not nearly as fast.

Nicholas Financial (NICK) is up slightly. I thought Medtronic (MDT) would be doing better, but it’s still early.

The good news today is that the consumer confidence report showed more optimism from Americans.The Conference Board, based in New York, said Tuesday that its Consumer Confidence Index rose to 63.3, up from a revised 57.7 reading in April. Economists surveyed by Thomson Reuters had expected 59.

The increase was boosted by consumers’ outlook over the next six months, one component of the index, which soared to 85.3 from 77.4, the highest seen since it reached 89.2 in August 2007, before the economy entered in a recession.

The other component of the index, which measures how shoppers feel now about the economy, rose to 30.2 from 28.2.The problem, of course, is that these are Americans, not Europeans.

-

So Long Dow 10,000

Eddy Elfenbein, May 25th, 2010 at 9:20 amThe pre-market activity is signaling another down day for the markets. The Dow looks to fall below 10,000 (yet again).

The troubles are once again coming from Europe. The euro is below $1.22 and it’s close to the low it reached last week.

The market’s activity is similar to what happened in 2008. I’m not saying this is a repeat or it’s on the same scale, but we’re seeing the similar moves. For example, investors are filing out of gold, oil and stocks and into U.S. Treasuries.

In the Treasury market, the five-year yield is down to a puny 1.91%. That’s just absurd! Who really wants to lock-in 1.91% over the next five years? I guess someone does because that’s where it is but it’s less than 10% for the entire time. The ten-year yield is just 3.10%.

The good news today came from Medtronic (MDT), one of our trusty Buy List stocks. The company earned 89 cents per share which beat Wall Street’s estimate by a penny a share. Medtronic’s revenue jumped to $4.2 billion from $3.13 billion a year ago. This just barely topped Wall Street’s forecast of $4.19 billion.

This earnings report was for Medtronic’s fourth quarter. Their fiscal year ends on April 30. For the current fiscal year, the company forecasts earnings growth between 10% and 13%. Excluding charges, that means the company is looking for EPS between $3.54 and $3.64. At $40 a share, the stock is a bargain although it may be even more of a bargain later today. -

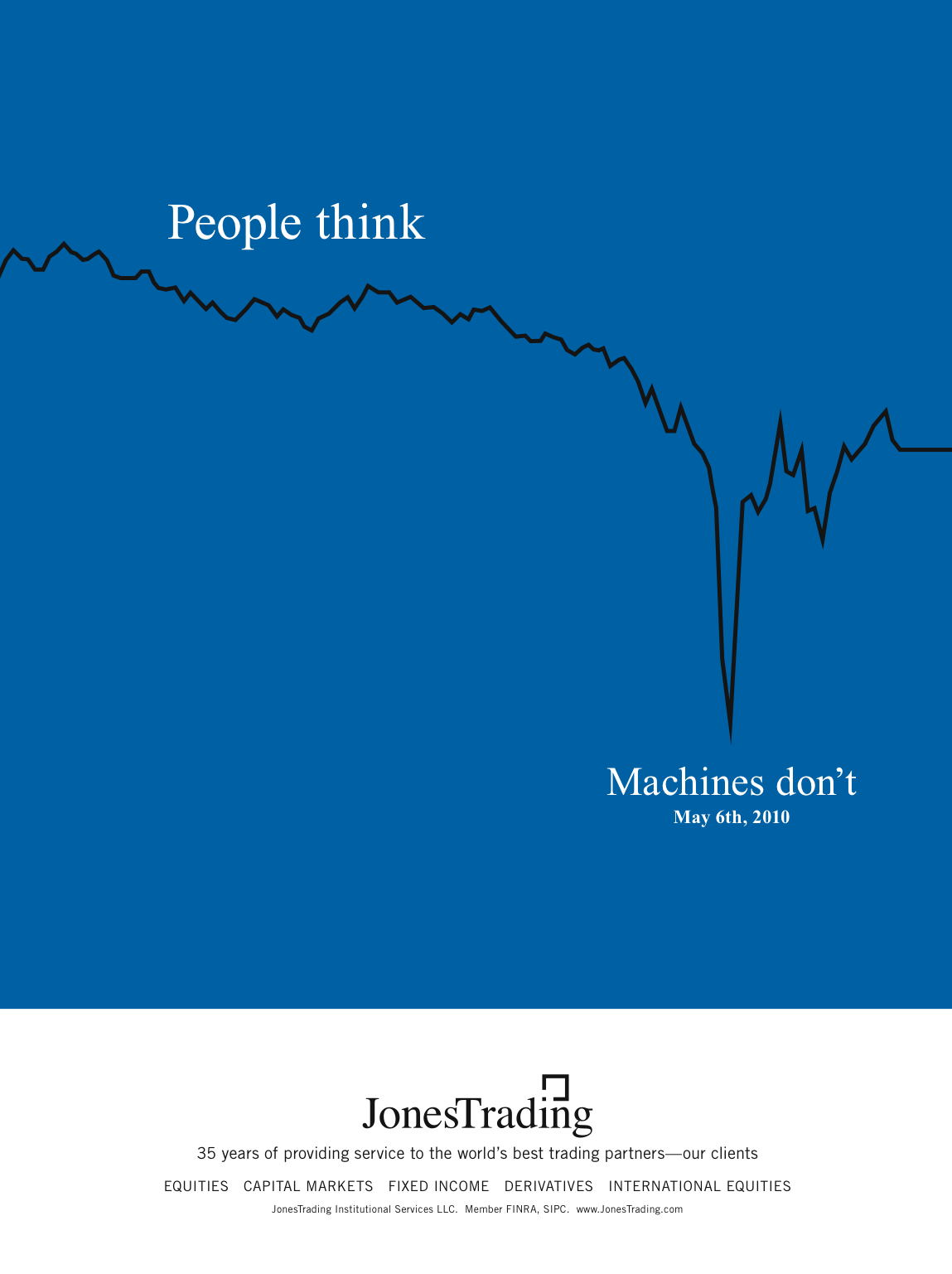

People Think, Machines Don’t

Eddy Elfenbein, May 25th, 2010 at 8:31 amHere’s a provocative ad:

Of course, on many days I wonder if “thinking” is an advantage or a disadvantage. -

Forecasters Turn Bullish on the Economy

Eddy Elfenbein, May 24th, 2010 at 9:57 amThere’s a new story this morning saying that the National Association for Business Economics is more optimistic on the economy.

The panel of forecasters boosted its expectations for growth in 2010 to 3.2 percent real gross domestic product, up from 3.1 percent in its February outlook. It also pegged the 2011 growth rate at 3.2 percent.

Household spending, while still lagging the overall economy, is still expected to grow significantly this year. The forecasters attribute part of that to consumers being less thrifty, with the saving rate for 2010 seen dropping to 3.4 percent from the 4.6 percent they predicted just three months ago.

Business investment also is expected to fuel the recovery. The economists expect higher operating rates and rising corporate profits boosting companies’ spending on equipment and software, while retailers restock inventory.That may sound good, but if the forecast is correct it means the jobs market still has a long way to go. For the unemployment rate to start dropping in a serious way, the economy will have to grow faster than 3% for several quarters. In fact, it would be much better if it grew by 4% to 5%.

The only silver lining is that these forecasts have a notoriously poor track record. -

S&P 500: 123 Dividend Increases to Just Two Decreases

Eddy Elfenbein, May 20th, 2010 at 3:30 pmAt the end of last year, I was asked to participate in Bespoke’s Roundtable Q&A. This was one of the questions:

What do you believe will be the dominant investing themes of 2010? What will be the biggest surprises of 2010?

Not a major theme, but I expect a new-found love for dividends. A company like GE could easily raise its dividend by 50%. I doubt many money managers will beat the SDY in 2010.Standard & Poor’s analyst Howard Silverblatt said that, in total, there have been 123 increases this year for S&P 500 companies, and just two decreases, compared with last year’s dismal environment when there were 79 increases and 63 decreases. Total dividend payments have grown by more than $9.2 billion this year, compared with a $37 billion drop last year.

“We are seeing a lot of increases,” Silverblatt said. The moves include “a lot of companies that normally increase and those that increase every couple of years, which is a good sign,” he noted.

But Silverblatt also said there are many companies that are still hesitant, in the face of economic uncertainty, to part with precious cash. European concerns have plagued the stock market in recent weeks and were managing to keep every one of the companies that raised their payouts in the past two days in the red on Thursday, likely making some wary.

And the tax rates on dividends are scheduled to climb sharply starting in 2011, making share buybacks or other alternative cash uses more attractive for some companies.

“They are waiting for actual, in-my-pocket, decent orders of my widgets,” Silverblatt said, “as opposed to just reading how great everything is in the newspaper.” -

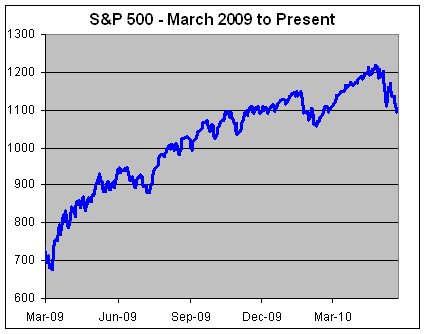

A Little Perspective

Eddy Elfenbein, May 20th, 2010 at 2:57 pmYou know how the markets are crashing today? Well, let’s take a small step back:

-

Sector Groups This Afternoon

Eddy Elfenbein, May 20th, 2010 at 2:23 pmHere’s how the different industry group ETFs are performing as of this afternoon:

Healthcare -2.33%

Staples -2.34%

Utilities -2.35%

Technology -2.68%

Discretionaires -3.21%

Financials -3.48%

Materials -3.57%

Industrials -3.76%

Energy -3.92%

Notice how closely bunched the three major defensive groups are (utes, healthcare and staples). Also, the bottom three are the major cyclical groups (materials, industrials and energy). -

Attention Income Investors

Eddy Elfenbein, May 20th, 2010 at 2:21 pmReynolds American (RAI) now yield 6.9%. I know Europeans like to smoke, but sheesh! Remember this is a company that recently beat expectations. There’s no value trap here.

-

The VIX Spikes Over 42

Eddy Elfenbein, May 20th, 2010 at 10:30 amThe Volatility Index (^VIX) is currently over 42 which is close to where it was two weeks ago during the Flash Crash. Two items are coming tomorrow. One is that it’s options expiration. The other is that the Germans are due to vote on the EU bailout. The good news is that the Buy List is holding up much better than the rest of the market.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His