Looking at the May Swoon

The stock market just finished its worst May since 1940. As it turns out, watching France fall to the Nazis isn’t good for stocks here. Also, watching the euro fall to reality is pretty nasty as well.

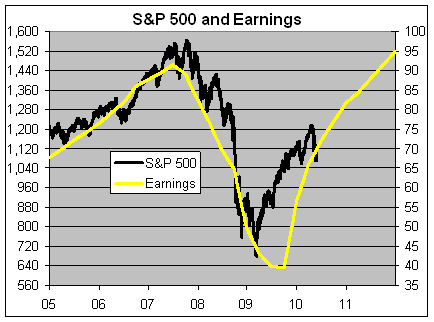

Let’s take a closer look at where the market stands today. Here’s the S&P 500 (black line, left scale) along with its earnings (gold line, right scale).

I’ve scaled the two lines at a ratio of 16 to 1 so whenever the lines cross, the market’s P/E Ratio is exactly 16.

Let me add that looking at the market’s P/E Ratio is far from perfect (the future earnings line is, of course, merely forecast), but nevertheless we can gain some insights as to what investors are thinking at the moment.

Two items stand out. The first is that the S&P 500 has fallen below a P/E Ratio of 16 which has generally been its lower bound over the past few years. The second is that the earnings forecast is still very favorable. If stocks keep pace with valuations, then the S&P 500 could easily be over 1400 within 18 months.

This is where the problems come in. It appears that investors are beginning to question the robustness of the recovery. Given the amount of aid needed, that’s certainly understandable. So if the earnings forecast turns out to be overly optimistic, then the whole bullish scenario falls apart.

My feeling is that the bearish cause has been pushed a bit too. Consider that many companies are still maintaining decent guidance. Even the bad guidance isn’t that bad. On Friday, shares of J.C. Penney (JCP) got knocked due to “poor guidance.” I’d agree that JCP is a weak buy right now, but they merely said to expect full-year EPS of $1.64 which was one penny below the Street.

I used JCP as one example, but if the future yellow line is off, then we’re going to have to see much more lower guidance announcements. That simply hasn’t come yet.

This week, we’ll get some news on our Buy List stock, Jos. A Bank Clothiers (JOSB). This company hasn’t missed an earnings forecast in four years. They haven’t given guidance for this year but they have said that they plan to open 30 to 40 new stores. Wall Street expects 71 cents per share which is a nice increase over the 62 cents per share from a year ago. My numbers say it will be close to 75 cents a share.

JOSB is a solid buy. We’ll know more on Thursday (correction: Tuesday) when the earnings report comes out.

Posted by Eddy Elfenbein on June 1st, 2010 at 10:26 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His