Archive for June, 2010

-

Update on Momentum Stocks

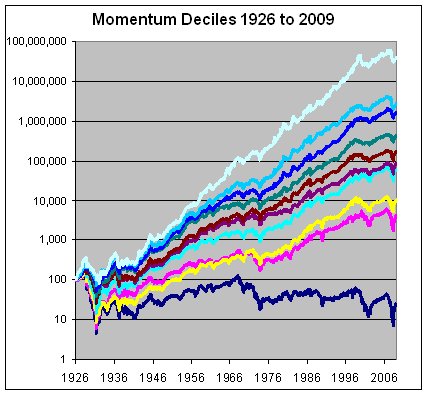

Eddy Elfenbein, June 22nd, 2010 at 2:59 pmHere’s an update to the chart of the historical performance of momentum stocks. This is one of the most fascinating phenomena in finance. Stocks that have done well, on average, continue to do well.

The chart shows the historical performance of stocks ranked by momentum decline (meaning 10% slices).

The deciles are perfectly rank ordered. The stocks that had been doing the best, do the best. The stocks that had been doing the worst, fare the worst.

The data comes from Dr. Ken French’s website. Just to be clear, momentum is defined by performance over the 11-month period starting 12 months ago and ending one month ago. The one-month directly prior to each period is excluded. At the end of the month, the whole thing is repeated. The data series goes back over 80 years.

Here’s how each decile has performed:

Decile 1: 16.79%

Decile 2: 13.11%

Decile 3: 12.42%

Decile 4: 10.63%

Decile 5: 9.42%

Decile 6: 8.47%

Decile 7: 8.05%

Decile 8: 5.73%

Decile 9: 4.54%

Decile 10: -1.73% -

The Yuan Rally Fades Away

Eddy Elfenbein, June 22nd, 2010 at 1:37 pmYesterday’s yuan rally totally collapsed and we’re not advancing much at all today. The market is becoming similar to a World Cup match—little scoring and lots of buzzing in the background.

The Buy List is finally having a good day today. I said before that I was wary of Bed Bath & Beyond (BBBY), but I didn’t expect such a pullback in that stock. I’ll be very curious to hear what they have to say about Q2 when Q1 earnings come out tomorrow.

The most notable move today is that energy stocks aren’t doing well. This is good four our Buy List’s relative performance since we’re underweighted in energy.

I’m also surprised by the rally in the five-year Treasury. The yield has dropped from 2.3% yesterday to 2% today. That’s a big move. What’s interesting is that the five-year T-note has tried repeatedly to break below 2% and it just can’t stick. It bounced off 2% last December and has had a longer battle with 2% ever since late April. If I knew more about technical analysis, I might call it “resistance.” -

Dow 1,000

Eddy Elfenbein, June 21st, 2010 at 12:35 pmPeter Brimelow finds this gem in a recent Elliot Wave Theorist:

The only way for the developing configuration to satisfy a perfect set of Fibonacci time relationships is for the stock market to fall over the next six years and bottom in 2016.

Got that. To be more specific, they see the Dow plunging below 1,000 as a very realistic scenario.

I’m curious about the off-chance that we don’t satisfy a perfect set of Fibonacci time relationships. Hey, stranger things have happened. -

Bed Bath & Beyond’s Earnings Report

Eddy Elfenbein, June 21st, 2010 at 10:47 amThis Wednesday, Bed Bath & Beyond (BBBY) is due to report its first-quarter earnings. This will be for the quarter that ended with the month of May.

I’m a little anxious about this report. Up until last Wednesday, the stock had had a pretty good run. During the financial crisis, the shares got to as low as $16 in November 2008. They hit a peak of $48 earlier this year.

The company is doing very well and BBBY has creamed earnings for the last few quarters, particularly the last five. But at this price, I can’t say that the stock is a screaming bargain. It’s a very good stock at a fair price, not a great price.

The current consensus on Wall Street is that BBBY will earn 48 cents a share for Q1. That’s probably low but not by much. In April, the company gave a range of 44 to 48 cents per share. That’s a lowball. My expectation is that BBBY will earn 52 to 54 cents a share. I’m curious what they’ll say for Q2 expectations. -

What’s the Best Stock of the Last 5 Years?

Eddy Elfenbein, June 21st, 2010 at 10:35 amIt’s up more than 10-fold.

I’ll give you a hint: Shatner is involved. -

The Cold War Is Officially Over

Eddy Elfenbein, June 21st, 2010 at 9:40 amRussia to drop capital gains tax to attract investment

Russia will scrap capital gains tax on long-term direct investment from 2011, President Dmitry Medvedev has said.

Mr Medvedev said that in terms of improving Russia’s investment climate “we, I hope, are moving forward”.

He also said the number of “strategic” firms, in which foreign investment is restricted and which cannot be privatised, would fall from 280 to 41. -

The Onion: White House Jester Beheaded For Making Fun Of Soaring National Debt

Eddy Elfenbein, June 21st, 2010 at 9:33 amThe rest of the media missed this one:

WASHINGTON—After serving 12 years in the position, Motley, the official White House Jester, was beheaded Tuesday after delivering a poorly received jape about the spiraling national debt before President and Mrs. Obama.

“For crimes of great arrogance and cheek, His Idiocy the White House Jester has been sentenced to a swift demise,” White House Press Secretary Robert Gibbs said following the death sentence. “Let it be heard over every city and suburb of this land that the National Debt is no topic for frivolity, and the mailed hand of Obama shall smite all offenders.”

Motley, who used his last words to beg in vain for Obama’s mercy, was executed on the North Lawn at the strike of noon. -

JoS. A. Bank Clothiers Declares 50% Stock Dividend

Eddy Elfenbein, June 21st, 2010 at 9:19 amJoe Banks (JOSB) announced today a 50% stock dividend. In other words, that’s a three-for-stock stock split. If you own 200 shares, you’ll get another 100 and you can expect the share price to drop by 33% (yes, a 50% increase followed by a 33% drop brings you back to where you started).

Ultimately, a stock split doesn’t mean anything to shareholder value. Companies say that do it to increase liquidity but that didn’t hold back Berkshire Hathaway (BRKA) for many years. In reality, these are nice press releases companies like to put out throughout the year. And JOSB has done well. -

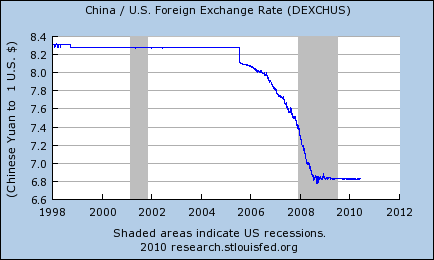

Market Looks to Rally on Yuan News

Eddy Elfenbein, June 21st, 2010 at 9:14 amGood news this morning. The market will most likely get a lift today thanks to China agreeing to let the yuan rise against the dollar. I know currency news is as dull as dirt, but this time it matters. The Chinese currency is now at its highest level in two years and it had its biggest one-day gain in five years.

Let me explain: China keeps a very tight leash on the yuan. Even though this was the biggest move since 2005, the rally was a lousy 0.42%. The Chicoms keep the yuan artificially low and that doesn’t sit well with the rest of the world, including me. One dollar will get you 6.7976 yuan. My take is that this was a just a nice gesture from China ahead of the next G-20 meeting.

The good news for us is that Asian markets like the news a lot. Not surprisingly, the major airline stocks inside China some very good gains. The downside is that oil rose. This makes sense since investors think it will spur greater demand from China.

Reuters lists some of the winners and losers from today’s move. The winners include automakers, consumers and tech, foreign heavy machinery makers, luxury firms and Chinese financials. The losers are foreign financials and commodity firms.

-

No Follow Through

Eddy Elfenbein, June 16th, 2010 at 9:11 amThe frustrating thing about this market is that there’s zero follow through. Every time we try to rally, we seem to give it all back the next day. For 13 of the last 17 sessions, the market has closed in the opposite direction from the day before.

From April 29 through June 1, the S&P 500 rose just eight times. The following day, every single time, the market closed lower. Since then, only two of the last five rallies have been followed by rallies and both were very modest (about 0.4%).

The S&P 500 hasn’t had a three-day win streak in two months. It looks like we’re going have a lower open. Again.

The only bright spot is over the last nine down days, seven have been followed by rallies.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His