Archive for June, 2010

-

The Economics of the World Cup

Eddy Elfenbein, June 8th, 2010 at 9:45 amGoldman Sachs has an interesting report on the economics of the World Cup.

Foreign Policy writes:UEFA’s (Union of European Football Associations) selection of the 2012 Euro Cup host proved prescient, as well. Picking in 2007, Poland won the rights to host the tournament (OK, co-host with Ukraine, but since then UEFA has suggested Poland be the sole host, which the Poles have graciously declined to accept). Poland, however, was the only bid country that hasn’t suffered economic decline since — and yes, Greece was the first bid country eliminated.

Other notable findings: the Growth Environment Scores (a Goldman-devised figure of sustainable economic growth and productivity) of respective countries loosely correlate to soccer performance, but a much stronger connection exists between the improvement of economic conditions and national soccer teams. (Algeria, which did not qualify for the 2006 finals in Germany, posted the highest GES improvement among developing countries over the last four years.) The report also argues that success is partially dependent on the number of males aged 18-34 in countries, and provides a UN chart with predictions for 2050. If the claim is accurate, the Nigerian Super Eagles are going to be really, really good in a few decades.

Lastly, Goldman offers their own predictions of the semi-finals (I won’t spoil, though I will say it’s what my predictions are as well), and lists the probability (with their metrics) that each country will become World Cup champions.

It’s lengthy, but an extremely interesting read, and provides the best rundown of the Cup to come that I’ve seen. Check it out. -

Bubbles Past, Present and Future

Eddy Elfenbein, June 7th, 2010 at 12:34 pmInvestment bubbles are often harder to spot than people think. Sure, in retrospect it looks easy. But at the time, events aren’t so obvious. In fact, after the fact can be difficult as well.

Let me show you what I mean. Consider Amazon.com (AMZN). The stock was a classic bubble when it rose from $1.50 (split-adjusted) in mid-1997 to over $100 by 1999. Naturally, the bubble burst and shares of Amazon fell all the way back to $6 shortly after 9/11.

So we all learned our lesson, right? But hold on, Amazon slowly recovered and traded as high as $150 just a few weeks ago (absurdly overvalued in my opinion, but that’s for another time). So even if you bought Amazon at its peak during the Internet craziness, you’d still have a modest profit today while many stock investors have had no profits at all. That is, if you held on to AMZN during some very unpleasant periods. The bubbleness is relative.

Yahoo (YHOO), by contrast, closed the first day of the new millennium at $118-3/4 (fractions, remember those). The stock closed Friday at $15 so YHOO is still off by more than 87%. So that’s a bubble, right. But I don’t think the bursting is quite done. Supposed Yahoo continues to fall, that would mean we’re in a bubble right now as well. But again, the future isn’t so obvious.

eBay (EBAY) is another problematic bubble. Back in the fun days, the stock rose from $2 to $25 in a little over six months. The bubble bust and the stock dropped to $7. Yet, by the end of 2004, eBay was closing in on $60. Again, if you had held on, you would have been in the black. The stock was back down to $10 last March.

So where’s the bubble? It depends where you stand. -

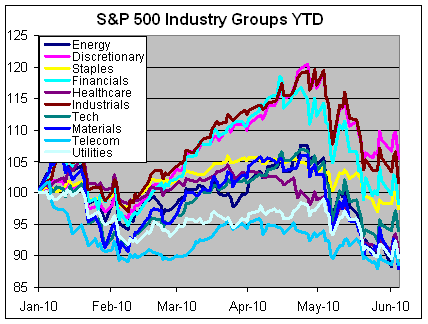

S&P 500 Industry Groups

Eddy Elfenbein, June 7th, 2010 at 10:21 amHere’s a look at how the different industry groups within the S&P 500 have performed this year:

What’s interesting is that the last stage of the bull market (February to April) was largely driven by three industry groups (industrials, financials and discretionaries). Those have also been the areas that are down the most since the market started heading south. Outside of those three, the market has been fairly stable.

Consumer staples are down just -7.9% from their 2010 high while financials are off by more than -17.1%. What’s interesting is that financials seems to have lost their downward momentum since May 20. From May 20 through June 4, financials are the third best-performing sector. Perhaps that’s a sign that the worst is over. Second-quarter earnings reports are only a month away. -

Walmart’s Awful $15 Billion Share Repurchase

Eddy Elfenbein, June 4th, 2010 at 10:40 amDo they do this just to annoy me?

At its 40th Annual Meeting of Shareholders today, Wal-Mart Stores, Inc. announced that its Board of Directors approved a new repurchase program that authorizes the company to repurchase $15 billion of its shares. This program replaces the previous $15 billion program, which was announced June 5, 2009 and had approximately $4.7 billion of remaining authorization. Under the program, repurchased shares are constructively retired and returned to unissued status.

“Share repurchase and dividends represent great ways to return value to our shareholders. In fact, in the first quarter of fiscal 2011, our $3 billion purchase representing 55.6 million shares, was a record for Walmart,” said Tom Schoewe, Wal-Mart Stores, Inc. executive vice president and chief financial officer. “During the past three years, our commitment to share repurchase was reflected in the company buying $18.5 billion of shares. In addition to share repurchase, Walmart will pay shareholders more than $4.5 billion in dividends during fiscal year 2011.”A great way to return value to shareholders is to return money to shareholders. Notice that a back buy announcement is in dollar figures not share figures because the share price will move, and not always in the way you want.

Walmart (WMT) has 3.76 billion shares outstanding so $15 billion is about $4 a share on a $51 stock. The stock is exactly where it was 11 years ago. This is another example where shareholders would have been much better off with dividends instead of stock repurchases. -

The Disappointing May Jobs Report

Eddy Elfenbein, June 4th, 2010 at 10:12 amToday’s unemployment was surprisingly weak. The jobless rate for May was 9.698%. That’s below the peak rate of 10.147% from last October but we’re slightly above where we were in January and February.

Here are some eye-opening stats: Over the last 10 years, the labor market has increased by 12 million yet the number of employed has risen by 2.8 million and the number of unemployed has grown by 9.2 million. It’s as if the unemployment is running at 77% for the number of new people added to the workforce. Not to mention the labor force participation rate has fallen from rough two-thirds to less than one-half.

Nonfarm payrolls rose by 431,000 but that was almost entirely due to government hiring of census workers.“The U.S. employment data was disappointing,” said Marc Chandler, global head of currency strategy at Brown Brothers Harriman, in a statement. Mr. Chandler noted that private-sector job creation, a crucial measure, reached only 41,000, compared with expectations for 180,000 and a three-month moving average of 155,600.

“The fact that the unemployment rate ticked down is not really good news,” he added, “as the decline in unemployment was not a function of more jobs but a reflection of people leaving the work force.”

The May figures suggest that the job market still has a long way to go. The economy has to add more than 100,000 jobs every month to absorb the new entrants to the market. And they are joining a labor pool that is already swollen with 15 million Americans looking for work.

More than eight million people have lost their jobs since the start of the recession in December 2007. -

A Falling Stock Isn’t Always a Cheaper Stock

Eddy Elfenbein, June 3rd, 2010 at 12:56 pmOne of the hard parts about investing is that good buys are often tarnished in some way. That’s why the market discounts the price. You have to be brave enough to overlook the bumps and bruises to find a gem (yep, I’m mixing metaphors—deal).The key for investors is judge whether the negatives are truly damaging to the business or merely a passing problem.

I’ve gotten some emails recently about BP (BP). If you’re not familiar with this story, the company has apparently had some public relation problems of late. Hey, these things happen. BP’s stock has dropped sharply from about $60 about six weeks ago to around $38 today.

So it’s a bargain, right?

Probably not. Just because the stock is down, doesn’t mean BP is a good buy. It only means that it’s cheaper than where it was, and that says little about where it will be. I think investors would be well-advised to steer clear of BP. The shares will hit bottom but I don’t think that’s come just yet. The difficulty is that even if this is a tremendous overreaction, the knowledge required to make that judgment is way outside my expertise. It’s not just me. It’s outside everyone’s expertise because BP’s future will probably be a heavily politicized one. -

Lockhart: Time to Start Thinking About Raising Rates

Eddy Elfenbein, June 3rd, 2010 at 9:54 amI’ve been saying that the Federal Reserve will probably raise interest rates before most people expect. Since last March, we’ve been in a Golden Period for stocks investors with very low interest rates and steeply low equity prices. Of course, equity prices are now no longer as low as they used to be. This may soon come to an end and today we got confirmation from Dennis Lockhart, the president of the Atlanta Fed.

The U.S. economy is almost strong enough to allow the Federal Reserve to begin thinking about raising interest rates, Atlanta Fed President Dennis Lockhart said on Thursday.

While he noted unemployment would likely remain elevated for some time, Lockhart said the U.S. central bank should not wait too long before beginning to tighten the reins.

“The time is approaching when it will be appropriate to consider recalibrating interest rate policy. I do not believe that time has yet arrived,” Lockhart told .

“As the economy continues to improve and financial markets find firmer ground, extraordinarily low policy rates will not be needed to promote recovery and will become inconsistent with maintaining price stability.”

In response to the most severe financial crisis in generations, the Fed not only slashed interest rates effectively to zero but also undertook a host of emergency measures such as buying up Treasury and mortgage bonds.

Lockhart’s comments mark a significant change in tone for the regional Fed president, who has been among the most dovish on the central bank’s policy in recent months. They suggest firmer growth in the United States is catching the attention of Fed policymakers, despite the renewed risks to the outlook from the turmoil surrounding European debt markets.The timing of a rate increase is still an issue. I think it could happen by the end of the summer. I also think the Fed may raise the Fed Funds rate by 50 or 75 basis points.

-

Bullet Bob Feller

Eddy Elfenbein, June 2nd, 2010 at 2:56 pm

At my town’s Memorial Day parade, I caught a glimpse of 91-year-old baseball great Bob Feller, the pride of Van Meter, Iowa. He was born eight days before Armistice Day.

Feller rocked the baseball world during the summer of 1936 when he debuted for the Cleveland Indians at the tender age of 17. He won his first start as he struck out 15 St. Louis Browns. Three weeks later, he struck out 17 Philadelphia Athletics (while walking nine).

Over his career, Feller pitched three no-hitters including the only one thrown on Opening Day. He also tied the record for throwing 12 one-hitters.

The day after Pearl Harbor, Feller joined the U.S. Navy. He was the first major leaguer to volunteer for combat service. Feller served on the USS Alabama.

After the war, he returned to baseball and struck out 348 batters in 1946. He probably would have broken a lot of records had it not been for the war. Feller also helped the Tribe win the 1948 World Series (they haven’t won one since). -

The Decline and Fall of Fannie Mae

Eddy Elfenbein, June 2nd, 2010 at 12:16 pmYesterday, shares of Fannie Mae (FNM) closed at 93 cents. That’s a gigantic fall from the stock’s high of $87.

Still, it’s important to remember how successful Fannie Mae had been in the years before its undoing. In 1981, you could have picked up a share of FNM for just 53 cents (adjusted for splits). So after nearly 30 years, you’d have a 75% profit not including dividends.

Maybe that’s a small consolation but it’s something to think about. -

Joe Bank Earns 85 Cents a Share

Eddy Elfenbein, June 2nd, 2010 at 9:47 amI was wrong about JoS. A. Bank Clothiers (JOSB). I was expecting the company to beat earnings by four cents per share. Instead, they beat by 14 cents per share. I’ll try to do better next time:

Clothing maker JoS. A. Bank Clothiers Inc. said Wednesday its fiscal first-quarter net income rose 38 percent as revenue improved.

Net income for the quarter ended May 2 rose to $15.8 million, or 85 cents per share, from $11.5 million, or 62 cents per share, last year.

Revenue rose 10 percent to $178.1 million from $161.9 million from last year.

Analysts polled by Thomson Reuters, on average, predicted a profit of 71 cents per share on revenue of $175.3 million.

Revenue in stores open at least one year, a key measure of a retailer’s financial health, rose 10.4 percent.

JoS. A. Bank operates 479 stores in 42 states and the District of Columbia.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His