Archive for July, 2010

-

What Really Moves the Markets

Eddy Elfenbein, July 27th, 2010 at 7:18 pm -

Fiserv Beats By Four Cents, Reaffirms Full-Year Guidance

Eddy Elfenbein, July 27th, 2010 at 5:22 pmThis is good news. Fiserv (FISV) made $1.00 a share last quarter. They see full-year earnings ranging between $3.96 and 4.07 per share.

-

Dividends Are In

Eddy Elfenbein, July 27th, 2010 at 5:09 pmSo far this year, 142 stocks in the S&P 500 have increased their dividends while just one stock has lowered it.

Last year at this time, 93 stocks had raised their dividends while 61 had lowered them.

Ten stocks have initiated dividends compared with just one at this time last year. -

AFLAC Beat By Two Cents

Eddy Elfenbein, July 27th, 2010 at 4:14 pmOperating earnings in the second quarter were $639 million, compared with $562 million in the second quarter of 2009. Operating earnings per diluted share rose 12.5% to $1.35 in the quarter, compared with $1.20 a year ago. The stronger yen/dollar exchange rate increased operating earnings per diluted share by $.02 during the second quarter. Excluding the impact from the stronger yen, operating earnings per share increased 10.8%.

And going forward:

“With half of the year complete, we believe we are in a very good position to meet our earnings objectives and extend our record of growth. Our objective for 2010 is to increase operating earnings per diluted share by 9% to 12%, excluding the impact of the yen. Within that range, we expect operating earnings to increase approximately 10% for the full year to $5.34 per diluted share before the impact of foreign currency. If the yen averages 90 to the dollar for the remainder of the year, we would expect full-year reported earnings to be about $5.44 per diluted share. Using that same exchange rate assumption, we expect third quarter operating earnings of $1.35 to $1.38 per diluted share. Our objective for 2011 of increasing operating earnings by 8% to 12% before the impact of foreign currency also remains unchanged.”

-

But Why?

Eddy Elfenbein, July 27th, 2010 at 2:51 pmLadies and gentleman, it is with deep regret that I inform you that Nassim Nicholas Taleb has blocked me from his Twitter feed.

Therefore, I will no longer be privy to insights such as:Giving businessreaders my book: like giving vintage Bordeaux to drinkers of Diet Coke and listening to their comments about it

-

Credit Cards — Robin Hood In Reverse

Eddy Elfenbein, July 27th, 2010 at 2:23 pmThe Federal Reserve Bank of Boston found that credit card fees and reward programs have the net effect of transferring wealth from the poor to the rich:

U.S. consumer finance data shows that people on a low income are less likely to have a credit card, and those who do, spend less a month on average, than higher earners. High-income consumers are also 20 percentage points more likely to receive credit card rewards — be they frequent flier miles, cash back or other enticements.

“What most consumers do not know is that their decision to pay by credit card involves merchant fees, retail price increases, a nontrivial transfer of income from cash to card payers, and consequently a transfer from low-income to high-income consumers,” Scott Schuh, Oz Shy and Joanna Stavins wrote.

They found that about 83 percent of banks’ revenue from credit card fees is obtained from cash payers “and disproportionately from low-income cash payers.”

After accounting for rewards paid by banks, households who earn more than $150,000 annually receive a subsidy of $756 on average every year, while the households earning $20,000 or less pay $23. -

Jersey Shore Rings the Opening Bell

Eddy Elfenbein, July 27th, 2010 at 1:57 pmVisit msnbc.com for breaking news, world news, and news about the economy

-

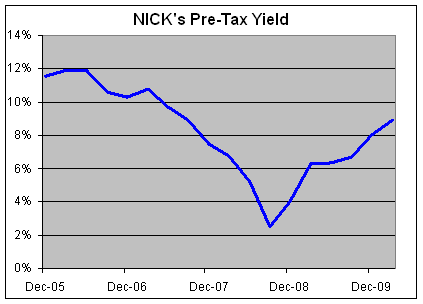

My Earnings Forecast for Nicholas Financial

Eddy Elfenbein, July 27th, 2010 at 12:03 pmOn Thursday morning Nicholas Financial (NICK) will release its fiscal first-quarter earnings. My view is that NICK will do pretty much what it’s been doing, only more so.

My ballpark estimates are as follows:

Receivables: $235 million to $240 million

Gross yield: 24% to 25%

Interest Expense: 3% to 4%

Provision for Credit Losses: 4%, maybe less

Pre-Tax Yield: 9%

None of these numbers is a surprise. For the bottom line, I think NICK should make 25 cents a share for the quarter. But a precise estimate really doesn’t matter much. Even if they earn, say 22 cents a share or 24 cents a share, it still confirms the reason why I like Nicholas.

Here’s how I see it: NICK’s earnings report only needs to confirm two things—one, that’s it’s a thriving business and two, that it’s in zero danger of financial distress. In my opinion, these two points are unarguably true. I’d also add that they’re pretty obvious to anyone who has looked at the company. NICK’s portfolio is clearly improving and the company is pulling in a decent amount of money. It’s almost like a 13% bond that’s selling for less than par.

Still, the stock market doesn’t seem to agree. NICK is still trading below its book value, and by my estimate, it’s going for about seven to eight times forward earnings. That’s not just, it’s almost absurdly cheap.

Bear in mind how panicked the market can be. Just 16 months ago, NICK got down to $1.80 a share. I expect NICK to earn about $1.10 a share for this calendar year (note that their fiscal year ends on March 31). So the stock was trading at a forward P/E Ratio of less than two.

I’m confident that NICK will deliver the goods. The major concern I have is how the market will react. On this subject, well…you just never know. I’d like to think the market can see the facts right in front of its face. We’ll know more on Thursday.

-

Wright Express Earns 68 Cents a Share

Eddy Elfenbein, July 27th, 2010 at 10:41 amThis morning, Wright Express (WXS) came out with a nice earnings report. The company earned 68 cents a share which was three cents more than estimates. For Q3, they see earnings between 65 cents and 70 cents per share. For all of 2010, Wright sees earnings-per-share ranging between $2.47 and $2.57.

That’s pretty good news. Three months ago, Wright said to expect Q2 EPS between 61 cents and 66 cents, and full-year between $2.39 and $2.54. The previous full-year range was $2.26 to $2.46. In other words, the high end of the old range is now below the low end of the current range.

There’s just one problem. The stock is taking a hit today. Currently, the shares are off by about 4.5%. I think a little pullback can be expected since WXS rallied over 22% in the previous three weeks. Wright Express is still an excellent stock. -

The Textbook Bubble?

Eddy Elfenbein, July 27th, 2010 at 10:26 amThe NYT hosts a fascinating debate on the market for textbooks. On July 1, a new set of federal rules come into effect in an effort to lower prices for textbooks. As an investor, I always take notice when the government enters a market because prices and profits can soon get very screwy.

By any standard, the market for textbooks is dysfunctional. James V. Kock writes:The textbook market is like the pharmaceutical market: the people who have the most influence over what is purchased (doctors and professors) don’t have to pay for their choices. Students do.

Further, several studies indicate that most professors don’t even know the cost of the textbooks they recommend, or that this is a minor factor in their choices. This makes the demand for textbooks “price inelastic” — student buyers are insensitive to price increases.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His