Archive for July, 2010

-

Full-Year Earnings Estimates

Eddy Elfenbein, July 26th, 2010 at 3:04 pmHere’s a look at Wall Street’s earnings estimates for the S&P 500 and its sectors from the end of the first quarter, the end of the second quarter and last week.

As you can see, the estimates for the S&P 500 have climbed higher.Sector 31-Mar-10 30-Jun-10 21-Jul-10 S&P 500 $78.05 $81.82 $82.15 Discretionary $15.21 $16.58 $16.59 Staples $19.43 $19.22 $19.22 Energy $33.26 $34.44 $34.54 Financials $13.17 $15.00 $15.02 Health Care $30.48 $29.68 $29.71 Industrials $15.53 $16.63 $16.84 Technology $23.75 $25.15 $25.40 Materials $11.73 $12.34 $12.30 Telecom $7.50 $7.94 $8.01 Utilities $12.84 $12.77 $12.82 At $82.15, that means the market is going for about 13.5 times this year’s earnings.

-

The Impact of Rude Behavior on a Business

Eddy Elfenbein, July 26th, 2010 at 12:46 pmFrom Scientific American:

Four separate studies published in the August issue of the Journal of Consumer Research provide some scientific evidence along these lines. Nearly 60 to 120 subjects were placed in various situations where they witnessed inter-employee rudeness as well as employee incompetence. And the researchers found that employee rudeness had a significantly greater impact on subjects’ overall opinion of the company than bad service.

In one study an employee reprimands his colleague who is gossiping on the phone with this: “Get off the phone you idiot!” Even such customer-oriented salespeople were found to lose all respect from customers for having barked at a co-worker.

The studies confirm that witnessing an uncivil argument between two employees leaves a bad taste that goes well beyond the individual incident. Customers tend to generalize their newfound negative opinion to the entire organization, its employees and any future interactions with it. So serve it with a smile, please, for those in front of the counter and behind it. -

Early Gains for AFLAC

Eddy Elfenbein, July 26th, 2010 at 10:35 amThanks to Barron’s article, AFLAC (AFL) has been as high as $51.26 this morning. We’ll know a lot more after tomorrow’s close when the company reports Q2 earnings. Fiserv (FISV) and Wright Express (WXS) also report tomorrow.

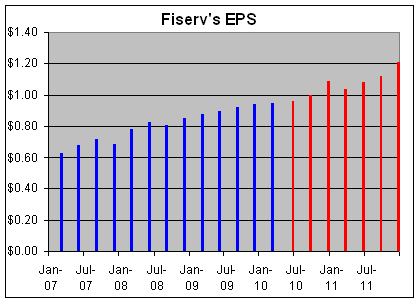

Fiserv, by the way, is a great example of a company that delivers consistently higher earnings. Here’s a look at their reported earnings in blue along with Wall Street’s projections in red.

As an investor that’s exactly what I like to see. I like to take the guesswork out of investing. That’s why I often refer to the full-year earnings projections that a company provides. Many companies don’t do that.

Fiserv has said to expect an EPS increase for this year of 8% to 11%. Last year, they made $3.66 per share so that works out to range of $3.96 to $4.07 for 2010.

Nicholas Financial (NICK) is due to report its earnings on Thursday morning at 10am. I’m also very curious to see the government’s first report on second-quarter GDP which comes out on Friday. I’m afraid it won’t be very good.

Lastly, let me add that I was pleased to see Amazon (AMZN) open down a lot on Friday. Well, I spoke too soon. The stock had one of the most impressive intra-day rallies I’ve ever seen. The shares opened at $115.93, down over $14, and closed just shy of $119. -

AFLAC at $71?

Eddy Elfenbein, July 25th, 2010 at 9:51 pmOver the weekend, Barron’s had a nice profile of AFLAC (AFL). Here’s a sample:

With Wall Street focused on the company’s investment portfolio, little attention has been paid to estimates of 8% to 12% growth in 2011 in Aflac’s operating earnings, excluding currency translation. Shares trade for only eight times 2011 projected profits, when a multiple of 12 times earnings is more appropriate, says Scott Chapman, another Lateef manager. Based on the 2011 consensus earnings estimate of $5.96 a share, that multiple would result in a stock price of 71. (Woo hoo!)

Aflac will report second-quarter earnings Tuesday. Analysts have penciled in $1.33 a share for the period, and $2.6 billion, or $5.45 a share, for the full year, on revenue of $20.4 billion. The company garners 73% of its premiums, and 78% of operating profit, from sales of supplemental policies in Japan; the remainder is generated in the U.S. Aflac is a market leader in Japan, but has had a tougher time domestically, particularly in recent years, as high unemployment has reduced the ranks of those who purchase policies through employers.

Like all insurers, Aflac invests the money it collects from policyholders, and tries to generate more income from its investments than it will have to pay out in claims. Despite today’s low interest rates, the company has been able to turn a profit on its investment portfolio.I don’t have an estimate for AFLAC’s Q2 earnings. In April, they gave a range of $1.33 to $1.38 per share. The company will probably beat $1.33 per share but that’s not the reason why I like the stock. My case for AFLAC is that everyone else seems to think the company is in dire straits and they’re clearly not.

If Tuesday’s earnings report comes in good, I think Wall Street will soon expect AFLAC to earn over $6 a share for 2011. -

When Reading the Yahoo Message Boards

Eddy Elfenbein, July 24th, 2010 at 12:02 pmYou never know when the CEO will respond.

-

Twitter Feed

Eddy Elfenbein, July 23rd, 2010 at 3:10 pmYou can also follow my ramblings on Twitter.

-

Eaton Corp.

Eddy Elfenbein, July 23rd, 2010 at 2:11 pmI’m often asked how I go about screening for stocks. The answer is, I don’t. I simply follow several very-high-quality stocks. If one dips down to a reasonable price, then I consider adding it to my Buy List.

One very high-quality stock that’s been catching my eye lately is Eaton Corp. (ETN) of Cleveland, OH. Like a lot of good companies, Eaton is fairly dull. The company is a “power management” company. I know, SNORE. They have 70,000 employees and a market cap of $13 billion, yet they seem to be totally unknown to most individual investors.

Investors should understand that Eaton is a cyclical stock. This means that its business is strongly correlated to the broader economy. When the economy does well, stocks like Eaton outperform. During recessions, they often fare much worse.

That pretty much describes what happened last year after Eaton sales and profits had climbed for several years. Their year-over-year earnings peak in the third quarter of 2008, then declined for the next four quarters. Importantly, only one quarter saw a net loss (Q1 ’09). Since then earnings have been on the rise, and the last three quarters have seen huge earnings surprises.

On Wednesday, Eaton posted outstanding results. They earned $1.36 a share which was 19 cents more than expectations. Eaton also gave very strong guidance:Eaton now expects third-quarter income per share of $1.25 to $1.35, with the Wall Street forecast $1.19. For the year, Eaton expects earnings of $4.75 to $4.95 per share, above the recent Wall Street forecast of $4.57.

As impressive as that is, it’s probably a bit on the low side. I think Eaton can swing $5 a share this year. Maybe more.

The company also raised its quarterly dividend from 50 cents a share to 58 cents a share which translates to a yield of 3%. This is a great company but at the current price, I wouldn’t call it a screaming buy. This is a good one to follow. If you ever seen it go into a downtrend, there might be a great opportunity at hand. -

The Ford Boom

Eddy Elfenbein, July 23rd, 2010 at 8:41 amEarlier this year, I called Ford (F) my Stock of the Decade.

Am I being a bit early? Maybe. But check out the results:Ford Motor Co. reported second- quarter net income of $2.6 billion, completing its most profitable first half in more than a decade, as car buyers pay more for its new models.

Ford earned $4.7 billion in the year’s first six months, its largest first-half profit since 1998 and its fifth straight profitable quarter. Excluding some items, profit was 68 cents a share, topping the 41-cent average estimate of 12 analysts compiled by Bloomberg. The second-largest U.S. automaker earned $2.26 billion a year earlier, helped by an accounting gain.

Chief Executive Officer Alan Mulally overhauled Ford’s lineup, redesigning cars such as the Taurus and Fusion, and adding extras like heated leather seats and voice-activated electronics. He also boosted quality, which had customers paying 14 percent more for Ford vehicles in June than five years ago, according to Edmunds.com. Ford held 17.5 percent of its U.S. market in the first half, up from 16.1 percent last year. -

A Reckoning?

Eddy Elfenbein, July 23rd, 2010 at 8:29 amI’ve been a critic of the valuation of Amazon (AMZN) and Netflix (NFLX), and I’ve been wrong as these stocks have climbed higher and higher.

Amazon, however, has finally disappointed the market. The company had another strong earnings report yesterday, but the earnings fell short of Wall Street’s expectations (45 cents per share versus 54-cent consensus). The stock was trading down over 10% in yesterday’s after-hours market.

This is the problem with owning a richly valued stock. Despite getting the enormous growth potential of the company, you always have to impress analysts. You have zero room for error. If you make one small misstep, you’ll be punished harshly.

Think of it this way. Amazon missed earnings by nine cents a share, yet the stock was down $15 a share. That’s the equivalent of a Price/Earnings Ratio of 166 for those marginal nine pennies. That’s obviously very high but that’s what you’re buying when you go after a hi-flier like Amazon.

Interestingly, late last year Amazon finally surpassed its December 1999 peak of $113 per share. After 9/11, the stock got down as low as $5.51. This past April, Amazon reached a high of $151.

Similarly, Netflix was hit hard yesterday due to slightly missing Wall Street’s revenue forecast. The WSJ even wonders if Netflix is the new Crocs. Ironically, Netflix is often mentioned as a potential acquisition candidate for Amazon.

Via Eric Savitz, I see that analyst Todd Greenwald notes that Netflix “spent $75 million to get 1 million net new subs in the quarter, after spending a comparable amount to add 1.7 million subs in Q1.”

Even after yesterday’s sell-off, Netflix is going for a 37 times this year’s earnings. That’s still way too high. -

GM to Acquire AmeriCredit for $3.5 Billion

Eddy Elfenbein, July 22nd, 2010 at 6:38 pmOne of the big stories today is that GM announced that it’s buying AmeriCredit (ACF), an auto financing company, for $3.5 billion which is $24.50 a share. Shares of ACF jumped over 21% on today’s news.

My interest is that AmeriCredit is a competitor of Nicholas Financial (NICK). The big difference, of course, is that AmeriCredit is about 30 times larger by market value.

The two companies are far from mirror images. In fact, I’m not sure if NICK’s business model can work on a very large scale. Still, when one company in a sector is bought out, it often brings attention on its competitors. Let’s look at some of the numbers.

GM is paying a 43% premium to ACF’s book value. If someone offered the equivalent for NICK, that would be an offer of $11.92 a share. If someone offered the same based on this calendar year’s forecast (this takes some guesswork), that would be the equivalent of $17.96 a share for NICK.

Let me stress that I’m not predicting a buyout, but I want to highlight how inexpensive NICK is using reasonable valuation comparisons.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His