Archive for October, 2010

-

Buy List Earnings Calendar

Eddy Elfenbein, October 18th, 2010 at 9:05 amWe’re heading into the peak of earnings season. Here’s a look at the upcoming earnings dates for our stocks on the March/June/September/December cycle.

Company Ticker Symbol Earnings Date Wall Street’s Estimate Gilead GILD 19-Oct $0.87 Johnson & Johnson JNJ 19-Oct $1.15 Stryker SYK 19-Oct $0.77 SEI Investments SEIC 20-Oct $0.26 Baxter BAX 21-Oct $0.97 Eli Lilly LLY 21-Oct $1.15 Reynolds American RAI 21-Oct $1.34 Fiserv FISV 26-Oct $1.00 AFLAC AFL 27-Oct $1.39 Moog MOG-A 4-Nov $0.70 Wright Express WXS 4-Nov $0.68 Becton Dickinson BDX 4-Nov $1.25 Sysco SYY 8-Nov $0.51 I didn’t include Leucadia and Nicholas Financial on the calendar because Wall Street doesn’t follow them. The Leucadia earnings report isn’t a big deal, but I’ll have an analysis of NICK since I believe I’m the only person who follows it.

-

Morning News: October 18, 2010

Eddy Elfenbein, October 18th, 2010 at 7:29 amBEFORE THE BELL: US Stock Futures Drop; Citigroup Results Due

Dollar Index Off Lows on Doubts How Far Fed Will Ease

BP Sells Venezuela, Vietnam Assets to TNK-BP for $1.8 Billion

Northeast Utilities to Buy NSTAR for $9.5 Billion

Banks Shared Clients’ Profits, but Not Losses

BHP and Rio Tinto Scrap $116 Billion Iron Ore Joint Venture

EU Debates New Debt Rules as Euro Surges

Crude Trades Near One-Week Low Because of Outlook for Weaker Fuel Demand

Production in the U.S. Probably Rose for 14th Time in 15 Months

-

RIP: Benoit Mandelbrot

Eddy Elfenbein, October 16th, 2010 at 12:52 amThe father of fractals has passed away. “Clouds are not spheres, mountains are not cones, coastlines are not circles, and bark is not smooth.”

-

Up

Eddy Elfenbein, October 15th, 2010 at 5:45 pmWe had a great week.The Buy List has risen for six-straight days. We gained 1.7% for the week and the Buy List is now at a five-month high. Since August 31st, we’re up 14.9%.

That’s enough market talk. Have a great weekend and enjoy this brilliant clip from Up.

-

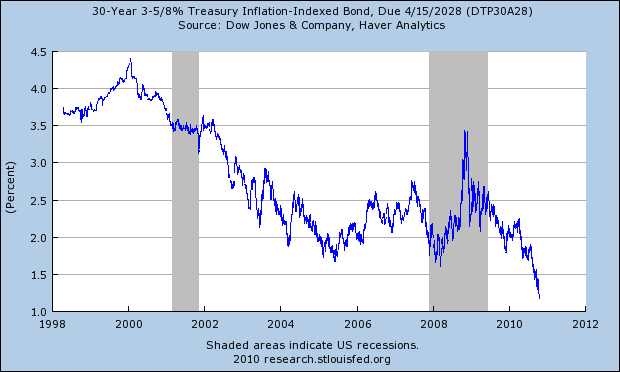

The Past 12 Years in One Chart

Eddy Elfenbein, October 15th, 2010 at 2:35 pmI apologize if you’re getting sick of these TIPs charts, but this one is fascinating. You can really see how the economic situation has changed over the past few years. This shows the real yield of the TIPs that comes due in April 2028.

This started as a 30-year bond and now it’s a 17-1/2 year bond. The real yield was once as high as 4.4% right at the dawn of the new millennium. Today it’s 1.2%.

-

Today’s Always-Finding-the-Downside Award Goes to Reuters!

Eddy Elfenbein, October 15th, 2010 at 12:10 pmFor this headline:

Dear Reuters, 1980 just called and they want to thank you for the laugh. Seriously, people. High inflation, for people new to earth, is terrible for retirees. The headline ought to read: “High Inflation No Longer Bites Millions of Retirees.” Inflation punishes savings. Our low inflation rate is a major victory for the economy over the past 30 years.

The story says that inflation punishes seniors because Social Security benefits aren’t going to be increased:

Social Security benefits will not automatically increase next year for 58 million Americans because of the low U.S. inflation rate, the Social Security Administration announced on Friday.

This is the second year in a row that retirees and millions of disabled workers and survivors of deceased workers will not receive an automatic cost of living adjustment.

It comes at a time when retirees’ savings — often their only other source of income — are earning poor returns because of low interest rates.

The average Social Security benefit is around $14,000 and experts say about one-third of retirees rely on the payouts from the government-run program for more than 90 percent of their income.

How exactly is anyone being punished?

-

From April: Deep Market Truths

Eddy Elfenbein, October 15th, 2010 at 11:11 amI’ve had a lot of new visitors the past few days so I thought I’d repost one of the most popular (and controversial) posts that I originally ran in April.

Here are some deep truths about the markets and investing that I’ve learned over the years:

The Federal Reserve isn’t nearly as powerful as is commonly believed.

There isn’t a person or group of people in charge of the market.

There’s no such thing as a “healthy correction.”

Good stocks can go down for no reason.

Bad stocks can go up for no reason.

A trend can last much longer than you thought possible.

Stocks don’t know you own them.

The market doesn’t care about politics.

The most important variable to the stock market, by far, is the direction of long-term interest rates.

Mega-mergers rarely work.

Investment bubbles aren’t due to the moral failings of the market participants.

Ignore anyone who tells you that the Federal Reserve is a private bank.

Commodities are almost always terrible investments.

The stock market hates inflation. The only thing it hates more is deflation. The best environment for stocks is a low stable inflation rate.

As an investment tool, P/E Ratios work much better for individual stocks than for the market as a whole.

The best three fundamental metrics are (in order) ROE, Debt Ratios and Cash Flow.

Wherever possible, seek out stocks with expanding margins.

Dividends are underrated by investors, especially companies that consistently raise them.

Portfolio diversity is overrated.

As a general rule, IPOs are a bad deal.

Boring but profitable always beats exciting and unprofitable.

CAPM and MPT are nonsense.

No one can consistently time the market. No one.

The Equity Risk Premium (over long-term debt) is probably much smaller than commonly believed.

The data showing a return premium for small-cap stocks is probably wrong.

The media never questions the bond market. Only stock investors are “greedy.”

Perma-bears are never held to account for being wrong so if you want to sound smart, be very bearish and very vague.

The market really does “climb a wall of worry.”

Follow unfollowed stocks.

The market is self-aware. Scary but true.

It’s far easier to rationalize selling than buying.

The market isn’t efficient—it can be beaten.

But it’s very, very, very, very hard.

Most technical analysis is complete garbage.

A high P/E Ratio is much better sign of a stock to sell than a low P/E Ratio is a sign to buy.

It’s pointless to measure the stock market relative to gold or in euros or pork bellies or whatever else people can come up with.

Ignore any chart that has seemingly similar lines trying to show how this market is “just like’ the one in 1831.

Except at very low levels, volatility is neutral.

Many gold bugs are quite simply fanatics.

Whatever the issue, your typical finance professor will blame the investing public and urge more self-denial as the solution. Bank on it.

Never base an investment decision on demographics.

The worst investor in the world is the guy holding on to a small loss waiting for the rally because “they don’t want to take the loss.” Again, the stock doesn’t know you own it.

Very, very few serious companies are traded on the pink sheets.

Never stress out about what a stock does after you sell it.

-

Reynolds American Raises Dividend and Splits Stock

Eddy Elfenbein, October 15th, 2010 at 9:38 amExcellent news today from Reynolds American (RAI)! The company has announced that it will split its stock 2-for-1 in mid-November. This means that shareholders will own twice as many RAI shares and the stock’s price will drop in half.

The other good news is that Reynolds is raising its quarterly dividend by 8.9%. The company will bump up the dividend from 45 cents per share to 49 cents per share (that’s adjusted for the split). Based on yesterday’s closing price, that translates to a forward yield of 6.5%.

Finally, Susan Ivey, currently Chairman, President and CEO of RAI, will retire next February. RAI’s board has elected Daniel (Daan) M. Delen, currently chairman, president and CEO of R.J. Reynolds Tobacco, to be President- and CEO-elect of RAI, and a member of the Board of Directors, effective Jan. 1, 2011.

-

The Apocoholics Dictionary

Eddy Elfenbein, October 15th, 2010 at 9:21 amBarry has the translation guide for newbies. Here’s a sample:

Apple: A fictitious company that does not exist.

BLS: A secret society of mathematicians and statistical wonks conspiring to falsify economic data, formerly known as the the sect of Opus Dei; See also Birth Death Adjustment.

Bernanke, Ben: Beelzebub

Bonds: An asset class that will eventually be worthless paper as its value is inflated away, but in the meantime, are a good alternative to equities.

Bubble: A catchall phrase used to describe any market not in freefall.

China: The centrally planned communist economy that is the model for Free Market Economies in the West. alt. An idealized form of Capitalism;

Death Cross: The most reliable and certain technical formation known to man. See also Golden Cross: An old wives’ tale, not to paid attention to or taken seriously at all.

Depression: The current state of economic affairs; See also Pornography.

European Union (EU): A soon to be dissolved association of Socialist states, whose sole purpose is to mislead investors into believing the United States is (comparatively) fiscally responsible. See also EuroFASB: A criminal legal enterprise of accountants whose members help banks hide massive losses;

Fiat Currency: The root of all evil

FOMC: Fertilizer for the root of all evil

Gold: A shiny yellow metal used primarily as an excuse for missing a generational rally in equities.

It’s funny because it’s true. Check out the whole thing.

-

Morning News: October 15, 2010

Eddy Elfenbein, October 15th, 2010 at 7:43 am7 U.S. Firms that Helped Save the Chilean Miners

Can High Dividend Stocks Beat 10-Year Bonds Or the Stock Market?

BEFORE THE BELL: US Stock Futures Mixed Ahead Of Bernanke Speech

Currency Tensions Persist as Markets Await Fed

HSBC Ends Talks to Acquire Nedbank, Old Mutual Says

Mortgage Mess May Cost Big Banks Billions

General Electric Tops Profit Expectations

China’s Sinochem Abandons Potash Bid Plan

GM on Track for Mid-November IPO

Priced in Silver, Gold is Actually Down (and other nonsense)

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His