Archive for December, 2010

-

JetBlue: My Unnecessary Splits Award

Eddy Elfenbein, December 20th, 2010 at 1:38 pmJetBlue Airways (JBLU) split its stock 3-for-2 not once, not twice, but three times between 2003 and 2006. That adds up to one 3.375-for-1 stock split.

Were any of these needed? It’s needless PR.

-

Medtronic’s Payments to Doctors

Eddy Elfenbein, December 20th, 2010 at 11:10 amThe WSJ has a front-page article on payments to spinal surgeons:

Norton Hospital in Louisville, Ky., may not be a household name nationally. But five senior spine surgeons have helped put it on the map in at least one category: From 2004 to 2008, Norton performed the third-most spinal fusions on Medicare patients in the country.

The five surgeons are also among the largest recipients nationwide of payments from medical-device giant Medtronic Inc. In the first nine months of this year alone, the surgeons—Steven Glassman, Mitchell Campbell, John Johnson, John Dimar and Rolando Puno—received more than $7 million from the Fridley, Minn., company.

Medtronic and the surgeons say the payments are mostly royalties they earned for helping the company design one of its best-selling spine products.

Corporate whistleblowers and congressional critics contend such arrangements—which are common in orthopedic surgery—amount to kickbacks to stoke sales of medical devices. They argue that the overuse of surgical hardware ranging from heart stents to artificial hips is a big factor behind the soaring costs of Medicare, the government medical-insurance system for the elderly and disabled.

Medtronic says it can’t develop new medical products that improve patients’ lives without the help of surgeons. It says the royalties it pays them are legitimate but it doesn’t give detailed information about what intellectual property each recipient contributes. It says it doesn’t pay its collaborating surgeons royalties on the devices they personally use in their patients, removing any financial incentive for them to do more surgeries than necessary.

In my understanding, the WSJ isn’t breaking any news. It’s merely highlighting something that’s already well-known. The news doesn’t seem to be affecting the stock at all (MDT is currently up as I write this).

The other Medtronic news is that the CEO, William Hawkins, has announced that he’s stepping down in June.

-

2011 Bespoke Roundtable

Eddy Elfenbein, December 20th, 2010 at 10:44 amI want to thank the crew at Bespoke for inviting me to join them again for their annual roundtable. Here’s the Q&A I did for the 2011 Bespoke Roundtable:

1) Looking back on 2010, what were your best and worst calls?

My worst call was easy. In April, I said that Netflix was “the absolute worst stock to buy.” The stock more than doubled since then. I also got an email from the CEO informing me that I had misspelled the name of the stock. I will never again say that it’s NetFlix.

My best call has been Jos. A Bank Clothiers (JOSB). Even after the recent tumble, it’s up more than 44% YTD.

2) What surprised you the most and least about financial markets in 2010?

I didn’t think the profit margin expansion story would be as strong as it’s been. Sales growth hasn’t been nearly as impressive as earnings growth.

I was least surprised (and I mentioned this in last year’s roundtable) by the return of dividends.

3) What is the one thing that you think has contributed the most to the market rally we’ve seen off the March 2009 lows?

Earnings growth

4) What will be the biggest surprise of 2011?

I think the Fed will start to tighten sooner than most people expect. Not a lot, but some. We’re still a long way from inflation being a problem, but there won’t always be the need for dirt-cheap money.

5) How long will the current bull market continue?

Can’t say yet, but stocks are still the place to be.

6) What are the various indicators that you follow closely telling you right now about where the stock market is headed in the near term (next couple of months)?

The yield curve and earnings forecasts. The wider the curve, the better it is for stocks. Wall Street loves cheap money. Also, Wall Street is fairly optimistic on earnings growth for 2011. Even at 15 times earnings, the S&P 500 can hit 1500 before the end of 2011.

7) Many of you noted that cloud computing would be a popular area of the market in 2010, which turned out to be correct. What areas of the market or themes will gain more popularity in 2011?

N/A

8) What do you believe is the contrarian call on equities right now? The economy? Is investor sentiment currently misplaced?

It’s hard for me to say since I don’t know what the consensus is. I will say that it’s very likely that volatility will continue to fall. The VIX may even drop below 13 soon.

9) There has been a lot of commentary about the US entering into a “lost decade” similar to Japan in the 90s. What is your take on this?

Yep, our lost decade has already passed. It’s over. Technically, our lost decade was one day short of nine years. The Nasdaq peaked on March 10, 2000. The market bottomed on March 9, 2009.

10) In what ways have you had to change your investment strategies over the past couple of years?

I’ve gotten much more open to dividends. I also strongly prefer companies that give guidance to those that do not.

11) What sectors do you believe will perform the best and worst in 2011?

N/A

12) Financials have been lagging the market for much of 2010. Do you expect this to continue into 2011? Can the market rally without the Financials?

If you’re looking to start a bank, this is about the best time you could choose. I think financials will do well. At least the better ones. You can also expect to see major dividend increases from a lot of financials. Many cut their pay to the bone.

13) What’s in store for the US economy in 2011?

Decent growth, around 4%, but we need that to last for a few years to get back to normal.

14) The consensus seems to think that the employment picture will get better in 2011, albeit slowly. Do you agree or disagree with this call?

I agree, but I fear there may be a new “floor” to unemployment of 7% or 8%.

15) What are the biggest problems that could emerge in the coming year that could derail the recovery, and how likely are they to occur?

Continued problems in the European periphery. Any country that’s an island or a near-island is having trouble and that’s putting pressure on the core. I’m also keeping an eye on China. The yuan situation is simply unsustainable.

16) Are Ben Bernanke and the Fed helping or hurting the recovery?

The Fed’s policies are helping as much as they can. The problem is that more of our problems are outside what monetary policy can do. The higher unemployment is structural. We have X number of workers and an economy designed to employ 0.9X.

17) When will the Fed begin to raise rates, and will this be too early, late, or just about right? (We asked this question last year as well, and rates have yet to change!)

That’s the 64,000 yuan question and it’s hard to say right now. It’s really a moving target. I still think that a modest Fed tightening is closer than most people realize. I also suspect that there’s growing dissention inside the Fed.

18) After a bounce off the lows, home prices and sales have begun to dip again. What is the reason for this and what’s in store for real estate in 2011?

There are simply way too many homes and way too many foreclosures. That’s the good part of a post-bubble. What’s also happening is that mortgage rates are on the rise. I think we’re in for a few years of flat to sluggish growth for home values.

19) Will the Dollar (US Dollar Index) be up or down in 2011 and why? Is there a serious threat to the Dollar as the world’s reserve currency?

The people waiting for the demise of the dollar are starting to remind me of Linus waiting for the Great Pumpkin. Believe as they might, it just ain’t happening.

I expect some weakness for the dollar since that’s in everyone’s interest right now.

As to the dollar’s supremacy—there’s zero threat to that.

20) What are your current thoughts on gold – bubble, just the beginning, or fairly valued?

Gold is fairly valued now. As long as rates stay low, gold will do well. However, once the Fed starts to end the free money party, gold will get hammered. High real rates are like Krypton for gold (I think I’m mixing my metaphors).

21) Oil doesn’t get nearly the attention it got back in 2006-2008, and it seems to be losing steam as an asset class that investors want to be in even though it has slightly outperformed stocks in 2010. What is your take on oil as an asset class in 2011?

N/A

22) Which alternative energy sources do you expect to gain the most market share over the next decade, and what are some of the best ways to invest in these areas?

N/A

23) What is your take on the automobile sector in both the US and abroad? Will the new GM stock be up or down in 2011? What is your favorite auto play?

GM actually sells more cars to China today than it does in the United States. Honestly, I don’t expect much from GM. Another recession, even a mild one, could push them under again. But the turnaround at Ford is amazing. I’ve already called Ford my “stock of the decade” (it’s never too early to spot a trend).

24) How will the new Congress impact the stock market and the economy in 2011?

I don’t know yet, but I doubt it will be good. For investors, the two major issues to watch are dividend taxes and repatriation of foreign profits.

25) What is your take on the political environment in the country right now and what changes, if any, need to occur to make it better? Will politics play a larger or smaller role in the year ahead?

N/A

26) Is the country finally serious about the deficit problem and ready to take steps to reduce it, or are we just seeing more posturing?

Many Americans are serious about the issue but they’re not a majority. I have a contrarian take about our national debt. Since it freaks people out, it’s therefore not a long-term threat.

27) What are the biggest global threats to the stock market right now, and how much of a threat are they?

The North Koreans are the biggest threat since we don’t know what we don’t know. They have the bomb and their leaders are nuts.

28) Which countries/regions are you the most bullish or bearish on at the moment?

N/A

29) China’s stock market has underperformed most of the world in 2010. Will we see outperformance or underperformance from China in 2011? How do you expect other emerging markets to perform in 2011?

N/A

30) Will the following be up or down (positive or negative) in 2011? Where noted, what are your 2011 year-end price targets? The price targets are meant to obtain a “wisdom of crowds” consensus number from all Roundtable participants.

-S&P 500 (up or down and year-end price target) N/A

-Long-Term US Treasuries (up or down) N/A

-Corporate Bonds (up or down) N/A

-Junk Bonds (up or down) N/A

-Gold (up or down and year-end price target) N/A

-Oil (up or down and year-end price target) N/A

-Dollar (up or down) N/A

-Average US Home Prices (up or down) N/A

-China’s stock market (up or down) N/A

31) Please provide readers with any stocks that you really like right now and for 2011 and beyond (and why).

Check my Buy List for full details.

32) As one of the most popular financial content providers out there, what advice would you give someone looking to get into this arena, and how has the industry changed since you started doing what you do? Where do you see our industry going with the ever-changing way that individuals and investors get their information?

Simply focus on writing good stuff. Don’t worry about building an audience. On the net, people will find you.

All the major media outfits now have blogs. When I started in 2005, none of them did.

I think we’re going to see more specialized financial/economic blogs. More sites will specialize in areas like tech or finance or commodities.

33) What are the websites, magazines, newspapers, books, apps that you use the most and would recommend others to use?

StockTwits is a great resource, and, of course, Bespoke. I probably read Bloomberg the most. It’s a great service.

34) Do you have any other advice that you would like to share with readers heading into next year?

Don’t confuse cynicism with wisdom.

Here are the responses for the other participants.

A Dash of Insight – 2011 Bespoke Roundtable Q&A

Financial Armageddon – 2011 Bespoke Roundtable Q&A

Footnoted.org – 2011 Bespoke Roundtable Q&A

Paul Kedrosky’s Infectious Greed – 2011 Bespoke Roundtable Q&A

Investment Postcards – 2011 Bespoke Roundtable Q&A

The Kirk Report – 2011 Bespoke Roundtable Q&A

Random Roger – 2011 Bespoke Roundtable Q&A

The Reformed Broker – 2011 Bespoke Roundtable Q&A

VIX and More – 2011 Bespoke Roundtable Q&A

-

Morning News: December 20, 2010

Eddy Elfenbein, December 20th, 2010 at 7:24 amBangladesh Investors Riot Over Stock Market Fall

Gold Draws in Safe-haven Flows, Up for Second Day

Nikkei Drops in Thin Trade on Losses in China

Spain Will Meet 2011 Deficit Target Even if Economy Undershoots, OECD Says

Ireland Defends Finance Minister’s Powers in New Bank Law

Bears Turn Bulls as U.S. Gains From Roiling Markets

Online Stores Start to Wean Shoppers Off Sales

EBay to Buy Germany’s Brands4friends to Boost Web Fashion Sales in Europe

Google to Delay Launch of TV sets

-

The 2011 Crossing Wall Street Buy List

Eddy Elfenbein, December 17th, 2010 at 11:03 am*Drumroll please*

Ladies and gentlemen, the following 20 stocks are my Buy List for 2011:

Abbott Laboratories (ABT)

AFLAC (AFL)

Becton, Dickinson & Co. (BDX)

Bed Bath & Beyond (BBBY)

Deluxe Corp. (DLX)

Fiserv (FISV)

Ford Motor Company (F)

Gilead Sciences (GILD)

Johnson & Johnson (JNJ)

Jos. A Bank Clothiers (JOSB)

JPMorgan Chase (JPM)

Leucadia National (LUK)

Medtronic (MDT)

Moog (MOG-A)

Nicholas Financial (NICK)

Oracle (ORCL)

Reynolds American (RAI)

Stryker (SYK)

Sysco (SYY)

Wright Express (WXS)The five new stocks are Abbott Laboratories (ABT), Deluxe Corp. (DLX), Ford (F), Oracle (ORCL) and JPMorgan Chase (JPM).

The five stocks I’m deleting are Baxter International (BAX), Eaton Vance (EV), Eli Lilly (LLY), Intel (INTC) and SEI Investments (SEIC).

This change doesn’t mean I think the old stocks are about to collapse. I simply believe the new stocks are better opportunities.

The new Buy List goes into effect at the start of trading on Monday, January 3, 2011 which is the first trading day of the new year.

I will track the Buy List as if it is a $1 million portfolio with 20 equally-weighted positions of $50,000 each based on the closing price on December 31, 2010.

My normal rule is that I can’t make any changes to the Buy List during the entire year.

The biggest stock is Johnson & Johnson with a market cap of $171 billion. The smallest is Nicholas Financial with a market cap of just $120 million. Combined, the 20 stocks are worth $820 billion.

Twelve of the 20 stocks pay a dividend, and if no stock raises or lowers its dividend for the next twelve months, the dividend yield for the entire Buy List will be 1.56%. The Buy List is trading at just 11.6 times next year’s earnings.

-

Morning News: December 17, 2010

Eddy Elfenbein, December 17th, 2010 at 8:22 amTracking the Global Recession (cool timeline with a quote from me)

Congress Votes to Extend Bush-era Tax Cuts Until ’12

Banks Weigh on FTSE as Moody’s Cuts Ireland’s Rating

European Leaders Create 2013 Debt Mechanism Amid Debate on Immediate Steps

German Business Sentiment Rises to Highest in Two Decades

U.S. Stock-Index Futures Are Little Changed; Oracle, RIM Climb on Outlooks

Mideast Crude in Longest Weekly Rising Streak Since September

China Leader Says Anti-Inflation Measures Needed

Venezuelan Bank Law Makes Nationalizations Easier

Visa, MasterCard May Be Damaged by Fed’s Proposal to Slash Debit-Card Fees

-

CWS Market Review – December 17, 2010

Eddy Elfenbein, December 17th, 2010 at 7:15 amI’m going to unveil the Buy List on the blog later today, but I wanted to give the CWS Market Review folks an advanced look, so here are the 20 stocks that will make up my Buy List for 2011:

Abbott Laboratories ($ABT)

AFLAC ($AFL)

Becton, Dickinson & Co. ($BDX)

Bed Bath & Beyond ($BBBY)

Deluxe Corp. ($DLX)

Fiserv ($FISV)

Ford Motor Company ($F)

Gilead Sciences ($GILD)

Johnson & Johnson ($JNJ)

Jos. A Bank Clothiers ($JOSB)

JPMorgan Chase ($JPM)

Leucadia National ($LUK)

Medtronic ($MDT)

Moog ($MOG-A)

Nicholas Financial ($NICK)

Oracle ($ORCL)

Reynolds American ($RAI)

Stryker ($SYK)

Sysco ($SYY)

Wright Express ($WXS)Not surprisingly, next year’s list looks a lot like this year’s list, and that’s no accident. I only change five stocks, or just one-quarter of the portfolio, each year. My goal has been to show investors that you don’t need to trade a lot to beat the market.

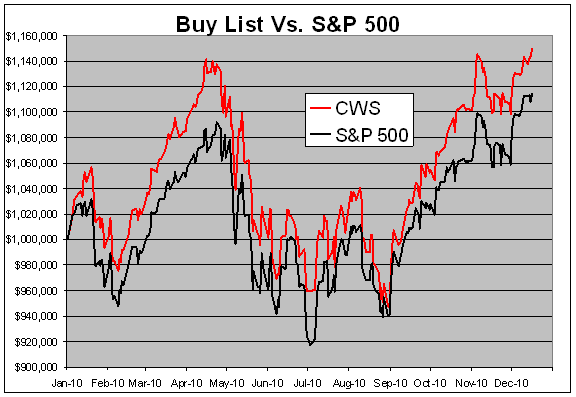

This will be the fourth year in a row that the Buy List has beaten the S&P 500. Not only have we beaten the S&P 500, but we’ve done it with less risk as well.

The five new stocks are Abbott Labs ($ABT), Deluxe ($DLX), Ford ($F), Oracle ($ORCL) and JPMorgan ($JPM).

The five stocks I’m deleting are Baxter International (BAX), Eaton Vance (EV), Eli Lilly (LLY), Intel (INTC) and SEI Investments (SEIC).

Don’t take this action to mean that I don’t like the stocks I’m deleting; I hate to see some of these names go. I simply think the new stocks are better buying opportunities. For disclosure purposes, you can assume that I own any of the stocks on the Buy List, but I won’t buy any of the new names until January.

The Buy List for 2010 just hit a new record high for the year. We’re now up 14.99% through Thursday compared with 11.46% for the S&P 500 (dividends excluded).

With last year’s Buy List I made a fairly heavy bet on the healthcare sector which turned out to be a bad move. Fortunately, the Buy List is well-diversified so it didn’t hold us back much. The lesson is that as long as you hold high-quality stocks, you can overcome sector weakness.

I’ve looked at the numbers, and what can I say? I still like a lot of healthcare stocks. I got rid of Baxter and Lilly but I added Abbott Labs. In April, I wrote a blog post saying that Abbott was a good stock but that I’d like it better under $50 per share. Well, now it’s there.

JPMorgan isn’t an easy choice. The stock is cheap by most conventional measures but it’s been criticized by some for poor earnings quality. I still like what I see. Plus, I think JPM will give us a hefty dividend hike sometime in 2011.

Ford is the comeback kid. The company has had an impressive turnaround and I think it will get even stronger in 2011.

Oracle is certainly well-known. My only complaint is that I didn’t add it earlier. The company just had another good earnings report on Thursday.

The only new stock that you may be unfamiliar with is Deluxe. I admit this is an odd little duck. I like to have a few unknown and overlooked gems in the Buy List. Deluxe is a Minnesota-based company that provides services for small businesses. It’s a pretty solid business. The stock is a member of the S&P Mid-Cap 400. DLX has a market cap of $1.1 billion and the current dividend yield is 4.6%. Only a few analysts on Wall Street follow the stock which is how I like it.

One of the lessons I often tell investors is to not worry about what happens to the stocks you sell. Trust me; they’re not thinking of you. Unfortunately, the temptation is sometimes too great. I know this because all five stocks I ditched last year, Amphenol (APH), Cognizant Technology Solutions (CTSH), Donaldson (DCI), Danaher (DHR) and FactSet Research Systems (FDS), did very well this year.

Since I unveiled the Buy List in this eletter, I’ll keep the market commentary short, but there are a few key items that I want to highlight. One is that interest rates continue to rise, and they did so even more after this week’s Fed meeting.

The five-year Treasury is now over 2% which means that it has doubled since the election. The 10-year recently broke 3.5% for the first time since May. The 30-year has been as high as 4.62% which is the highest it’s been since April.

Once again, money is going out of bonds and into stocks.

Here’s what’s happening: There’s a reverse tidal wave going on through the yield curve. Yields bottomed out at the long end first and the bottoming has moved progressively shorter since then.

For example, the 30-year yield bottomed in August and the five-year bottomed last month. At some point, the three-month yield will start to move higher. I don’t know exactly when that will be, but the events that ought to proceed it have already happened.

Concurrently, there’s been some good economic news. In fact, some folks on Wall Street think the Q4 GDP numbers will be quite good thanks to the recent retail sales report and industrial production numbers. Morgan Stanley just raised their Q4 GDP estimate to 4.3%. A few months ago, not many folks saw that happening.

The market’s equation has been “higher yields equals stronger economy equals higher cyclical stocks.” The Morgan Stanley Cyclical Index closed Thursday at 1027. That’s an 8% rise over the last four weeks.

Next Wednesday, we’ll get another revision to Q3 GDP. The initial report showed 2% growth and it was revised up to 2.5% growth last month. That’s not very good, but I’ll be much happier if it’s a ramp to 4%+ growth for the fourth quarter. If growth comes in stronger than expected, the Fed could pull the plug on QE2.

Lastly, let me remind you that the market will be closed next Friday on Christmas Eve, but it will be open for business on New Year’s Eve. Sorry for all you Wall Streeters, but the change of years is too important to accommodate a closure.

That’s all for now. I’ll have more market analysis for you in the next issue of CWS Market Review!

Best – Eddy

-

Buy List Reaches New High

Eddy Elfenbein, December 16th, 2010 at 5:32 pmI’m happy to see that our Buy List has reached a new high for the year. Our Buy List is now up 14.99% for the year (not including dividends). The S&P 500 is up 11.46% for the year.

The beta for the portfolio this year is 0.9485.

-

Time to Sell Hawkins

Eddy Elfenbein, December 16th, 2010 at 5:21 pmA few times this year I highlighted one of my favorite micro-cap stocks, Hawkins (HWKN). This is how I described them earlier this year:

Hawkins is a specialty chemical company based in Minnesota. So if you’re in, say, Fargo and you need a shipment of sodium hydroxide, well…these are the boys to call. They’ve been around for many years and the company is largely in family hands. They do what they do, and they do it well.

The odd thing about Hawkins is that they used to split their stock almost every, but by small amounts. You’d get a 10%, 15% or 20% stock dividend each year. As a result, the nominal share and dividend price didn’t move much, but the stock really did very well.

I’ve watched Hawkins for years, so it’s odd for me to see the stock become so popular lately. The shares closed at a new all-time high of $49.20 — and I say that that is way too much. If I owned the stock (which I don’t), I’d sell it right now. It’s had a good ride, but $50 is simply too expensive.

-

FedEx Raises Forecast Despite…

Eddy Elfenbein, December 16th, 2010 at 11:46 amGood news for FedEx (FDX). The company raised its EPS range to $5 to $5.30 from $4.80 to $5.25. This is the third time that FedEx has raised its forecast.

The company reported earnings of 89 cents per share which is a drop from the $1.10 per share they earned a year ago. I like to follow FDX because I think this is a good indicator of the broader economy. (I’ve also said that FDX would be a better fit for the Dow than many of the current members.)

Excluding charges from a legal reserve and the combination of its freight and national LTL operations, earnings were $1.16 per share. The company in September had forecast earning $1.15 to $1.35 per share.

Revenue jumped 12% to $9.63 billion. Analysts were expecting $9.7 billion.

Sales in the express-shipping segment—FedEx’s biggest contributor to revenue—jumped 13% as international-priority average daily volume increased 11%, led by exports from Asia. U.S. domestic revenue per package rose 5% while average daily package volume increased 3%.

Revenue for the ground-shipping segment also rose 13%, as average daily volume rose 7%.

Freight revenue climbed 14%.

The CEO, Fred Smith, said: “We’re now more bullish about the remainder of the year.” I think this is good news for the economy. Several economists have been raising their forecasts for the fourth quarter. J.P. Morgan sees Q4 GDP coming in at 3.5% and Morgan Stanley is now up to 4.3%.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His