Archive for January, 2011

-

The Dow Has Missed the Rally

Eddy Elfenbein, January 7th, 2011 at 10:15 amHere’s one for the wonks. The Dow Jones Industrial Average has badly trailed the S&P 500 since the rally began in late August.

I’m not much of a fan of the Dow since it’s 30 stocks are weighted by price. The problem is that the Dow hasn’t captured the strength in cyclical stocks.

-

NFP = 103,000

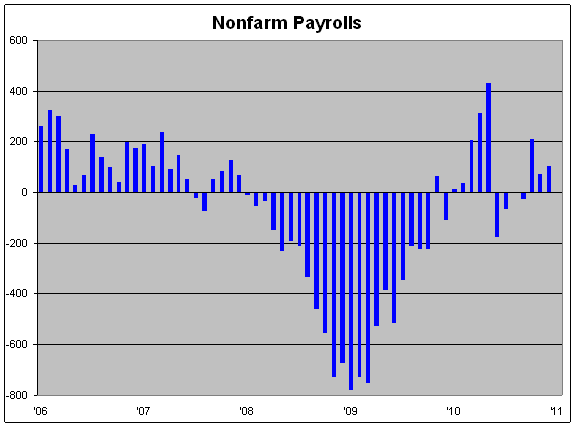

Eddy Elfenbein, January 7th, 2011 at 8:41 amThe Labor Department has reported that the economy created 103,000 jobs last month. That’s not good. With revisions, the economy created 71,000 jobs in November and 210,000 in October.

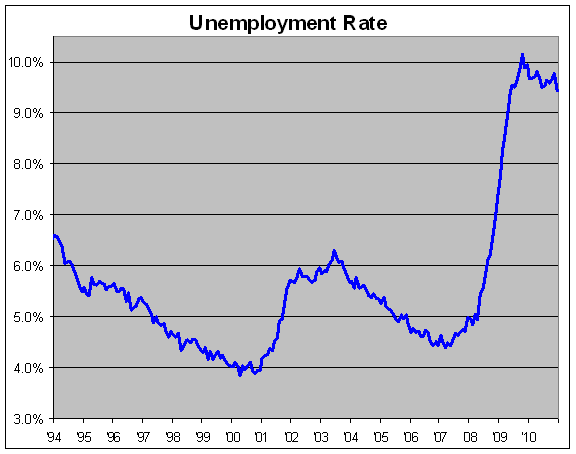

The unemployment rate fell to 9.4%. Ben Bernanke testified before Congress this morning. Here’s the bit getting a lot of attention:

Although it is likely that economic growth will pick up this year and that the unemployment rate will decline somewhat, progress toward the Federal Reserve’s statutory objectives of maximum employment and stable prices is expected to remain slow. The projections submitted by Federal Open Market Committee (FOMC) participants in November showed that, notwithstanding forecasts of increased growth in 2011 and 2012, most participants expected the unemployment rate to be close to 8 percent two years from now. At this rate of improvement, it could take four to five more years for the job market to normalize fully.

-

Morning News: January 7, 2011

Eddy Elfenbein, January 7th, 2011 at 7:59 amU.S. Stock Futures Flat Ahead of Payrolls Data

Eurozone Economy Suffers Growth Slowdown

China’s Stocks Decline for Second Day on Inflation Concern; Ping An Drops

Bernanke to Face Senate Skeptical of Fed Policy

Apple, Dow Drive U.S. Fourth-Quarter Profits to 19-Year High

Average Stock Ownership: 22 Seconds

So, Now That We Know Facebook’s Numbers, Is It WORTH $50 Billion?

JPMorgan, Morgan Stanley Approved to Form Chinese Joint Venture

With Android Phones, Verizon Is in Position to Gain Lost Ground

Private Equity Fundraising Grinds to Halt

-

CWS Market Review – January 7, 2011

Eddy Elfenbein, January 7th, 2011 at 7:43 amIt’s now official: 2010 marked the fourth-straight year that our Buy List beat the S&P 500. The final numbers showed that our Buy List gained 16.62% including dividends compared with 15.06% for the S&P 500. For the five years combined, we’re up 34.03% to the S&P 500’s 11.99%.

We actually had a much bigger lead against the S&P 500 but our Buy List was underweighted in cyclical stocks (I’ll have more on that in a bit). The big rally over the past few weeks heavily favored cyclicals and that hurt our relative performance. While our Buy List did rally, it didn’t rally quite as strongly as the rest of the market did.

With the new stocks for this year’s Buy List, I tried to rectify our underweighting in cyclicals with stocks like Ford ($F) and JPMorgan Chase ($JPM). I’m glad I did. Ford is already up 8.52% making it our #1 performer so far.

I’m pleased to say that the new Buy List has gotten off to a nice start so far in 2011. Through Thursday, our Buy List is up by 1.95% compared to 1.29% for the S&P 500 (excluding dividends). Sure, that’s only four days’ worth of data—we keep our eyes fixed on the long-term around here—but at least we’re headed in the right direction.

Turning to the economy, we had some pretty good reports this week. On Monday, the ISM Index for December came in at 57.0. That’s basically what I had been expecting. Any reading higher than 50 means that the economy is expanding. Wall Street had been expecting 57.5 so this was a slight miss, but I’m not worried. The most important takeaway is that the economy expanded for the 17th month in a row in December.

The key economic report will be Friday’s jobs report. Investors need to pay attention to this report because it may tell us a lot about where the market is headed. So far, this recovery has been very slow and jobless. While corporate profit growth has been impressive, jobs growth has not.

Most of the increase in profits has come from higher margins which have come from lower overhead which has come from corporate layoffs. Put it this way: The economy lost over seven million jobs during the recession, and we’ve lost another 101,000 jobs during the recovery.

The higher profit margins appear to have run their course. You can’t slash overhead indefinitely. At some point, we need to see higher sales and that means we need to see more hiring. More jobs means more consumers.

Here’s the problem: Companies are sitting on mountains of cash. Apple ($AAPL), for example, has a cool $25.6 billion in the bank. The problem for many such companies is that the cash is overseas and if they bring it back home, they’ll get a big tax bill. But not all of it is held outside the United States. Much of it is just sitting there earning next to nothing in the bank. The Fed lowered rates to zilch, but companies still aren’t budging.

I’ve been expecting a good jobs report for the last few months but I’ve been disappointed with every new report. In fact, the jobs news has actually gotten slightly worse. The unemployment rate jumped 0.2% in November to 9.8%. That was the second-highest level reached in all 2010. Thirteen months after peaking at 10.1%, the jobless rate has only fallen by 0.3%. That’s just lousy.

There is some optimism for Friday’s report. One is the strength in cyclical stocks. Truth be told, the market is often not the best analyst at all. The surge in heavy industry stocks like Ford may be an omen that things are better on Main Street than Wall Street realizes.

Another reason for optimism was the strong jobs report from ADP. This is a private company involved in payroll processing, so they ought to have a good read on the jobs front. I’ve never been too impressed by ADP’s forecasting skills, but I did take note that their report was very strong. ADP said that 297,000 jobs were created last month. Wall Street is expecting 150,000. We’ve also seen decent improvement in initial claims for unemployment insurance.

Except for Census hiring, I’m not exaggerating when I say that we haven’t had a really strong jobs report (over 300,000 jobs) in close to five years.

After the jobs report, we’ll soon start the fourth-quarter earnings season. On Monday, Alcoa ($AA) will be the first Dow component to report. Once I have the earnings dates, I’ll post a complete earnings calendar for our Buy List stocks on the blog.

We already know that Buy List newbie JPMorgan Chase ($JPM) will report earnings next Friday, January 14. Wall Street currently expects 98 cents per share. I think that’s laughably too low. By my numbers, the bank should earn at least $1.10 per share and probably a lot more.

I’m also expecting to see a big dividend increase from JPM. Before the financial crisis struck, the company paid a quarterly dividend of 38 cents per share. They slashed it to just five cents per share, and that wasn’t as severe as many others’ cuts were.

I think JPM could easily increase their quarterly dividend to 25 cents per share. That would only be a dividend yield of 2.2%, but it would indicate to the world that the bank is confident in its future. JPM is currently going for less than 10 times this year’s earnings estimate. And as I said before, I think the Street’s earnings estimates are too low.

Another attractive opportunity on the Buy List is AFLAC ($AFL). I still think AFL is running up to $60 per share.

Two weeks ago, I highlighted Reynolds American ($RAI). Thanks to an upgrade from UBS, Reynolds rose 3% on Thursday. The stock currently yields 5.8%.

Oracle ($ORCL), another new stock, is a good buy up to $34.

Nicholas Financial ($NICK) is great bargain, especially if you see it below $10 per share.

Finally, Gilead Sciences ($GILD) is nice bargain below $39 per share.

That’s all for now. I’ll have more market analysis for you in the next issue of CWS Market Review!

Best – Eddy

-

RIP: Donald Tyson

Eddy Elfenbein, January 6th, 2011 at 9:08 pmThe founder of Tyson Foods has died at the age of 80:

In a career that spanned five decades, Mr Tyson transformed Tyson Foods through serial acquisitions from one of many chicken producers – it was 14th in size in the US in 1968 – to the country’s largest.

In 1968, it supplied 1 percent of the country’s chicken. Last year, Tyson accounted for 20 percent of chicken consumed in the US, according to the National Chicken Council.

Mr Tyson served as chairman emeritus when his son engineered the acquisition of IBP, a leading producer of meat and pork, in 2001, after which Tyson Foods became the world’s largest meat company. In 2009, Brazil-based JBS eclipsed Tyson, taking over the number-one spot after its acquisition of Bertin and Pilgrim’s Pride.

Like Frank Perdue, another major figure in the development of the industry in the US, Mr Tyson benefited from the steady growth in chicken consumption across America in the latter half of the 20th century. Mr Tyson was not well known outside the industry, or politics, where he was an active player for much of his career.

In 1980, Mr Tyson helped the company develop a relationship with McDonald’s, supplying chicken meat for the restaurant chain’s experimental new product, the “Chicken McNugget”. The relationship continues to this day.

-

The Buy List Is Off to a Good Start

Eddy Elfenbein, January 6th, 2011 at 4:45 pmYesterday marked the end of the Santa Claus Rally period which runs from December 22 to January 5. Historically the Dow has gained 3.39% over that stretch, but this time around, the index gained just 1.41%.

Today was a very good day for the Buy List. While the S&P 500 lost 0.21%, the Buy List gained 0.38%.

The biggest winner of the day was Reynolds American (RAI) which was up 3.04% thanks to an upgrade by UBS. Moog (MOG-A) wasn’t far behind with a 2.41% gain. Ford (F) gained 1.84% to reach another new 52-week high. Ford is our biggest winner for the year as it’s up 8.52% in just four days.

For the year so far, our Buy List is up 1.95% compared with 1.29% for the S&P 500. Yes, it’s very early, but I’m happy to say that this looks like a strong start to 2011!

-

JPMorgan Chase’s Mounting Legal Bills

Eddy Elfenbein, January 6th, 2011 at 1:08 pmOne sign that JPMorgan Chase (JPM) is doing well: Everyone’s trying to sue them. Bloomberg notes that a Madoff trustee is after them for $6.4 billion. Also, Lehman Brothers is on the warpath for $8.6 billion.

So far this year, JPM has reported $5.2 billion in legal costs. The company had very good earnings for the third quarter, but it would have been even greater if they hadn’t had to set aside a big chunk of change for lawsuits.

Linda Sandler picks out some interesting facts: In their latest 10-Q filing, the bank used the word “litigation” more than 50 times. The potential losses for JPM come to 13% of their book value. For Bank of America (BAC) the figure comes to 17%.

Naturally, this is a big headache for banks. I’m sure JPM wouldn’t be sued if they weren’t so successful. The difficulty is how to value these suits. Obviously, the bank thinks most of these suits are bogus and therefore shouldn’t cost them a dime. Of course, that decision isn’t up to them; it’s up to the courts. Still, they need to disclose the potential costs however frivolous.

JPM reports earnings one week from tomorrow. The consensus on the Street is for 98 cents per share. In my opinion, that’s laughably too low. I understand why analysts want to low-ball their estimates. Personally, I’d be surprised if JPM earns anything less than $1.10 per share.

In other JPM news, Obama will name William Daley, one of the bank’s big shots, as his new Chief of Staff.

-

“Snowstorms do not destroy demand”

Eddy Elfenbein, January 6th, 2011 at 10:29 amThe Labor Department reported that initial unemployment claims rose by 18,000 last week to 409,000. The number for the week before was revised up by 3,000 to 391,000. Last week’s report got some attention because it dropped pretty sharply. This drop coupled with the very strong ADP report hints that tomorrow’s jobs reports will be strong.

Why is this important for investors? The good news is that profit growth has been very strong lately. The problem is that the increase in profits has mostly been due to increased profit margins.

For example, let’s look at Wal-Mart (WMT). For their fiscal year that ended in January 2010, their sales rose by less than 1% while their profits rose by 7%. For the first nine months of this year, sales were up by 3.8% while profits rose by 7.5%. Make no mistake, that’s good. The issue is that raising profit margins can’t continue forever. At some point, a company needs to grow its sales. More profits means more sales which means more jobs.

We’re also getting sales reports from retailers and so far, they’re not so good.

Some U.S. retailers’ sales fell short of analysts’ projections last month as a blizzard the day after Christmas kept shoppers from stores, overshadowing earlier holiday buying.

Sales at stores open more than a year at Gap Inc., the largest U.S. apparel retailer, declined 3 percent, compared with the 2.4 percent average increase indicated by analyst estimates compiled by Retail Metrics Inc. Macy’s Inc., Target Corp. and American Eagle Outfitters Inc. also trailed projections.

A Dec. 26 storm that dumped more than a foot of snow on parts of the U.S. Northeast “disrupted” post-holiday shopping, Macy’s Chief Executive Officer Terry Lundgren said in a statement. The day after Christmas is typically one of the busiest shopping days of the year. That may have pushed sales into January, according to Customer Growth Partners’ Craig Johnson.

“Snowstorms do not destroy demand, they simply displace demand,” said Johnson, president of the New Canaan, Connecticut-based retail consulting firm. “Those gift cards don’t disappear, they get redeemed in January.”

The Buy List is having another good day. Leucadia (LUK), Reynolds American (RAI) and Moog (MOG-A) are all at new 52-week highs. Ford (F) and Wright Express (WXS) are also close to new highs.

-

Morning News: January 6, 2010

Eddy Elfenbein, January 6th, 2011 at 7:42 amJapanese Stocks Shine, Others Lag Before U.S. Payrolls

Euro Depreciates on Regional Sovereign Debt, EU Bondholder Plan Concerns

German Factory Orders Surged in November on Export Demand

Standard Life Picks Barclays, BP to Lift U.K. Stocks in 2011

Gold Drops for a Fourth Day as Stronger Dollar Curbs Demand From Investors

The 11 Slowest Growing Economies Of 2011

Bonanza in TV Sales Fades Away

Costco December Same-store Sales Rise 6%

Goldman Unit Passed on Earlier Facebook Investment

-

The Truth on Pink Sheet Stocks

Eddy Elfenbein, January 5th, 2011 at 1:48 pmEvery so often, I’m asked for my opinion on a stock trading on the Pink Sheet, or more formally, the OTC markets. Simply put, if a company is serious about its business, it’s not on the Pink Sheets. It’s on a real exchange.

Here’s a study that looked at Pink Sheet returns from 2000 to 2008. A tiny few did well. The overwhelming majority did horribly. The median return was -97%.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His