Archive for January, 2011

-

10-DMA Streaks

Eddy Elfenbein, January 18th, 2011 at 12:56 pmUnless something very dramatic happens, this will be the 33rd-straight trading day that the S&P 500 closes above its 10-day moving average. Part of this streak is due to the market’s huge falloff in volatility.

Here’s a look at the longest streaks going back to 1932:

Began Ended Days 23-Nov-70 18-Feb-71 59 20-Feb-35 30-Apr-35 57 27-Oct-52 7-Jan-53 47 7-Dec-60 10-Feb-61 45 27-Mar-57 27-May-57 42 12-Aug-68 24-Oct-68 42 16-Feb-10 16-Apr-10 42 30-Dec-42 18-Feb-43 41 19-May-55 18-Jul-55 40 26-Nov-71 24-Jan-72 40 6-Apr-70 28-May-70 38 7-Oct-35 22-Nov-35 37 22-Aug-58 15-Oct-58 37 26-Jul-63 18-Sep-63 37 20-Oct-72 14-Dec-72 37 15-Apr-97 4-Jun-97 35 11-Jun-56 27-Jul-56 33 1-Dec-10 present 33 So This Central Banker Walks Into a Bar….

Eddy Elfenbein, January 18th, 2011 at 11:08 amThe Federal Reserve recently released the full transcripts of its meetings from 2005. By glancing at them, you might be surprised by the amount of wise-cracking they do.

Ladies and gentlemen, check out the comedy stylings of the FOMC:

#1:

MR. GRAMLICH. I nominate Alan Greenspan to be Chairman.

MR. FERGUSON. And do you have a nomination for Vice-Chairman?

MR. GRAMLICH. I nominate Timothy Geithner as Vice-Chairman.

MR. FERGUSON. Is there a second to those nominations?

SEVERAL. Second.

MR. FERGUSON. Any other nominations? Any objections? Any comments? Well, we’re

not in an era of great democracy. [Laughter] Let the record show a unanimous vote for Messrs.

Greenspan and Geithner to be Chairman and Vice-Chairman of the FOMC until its first regularly

scheduled meeting of 2006. Congratulations.

CHAIRMAN GREENSPAN. Thank you very much. I wish to note that there was no voter

fraud that I could perceive. [Laughter]

MR. FERGUSON. And we have a turnout of 100 percent!#2:

CHAIRMAN GREENSPAN. Without objection, that is approved. The next item on the

agenda is the selection of a Federal Reserve Bank to execute transactions for the System Open Market Account. My notes indicate to me, and I quote, “New York is the odds-on favorite.” [Laughter]#3:

MR. GRAMLICH. Thank you, Mr. Chairman. A lot of points have been put on the table

already, so I feel a bit like I’m taking an oral exam, but here goes. First question, is low inflation desirable? Yes, I definitely think it is.

MS. MINEHAN. That’s one right answer! [Laughter]#4:

MR. MOSKOW. One result of the relatively poor performance of the Big Three is that Michigan now has the highest unemployment rate in the nation.

MR. GRAMLICH. You’ve got to be first in something! [Laughter]

MR. MOSKOW. Actually, Illinois is leading the Big Ten in basketball. [Laughter] They are undefeated so far.#5:

CHAIRMAN GREENSPAN. First Vice-President Holcomb.

MS. HOLCOMB. Thank you, Mr. Chairman. This is only the third FOMC meeting that

I’ve had the privilege of attending, and I cannot help but notice how much the U.S. economy has

improved in that short time. [Laughter]

CHAIRMAN GREENSPAN. You’re welcome to attend any time!#1:

VICE-CHAIRMAN GEITHNER. Karen, could you give us a fair and balanced view—

[laughter]—of the significance of the changes to the Stability and Growth Pact?#2:

MR. KOS. Mr. Chairman, if I could just add a point on the market effect. As some of

you know, Greece issued a 30-year bond recently at 26 basis points above the rate on Bunds, or

about ½ point below the U.S. 10-year rate and about 100 basis points below the 30-year rate.

CHAIRMAN GREENSPAN. Can we borrow from the Greeks? [Laughter]#3:

MS. HOLCOMB. Turning to the national economy, I’d like to provide support for the Greenbook’s conclusion about the extra positive thrust in the economy by noting that congressional hearings have been focusing on the use of steroids in major league baseball rather than the economy. [Laughter]

#4:

VICE-CHAIRMAN GEITHNER. I have no humor in my statement and nothing that differs from the consensus.

CHAIRMAN GREENSPAN. Your straightforward remarks are very humorous. [Laughter]

VICE-CHAIRMAN GEITHNER. Careful. [Laughter]#1:

MR. OLSON. So I suspect that we may be closer to a pothole or perhaps even the head fake that the entire Chicago Bulls went for last night when Juan Dixon went up for his jump shot, which he made consistently.

MR. MOSKOW. That’s unfair. [Laughter]

MR. OLSON. It has been 17 years, Michael. It has been a long time.#2:

MR. FERGUSON. To put it another way, while I’m comfortable with the strategy for today, I think we’re really entering the neutral zone. And for those of you who are Star Trek fans, you may recall that when you enter the neutral zone that’s when the aliens are most likely to attack. [Laughter] It is quite clear to me that we have executed one exit strategy, but unfortunately I think we’re entering a mode where we need a new exit strategy from the exit strategy! [Laughter]

#3:

MR. MOSKOW. Now, I am not going to respond to Governor Olson’s very unfair comment about the Chicago Bulls except to say that we will see how the Washington Wizards do when they lose their home court advantage in the next game and have to face the Chicago Bulls in the friendly confines of the United Center. [Laughter]

MR. OLSON. Let me point out that it isn’t how they do but how they communicate what they do. [Laughter]

MR. MOSKOW. Touché.

CHAIRMAN GREENSPAN. Is that the end of your—[laughter]?

MR. MOSKOW. Yes.#1:

CHAIRMAN GREENSPAN. The argument for the rapid rise in land prices in 1837 was that land was fixed in quantity. [Laughter] So, new ideas are very rare. Vice-Chair.

VICE-CHAIRMAN GEITHNER. I remember that bubble! [Laughter]#2:

VICE-CHAIRMAN GEITHNER. I meant in our history. In our history, have we used that tool to good or ill effect? Have we used it wisely and with foresight?

CHAIRMAN GREENSPAN. You’re biasing the answer. [Laughter]

MR. FERGUSON. The answer is obviously “yes.” [Laughter]#3:

MR. POOLE. Just for the hell of it, I’d like to offer the hypothesis that property values are too low rather than too high. [Laughter]

#4:

MR. FISHER. Mr. Chairman, I’d like to propose that he buy my house in Washington, [laughter] given that confidence.

MR. POOLE. If I’m right, you won’t need me to buy it.#5:

MR. GRAMLICH. Sticker shock question: In the history of the world, has a country ever run a $1 trillion current account deficit?

MS. JOHNSON. I don’t think so. [Laughter]

CHAIRMAN GREENSPAN. Is that your question?

MR. GRAMLICH. Yes. I didn’t say it was heavy! [Laughter]#6:

CHAIRMAN GREENSPAN. I get quoted on everything under the sun that is irrelevant, but that was a really meaningful insight and it got lost! [Laughter]

#7:

CHAIRMAN GREENSPAN. One thing we can be sure of is that the value of the dollar will be worth 100 cents. [Laughter]

#8:

MR. GRAMLICH. What should monetary policy do about bubbles? I was enlisted as a speaker in this session, and I then characterized my views in Gilbert & Sullivan terms as, “Well, never. Oh, hardly ever.” [Laughter]

#9:

MR. GRAMLICH. Imagine what Steve Roach and John Makin would say about that! If I can coin a term, this would be viewed as a Greenspan “shotput.” [Laughter]

#1:

MR. WILCOX. There used to be a view—I’m thinking back to the Brookings 1960s view—of an L-shaped supply curve.

CHAIRMAN GREENSPAN. Well, how about a J? [Laughter]

MR. WILCOX. I’ll give you J. [Laughter]#2:

CHAIRMAN GREENSPAN. So I’d prefer to have poor but clear language [laughter] because we certainly don’t want to convey a message that will bring the long-term forward rates down.

AFLAC Hits Two-Year High

Eddy Elfenbein, January 18th, 2011 at 10:49 amThe stock got as high as $58.48 today although it’s pulled back some.

20 New Economic Records Set Last Year

Eddy Elfenbein, January 18th, 2011 at 10:35 amThe blog Economic Collapse has a great list of 20 records that the economy set last year. Here’s a sample:

#1 An all-time record of 2.87 million U.S. households received a foreclosure filing in 2010.

#2 The number of homes that were actually repossessed reached the 1 million mark for the first time ever during 2010.

#3 The price of gold moved above $1400 an ounce for the first time ever during 2010.

#4 According to the American Bankruptcy Institute, approximately 1.53 million consumer bankruptcy petitions were filed in 2010, which was up 9 percent from 1.41 million in 2009. This was the highest number of personal bankruptcies we have seen since the U.S. Congress substantially tightened U.S. bankruptcy law several years ago.

#5 At one point during 2010, the average time needed to find a job in the United States had risen to an all-time record of 35.2 weeks.

#6 Back in 1970, 25 percent of all jobs in the United States were manufacturing jobs. Today, only 9 percent of the jobs in the United States are manufacturing jobs, which is believed to be a new record low.

#7 The number of Americans working part-time jobs “for economic reasons” was the highest it has been in at least five decades during 2010.

#8 The number of American workers that are so discouraged that they have given up searching for work reached an all-time high near the end of 2010.

#9 Government spending continues to set new all-time records. In fact, at the moment the U.S. government is spending approximately 6.85 million dollars every single minute.

#10 The number of Americans on food stamps surpassed 43 million by the end of 2010. This was a new all-time record, and government officials fully expect the number of Americans enrolled in the program to continue to increase throughout 2011.

Earnings Season Kicks It Up a Notch

Eddy Elfenbein, January 18th, 2011 at 10:25 amToday is when earnings season starts to get serious. Just this morning, we learned that Citigroup’s (C) earnings fell short of expectations (I’m not much of a Citi fan). On the plus side, both Charles Schwab (SCHW) and Comerica (CMA) beat expectations. Shares of Apple (AAPL) are down on Steve Jobs’ health news but they should recover, and hopefully so will Mr. Jobs.

The Buy List is doing well so far today. Gilead Sciences (GILD) is particularly strong. I’m happy to see that AFLAC (AFL) is close to a new 52-week high. Friday was a difficult day for us. While the Buy List did gain for the day, we significantly lagged the market due to our exposure to the healthcare sector. For the day, we made 0.21% which was less than the S&P 500’s 0.74%.

Over the weekend, the New York Times had a good and very thorough article on the challenges facing Johnson & Johnson (JNJ). Last year was a very difficult one for the company due to the multiple recalls. Fortunately, J&J’s business is very diversified so the overall business hasn’t suffered. Still, the dents to their image have taken a toll. The company is very aware of what’s happened and is working hard to improve its image.

Morning News: January 18, 2011

Eddy Elfenbein, January 18th, 2011 at 7:55 amWorld Stocks at High, Euro Jumps on ZEW

Shipping Costs in the Pacific Are Now Negative

Germans Remain Wary Over Boosting Bailout

‘Explosive’ Food Prices the Biggest Risk

Brent Oil Rises, International Energy Agency Sees Gradual Demand Increase

Goldman Fails to See Hype That Derailed Facebook Sale

Apple’s Cook Faces Product Development Challenge, Google

Comerica to Buy Sterling Bancshares for $1 Billion

U.S. Near Approving Comcast’s NBC Deal

Delta Profit Misses Estimates as Costs Rise

Citigroup Set to Post Fourth Quarterly Profit

Blog Network Behind Lolcats And Other Memes Raises $30 Million

Steve Jobs’ Liver Is Worth $22 Billion

Eddy Elfenbein, January 17th, 2011 at 10:35 amApple (AAPL) has announced that their CEO Steve Jobs is taking another leave of absence due to his health. I concur with Paul Kedrosky that the media cover of his health is ghoulish.

Although our markets are closed today, Clusterstock reports that shares of AAPL are down 7% today. That translates to a loss of market value of $22 billion.

Morning News: January 17, 2011

Eddy Elfenbein, January 17th, 2011 at 7:20 amTokyo Shares End Mixed As Falling Asian Bourses Offset Weaker Yen

Orphanides Says Bailout Fund Could Buy Bonds Instead of ECB

Spanish Bond Yields Rise on Syndicated Sale

Yuan Hong Kong Premium Widens on Supply Limits, Bond Sales: China Credit

Egyptian Protester Sets Himself on Fire, And Stocks Dive, As The Tunisian Domino Tumbles

Investors Crave More Strong Bank Results

Crude Oil Slides as Alyeska Prepares to Start Trans Alaska Pipeline System

OPEC Raises 2011 Forecast of Demand for Its Oil as Asian Consumption Grows

Rosneft Deal Brings BP Trove of Untapped Reserves

10,000th Sale Lifts Airbus Past Boeing in 2010

J. Crew Said to Get No Offers to Rival $3 Billion TPG, Green Bid

Howard Lindzon: The Semiconductor Train…MIPS, ATML, ARMH, CRUS with Roy Kaller

The Marshmallow Test

Eddy Elfenbein, January 14th, 2011 at 4:15 pmYep, it’s Friday. Enjoy.

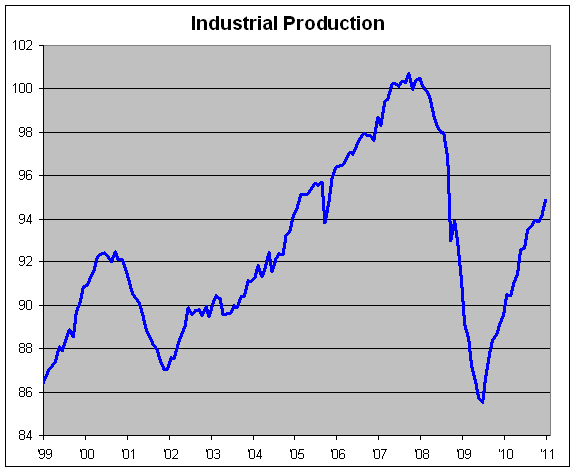

Industrial Production +0.8%

Eddy Elfenbein, January 14th, 2011 at 11:15 amIndustrial production rose in December by the largest amount in five months, providing the economy with solid momentum heading into the new year.

Activity at the nation’s factories, mines and utilities increased 0.8 percent last month, the Federal Reserve said Friday. Industrial production was up in every month but one in 2010.

Overall industrial activity has risen 11 percent since hitting its recession low in June 2009. But it is still 6 percent below its peak reached in September 2007.

Factory production, the biggest slice of industrial output, rose 0.4 percent, the sixth straight monthly increase. Makers of computers and electronic products, clothing and leather, chemicals and other products were among the industries seeing gains. But auto production dipped.

“Manufacturing looks like it is doing its job and moving the economy ahead,” said John Silvia, chief economist at Wells Fargo.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His