Archive for January, 2011

-

JPMorgan Earns $1.12 Per Share

Eddy Elfenbein, January 14th, 2011 at 8:35 amGood quarter for Jamie & Co (JPM).

JPMorgan Chase & Co., the second- biggest U.S. bank by assets, said profit rose 47 percent as the bank cut provisions for future credit-card and real-estate losses by $4.9 billion.

Fourth-quarter net income climbed to $4.83 billion, or $1.12 a share, from $3.28 billion, or 74 cents, in the same period a year earlier and from $4.42 billion, or $1.01, in the third quarter, the New York-based company said today in a statement. The results compared with an average per-share estimate for adjusted earnings of $1 projected by 25 analysts surveyed by Bloomberg.

Hey, every so often I get something right. I had been saying that I expected earnings of at least $1.10 per share.

Let me explain something about banks’ earnings. There’s an odd future-present relationship within a bank’s earnings statement. A bank needs to set aside reserves for its bum loans. The problem is that a bank can only make a guess as to how many of its loans will be bad (or non-performing to keep in jargon).

The bank can either guess too high or it can guess too low. If it knew exactly, it wouldn’t make the loans in the first place. The issue to note is that a guess made today about the future impacts what the bank reports today. When a bank sets aside more money for reserves, that’s money it can’t lend out. For a bank, that’s as critical as it would be for Walmart to take products off their shelves and put them back in the stock room.

If a bank doesn’t set aside enough in reserves, it can be criticized for sacrificing quality for quantity. What’s happening with JPM is the opposite. JPM set aside too much for bank reserves. Since the economy is slowly improving, JPM isn’t draining bank reserves. Now it’s being criticized for artificially inflating its earnings. Bloomberg notes that 40% of JPM’s earnings for the first nine months of 2010 came from dipping into reserves.

I really don’t get these criticisms. It’s just the nature of the game.

JPM’s internal numbers look pretty solid. The fixed-income side is doing well, but it’s nothing outstanding. Profits from investment banking are down. For the quarter, revenue rose by 13%. Fixed-income was decent, but not great. The retail banking and credit card businesses are now in the black. Both divisions reported losses a year ago, hence the lower reserves for losses. Profits for mortgage banking are up 117% from last year. The WSJ notes that “Full-year compensation per employee in investment banking fell 2.4% for all to $369,651 from $378,599 in 2009.”

There’s no dividend increase just yet for JPM. Dimon has said that he wants the dividend to be to between 75 cents and $1 per share. JPM still needs approval from the Fed, but by April, they might be able to raise their dividend.

-

Burton Malkiel on EMT and Index Funds

Eddy Elfenbein, January 14th, 2011 at 8:30 am -

The Financial Panic Was a Government Panic, Too

Eddy Elfenbein, January 14th, 2011 at 8:03 amHere’s one of the questions from last year’s Bespoke roundtable followed by my answer:

2) What do you believe are the most important lessons to be learned from the 08/09 financial crisis?

When market participants panic, governments panic as well. Not a new lesson but a good example of an old one.

Yesterday, the Inspector General’s office of the TARP (known as SIGTARP) released a fascinating report on the government’s action to prevent Citigroup from going under.

Here are the official SIGTARP report and part of an article from the AP:

The government’s $45 billion bailout of Citigroup met the goal of restoring the market’s confidence in the nation’s third-largest bank in the wake of the financial crisis and limited taxpayers’ risk, a new watchdog report says.

The report was issued Thursday by the office of Neil Barofsky, the special inspector general for the $700 billion bailout of the financial industry and automakers. It found, however, that the government’s decision to aid Citigroup in the fall of 2008 wasn’t made coherently, and seemed to be based on “gut instinct” and “fear of the unknown” rather than objective criteria.

Also, the report says that by bailing out Citigroup, the government encouraged high-risk behavior by signaling that big financial institutions would be protected from failing.

The report makes it clear that Citigroup was very close to going under. The government pushed for a management shake-up that didn’t come…and has never come.

I think this report severely undermines two of the current narratives. One is the conspiratorial narrative: that the government and the bankers knew exactly what they were doing. They didn’t. They made up their plans as they went along. The report criticizes that “strikingly ad hoc” nature of the process.

The other isn’t a narrative but is the belief that government can serve as a rational actor to prevent the irrational exuberance of the private sector. In reality, the government was just as clueless as everyone else was.

Ultimately, the government got lucky. Taxpayers made a nice $12 billion profit but the public’s investment in Citi was hardly a sober-minded affair.

My guess, and it’s just a guess, is that the genius of the TARP program wasn’t that it bought preferred shares but that instead, it bought time. Shares of Citi didn’t bottom out until the following March. I think the key is that the TED spread gradually compressed which took some pressure off of Citi and other banks. Next time we may not be so lucky.

-

CWS Market Review – January 14, 2011

Eddy Elfenbein, January 14th, 2011 at 7:37 amFourth-quarter earnings season has begun! This morning, our first Buy List stock reported earnings. As I said before, I expected JPMorgan Chase ($JPM) to soundly beat expectations and that’s exactly what happened.

The bank earned $1.12 per share. Wall Street was expecting 99 cents per share. JPM has been greatly helped in recent quarters by having smaller reserves for its loan losses. I was really impressed to see turnarounds in JPM’s credit card and retail banking divisions. Both divisions were money-losers a year ago. The improving economy is definitely helping their bottom line and this is why they have smaller loan reserves.

JPM still needs to get approval from the Fed to raise their dividend, but I think an increase is coming soon. Jamie Dimon has said that he’d like to pay out between 75 cents and $1 per share. My guess is that we can expect to see a dividend increase by April.

As I write this, the stock is up about 1.5% for the day. Shares of JPMorgan Chase are an excellent buy up to $47 per share.

I sent you an email earlier this week to highlight the good news from Stryker ($SYK) and Nicholas Financial ($NICK). I’m happy to see that Stryker is still holding above $57.50. The stock popped above $58 earlier this week on its strong guidance. Nicholas Financial is also finding a new home between $11.50 and $12 per share. Both stocks are excellent buys.

We also had more good economic news today. The Federal Reserve reported that industrial production rose by 0.8% in December. That’s the biggest increase in five months. On top of that, the increase for November was revised up to 0.3%. I think this explains much of the strength we’ve seen in cyclical stocks. Ford Motor (F), for example, is already a 10% winner for us this year.

A few of our other stocks are doing well for us. Both Leucadia ($LUK) and Fiserv ($FISV) hit new 52-week highs today.

There’s not much else to say so I’ll keep it brief. The market has been very good to investors in high-quality shares. Through Thursday, the Buy List was up 3.89% for the year compared with 2.08% for the S&P 500.

This is an oddly perfect investing moment for us. Volatility has plunged. The S&P 500 has stayed above its 10-day moving average for six-straight weeks. That’s one of the longest runs in history. This won’t last forever, so I encourage investors to play it safe and focus on the high-quality names on the Buy List. Stocks like AFLAC ($AFL), Wright Express ($WXS), Gilead ($GILD) and Reynolds American ($RAI) continue to look very strong.

Volatility will probably pick up as more earnings are released. I don’t yet know the dates for most of our Buy List companies’ earnings reports, but the reports will likely begin the week after next. I’ll have complete coverage on the blog.

Remember that even strong stocks can fall after strong earnings announcements so please be well-diversified.

That’s all for now. I’ll have more market analysis for you in the next issue of CWS Market Review!

Best – Eddy

-

Morning News: January 14, 2011

Eddy Elfenbein, January 14th, 2011 at 7:34 amCan Europe Be Saved? (When he’s not calling innocent people murderers, Paul Krugman writes very well on economics.)

China Raises Banks’ Required Reserves Again

China, Japan, And The Sudan Proxy Playground

Goldman Says S&P 500 to Gain 18%, Forecasts `Decent’ Year for Treasuries

Bernanke Says Joblessness to Linger Despite Growth

Uncle Sam Wants His AAA Rating

Stock Index Futures Dip; Eyes on Intel

Citigroup Was On The Verge Of Failure, New Report Finds; Rescue Was Based On ‘Gut Instinct’

JPMorgan’s Fourth Quarter Profits Rise 47% to $4.8 Billion

Marathon Oil Credit-Default Swaps Surge on Risk Tied to Spinoff Proposal

-

30 Straight Days Above the 10-DMA

Eddy Elfenbein, January 13th, 2011 at 1:24 pmHere’s a fascinating factoid I found via Sentiment Trader via ZeroHedge via Pragmatic Capitalist: The S&P 500 has closed above its 10-Day Moving Average for the last 30-straight trading sessions.

That’s the longest streak since a 42-day run from February to April 2010. The longest I can find (my records go back to the 1930s) is a 59-day streak from November 1970 to February 1971.

We’re about 15 points above the 10-DMA which means that this run may have some room to go, especially if volatility stays so low.

Part of this, I think, is due to the market’s ultra-low volatility combined with a slow-motion rally. The S&P 500 has closed higher for 21 of the last 30 days and for 43 of the last 67 days.

-

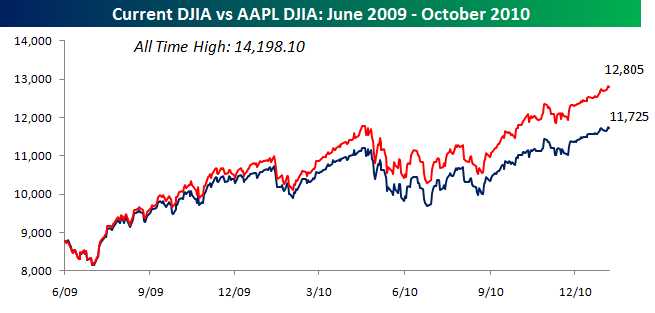

What If Apple Were In the Dow?

Eddy Elfenbein, January 13th, 2011 at 11:31 amIn June 2009, the gatekeepers of the Dow Jones Industrial Average decided to put Cisco (CSCO) in the index in place of General Motors (GM). The guys at Bespoke wonder what would have happened if they had chosen Apple (AAPL) instead. The difference: 1,000 more points.

-

FBR’s Target for AFL = $69

Eddy Elfenbein, January 13th, 2011 at 11:00 amI thought Aflac made it pretty clear that they were going to survive Europe’s troubles, but apparently FBR was late to get the word:

Aflac is well positioned to weather credit losses in Europe and investors should take advantage of the discounted stock of the disability insure, an analyst said Thursday.

FBR Capital Markets analyst Randy Binner upgraded Aflac’s shares to “Outperform” from “Market Perform,” and lifted the price target to $69 from $59. Binner said the stock has lagged its peer group by 14 percent in the last three months, likely on heightened concerns over European sovereign debt.

Aflac’s exposure to debt holdings from Portugal, Ireland, Italy, Greece and Spain total $3.4 billion, or 34 percent of equity. Binner said the company has more than enough cash on hand, about $1.3 billion, to cover losses in even the most stressed scenarios.

Additionally, the analyst still expects Aflac to buy back between 6 million and 12 million shares over the next two years, despite European losses.

-

Morning News: January 13, 2011

Eddy Elfenbein, January 13th, 2011 at 7:41 amStock Futures Flat Ahead of Jobless Data, Intel Results

Trichet Faces `Annus Horribilis’ as Crisis Tests European Central Bank

China Expands Yuan’s Role to Overseas Investment

Indian Oil Margins May Fall on Rising Crude Oil Prices

Another Asian Economic Power Just Hiked Rates To Fight Inflation

Beige Book Shows Increased Activity

1 Million Homes Repossessed in 2010

AIG Readies for Recapitalization

Auto Rebound Pays Dividend to Ford, GM Work Forces

In Nielsen’s Public Offering, a Bellwether for Buyout Firms

Paul Kedrosky: The Debt Ceiling and Gravity

-

Maria Bartiromo Interviews Jamie Dimon

Eddy Elfenbein, January 12th, 2011 at 4:09 pmIt’s a good interview. (One nitpick: He says he wants to reinstate the dividend. Um, Jamie…you already have one.)

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His