Archive for February, 2011

-

CWS Market Review – February 25, 2011

Eddy Elfenbein, February 25th, 2011 at 7:47 amIn last week’s e-letter, I said I was concerned that the stock market’s rally looked overextended. Unfortunately, I was spot on. On Tuesday, Wall Street gave us our biggest one-day sell-off in six months-and that was just the beginning. The market continued to fall on Wednesday and Thursday. The $VIX, which is the Volatility Index, spiked to its highest level since November.

What’s also troubling is that oil has soared due to the political unrest in the Middle East. If you’re a Middle Eastern tyrant, your job security ain’t looking too hot right about now. The problem with higher gasoline prices is that it almost acts like a regressive tax on American consumers. The major difference is that those funds generally leave the country instead of heading towards the U.S. Treasury.

I continue to believe that stock returns won’t be very impressive this spring. A flattish market is the safest assumption. For the entire year, I continue to like the market a lot. Profits have been very strong and the rout in the bond market has cooled off. The yield on the 10-year Treasury is back below 3.5% which isn’t much competition to a market that just completed its fastest double since the Depression. I think it’s very possible that the S&P 500 can break 1,500 before the year is over. Make no mistake; that’s a very aggressive forecast. On top of that, our stocks are ahead of the market for the year so far, and I expect that lead to grow. We already have five double-digit winners on the Buy List.

Today I want to revisit an issue I discussed before: the relative downturn of cyclical stocks. I thought we had already seen the peak in cyclicals a few weeks ago, but it turned out to be a head-fake as cyclicals gave us one last surge. Since February 11th, cyclicals have been trailing the market and they’ve faced a lot of pain this week. Since last Thursday, the Morgan Stanley Cyclical Index ($CYC) is down over 6.2%. That’s equivalent to 750 points on the Dow which is about three times what the Dow has actually lost.

You may be curious as to why I pay so much attention to the relative performance of cyclical stocks. The reason is it tells us a lot of what the market is thinking. Also, cyclical peaks and valleys tend to be very pronounced. Once a trend is established, it’s often quite strong and will last for a few years. If you want an example, the Dow would have to be around 24,000 today if it had kept pace with the CYC since March 2009.

Many of the stocks on the Buy List are counter-cyclicals (also known as “defensive stocks”). These are stocks from sectors like healthcare, utilities and consumer staples. The common characteristic is that defensive stocks don’t see their businesses suffer much during an economic downturn. Consumers don’t cut back as much on their food or medical costs (or cigarettes-thank you, RAI). I think it’s very likely that these sectors are due for a long stretch of outperformance.

The other fact to keep in mind is that cyclical stocks tend to outperform the market when the market itself is rising. This is sort of a double-whammy effect and that’s exactly what we’ve seen over the past two years. Conversely, cyclicals tend to underperform during falling markets, though this is more of a generality than an iron rule. That’s why I think defensive stocks will prosper this year even though the market will also do well, but you certainly shouldn’t expect the S&P 500 to double again over the next two years.

Now let’s look at some individual stocks. One of our healthcare stocks, Medtronic ($MDT), reported earnings this week. In last week’s issue of CWS Market Review, I said to expect earnings of 86 cents per share which was two cents more than Wall Street’s consensus. Once again, I was spot on.

My take is that Medtronic is a very good buy, but I should warn you that the company is currently working its way through a rough patch. Stocks that turn out to be good buys are often seen as damaged goods on Wall Street. That’s why their share price is low and that’s how Medtronic looks today. The company lowered its full-year guidance twice last year. No doubt, that’s spooked a lot of folks. Still, the company is making a good profit and the lowered guidance isn’t as bad as it may appear.

With the earnings report, Medtronic narrowed its full-year guidance to a range between $3.38 and $3.40 per share. Since MDT’s fiscal year ends in April, that’s equivalent to a Q4 forecast of 91 to 93 cents per share. (My take: That’s probably a wee bit too low.)

Let’s bust out some math: In August MDT lowered its 2011 EPS guidance to a range of $3.40 to $3.48 from $3.45 to $3.55. Then in November, it was brought down to $3.38 to $3.44; and now it’s $3.38 to $3.40. This means that MDT will probably wind up missing the low end of the original forecast by a few pennies, yet the stock has badly lagged the market. Medtronic is a strong buy below $40 per share.

Outside of Medtronic, some other Buy List stocks that look good right now include Moog ($MOG-A), Stryker (SYK) and Oracle ($ORCL). Oracle is due to report earnings in about a month and I think we’ll see some very strong numbers. I also want to note that shares of Ford ($F) continue to plunge lower. Ford is a risky stock but it’s one the few cyclicals I like.

Next week will be a fairly quiet time for earnings news, although Leucadia ($LUK) may report. The big news event will occur next Friday when the Labor Department releases the jobs report for February. Almost all of the jobs reports have been terrible, so it will be interesting to see if there’s a break in that trend.

I’m also keeping a close eye on the market’s 50-day moving average. This is one of those simple rules that has a pretty good track record. As long as the S&P 500 trades above its average close for the previous 50 days, the market tends to do well. When it breaks below the 50-DMA, the index does much worse. It’s that simple, but the 50-DMA has a much better track record than folks who are paid much more than it have. Despite the recent sell-off, we’re still holding just above the 50-DMA. This could change very soon.

That’s all for now. Be sure to keep visiting the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

Best – Eddy

-

S&P 500 Earnings for 2010 = $83.78

Eddy Elfenbein, February 24th, 2011 at 6:38 pmThe numbers are almost complete. According to the latest figures, the S&P 500 earned $83.78 for 2010.

I bring this up because that number would have been considered insanely bullish a few months ago. In June 2009, I noted that Wall Street was expecting earnings of $73.56. One commenter at Seeking Alpha wrote “There is No Way the S&P will earn $70+ in 2010.”

In May 2009, David Rosenberg had an S&P 500 target of 600 to 840 based on earnings of $50 to $70. In January of 2010, the bears were ready to mock the bullish forecasts of Wall Street which turned out to be too low.

I point this out because the perma-bears are so rarely held accountable.

-

Three Down Days in a Row

Eddy Elfenbein, February 24th, 2011 at 4:40 pmSorry for the lack of posting today; I had a few technical issues to address.

Unfortunately, Wall Street made it three losses in a row today. The S&P 500 dropped 0.10% to 1,306.10. This comes on the heels of yesterday’s 0.61% drop and Tuesday’s 2.05% rout.

The good news is that our Buy List swam against the tide and rallied for a 0.32% gain. Abbott Labs (ABT) had a good day thanks to the reversal of a $1.8 billion patent infringement lawsuit. Another one of our Buy List stocks, Johnson & Johnson (JNJ), was one of the plaintiffs but their stock didn’t suffer much. Gilead Sciences (GILD) and Leucadia (LUK) also had good days.

I’m still a little surprised that Medtonic (MDT) is hanging below $40 per share. Despite the troubles from last year, the company is still churning out the profits, and we need to remember that they beat expectations. If you have free cash you’re looking to deploy, MDT is a solid value.

I should also note that, once again, cyclical stocks lagged the market today. The CYC dropped 0.50% which is 40 basis points more than the S&P 500.

-

Morning News: February 24, 2011

Eddy Elfenbein, February 24th, 2011 at 7:42 amOil Keeps Rally Going, Weighing on Global Markets

Why the Disruption of Libyan Oil Has Led to a Price Spike

Solid Q4 Growth Puts Germany on Firm Footing for 2011

Geithner Says U.S. Financial System Now Stronger Than Before Recession Hit

Foreclosures Make Up 26% of Home Sales

Durable Goods Orders in U.S. Probably Rose in January

Wheat Resumes Plunge as African Unrest Drives Away Speculators

Gold Hits 7-Week Top on Libya Unrest, Market Jitters

JPMorgan Raises $1.2 Billion To Invest In Twitter And Facebook

Brazil Cellular Leader Vivo 4Q Net Soars On Better Operational Performance

Dish 4Q Net Up 41% Though Co Loses Subscribers; EchoStar Swings To Profit

Sears 4Q Profit Falls 13% On Weakness At Namesake Brand >SHLD

Leigh Drogen: Dictators Don’t Have Perfect Information

James Altucher: 10 Unusual Things I Didn’t Know About Steve Jobs

-

Strategist: S&P to Hit 1,550 This Year

Eddy Elfenbein, February 23rd, 2011 at 9:49 pm -

Double Top in Cyclicals?

Eddy Elfenbein, February 23rd, 2011 at 11:15 amThe stock market is getting knocked again today, but the pain isn’t evenly spread out. Who’s up for another look at the relative strength of cyclicals? Great–me, too!

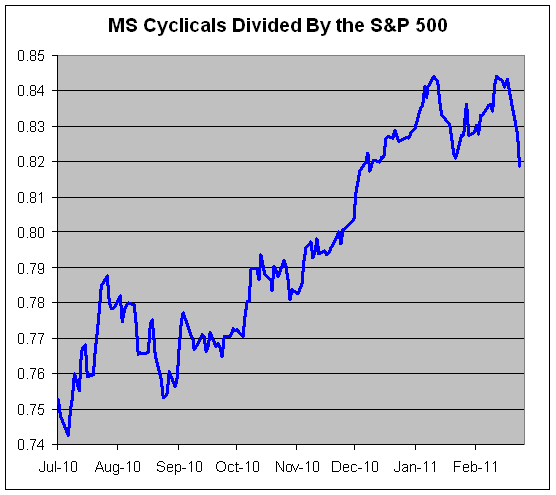

As long-term readers know, one of my favorite metrics to follow is the Morgan Stanley Cylical Index (^CYC) divided by the S&P 500 (^SPX). This is far from a comprehensive analysis but it is a quick-and-dirty look at the “mind of the market.”

Since late August, the market’s rally has been disproportionally powered by cyclical stocks. In fact, the ratio of the CYC to the S&P 500 reached an all-time high on February 11th (my data goes back to 1978).

The ratio hit a previous peak on January 10th, and soon after, cyclicals dropped off sharply. I quickly jumped on this and thought it was the end of the cycle. Wrong! The ratio soon rallied and peaked on February 11th, just a hair above the level for January 10th (0.8442 to 0.8441).

The CYC is down again today (although many energy names are up). If today’s numbers hold up, the ratio will close below the low made on January 21st.

The reason these cycles are so important is that once they get going, they often last for a few years. Put it this way: if the Dow had kept pace with the CYC since the low from two years ago, today the Dow would be over 24,000 today.

-

$60 For Every Man, Woman and Child

Eddy Elfenbein, February 23rd, 2011 at 7:50 amWalmart (WMT) released its earnings report yesterday. I’m always astounded by the size of this company. For 2010, Walmart had sales of $418.52 billion. That works out to an average of $1.14 billion in sales every day of the year—or nearly $50 million every hour of the day. Another way to think about it is that it’s equal to roughly $60 in sales for every man, woman and child on planet earth.

Despite what many critics may think, Walmart’s profit margins are very small. For 2010, Walmart’s gross margins worked out to 25.3%.

Gross margin refers to the profit compared to the variable cost of each item. If we go down another level to operating profit, which includes fixed costs, Walmart’s profit is just over 6%. Then when we get to post-tax net income, Walmart’s profit margin is just 4%.

As impressive as Walmart’s numbers are, ExxonMobil (XOM) will probably top them this year. The current consensus is that XOM will have revenue of $460 billion this year.

-

Morning News: February 23, 2011

Eddy Elfenbein, February 23rd, 2011 at 7:47 amPound Rises After BOE Minutes Reveal 6-To-3 Split Vote

Oil Rises on Libya Turmoil; Euro, Pound Rally, Stocks Decline

South Korea Sanctions Deutsche Unit for Market Manipulation

ECB Rejects EU Call to Become Ratings Provider

HK Government To Sell HK$5 Billion-HK$10 Billion Inflation-Linked Bonds

Nasdaq Mulls NYSE Bid in Exchange Deal Dash

Bank Closings Tilt Toward Poor Areas

HP Shares Plunge as Sales, Outlook Lag Street

Toll Brothers Reports First-Quarter Profit as Luxury-Home Demand Revives

Holly to Pay $2.9 Billion for Frontier Oil in All-Stock Deal

Best Buy Shuts China Stores to Focus on More Profitable Brand

Danish Maersk Returned to Profit in 2010 as Container Market Grew

James Altucher on Pundit Review Radio

Paul Kedrosky: How Institutional Investors Destabilize Commodity Markets

-

Ouch! Dow Drops 178 Points

Eddy Elfenbein, February 22nd, 2011 at 5:03 pmServes me right for boasting. Right after I tell you how well the Buy List has been doing for the year, we get smacked down today.

This was an ugly day of trading. All told, the S&P 500 dropped 2.05% making it the market’s worst day since August 11, 2010. Plus, oil gained more than 6% on tensions in the Middle East. Some are now talking about oil hitting $200 per barrel.

The S&P 500 is still holding above its 50-DMA. This was the 119th day in a row that the index has been above its 50-DMA. That’s the 10th-longest run since 1932. Tomorrow we’ll have a chance to tie the ninth-best streak which happened 40 years ago.

The Buy List dropped 2.25% today. Leucadia National (LUK) was especially hard-hit as it lost 5.93%. LUK owns a stake in Fortescue Metals Group and that company lost a court ruling last week. JPMorgan Chase (JPM) and Wright Express (WXS) were also hit hard.

-

The S&P 500 Is Still Below 16 Times Earnings

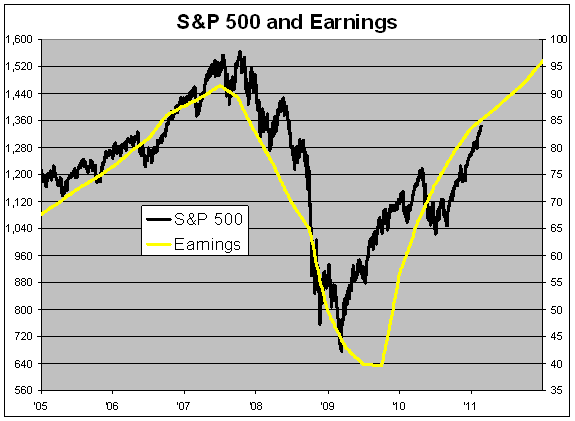

Eddy Elfenbein, February 22nd, 2011 at 2:18 pmHere’s a look at the S&P 500 and its earnings. The index is the black line and it follows the left scale. The trailing four-quarter operating earnings is the gold line and it follows the right scale. The two lines are scaled at a ratio of 16-to-1 so whenever the lines cross, the P/E Ratio is exactly 16.

The black line has almost caught up to the gold line. The market hasn’t had its P/E Ratio at 16 since last May. The Double Dip hysteria of last summer brought the S&P 500 down below 1,030 and the P/E Ratio got as low as 13.62 which was a 20-year low.

There’s nothing magical about 16. It seems to be the number that the market most likes to track. The future part of the earnings line is Wall Street’s projection.

For 2011, Wall Street sees the S&P 500 earning 96.14. At a 16 P/E Ratio that means the market would be at 1,538.24 by year’s end. That’s a 14.5% rise from Friday’s close.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His