Archive for February, 2011

-

Bernanke’s Opening Statement

Eddy Elfenbein, February 9th, 2011 at 10:10 pm -

AOL Sheds $315 Million

Eddy Elfenbein, February 9th, 2011 at 10:08 pmHere’s an interesting judgment from the market. AOL bought the Huffington Post for $315 million. Then AOL’s market value dropped by exactly…$315 million.

Since Feb. 1, the price of AOL shares has dropped from $23.85 to $20.89 at yesterday’s close.

With 106.7 million shares outstanding, that means AOL has shed $315 million in value over the last five trading days — which happens to be exactly the same price AOL agreed to pay to acquire HuffPo.

-

Stocks to Watch

Eddy Elfenbein, February 9th, 2011 at 2:38 pmHere are some stocks that I like to keep an eye on. All of these are very strong companies and all are former members of the Buy List. The only thing I have against them is that they’re not cheaper.

I’ve listed each stock’s name, symbol, price as of earlier today, earnings estimate for 2011 and 2012, the 5-year projected earnings growth rate and the P/E Ratio based on 2012’s earnings. For VAR, DCI and FDS, I extrapolated what earnings would be for the calendar year to make the numbers consistent.

Company Symbol Price 2011 Est 2012 Est Growth Rate Forward P/E SEI Investments SEIC $23.47 $1.30 $1.49 15.87 15.75 FactSet Research Systems FDS $103.35 $3.77 $4.51 14.85 22.92 Danaher Corporation DHR $49.75 $2.69 $3.02 16.09 16.47 Donaldson Company DCI $59.79 $2.87 $3.29 13.15 18.17 Expeditors Intl of Washington EXPD $51.28 $1.84 $2.13 14.37 24.08 Amphenol Corporation APH $57.18 $3.08 $3.39 11.65 16.87 Cognizant Technology Solutions CTSH $74.67 $2.71 $3.29 20.09 22.70 Varian Medical Systems VAR $68.47 $3.59 $4.02 15.62 17.03 -

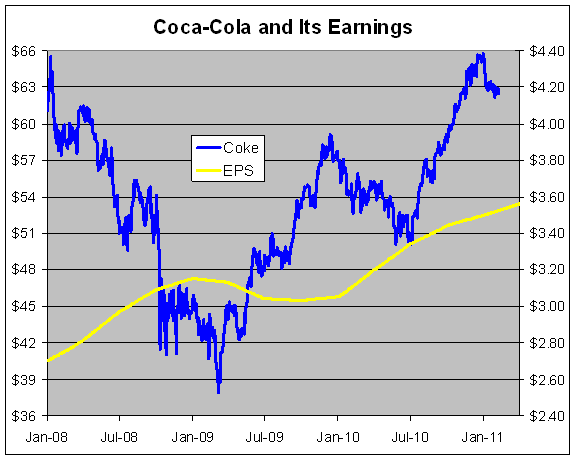

Coke Earns 72 Cents Per Share

Eddy Elfenbein, February 9th, 2011 at 11:59 amCoca-Cola (KO) reported Q4 earnings today of 72 cents per share which matched expectations. I like Coke a lot and the stock has had a very nice run since last summer. Still, I think the shares are a bit rich.

The P/E Ratio went from being 37% less than the market in mid-2009 to more than 25% over the market today. I’m staying away from shares of KO.

-

Updated CWS Buy List Earnings Calendar

Eddy Elfenbein, February 9th, 2011 at 11:06 amCompany Symbol Date EPS Est EPS JPMorgan Chase JPM 14-Jan $0.99 $1.12 Gilead Sciences GILD 25-Jan $0.94 $0.95 Johnson & Johnson JNJ 25-Jan $1.03 $1.03 Stryker SYK 25-Jan $0.91 $0.93 Abbott Laboratories ABT 26-Jan $1.29 $1.30 Deluxe Corp. DLX 27-Jan $0.71 $0.78 Nicholas Financial NICK 27-Jan n/a $0.38 Ford Motor F 28-Jan $0.48 $0.30 Moog MOG-A 31-Jan $0.63 $0.73 AFLAC AFL 1-Feb $1.35 $1.33 Fiserv FISV 3-Feb $1.07 $1.06 Reynolds American RAI 3-Feb $0.61 $0.60 Sysco SYY 7-Feb $0.47 $0.44 Becton, Dickinson BDX 8-Feb $1.29 $1.28 Wright Express WXS 10-Feb $0.71 -

Bernanke To Tell Congress Budget Needs Balancing

Eddy Elfenbein, February 9th, 2011 at 10:52 amToday will be a day for sound bites. Ben Bernanke will be testifying before Congress on the budget. This will be the first time he goes before the new GOP-led Congress and he’s not terribly popular among many Republicans.

Of course, I don’t know exactly what Bernanke has to tell Congress about the budget that a simple calculator couldn’t tell. We’re spending a great deal more than what we take in. When we do that, the debt goes up. When we stop doing that, the debt also stops growing. Magic!

There’s been a lot of media coverage of the lawsuit brought by the Madoff trustees against JPMorgan Chase (JPM) for being complicit in the Ponzi scheme. I haven’t commented on it yet for two reasons. One is that the media coverage has been all one-way, focusing on the trustees’ complaint. The second is that this strongly sounds like a case of shifting the blame.

Trustees are people whom you trust. With Madoff, they failed miserably. I don’t see how that’s JPM’s fault. I’m not a lawyer so I don’t know exactly what fiduciary responsibilities a bank has, but Madoff’s aim was to mislead people. I don’t see how it’s JPM’s duty to sleuth him out.

The second-largest U.S. bank said court-appointed trustee Irving Picard is exceeding his power by suing in bankruptcy court, where a judge rather than a jury would decide the case.

“The trustee’s massive damages action against JPMorgan bears no resemblance to a typical lawsuit commenced by a bankruptcy trustee,” JPMorgan’s lawyers said in a court filing late Tuesday.

“In substance,” the bank said, “the trustee is trying to pursue an enormous back-door class action.”

A spokesman for Picard did not immediately respond to a request for a comment.

JPMorgan asked U.S. Bankruptcy Judge Burton Lifland, who oversees the Madoff proceedings, to move Picard’s lawsuit to federal district court, where it can demand a jury trial.

In court papers unsealed on February 3, Picard accused JPMorgan of having significant doubts about Madoff but silently acquiescing in his fraud, hoping to preserve its own investments and a more than 20-year business relationship.

JPMorgan has said it did not know about or assist in the estimated $65 billion Ponzi scheme.

The yield on the 10-year bond has risen in six of the last seven trading sessions. During that time, the yield has climbed from 3.33% on January 28 to 3.72% yesterday. Mirroring that move, the S&P 500 has rallied for six of the last seven days. The only decline was a slight one on February 2nd.

The trend continues to be out of bonds and into stocks.

-

Morning News: February 9, 2011

Eddy Elfenbein, February 9th, 2011 at 7:30 amLondon Stock Exchange Ties Transatlantic Knot With Canada’s TMX Group

China Yuan Trades Near 17-Year High After PBOC Rate Increase

German Uber-Hawk Axel Weber Won’t Replace Trichet As ECB Chief

AOC, Bridgestone, NEC, Nissan, Pioneer: Japan Equity Preview

Emerging Stocks, U.S. Index Futures Decline as Wheat Advances

Fannie, Freddie Could Be Phased Out Under Treasury Housing Plan

Precious Metals: Platinum, Palladium Hit Records; Gold Ebbs

UBS Posts First Annual Profit Since Crisis

Disney Parks Help Drive Gain in Profit

Norwegian Oil Giant Statoil Falls 3% After 4Q Results Disappoint

SAC, Citigroup, Galleon, Airgas, UBS in Court News

Joshua Brown: Research or Insider Trading? A Guide (Reprise)

-

The CNBC Effect

Eddy Elfenbein, February 8th, 2011 at 3:26 pmAn academic paper looks at what happens to a stock after the CEO appears on CNBC. Basically, the stock pops then gradually gives it back.

This paper investigates whether media attention systematically affects stock prices by analyzing price and volume reactions to 6,937 CEO interviews that were broadcast on CNBC between 1997 and 2006. We document a significant positive abnormal return of 162 basis points accompanied by abnormally high trading volume over the [-2, 0] trading day window. After the interviews, prices exhibit strong reversion; over the following ten trading days, the cumulative abnormal return is negative 108 basis points. The pattern is robust even after controlling for the announcements of major corporate events and surrounding news articles, and is larger in magnitude if the interview is accompanied by larger viewership. Furthermore, we find evidence that enthusiastic individual investors are more likely to trade based on CNBC interviews that are neither confounded by any events nor by other news articles. Lastly, we find that more attention drawing interviews are associated with higher short-selling volume, which suggests that rational utility maximizing investors take advantage of the regular pricing pattern related to the media attention.

-

John Paulson Made $5 Billion Last Year

Eddy Elfenbein, February 8th, 2011 at 1:11 pmHow’d you do last year? John Paulson made a cool $5 billion in 2010. Gregory Zuckerman explains how he did it:

So John Paulson made $5 billion –- for himself -– during 2010. A number of Journal readers have contacted us, wanting more specifics on how he pulled off such huge gains. Still more readers want to know: Will this golden touch continue?

First, a fuller explanation of the $5 billion personal gains. About $1 billion came from the 20% performance fee that Paulson & Co. reaped from the approximately $5 billion the hedge-fund firm generated for clients in 2010, as well as from management fees charged to clients of his $36 billion firm.

What about Paulson’s remaining $4 billion? Keep in mind that Paulson began 2010 with about $10 billion of personal investments in his hedge funds, his investors say. Those holdings rose about 40%, or $4 billion, his investors say.

Read the whole thing.

-

U.S. Takes Out Debt-Consolidation Loan

Eddy Elfenbein, February 8th, 2011 at 11:18 am

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His