Archive for February, 2011

-

Michael Lewis on Ireland

Eddy Elfenbein, February 4th, 2011 at 3:34 pmHere’s another great piece by Michael Lewis (warning: it clocks in at 13,000 words). This time, he looks at Ireland.

Here’s my favorite line:

Across Europe just now men who thought their title was “minister of finance” have woken up to the idea that their job is actually government bond salesman.

-

Unemployment Drops to 9% in January

Eddy Elfenbein, February 4th, 2011 at 9:05 amHere’s a rather strange-sounding jobs report: The jobless rate dropped from 9.4% in December to 9% in January, yet the economy only created 50,000 jobs last month. The private sector added 50,000 jobs and the public sector shed 14,000.

The reason for the big decline in the rate is that fewer people are looking for jobs. Economists are also blaming the snow which sounds like a pretty lame excuse. The construction sector lost 32,000 jobs in January.

If that’s not bad enough, the government did its benchmark revisions this past month, so the numbers for 2010 were even worse than we originally expected.

-

CWS Market Review – February 4, 2011

Eddy Elfenbein, February 4th, 2011 at 7:59 amLast week was a mixed week for our Buy List. Ford ($F) was hurt by its weak earnings last Friday, but Moog ($MOG-A) came out with a very strong report that beat expectations by 10 cents per share. AFLAC ($AFL), Fiserv ($FISV) and Reynolds American ($RAI) all fell just shy of expectations, but all three gave very good guidance for the year ahead. I still like all of these stocks and I fault Ford for not communicating its business outlook better with the public.

We’re heading to the back end of earnings season and this is when we often see smaller companies report since the “big boys” usually report at the beginning of the season.

The latest numbers show that 297 companies in the S&P 500 have reported so far. On the whole, the reports have been quite good. A total of 243 companies have seen higher earnings while 50 have seen lower earnings and four have remained unchanged. Earnings are tracked to hit $22.91 (that’s in terms relative to the S&P 500 index) which is a nice 36.37% increase over the fourth quarter of 2009. No matter how you slice it, that’s very strong growth.

Considering earnings compared with expectations, a total of 70.7% companies have beaten expectations, 21.8% have fallen short of expectations and 7.5% have gotten it right in the clown’s mouth.

Let’s break down the numbers some more. Wall Street currently expects full-year 2011 earnings of 95.84 for the S&P 500. Going by Thursday’s close, those figures translate to a forward P/E Ratio of 13.64. If you invert that, you get an earnings yield of 7.33% which easily beats just about any bond you’ll find.

For comparison, Moody’s index of bonds rated BAA is currently yielding 6.14% which is a good deal less than you can get in stocks. So stocks continue to be a good buy compared with bonds. In fact, “out of bonds and into stocks” has been the major trend over the past few months.

I expect to see Wall Street raise its full-year forecasts but not by much. The Street currently expects 2012 earnings of 106.17 but I should caution you that that is a very preliminary estimate.

There will certainly be bumps along the way, but I also expect to see more gains for the stock market. I think the S&P 500 can reasonably hit 1500 by the end of the year. (That’s a 14.8% gain in less than 11 months.)

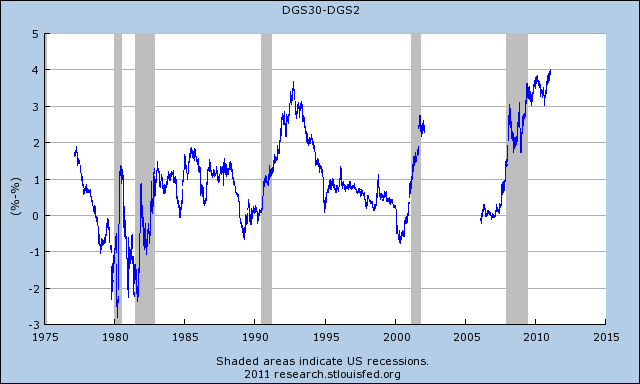

The other reason why I like equities is that the yield curve continues to be very wide. The steepness of the yield curve is one of our best “secret predictors” of the stock market. The difference between the yield on the two-year Treasury and the 30-year Treasury just hit an all-time high of 400 basis points. This means that interest rates are expected to rise, but not for a good long time.

The lesson of history is very clear: Wall Street loves cheap money. The major downside is that Wall Street hates the inevitable consequences of cheap money. But using the yield curve as our guide, we can see that any trouble is still a way off.

A few years ago I ran the numbers on how the stock market reacts to the yield curve. I found that from 1962 to 2007, all the stock market’s gains have come when the spread between the 90-day T-bill and the 10-year T-bond is 65 or more basis points. Today that spread stands at 340 basis points.

For this earnings season, we have three more reports ahead of us. Don’t hold me to these dates, but I expect Sysco ($SYY) to report on Monday, Becton Dickinson ($BDX) on Tuesday and Wright Express ($WXS) on Thursday. I believe that WXS is the best candidate for an earnings beat. The other two stocks rarely beat or miss estimates by much so I’m not expecting any surprises there.

I still like all the stocks on the Buy List but I’ll give you a few names that are especially good buys right now. Nicholas Financial ($NICK) had a great earnings report. On Tuesday, NICK got as high as $12.98 per share. I wouldn’t be surprised if NICK earned as much as $1.50 this calendar year.

Ford ($F) got knocked around this past week but I fault the company for poor communication. The Ford story still holds and the stock is a little cheaper now. Frankly, the amount of selling surprised me. For now, Ford seems to have a floor of $15 per share. Any new position under $16 is a smart move.

I think Oracle ($ORCL) can be a $40 stock before the end of the year.

If you like dividends, Reynolds American ($RAI) is still as solid as ever. The stock now yields about 6.1%. The shares are off about $2 in the last month even though they missed earnings by one penny per share.

JPMorgan Chase ($JPM) hasn’t done much since it creamed Wall Street’s forecast. I think JPM can make a run at $50 very soon, and a big dividend hike should be coming by April.

In last week’s e-letter, I said that I wasn’t too worried if AFLAC ($AFL) were to miss earnings by a penny or two and that I was more concerned with their future earnings guidance. Well, maybe I was on to something. The company did indeed miss Wall Street’s EPS forecast by two cents ($1.33 versus $1.35) and they gave us decent full-year guidance. AFLAC now sees 2011 earnings coming in at the low end of their range of $5.97 to $6.19 per share. Despite the earnings miss, AFL is an excellent buy.

That’s all for now. Be sure to keep visiting the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

Best – Eddy

-

Morning News: February 4, 2011

Eddy Elfenbein, February 4th, 2011 at 7:57 amOil Climbs, Heads for Second Week of Gains, on Economic Optimism

Asian Shares End Higher; Merger Talks Boost Japan Steel Plays

Merkel Turns Crisis into Opportunity to Reshape Euro Zone

In Asia, Hello to Faster Trades and Goodbye to Lunch Hour

Gold Falls as Recovering Economy Curbs Alternative-Asset Demand

Bernanke Takes Sides on Debt Limit Vote

Municipal Bond Yields Rise as Market Rally Stalls

Aetna Lifts Dividend as Profit Tops Views

Blackstone Posts 56% Rise in Quarterly Profit

Luxury Goods’ LVMH Falls After 2010 Operating Profit Trails Estimate

Joshua Brown: Brian Shannon: The Answer is Real Simple

Leigh Drogen: Rupert Murdoch Just Doesn’t Get It

Paul Kedrosky: Niall Ferguson on Systemic Risk in Egypt

Turkey Claimed by Ethel Kennedy Sought for Harassing Mail Trucks

-

Fiserv Misses by a Penny

Eddy Elfenbein, February 3rd, 2011 at 11:07 pmAfter the closing bell, Fiserv (FISV) reported Q4 earnings of $1.06 per share which was a penny below expectations. The market may not be pleased tomorrow by the earnings miss, but I’m not worried about one penny. My concern was a major miss and I thought that was a very remote possibility. In October, I wrote: “if they make less than $1 per share this quarter, we’ll know something went very wrong. In fact, if they made less than $1.04, it would be ugly.” So $1.06 is fine by me.

For all of 2010, the company earned $4.05 compared with $3.66 in 2009. Quarterly sales rose from $1.06 billion to $1.08 billion. In October, Fiserv’s full-year guidance was $3.96 to $4.07 per share. I had wanted them to at least raise the low end because it seemed very obvious that they would easily top that. As it turns out, they did.

The earnings miss is a disappointment, but not a major one. By far, the most important news is that Fiserv gave us full-year earnings guidance of $4.42 to $4.54 per share. Wall Street had been expecting $4.46.

I think we’ll see a lower open tomorrow but that’s just the Street being a drama queen. My view hasn’t changed at all. Even going by the low end, FISV is going for 14.1 times 2011’s estimate. That’s a good buy.

-

Yield Curve At All-Time Steepiness

Eddy Elfenbein, February 3rd, 2011 at 2:32 pmThe spread between the two-year and the 30-year Treasury is now over 400 basis points. That’s the widest spread since the Treasury started issuing 30-year paper in the 1970s.

-

Your Efficient Market Data Point of the Day

Eddy Elfenbein, February 3rd, 2011 at 1:52 pmAccording to Sportsbook.com, the odds for both heads and tails for Sunday’s big coin toss is -101. That means that you have to put up $101 to win $100.

Since something has to go to the house, you can’t even get 50-50 odds on a coin toss. However, the house’s take on this bet is extremely small so I’m guessing they’re just using it to entice customers to wager on bets with wider spreads.

Still, that’s better than betting on which team will win the coin toss which is -105 for both teams.

For the winner of the game, Sportsbook.com has the Steelers at +120 and the Packers at -140.

That’s like saying the Packers have a 58.3% chance of winning and the Steelers have a 45.5% chance of winning. You may have noticed that those add up to more than 100%, and that excess is the house’s cut.

I think it’s interesting that on the biggest bet of the year, the vig is still—in my eyes—pretty sizeable.

According to Brian Burke, one of the top football number crunchers around, the Steelers and Packers are almost perfectly matched. He has the Steelers at 50.07% and the Packers at 49.93%.

Burke thinks the public’s turn toward the Packers is due to their strong playoff run which he places under the cognitive bias known as the recency effect.

-

Reynolds American Earns 60 Cents Per Share

Eddy Elfenbein, February 3rd, 2011 at 10:41 amFor Q4, Reynolds American (RAI) earned 60 cents per share which was a penny below the Street. The company sees full-year 2011 earnings-per-share coming in between $2.60 and $2.70.

The number of cigarettes sold fell by 5.1% but the total revenue in dollars fell just by less than 1%. In other words, RAI was able to raise prices. I was very impressed by RAI’s gross margins which rose from 45.2% to 46.8%.

The shares pulled back below $32, but don’t be alarmed, Reynolds is still a very good buy. The stock pays a quarterly dividend of 49 cents per share which works out to a yield of 6.1% at the current share price.

-

Time To Fine The SEC

Eddy Elfenbein, February 3rd, 2011 at 7:52 amGuess what company has screwed up its accounting for the past seven years in a row? Actually it’s even worse than that. They’ve screwed up basic tasks like tracking income.

You’d probably think the SEC would be all over them. Yeah…about that.

“A reasonable possibility exists that a material misstatement of S.E.C.’s financial statements would not be prevented, or detected and corrected on a timely basis,” the auditor concluded.

The auditor did not accuse the S.E.C. of cooking its books, and the mistakes were corrected before its latest financial statements were completed. But the fact that basic accounting continually bedevils the agency responsible for guaranteeing the soundness of American financial markets could prove especially awkward just as the S.E.C. is saying it desperately needs money to increase its regulatory power.

Like the rest of the federal government, the S.E.C. is operating without an increase in its budget, which was $1.1 billion last year. With President Obama talking about extending the freeze and lawmakers continuing their criticism of its embarrassing performance before the financial crisis, the agency’s prospects for more money appear bleak.

That has ominous implications for investors. The S.E.C.’s technology systems, for example, lack the ability to perform sophisticated analysis of large batches of financial material. As a result, a Congressional report says, S.E.C. analysts sometimes resort to printouts, calculators and pencils. While investigating the “flash crash” of May 6, 2010, S.E.C. computers were so strained by the crush of data from just one day of trading that it took three months to figure out what had happened.

-

TARP Nearly Even

Eddy Elfenbein, February 3rd, 2011 at 7:31 amPromise not to tell anyone…the TARP program is nearly in the money:

The U.S. Department of Treasury on Wednesday said the government’s bank bailout program has recouped nearly everything it issued in loans two years ago.

The Troubled Asset Relief Program lent out about $245 billion and has received repayments of $243 billion with the latest repayment of $3.4 billion from Fifth Third Bank. The Cincinnati bank took $1.7 billion from existing capital and generated the other $1.7 billion by creating shares of stock to sell.

The TARP loan program is expected to ultimately yield a $20 billion profit to taxpayers, Treasury said in a release.

Including money provided to banks, automakers and AIG, as well as programs to improve lending and prevent foreclosure, the government provided $410 billion. About $274 billion has been received in repayments and income.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His