Archive for March, 2011

-

Cisco to Pay First Ever Dividend

Eddy Elfenbein, March 18th, 2011 at 10:45 amFew stocks have lost as much luster as Cisco (CSCO) has over the past few years. I’ve been continuously disgusted by how much money they’ve wasted on stock buybacks.

Here’s a post from August 2005 where I predicted that Cisco would start paying a dividend:

I’m going to make a prediction. No, not like my other lousy predictions. This time, I’m nearly serious. I predict that Cisco will start paying a cash dividend. Really, it makes perfect sense. The company generates gobs of cash, but they waste it on buying their own stock (just like everyone else who buys Cisco’s stock).

There are two reasons why Cisco buys so much stock. They issue tons of stock, and they give out tons of options to their employees. They bought nearly $20 billion of stock in the last two years and the stock hasn’t done a thing. Forget fighting the market: Just give it to shareholders.

It only took them five-and-half-years to listen to me. Cisco is sitting on a mountain of cash ($40 billion or $7.28 per share). The company announced a six-cent quarterly dividend that will be paid on April 30th to shareholders of record on March 31st.

-

CWS Market Review – March 18, 2011

Eddy Elfenbein, March 18th, 2011 at 10:22 amThis has obviously been a tough week for the stock market. The news out of Japan has been grim and our thoughts go out to the people who have been impacted by these awful events.

Truthfully, equity markets aren’t the best places for short-term analysis of real-world events. Traders are nervous folks who tend to act before thinking. Actually, they’ll do many things before thinking. Stocks pulled back on Monday, Tuesday and Wednesday, but we got a decent rally on Thursday. Measuring from the S&P 500’s February high to the intra-day low on Wednesday, the market dropped 7%. That’s a pretty sharp pullback for such a short time period.

We still really don’t know what the economic impact of the earthquake and tsunami will be. My initial thoughts are that the media tends to overplay these events, but ultimately, no one has enough information to make a proper assessment.

So now we ask, “What should investors do?” Earlier this week, Barry Ritholtz was asked what investors ought to do in emergencies. He said that people should already have their contingency plans in place. He’s exactly right. If there’s some plan you need to go to, you can be sure that some trader got there first. Fortunately, we have a contingency plan built into our Buy List, and that’s simply that the Buy List is full of high-quality stocks. Few things are safer than investing in well-run companies led by managers that know what they’re doing.

While the Buy List fell along with the rest of the market, it didn’t fall nearly as much as the broader indexes did simply because our stocks are much stronger. For example, I know that Bed Bath & Beyond (BBBY) is a good business today and I’m very sure it will be a good business tomorrow and the day after that. The management team is smart and they’ll know how to work their way through short-term problems.

Even shares of Nicholas Financial (NICK) fell, though I can’t imagine how their business would be impacted by this week’s events. If anything, I would assume a used-car financer would be helped. But I’ve long ago stopped questioning why the market does what it does. If some people want to panic and give me a bargain, I can live with that.

The one stock that’s been most impacted by the events in Japan is AFLAC (AFL). The company has operated in Japan for several decades and it has a very large presence there. Currently, about three-fourths of their revenue comes from Japan. One month ago, AFL was closing in on $60. Earlier this week, it bounced off $48 per share.

I applaud AFLAC’s management for communicating with the public. Dan Amos, the CEO, has said that AFLAC will barely be impacted by the earthquake and tsunami. He said on Bloomberg TV this week that the company’s 2011 outlook is unchanged.

Let’s look at the numbers. Wall Street currently expects AFLAC to earn $6.20 per share for 2011 and $6.75 in 2012. The stock closed Thursday at $50.45. This means the stock is going for about eight times this year’s estimates and 7.5 times next year’s estimate. I thought AFLAC was cheap at $59 and I think it’s even cheaper at $50. I apologize if you’ve found the bumps and bruises unpleasant. So have I. But AFLAC continues to be an excellent buy.

Next I want to turn to Oracle (ORCL). The company is due to report its fiscal Q3 earnings next Thursday, March 24th. The consensus on Wall Street is for 49 cents per share. I think that’s too low. My take is that Oracle will earn 53 cents per share. Oracle has a very strong business and they’ve been executing very well lately.

I try not to be shocked by what I see on Wall Street, but even I took notice when Oracle fell below $30 per share this week. Look forward to good numbers from them next week. I think Oracle is a very strong buy below $32 per share.

Let me add a few words on some other Buy List stocks. Leucadia National (LUK) not only refused to pull back but it made a new 52-week high on Thursday. Abbott Laboratories (ABT) is back below $48 per share which is a very good entry price.

We also had some decent economic news this week. Jobless claims fell to 385,000. This is the fourth-straight time that claims have come in under 400,000. Industrial production dropped 0.1% in February but that was due to milder weather. Just looking at manufacturing, production rose by 0.4% in February. That’s the sixth-straight increase for manufacturing production. The Index of Leading Economic Indicators, which tries to pinpoint where the economy is headed, rose 0.8% last month after a meager 0.1% increase in January. The economic recovery is slow, but the economy is recovering.

I had been a little concerned that inflation was showing early signs of heating up. The latest report, however, shows that core consumer prices are still contained (just 0.2% last month). This could change soon. I noticed that Kimberly-Clark (KMB), a consumer products company, said it will start raising prices in North America. Consumers expect gasoline prices to bounce around, but when prices for tissues and diapers start to rise, that’s another story. I still think there’s a good chance the Fed will raise rates sooner than most folks expect.

Let’s stick with our game plan of investing in high-quality stocks. I still believe cyclical industries will lag the market. The market will probably be range-bound for the next few weeks. Once Q1 earnings season starts in mid-April, we will get a better sense of how well our stocks have been doing. I’ll be particularly interested to see dividend increases from many financial stocks.

That’s all for now. Be sure to keep visiting the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

-

Morning News: March 18, 2011

Eddy Elfenbein, March 18th, 2011 at 6:26 amG-7 Sells Yen in First Joint Intervention Since 2000

Asian Shares End Mostly Up; Tokyo Leads Gains As Yen Drops On G-7 Deal

Japan’s Meltdown and the Global Economy’s

Crude Oil Above $103/Barrel On Libya No-Fly Zone Decision

Euribor Rates Up as Japan Woes Muddy ECB Rate Plans

Key Details of EU Stress Tests Still Undecided

Consumers Feel Pinch of Commodities

U.S. Foreclosure Deal Could Be Delayed

Groupon IPO Worth $25 Billion?

General Mills Poised to Buy Yoplait Stake for $1.1 Billion

New York Times: Sulzberger Risks His Legacy

Goldman Sachs Cuts 5% of Trading Desk

-

Entergy Now Yields 5.1%

Eddy Elfenbein, March 17th, 2011 at 2:24 pmI’m not even going to pretend that I’m an expert on nuclear issues, but I’ll point out that shares of Entergy (ETR) are down sharply today. The stock is down 11% for the week and it just touched a 52-week low.

Entergy has ten nuclear plants, and it’s the second-largest nuclear energy provider in the country. The company considered spinning off some of its nuke assets a year ago, but regulators didn’t go for it.

Entergy currently pays an 83-cent quarterly dividend. At the current price, that yields 5.1% which is a lot more than you can find in other places. It’s also likely that the company will raise its dividend next month.

I’m not recommending the stock, but I’m pointing out how short-sighted the market can be. The way to “play” what’s happening in Japan isn’t to seek out a rebuilding stock or some contamination stock. Instead, it’s to see what good stocks have been brought down for transient reasons.

-

A “Snap-Back Rally”

Eddy Elfenbein, March 17th, 2011 at 11:33 amThe market is rebounding nicely today. As I write this, the Dow is up 148 points to 11,768 and the S&P 500 is up 18 to 1,274. Today seems to be a “snap-back rally” where what had been doing poorly is now doing well and what’s been doing well is now doing poorly.

The Morgan Stanley Cyclical Index (^CYC) is up close to 2%. The energy and materials stocks (those most inflationary) are doing particularly well.

The Buy List is going to lag the market today pretty badly simply because our stocks have been the ones investors have retreated to since the jitters began. Every stock except for Jos. A Bank Clothiers (JOSB) is currently up today. AFLAC is back up to $51 per share. Leucadia National (LUK) actually hit a new 52-week high. That means that investors still like quality stocks.

-

Highest Inflation in 20 Months

Eddy Elfenbein, March 17th, 2011 at 7:57 amFrom AP:

The Labor Department says the Consumer Price Index rose 0.5 percent in February, the largest increase since June 2009. But excluding food and energy costs, core prices rose 0.2 percent, the same as in January.

Gas prices jumped 4.7 percent in February, above January’s increase but below December’s rise. Food costs increased 0.6 percent, the most in two and a half years.

Costs for other goods and services, such as health care and cars, are also rising. Core consumer prices increased 1.1 percent in the past year, up from a 0.6 percent annual increase in October. Still, that’s below the Fed’s preferred range of 1.5 percent to 2 percent.

-

Happy St. Patrick’s Day

Eddy Elfenbein, March 17th, 2011 at 7:02 am -

Are Stars’ Opinions Worth More?

Eddy Elfenbein, March 17th, 2011 at 6:58 amFrom a recent academic paper:

Are Stars’ Opinions Worth More? Evidence from Stock Recommendations 1994-2009

Abstract:

Using 1994-2009 data, we document that All-American (AA) analysts’ buy and sell recommendations outperform those of non-AAs by over 7% per annum after risk-adjustments. This performance differential exists both before and after AAs are elected, does not exhibit long-run reversal, and is not significantly eroded by Reg-FD. Election to top-AA ranks predicts performance in buy recommendations above and beyond other observable analyst characteristics. Conflicts-of-interest reforms around 2002-2003 led to departures of experienced and high-performing AAs from the sell-side analyst pool; as a response, institutional investors shuffled the AA pool in a way that helped preserve the AA pool’s performance. Collectively, these results suggest that skill differences among analysts exist and the AA status incorporates institutional investors’ ability to evaluate analysts. -

Morning News: March 17, 2011

Eddy Elfenbein, March 17th, 2011 at 6:40 amYen Surge, Despite Disasters, Reflects Shaky Repatriation Bets

U.S. Futures, European Stocks Rise on G-7 Speculation; Yen Touches Record

Swiss National Bank Keeps Rate on Hold as Japan Aftermath Strengthens Franc

Long Pause for Japanese Industry Raises Concerns About Supply Chain

Refiners Beat Bond Market as Japan Earthquake Cuts Oil Costs: India Credit

Wholesale Prices Rise on Energy Costs

ATM Fees Rise as Banks Feel Funding Squeeze

Consumer Bureau Overseer Debates G.O.P. Critics

Mizuho ATMs OK; Computer System Still Malfunctioning

Visa Goes After PayPal And Square With Person-To-Person Payments

Groupon Is Said to Discuss IPO Valuation of Up to $25 Billion

Greenbrier Expects 2Q Revenue Above Estimates Amid New Orders

Shares of Peet’s Coffee & Tea Rise With Talk of Starbucks Deal

Joshua Brown: Natural Disasters Do Not Justify a Losing Short Thesis

-

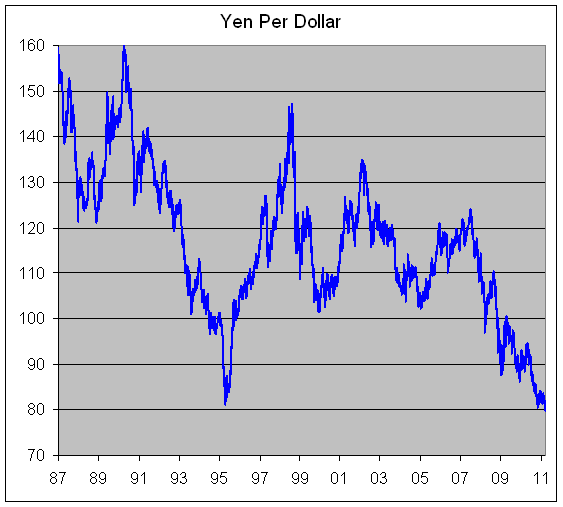

Dollar Hits All-Time Low Vs. Yen

Eddy Elfenbein, March 16th, 2011 at 1:48 pmForty years ago, one Japanese yen was worth 0.27 cents.

Thirty years ago, it was worth 0.48 cents.

Twenty years ago it was 0.72 cents.

Ten years ago, it was 0.81 cents.

Today, one yen is worth 1.25 cents.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His