Archive for March, 2011

-

AFLAC CEO Dan Amos on Bloomberg

Eddy Elfenbein, March 16th, 2011 at 10:05 amHere’s a good interview with Dan Amos, CEO of AFLAC.

-

Japan and Medical Device Makers

Eddy Elfenbein, March 16th, 2011 at 8:54 amReuters notes that Japan is the second-largest market for medical devices. Some of our Buy List stocks will be impacted.

Other device makers with large sales in Japan include Boston Scientific Corp (BSX), with 12 percent of total sales in Japan, St Jude Medical Inc (STJ) and Wright Medical Group Inc (WMGI) at 11 percent each, Stryker Corp (SYK) at 10 percent and Zimmer Holdings Inc (ZMH) at 9 percent.

Diversified companies Medtronic Inc (MDT), Johnson & Johnson (JNJ) and Abbott Laboratories (ABT) are less exposed with 5 percent to 6 percent of sales coming from Japan.

-

Morning News: March 16, 2011

Eddy Elfenbein, March 16th, 2011 at 6:29 amTokyo Shares End Up 5.7%, Partially Repairing Prior Day’s Losses

China Mobile Unexpectedly Boosts 2011 Capital Spending to $20.1 Billion

Do Women Need to Act Like Men on Wall Street? (Given the evidence, shouldn’t we be asking the opposite?)

U.K. Jobless Claimants Decline Unexpectedly

Stock Futures Fall Amid Japan, Mideast Fears

Oil Price Falls as Investors Dump Commodities

Oil Rises as Bahrain Violence Spurs Concern Middle East Supplies at Risk

Gold Rebounds on Drop to One-Month Low, Bahrain, Japan Concerns

Treasuries Fluctuate as Japan Struggles to Avert Meltdown

Fed Signals Further Stimulus Unlikely as Recovery Strengthens

Watchdog Says TARP Helps Perpetuate “Too Big to Fail”

Worker Confidence on Having Enough Money for Retirement Hits 20-Year Low

Nasdaq Is Nearing Rival Bid for NYSE

Freddie Mac’s Former Chief May Face S.E.C. Action

Joshua Brown: Super-Contrarian: Fukushima is a Triumph for Nuclear Industry

Paul Kedrosky: China Passes U.S. in Manufacturing Value-Added

-

Three Cheers for Diversification

Eddy Elfenbein, March 15th, 2011 at 3:35 pmDespite holding AFLAC (AFL), which dropped 5.58% today, our Buy List narrowly out-performed the S&P 500. Our Buy List dropped 0.96% while the S&P 500 lost 1.12%.

Naturally, I don’t like it when out-performance means that our day was less awful than everyone else’s. But it does indicate what a well-diversified portfolio can do. Just like a good sports team, when one player is having an off night, his teammates are ready to pick up the slack.

-

AFLAC’s Press Releases

Eddy Elfenbein, March 15th, 2011 at 2:09 pmSince the Japanese earthquake, AFLAC has released exactly three press releases. Here they are:

Aflac Pledges 100 Million Yen to Red Cross Disaster Relief for Japan

Aflac Severs Ties with Gilbert Gottfried

This is the full text of the last one:

COLUMBUS, Ga., March 14, 2011 /PRNewswire via COMTEX/ — Aflac Incorporated today announced that its operations in Japan are up and running and ready to assist policyholders following the recent earthquake in the Tohoku area, which includes the cities of Sendai and Minami Sanriku. Aflac Japan’s main offices, including the corporate offices in Tokyo and operational centers in both Tokyo and Osaka, are undamaged and fully functional.

Aflac Japan’s employees are safe, and the company continues to reach out to their independent sales force to assess their needs. The Aflac leadership teams from both the U.S. and Japan remain in close contact.

While the hardest-hit areas were Iwate, Miyagi and Fukushima prefectures, less than 5% of Aflac Japan’s new sales and in-force premiums are derived from these prefectures. Only two of Aflac Japan’s 82 sales offices have been negatively impacted; these two offices, located in a single building in Sendai, have minimal damage, but will be closed temporarily due to power outages.

About this natural disaster, Aflac Japan President and Chief Operating Officer Tohru Tonoike commented: “First and foremost, our thoughts go out to all those affected here in Japan. We are very grateful none of our employees were injured. We are working with our sales force to ensure that we provide them with assistance and help them take care of our customers. We remain ready to respond to the needs of our policyholders by paying claims swiftly, and will prioritize our response to those in the affected areas. We successfully executed our disaster preparedness plan and as a result, our operations stand ready to serve our policyholders and claimants.”

Aflac Incorporated Chairman and CEO Daniel P. Amos added: “In addition to sending our thoughts and prayers to each and every Japanese citizen, we want all of our Aflac Japan employees, sales agents and policyholders to know that your Aflac family here in the U.S. sends our support in every way possible. On Friday, we made an initial donation of 100 million yen to the International Red Cross to help with the start of the relief effort. Additionally, funds have been established by both our U.S. and Japanese employees and sales forces for our friends in Japan, including fellow employees and sales associates that have been most impacted by the disaster. Most importantly, we want our policyholders to know that we are here to deliver on our promise – we will be there when they need us most. Having operated in Japan for almost four decades, we know Japanese citizens are incredibly resilient and we want to help in any way possible as they work through this difficult time.

“As we look to the remainder of 2011, we expect Aflac Japan sales will only be minimally impacted by these events. Our earnings guidance for the year remains unchanged: we will likely be at the low end of the 8% to 12% range for operating earnings per diluted share growth in 2011, excluding the impact of currency.”

Leslie Scism of the WSJ reports:

Aflac Inc., a life and health insurer that gets up to 75% of its earnings from Japan, took another hit Tuesday amid investors’ concerns about life insurers’ shares.

The Columbus, Ga., company continues to stand by its view, since the disaster began unfolding last Friday, that it doesn’t expect a meaningful impact on its earnings and it isn’t changing its earnings guidance for the year, Chief Executive Daniel Amos said in an interview.

“We may see a spike in claims for the short-term due to the tsunami and the earthquake. However, it will not make a significant difference to our overall claims cost,” Mr. Amos said.

“In regards to the nuclear issues, it is too early to tell. But based on our actuarial assumptions with the worst-case scenario being a Chernobyl, we still don’t believe it will create a significant change in our claims costs.”

He said that the three prefectures hardest hit by the earthquake, tsunami and resulting nuclear-reactor problems represent less than 5% of the company’s sales in Japan. If the company got hit with thousands of sudden claims, he said, those would be a tiny slice of the company’s 20 million outstanding life and supplemental-medical policies.

“I think the tendency is that you look at the worst case, so I think that’s what is going on” in the selloff, he said.

-

Corporate Profit Margins to Hit 18-Year High

Eddy Elfenbein, March 15th, 2011 at 10:35 amRecord earnings fueled by the highest profit margins since 1993 are giving executives more leeway than ever to boost dividends as the bull market enters its third year.

Margins will climb to 8.9 percent in 2011, the highest level in at least 18 years, according to data compiled by Bloomberg on non-financial companies in the Standard & Poor’s 500 Index through March 11. Greater profitability combined with dividend cuts during the credit crisis have pushed earnings to 6.53 percent of the gauge’s price, or 3.5 times more than its payout rate, close to the record 3.6 multiple in January.

A total of 95 companies led by Aetna Inc. (AET) and Carnival Corp. have raised dividends as the fastest economic expansion in six years and five straight quarters of earnings growth increased confidence among chief executive officers. Of the 380 that pay dividends, 378 are forecast to maintain or increase them, according to data compiled by Bloomberg using options prices, profits, management statements and peer comparisons.

The article notes that there have been 95 dividend increases in the S&P 500 and zero decreases this year.

-

What To Do Now?

Eddy Elfenbein, March 15th, 2011 at 10:14 amThe stock market is down sharply today. The world is beginning to learn of the extent of the damage in Japan combined with the explosions at the nuclear plants.

The market’s initial response to the news from Japan was rather restrained. The S&P 500 dropped 0.60% yesterday, which is far from alarming; plus the market rallied in the afternoon.

As I write this, the market is down 1.81% and we’ve been down as much as 2.72% this morning. The Nikkei dropped over 1,000 points today which is a loss of 10.55%. Since Friday, the Japanese market has lost 16.1%.

The stock jitters have clearly spread to the U.S. market. The Volatility Index (^VIX) is up 2.66 this morning to 23.79. Both oil and gold are down sharply.

Barry Ritholtz makes a good point this morning: When people ask, “how should I be investing now?” the answer is that your contingency plan should already be in place.

I’m happy say that I wouldn’t make any changes to my Buy List. They’re all good companies and it’s very, very likely that they will remain being good companies.

Investing isn’t about predicting the future. No one can do that. In fact, being a good investor means beginning with the assumption that you can’t predict the future, so what can you do? It’s always good to start with good first principles and that means investing in solid businesses.

At times like this, traders madly scramble for “plays.” Solar stocks, for example, are doing well today. I strongly advise against chasing any of these “Japan plays.” I remember that on the first day of trading after 9/11, shares of Sturm Ruger (RGR) jumped more than 10%. Why? Were we all going to buy guns to shoot the terrorists? As you might expect, it didn’t take long for RGR to give back all of its gains.

The one alarming stock we have is AFLAC (AFL) and that stock is currently down close to 10% today. So far, the company has made it clear that they haven’t suffered much damage. Until I hear more, I’ll continue to trust the company more than nervous traders.

The other news from AFLAC is that they fired comedian Gilbert Gottfried, who was the voice of the AFLAC duck, for making tasteless comments on his Twitter feed. I should add that he’s not the voice of the duck in the ads that run in Japan. Bear in mind that this is one of the best marketing campaigns in recent history. AFLAC’s name recognition has risen from 2% before the duck to 90% today.

My advice on what to do now is just sit and wait. We don’t know all the facts yet, and more importantly, we don’t know what the long-term implications will be. I know it’s painful to watch your stocks go down, but you’re just as likely to make things worse by joining the panic.

-

Morning News: March 15, 2011

Eddy Elfenbein, March 15th, 2011 at 6:18 amStocks Slide as Japan Plummets on Nuclear Concern; Oil Falls, Bonds Surge

Futures Tumble After Nikkei Plunges

EU Debt-Relief Pact Puts Pressure on Nations to Cut Deficits: Euro Credit

German Investor Confidence Unexpectedly Declined in March

Crude Oil Drops as Loss of Demand in Japan Outweighs Middle East Tension

Earthquake Dents Japan’s Chances in China’s Luxury Car Market

Gold Declines as Investors Sell to Cover Drop in Other Assets

Disaster in Japan Batters Suppliers

U.S. Seizes Two Banks; Year’s Total at 25

How Long Can the Fed Continue to Downplay Inflation?

Carlyle Forms $5 Billion Shipping Joint Venture

Buffett Still Gets Lubrizol at Lehman-Bust Price After 183% Gain: Real M&A

HP’s Apotheker Accelerates Move Into Cloud Computing, Increases Dividend

Joshua Brown: Uranium Sector Trashed

Paul Kedrosky: Long-Term Growth in U.S. GDP Per Capita: Graph

-

The Japanese Market Tanks

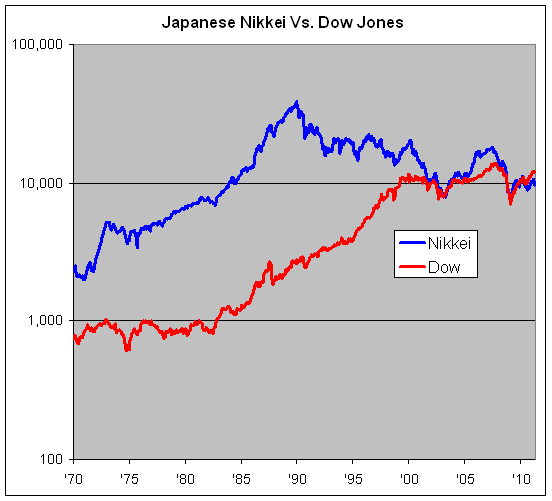

Eddy Elfenbein, March 14th, 2011 at 12:32 pmThe Japanese Nikkei 225 (^N225), the Japanese counterpart of the Dow, dropped 6.18% today to close at 9,620.49. The index is actually lower than it was on the final day of 1983 when it closed at 9,893.82. At the same time, the U.S. Dow closed at 1,258.64.

This means that in 27 years, we’ve gone up by more than 10-fold while the Japanese market is down slightly. The Nikkei used to be 14 times the Dow. Now it’s 20% less.

-

The Onion: Hidden Bank Fees

Eddy Elfenbein, March 14th, 2011 at 11:09 amThe Onion has the news:

As a result of recent regulations prohibiting certain types of account fees, banks are finding new ways to make money from their customers. Here are some of the hidden charges now being applied:

* Wells Fargo—$10 to speak to a human teller, $20 to speak to a cute one

* Chase—$2 fee if Chase Rewards debit card is placed next to a debit card from a competing bank

* Citibank—Customers who think Citibank has a ‘y’ in its name are penalized, monthly, on an increasing scale

* Bank of America—Safe deposit boxes now on coin-operated timers

* HSBC Bank USA—HSBC gets 10 percent cut of all birthday money

* TD Bank—$1 for stopping in any TD branch location to warm up while out walking on a cold day

* Regions Bank—$10 Felix-the-Cat-opt-out charge will be administered to anyone choosing a check design not featuring silent-film-era cartoon character Felix the Cat

* SunTrust—$1.75 High Roller fee applied when card is used at locations other than CVS

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His