Archive for April, 2011

-

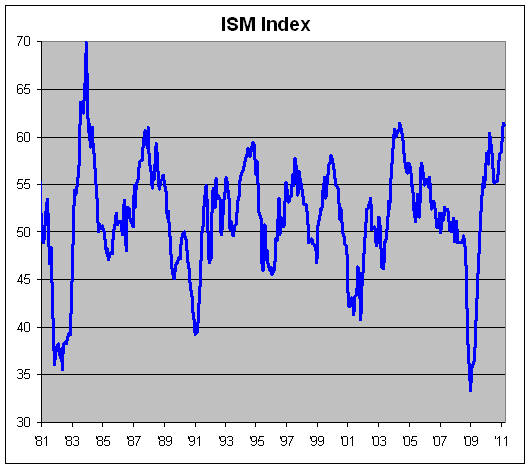

March ISM = 61.2

Eddy Elfenbein, April 1st, 2011 at 10:04 amToday’s ISM report was 61.2 for the month of March. This is the 20th-straight reading over 50. Last month’s number of 61.4 was tied for the best reading since 1983.

Even though we’re down slightly from that, we’re still at a very high level. In the last 30 years, there have only been 22 months were the ISM has been 60 or more — and we’ve now done that for three-straight months.

-

March Payrolls +216,000

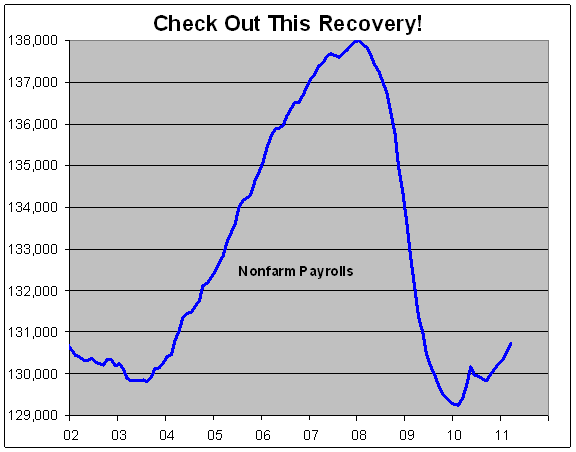

Eddy Elfenbein, April 1st, 2011 at 8:34 am216,000 jobs were created last month which beat expectations; 230,000 were in the private sector. The unemployment rate ticked down from 8.9% to 8.8%.

Here’s another way of looking at it: The official recovery will soon turn two years old. Nonfarm payrolls went from being 8.72 million below the high to now being only 7.26 million below the high.

-

CWS Market Review – April 1, 2011

Eddy Elfenbein, April 1st, 2011 at 8:02 amThe first quarter of 2011 is now officially on the books and it was a very good one for our Buy List. Once again, patient investing and sticking with high-quality stocks paid off.

For the first three months of the year, the S&P 500 gained 5.42% while our Buy List gained 7.62%. That’s an outperformance of 220 basis points which is pretty good for such a diversified portfolio. Including dividends, we gained 8.06% to the S&P 500’s 5.92%. Of course, I should mention that we accomplished this without making one single change to the Buy List all year, nor will we make any changes for the next nine months.

Our Buy List yields slightly less than the S&P 500, but it’s not a very big gap. Annualized, the S&P 500 out-yields us at about 1.9% to our 1.6%. If this matters to you, the beta of the Buy List was 1.035 for the first three months of the year. (Personally, I gave up on that mumbo-jumbo years ago.)

My goal for the Buy List is to beat the S&P 500 by a few percentage points each year and do it with slightly less risk. It’s an odd notion but an important lesson for investors: if you don’t try and swing for the fences, but rather just try to punch out singles, you can do much better. In fact, trying to go deep all the time actively hurts you.

Now let’s look at the long-term record: For the five-and-a-quarter years that I’ve been tracking our Buy List on the blog, we’re up 44.83% to the S&P 500’s 18.62%. That’s a hefty out-performance. (Our long-term beta is 0.943, again, to anyone who cares.)

To restate the rules of the Buy List, which have been the same rules since we started, the Buy List contains 20 stocks. We don’t make any changes during the trading year. At the end of each year, we add and delete just five stocks which keeps our turnover very low. It’s simple, but it works.

Now let’s turn to recent happenings on Wall Street. This past week was fairly quiet for the stock market and for our Buy List, but that will change soon. Earnings season kicks off in a few weeks and most of our stocks will report their earnings for the first quarter.

We did, however, get one very strong earnings report this week from Jos. A Bank Clothiers ($JOSB). This report was a crucial one for the company since it covers the holiday shopping season. Usually, JOSB makes about half of their annual profit during December-January-February period.

For the quarter, Joey Banks said it made $1.47 per share which was four cents more than Wall Street’s consensus. In the CWS Market Review from three weeks ago, I said that Wall Street’s consensus was probably too low. I said I expected earnings of $1.50 per share or more. I was wrong on the $1.50 or more, but I was right that Wall Street was too low.

JOSB is a very impressive company. I’ll warn that the stock can be highly volatile, but the business results are impressive. For 2010, earnings-per-share jumped 20% to $3.08 compared with $2.56 in 2009. JOSB has no debt, and earnings have risen for the last 19 quarters in a row and for 37 of the last 38 quarters. That’s a very good record.

Three weeks ago, I urged investors not to chase JOSB but rather to wait for a pullback below $45 per share. As it turned out, the stock did indeed pull back to a low of $44.93 before resuming its climb. At Wednesday’s opening bell, the stock gapped up to a high of $52.50 before drifting lower. Since then, it’s mostly bounced around between $50 and $51.

In light of the strong earnings report, I’m going to raise my Buy Price to $50 per share. Once again, I suggest letting JOSB come to you. Please be disciplined here. Chasing stocks you want to own is a sucker’s game. It’s hard watching the good ones pull away from you, but sometimes you need to do it.

I think it’s interesting that Oracle ($ORCL) followed a similar pattern to JOSB’s pattern. If you recall, Oracle posted very good earnings (as predicted by moi). As I expected, ORCL made a new 52-week high of $34.10. Since then, it’s pulled back and found a range roughly between $33 and $33.50. Last week, I raised my buy price to $34 which I think is a good place. Oracle is a very strong company and I wouldn’t be surprised to see it break out soon.

The next Buy List earnings report will most likely be from Bed Bath & Beyond ($BBBY) and that’s due on April 6th. The company said to expect earnings to range between 91 cents and 95 cents per share. My take: That sounds about right, though maybe a little low.

What I’ll be most interested in hearing is if they give guidance for this year. If so, I’m looking for something between $3.30 and $3.40 per share. BBBY tends to give conservative guidance. I’m not ready to offer a specific buy price on BBBY until I hear more from them. Fundamentally, this is a very sound company and I expect the shares to do well.

I like all 20 stocks on the Buy List, but a few stand out as particular bargains. I like Johnson & Johnson ($JNJ) below $60. Sysco ($SYY) hasn’t performed well lately and I think it’s looking pretty cheap. It could be a $30 stock. You probably won’t be surprised to hear that I like AFLAC ($AFL) at this reduced price. The company will report earnings on April 27th and we’ll see proof of how well this outfit is managed.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

-

The Nasdaq and ICE Bid for the NYSE

Eddy Elfenbein, April 1st, 2011 at 7:58 amThis is getting interesting. In February, Deutsche Boerse agreed to buy the New York Stock Exchange for $9.53 billion. Now the Nasdaq has teamed up with ICE to offer a counter bid of $11.3 billion.

Under the terms of the proposed acquisition, NYSE Euronext stockholders would receive $14.24 in cash, plus 0.4069 shares of NASDAQ OMX common stock and 0.1436 shares of ICE common stock for each NYSE Euronext share.

-

Morning News: April 1, 2011

Eddy Elfenbein, April 1st, 2011 at 7:43 amYen Falls 7th Day, Franc Drops as Data Seen Backing Recovery

Investors React to Irish Bank Plan

U.K. Manufacturing Growth Slows Sharply

EU Appeals WTO Ruling Finding U.S. Aid to Boeing Was Illegal

Portugal Pays Up to Sell Bonds

Foreign Banks Tapped Fed’s Secret Lifeline Most at Crisis Peak

Oil Reaches 30-Month High on Strong China Data, Libya Conflict

Nasdaq, ICE Top Deutsche Boerse with $11.3 Billion NYSE Bid

Report Criticizes High Pay at Fannie and Freddie

Corn Rises on Concern Higher Acreage Will Fail to Boost Stocks

Immelt Says GE’s 2011 Tax Rate to Be ‘Much Higher’ as Losses End

Glencore Gets HK Exchange Nod for Planned $10 Billion IPO

Toyota Profit to Be Reduced by Quake, Japan Auto-Sales Plunge

Logitech Falls Most in More Than 7 Years on Lower Forecasts

Joshua Brown: Not-So-Private Payrolls

Paul Kedrosky: Research Productivity Around the World

James Altucher: Why Are Larry Page and I So Different? (or…why didn’t Google buy my company?)

-

-

Archives

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His