Archive for April, 2011

-

Return on Equity Capital Futures

Eddy Elfenbein, April 19th, 2011 at 2:20 pmPardon this thinking-out-loud post, but I’m curious if there could be a futures product that’s somehow tied to expected return on equity capital.

I have no idea how it would work, but it would be a boon to financial academics everywhere.

-

Alpha Indices

Eddy Elfenbein, April 19th, 2011 at 2:12 pm -

Is J&J’s 48-Year Dividend Streak in Jeopardy?

Eddy Elfenbein, April 19th, 2011 at 12:21 pmOne more item on Johnson & Johnson ($JNJ): The company has raised its dividend for 48 years in a row. Number 49 should come any day now.

The issue is that the company’s earnings haven’t grown very much, so the board probably won’t raise the dividend a lot. Earnings-per-share rose from $4.63 in 2009 to $4.76 in 2010. That’s an increase of 2.8%.

If the board kept the payout ratio constant, that would mean the quarterly dividend would rise from 54 cents per share to roughly 55.5 cents per share.

On one hand, the board certainly feels they need to keep the dividend streak going. On the other hand, they can’t raise the dividend too much. Nearly all the free cash will be going to a possible Synthes deal. On the third hand, a dividend increase of a penny per share will look pretty lame.

I think we’ll see an increase of two or three cents per share. Still, the stock currently yields more than a 10-year Treasury bond.

Of course, they could shock us by foregoing a dividend increase.

-

J&J Beats Earnings and Guides Higher

Eddy Elfenbein, April 19th, 2011 at 12:00 pmFinally some good news from Johnson & Johnson ($JNJ). This company has made just about every mistake possible over the last year but at least they’re still making a good profit.

For the first quarter, JNJ earned $1.35 per share (after charges) which beat Wall Street’s estimate by nine cents per share.

But more importantly, JNJ raised its full-year EPS guidance. The earlier guidance was $4.80 to $4.90. Now it’s $4.90 to $5.00. That’s excellent news. In January, the company gave the initial guidance numbers which disappointed Wall Street. Today’s news should help restore some faith in JNJ.

The stock is currently up about 3% today. Also, here’s more on the impact a Synthes deal could have on the medical device industry.

-

Morning News: April 19, 2011

Eddy Elfenbein, April 19th, 2011 at 7:28 amEU Denies Greek Restructuring Reports, Markets Wary

With Much at Stake, Asia Voices Confidence in U.S. Debt

Best BRIC Stock Rally Since 1997 Seen Doomed as Rates Increase

NEWSFLASH: Ratings Downgrades Do NOT Equal Higher Interest Rates

Bernanke May Sustain Stimulus to Avoid ‘Cold Turkey’ End to Aid

Builders Probably Broke Ground on More U.S. Homes in March

Samsung Sells Hard Disk Drive Business To Seagate For $1.375B In Cash, Stock

Citigroup Shares Rise as Profit Beats Estimates, Bad Loans Drop

Halliburton 1Q Profit More Than Doubles

Sony Ericsson Q1 Profit Drops By Half

Zillow Files for $51.8 Million IPO Amid Zeal for Fast-Growing Web Startups

Deutsche Bank’s $4 Billion Las Vegas Bet

-

More on Synthes/J&J

Eddy Elfenbein, April 18th, 2011 at 5:14 pmThe deal would help Johnson & Johnson‘s ($JNJ) finances:

Health giant Johnson & Johnson could boost its revenue and profit in the short term by buying Switzerland’s Synthes Inc., while quickly gaining a dominant position in the growing market for orthopedic surgery products.

The Swiss maker of implants and instruments for bone and tissue repair confirmed Monday that it’s in talks about a possible purchase by Johnson & Johnson, one of the world’s biggest manufacturers of medical devices, drugs and consumer health products.

The sale of Synthes could make multibillionaire chairman Dr. Hansjorg Wyss the richest man in Switzerland. He owns 40 percent of the company, and his family’s trust owns an additional 8 percent, according to Synthes’ 2010 annual report.

For Johnson and Johnson, based in New Brunswick, N.J., buying Synthes would make sense on multiple fronts.

“From many different angles, it looks like this deal would be a good deal for Johnson & Johnson, if it’s at the right price,” said analyst Linda Bannister of Edward Jones. “$20 billion seems reasonable.”

That is the rumored purchase price, as reported last Friday by the Wall Street Journal, an amount far bigger than a typical J&J acquisition.

Buying Synthes would double J&J’s market position in spine repair products, Bannister said.

“It would move (J&J) to a dominant position in orthopedics, particularly in trauma,” she said.

Medical devices became the largest of J&J’s three businesses in 2009. Their appeal? They don’t see sales suddenly plunge when generic competition arrives, as drugs do. And they’re far more profitable than commodity over-the-counter drugs such as Motrin and Tylenol.

In addition, those pain relievers are among the dozens of nonprescription J&J products hit by an astounding series of recalls over the past 19 months. The recalls cut 2010 revenue by about $900 million and have severely hurt J&J’s image.

With an aging population around the world and emerging markets spending more on advanced health care, devices and implants to repair fractures in the spine and other bones are in increasing demand. Synthes revenue rose almost 9 percent in 2010 to $3.87 billion, and its net income increased 10 percent, at $908 million.

-

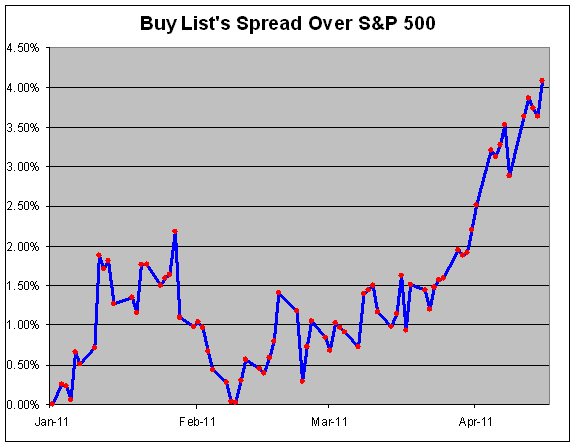

408 Bps Ahead of the S&P 500

Eddy Elfenbein, April 18th, 2011 at 12:26 pmAlthough the market has stumbled recently, our Buy List is opening a nice lead over the S&P 500. By the close on Friday, our lead stood at 4.08%.

-

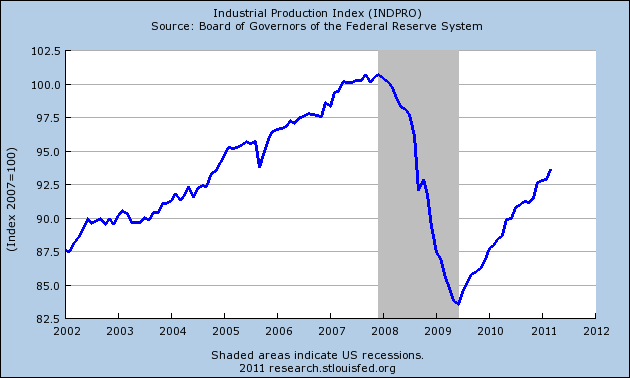

Industrial Production Continues to Rise

Eddy Elfenbein, April 18th, 2011 at 12:05 pmOn Friday, the government reported that industrial production rose by 0.8% in April. Industrial production has climbed sharply off its low but it still has a long way to go to surpass its September 2007 high.

Industrial production increased more than forecast in March, led by a rebound in consumer goods manufacturing, a sign that factories will keep driving the U.S. economy.

Output rose 0.8 percent, the fifth straight gain, after a revised 0.1 percent rise in February, the Federal Reserve said today in Washington. Economists surveyed by Bloomberg News projected a 0.6 percent gain, according to the median estimate. Manufacturing, which makes up 75 percent of the total, climbed 0.7 percent following a 0.6 percent increase. Utility output and mining also rose.

Factories in the U.S. are benefiting from gains in business investment, expanding economies overseas and inventory rebuilding. The pace of production may cool temporarily as some factories scramble to replace supplies of parts interrupted after last month’s earthquake and tsunami in Japan.

“The economy is really starting to take shape,” said Bricklin Dwyer, an economist at BNP Paribas in New York. While “we expect a cool down” in the next couple of months because of events in Japan, that will be “a short-lived phenomenon,” he said. “We’ve seen global manufacturing increase since the crisis.”

-

S&P 500 Breaks Below 1300

Eddy Elfenbein, April 18th, 2011 at 10:03 amUgly day today. Standard & Poor’s put a “negative” outlook on America’s debt rating.

“We believe there is a material risk that U.S. policy makers might not reach an agreement on how to address medium-and long-term budgetary challenges by 2013,” New York-based S&P said in a report today. “If an agreement is not reached and meaningful implementation does not begin by then, this would in our view render the U.S. fiscal profile meaningfully weaker than that of peer ‘AAA’ sovereigns.”

I really don’t understand a debt rating for the U.S. Treasury bonds. America’s debt is “rated” every day in that it’s priced by traders.

Sure, the long-term numbers look awful but the reality is that investors keep buying our debt, and they’re willing to give us a good deal.

The S&P 500 is again below its 50-DMA.

-

Taibbi Swings and Misses — Again

Eddy Elfenbein, April 18th, 2011 at 9:44 amAs long-term readers know, I’m not a fan of Matt Taibbi. I think he’s a dishonest journalist who distorts facts and bends narratives to suit his agenda.

I hate giving Taibbi any time but since he’s respected by so many, I feel compelled to point out his lousy reporting. Taibbi’s MO is take a perfectly understandable yet slightly complex story and retell it.

But in Taibbi’s retelling, he’ll leave out key facts and imply sinister motives to people he doesn’t like. He’ll then sprinkle in forced sex and drug references to give his lousy reporting a sophomoric “edge.”

Fortunately for us, Ari I. Weinberg at the WSJ tears apart his latest:

Taibbi, famous for dubbing Goldman a “vampire squid,” is simply piling on the gotchas, trying to whip disparate, innocuous facts into one scary soufflé of ominousness.

Back to his story, and items omitted or glossed over.

The women, directly along with other investors, invested in a fund called Waterfall TALF Opportunity, LLC. The fund was one of over 100 funds set up specifically to borrow and invest through the Term Asset-Backed Securities Loan Facility (TALF).

This program, as Taibbi begrudgingly concedes, was designed to restart the market for pooled loans of credit cards, auto loans, mortgages, student and small business loans. Somehow Taibbi, and Rolling Stone, omit the notion that you, me and the magazine’s readers were the ultimate beneficiaries of revived credit markets. Neither Taibbi nor Rolling Stone responded to a request for comment.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His