Archive for April, 2011

-

Bastiat 2011

Eddy Elfenbein, April 18th, 2011 at 9:16 amIn 1845, French economist Frédéric Bastiat wrote his famous satire, The Candlemaker’s Petition. This was a move by the candlemakers to protest unfair business competition from the sun.

That, of couse, was satire. This isn’t.

In a related note, Rep. Chris Van Hollen warns us that “This Republican Plan simply rations health care and choice of doctor by income.” I hate to break this to Rep. Van Hollen, but nearly everything is rationed by income.

-

Q1 Earnings Calendar

Eddy Elfenbein, April 18th, 2011 at 8:40 amIt’s still early but here’s a look at the earnings calendar for our Buy List stocks:

Symbol Date EPS JNJ 19-Apr $1.26 SYK 19-Apr $0.89 GILD 20-Apr $0.98 ABT 20-Apr $0.90 RAI 21-Apr $0.58 BDX 26-Apr $1.30 AFL 27-Apr $1.53 FISV 27-Apr $1.04 DLX 28-Apr $0.73 F TBA $0.49 MOG-A TBA $0.64 SYY TBA $0.41 WXS TBA $0.69 These are all the stocks that follow the March/June/September/December reporting cycle. The only two I’ve excluded are Leucadia ($LUK) and Nicholas Financial ($NICK) since they’re not followed on Wall Street.

-

J&J in Talks to Buy Synthes

Eddy Elfenbein, April 18th, 2011 at 8:16 amThe big news this weekend for Johnson & Johnson ($JNJ) is that it’s in talks to buy Synthes. This would be a huge deal for J&J. I have to say that I’m very skeptical of large-scale mergers. The historical evidence suggests that these deals usually don’t boost profitability.

No deal has been announced yet but the market is guessing that it will be valued at about $20 billion. J&J’s current market value is $165 billion. According to the most recent balance sheet, the company has a cash balance of $27.66 billion so this purchase won’t require any financing.

Buying Synthes, the biggest maker of devices to treat bone fractures and trauma, would end months of speculation about talks between J&J and U.K. device maker Smith & Nephew Plc. Synthes would give New Brunswick, New Jersey-based J&J a line of hip screws, surgical power tools and instruments to treat spinal and soft-tissue injuries that had $3.69 billion in 2010 sales, boosting the U.S. company’s share of the market for trauma care.

“If I were J&J, I would rather buy Synthes,” said Lisa Bedell Clive, an analyst with Sanford C. Bernstein Ltd. in London, in a phone interview today. “It’s the chance to become the market leader in trauma,” which has more long-term growth and profit margin potential than replacement hips and knees.

This could be a very smart move for J&J. Given the fact that its price hasn’t moved much, they’ve been forced into doing something. At this point, I don’t see how buying Synthes is a negative for J&J.

-

Morning News: April 18, 2011

Eddy Elfenbein, April 18th, 2011 at 6:58 amEuro Down On Regional Debt Concerns, But Losses Limited

China Yuan Up Late As Stronger Currency Helps Curb Inflation

Tokyo Shares End Off 0.4% Amid Pre-Earnings Caution, Stronger Yen

Spain’s T-bill Yields Jump on Periphery Jitters

G-20 Names ‘Too Big to Ignore’ Economies, Downplays Shocks

Bonello Urges ECB Caution in Raising Rates as Most-Indebted Nations Suffer

Gold Is Little Changed After Reaching a Record on Concern About Inflation

UAE’s Oil Minister Says Crude Oil Market Is Well Supplied

Bernanke Briefings May Offset Fed Hawks With Words as New Tool

Debt Ceiling Increase Is Expected, Geithner Says

Synthes Says It’s In Talks With J&J on Possible Combination

Chinese Telecomm Equipment Giant Huawei Reports Profit, Reveals Board Details

Inflationary Adventures in Extremistan

Euro vs. Invasion of the Zombie Banks

Howard Lindzon: The ‘Swipe’ and ‘Tap’ Economy Continues To Pick up Steam

-

“Parasites who persistently avoid either purpose or reason perish as they should”

Eddy Elfenbein, April 15th, 2011 at 2:14 pmThe movie Atlas Shrugged is opening this weekend. The book came out in 1957 and it was absolutely panned by critics.

Some of the readers didn’t like the criticism. Here’s one such response:

To the Editor:

Atlas Shrugged is a celebration of life and happiness. Justice is unrelenting. Creative individuals and undeviating purpose and rationality achieve joy and fulfillment. Parasites who persistently avoid either purpose or reason perish as they should. Mr. Hicks suspiciously wonders “about a person who sustains such a mood through the writing of 1,168 pages and some fourteen years of work.” This reader wonders about a person who finds unrelenting justice personally disturbing.

Alan Greenspan, NY

Yes, this is real.

-

Elmo Talks Money

Eddy Elfenbein, April 15th, 2011 at 1:01 pmIt’s scary how many adults need these kinds of lessons.

-

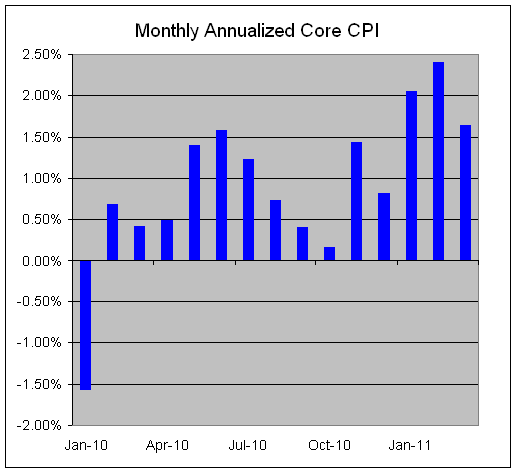

The CPI Report for March

Eddy Elfenbein, April 15th, 2011 at 10:48 amToday’s CPI report said that headline inflation rose 0.5% in March which was inline with economists’ expectations. The core rate rose by 0.1% which was half of what was expected.

Economists were expecting headline inflation to rise 0.5% and core inflation to rise 0.2%.

With my blog I like to find the stats behind what’s reported by the media. Breaking out the decimals, we see that headline inflation actually rose by 0.549% for March. In other words, the CPI was just a teeny tiny bit from rounding up to 0.6%.

While it’s really not that big of a deal, and we should laugh at the idea of the government’s measurements being so accurate, if the media had said that headline inflation rose by 0.6% in March, I think the market’s behavior would be very different today.

Breaking out the core rate, we see that it rose by 0.135% in March which is still below the 0.2% expected by economists but not as much as the media reports would lead us to believe.

By the way, those numbers are seasonally adjusted. The non-seasonally adjusted headline rate, rose by an annualized rate of 12.35%.

Here’s a look at the annualized monthly core seasonally-adjusted inflation rate:

-

Morning News: April 15, 2011

Eddy Elfenbein, April 15th, 2011 at 7:33 amEurozone Inflation Continues To Surge And It’s Not Just Food And Fuel Anymore

Moody’s Cuts Ireland Rating Two Levels, Outlook Negative

Greece Will Cut Spending, Sell Assets to Meet Debt Goal; Won’t Restructure

China Vows to Punish Those Responsible for Leaking Economy, Inflation Data

Singapore’s Policy Tightening May Prompt Asia to Step Up Inflation Fight

World Bank and I.M.F. Discuss Inequality in Middle East

U.S. Wholesale Prices Rise 0.7% in March

Nestle Sales Beat Analyst Estimates on Emerging Markets

High Costs Slow Google’s Profit

BofA Earnings Miss Big, And The Stock Is Slipping

Mattel Profit Drops 33% as Costs Rise

Paul Kedrosky: Shutdowns and Foreign Debt

James Altucher: How Kai Fu Lee Talked Me Out of Making a Million Dollars

-

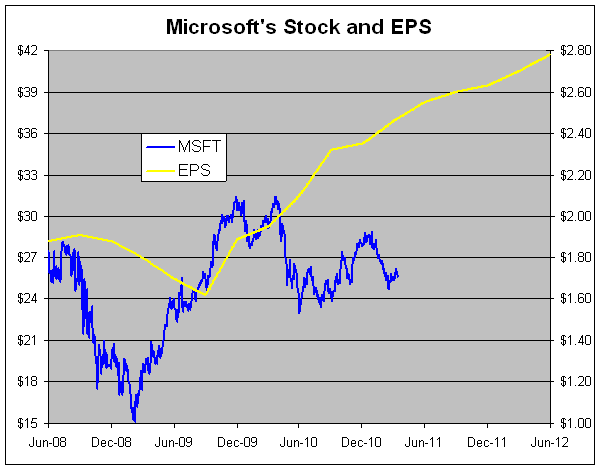

Microsoft Looks Very Cheap

Eddy Elfenbein, April 14th, 2011 at 1:40 pmIf you’re looking for a good stock to buy, I just noticed that there’s some sort of software outfit in the Seattle area. Here’s a look at Microsoft‘s ($MSFT) stock and its EPS line.

The stock line is in blue and if follows the left scale. EPS is in gold and it follows the right. The two lines are scaled at a ratio of 15-to-1. The forward earnings represent Wall Street’s consensus.

Microsoft is currently expected to earn $2.63 per share in this calendar year which means the stock is trading at about 9.6 times this year’s estimate.

The S&P 500 is expected to earn 96.69 this year which means it’s trading at 13.5 times this year’s estimate. That means MSFT is going for a 29% discount to the market’s valuation.

On top of that, MSFT is holding $4.76 per share in cash which generates almost no income. This means that the “operations” assets of Microsoft are probably going for around eight times earnings.

-

What Number for the Equity Risk Premium?

Eddy Elfenbein, April 14th, 2011 at 12:11 pmI’ve often said that the equity risk premium is probably a lot lower than most people realize. This is the amount that investors pay to own stocks over the risk-free rate of Treasury bills.

Some academics decided to do a broad survey to see what others think:

US Market Risk Premium Used in 2011 by Professors, Analysts and Companies: A Survey with 5.731 Answers

The average Market Risk Premium (MRP) used in 2011 by professors for the USA (5.7%) is higher than the one used by analysts (5.0%) and companies (5.6%). The standard deviation of the MRP used in 2011 by analysts (1.1%) is lower than the ones of companies (2.0%) and professors (1.6%). Most previous surveys have been interested in the Expected MRP, but this survey asks about the Required MRP. The paper also contains the references used to justify the MRP, comments from 58 persons that do not use MRP, and comments of 110 that do use MRP. The comments illustrate the various interpretations of the required MRP and its usefulness.

Professors, analysts and companies that cite Ibbotson as their reference use MRP for USA between 2% and 14.5%, and the ones that cite Damodaran as their reference use MRP between 2% and 10.8%.

Wow, the professors think it’s 5.7%! That’s quite high — and it’s down from 6% in 2010.

My preference is to see what investors demand to own stocks over long-term Treasuries, and I think that’s probably around 1.5% to 2%.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His